wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 754,154 times.

Learn more...

If you have a credit card, a certain portion of your credit line is typically available for cash advances. You can get these cash advances from any ATM or financial institution that does transactions with your credit card company. To get a cash advance you will usually be charged a fee and a high interest rate that starts the moment you take the money, but if you really need one here is how to do it.

Steps

Getting a Cash Advance From an ATM

-

1Check your latest credit card statement to see how much cash you can withdraw and the terms you will need to agree to when taking out a cash advance.

- Depending on your card, your cash advance limit may be the same as your total credit limit available or a much smaller amount.

- When you take out a cash advance you are usually charged a one time fee and a very high interest rate that is higher than your interest rate on basic purchases. If at all possible, it may make more financial sense to avoid taking out cash advances.

-

2Check your financial records for your personal identification number (otherwise known as your PIN) that was issued with your credit card.

- You don't need your PIN for everyday credit card transactions--only for making ATM withdrawals against your credit line. In some cases, you may have been allowed to set your own PIN. If you cannot remember it, call your credit card company to retrieve it or log into your credit card account online to reset you PIN.

Advertisement -

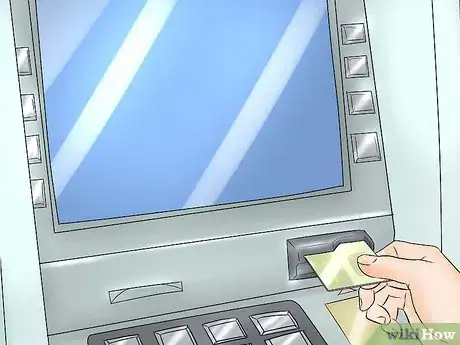

3Insert your credit card into any ATM that displays the logo of your credit card. Enter your PIN when prompted, then select the amount of money you want to withdraw.

- If the machine prompts you whether to make the withdrawal from checking, savings or credit, select "Credit."

- Note that some ATM operators may charge a small fee for each transaction. Your credit card issuer might also charge you an extra fee, usually a percentage of the cash advance, for processing the transaction.

- Protect yourself at the ATM, just as you would while using a debit card. Don't flash the cash or your credit card around, and don't let others see your PIN.

Getting a Cash Advance From a Credit Union or Bank

-

1Check your latest credit card statement to see how much cash you can withdraw and the terms you will need to agree to when taking out a cash advance.

- Depending on your card, your cash advance limit may be the same as your total credit limit available or a much smaller amount.

- When you take out a cash advance you are usually charged a one time fee and a very high interest rate that is higher than your interest rate on basic purchases. If at all possible, it may make more financial sense to avoid taking out cash advances.

-

2Take your credit card to a bank or credit union that displays the logo of your credit card company. Go through the teller line.

- You don't always have to be a member of the financial institution to conduct this transaction. If the bank or credit union has the logo of your credit card company displayed it means that they do business with your credit card company and they should be able to fulfill your request.

-

3Present your card and photo identification to the teller. Let them know that you would like a cash advance and how much you would like to withdraw. They will process your card through a cash advance machine and, if the transaction is approved, give you the cash.

Getting a Cash Advance With a Cash Advance Check

-

1Check your latest credit card statement to see how much cash you can withdraw and the terms you will need to agree to when taking out a cash advance.

- Depending on your card, your cash advance limit may be the same as your total credit limit available or a much smaller amount.

- When you take out a cash advance you are usually charged a one time fee and a very high interest rate that is higher than your interest rate on basic purchases. If at all possible, it may make more financial sense to avoid taking out cash advances.

-

2Request cash advance checks from your credit card company. In fact, many times your credit card company will send them to you unsolicited, so you may not even need to request them. These will arrive in the mail and they look very similar to a personal check, with your information, including your account information, on them.

- If you're sent cash advance checks without asking for them, remember that you are under no obligation to use these checks, but you should always shred or otherwise destroy them. They have your personal and account information on them and could be used to commit identity theft or fraudulent charges on your account.

- When you request the cash-advance check it might arrive blank and then you will need to fill it out or the card issuer might also ask you to specify the amount of each check and who it should be made out to over the phone.

- Sometimes credit card companies send cash advance checks that have a low promotional rates that have the same interest rates as your regular credit purchases. Be sure to use these if you really need to take out a cash advance and you have them available.[1]

-

3Fill out the check. If you want cash, simply make it payable to "cash" and sign it as usual.

- Cash advance checks can also be used to pay for non-cash transactions, such as paying rent, basically anything you would use a personal check for. The only difference is that these checks are drawing money from your credit line, instead of your checking account.[2]

-

4Go to your bank or a bank that displays the logo of your credit card company. Give your check to the teller and, if it is approved and the money isn't held for a few days while the check clears, tell the teller what denominations you would like your cash in. The teller will give you the money and you will be all done!

- Some banks may hold cash advance checks for a short time before they release the funds. If you need your cash quickly, you may want to call the bank or credit union you are planning on going to before hand to see if this will occur.

Community Q&A

-

QuestionCan a credit card be used at an ATM without a PIN?

Community AnswerIf it's a credit card, then you should be able to withdraw money for a fee, but this should be avoided. If you have a debit card, you will not be able to withdraw money without a PIN.

Community AnswerIf it's a credit card, then you should be able to withdraw money for a fee, but this should be avoided. If you have a debit card, you will not be able to withdraw money without a PIN. -

QuestionCan I get a payday loan with a debit card for SSI?

DonaganTop AnswererNo. Debit cards are linked to your own bank account, which is money you already have.

DonaganTop AnswererNo. Debit cards are linked to your own bank account, which is money you already have. -

QuestionCan I get a cash advance from a store if I do not know the card's PIN?

DonaganTop AnswererA cash advance does not come from a store. It comes from a credit card company, and whether or not you need a PIN for a cash advance depends on the card company's rules.

DonaganTop AnswererA cash advance does not come from a store. It comes from a credit card company, and whether or not you need a PIN for a cash advance depends on the card company's rules.

Warnings

- Remember that cash advances are usually subject to much higher interest rates than other credit card transactions; check your credit card agreement or call customer service to check the exact interest rate and any fees associated with a cash advance. In addition, interest starts accruing on cash advances as soon as you take them, so be sure to pay it off as quickly as possible! You do not want to get in over your head and end up with a bunch of credit card debt that you can't pay off![5]⧼thumbs_response⧽

References

- ↑ http://creditcardforum.com/blog/how-to-get-a-cash-advance-on-a-credit-card/

- ↑ https://www.discover.com/credit-cards/help-center/faqs/cash-advance.html

- ↑ http://usa.visa.com/personal/card-benefits/credit-card/emergency-card-cash.jsp

- ↑ https://www.nerdwallet.com/article/credit-cards/what-is-a-cash-advance

- ↑ http://www.consumer.gov/articles/1014-managing-debt

About This Article

To get a cash advance from a Visa card, go to an ATM. Find an ATM with the logo of your bank on it, insert your card and pin number, and follow the instructions. If you would prefer not to pay ATM fees, go to the bank where your credit card was issued and ask for a cash advance in person. Another way to get a cash advance is to ask your credit card company for cash advance checks, which can be used like personal checks. To learn about the fees you may encounter doing cash advances, read on!