This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 14 testimonials and 82% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 343,503 times.

Debit cards work like credit cards, but they are connected to your checking account. Money is deducted automatically every time you make a purchase. There is no credit check involved in getting a standard debit card, and because you need a PIN to use one, your transactions are relatively secure. Debit cards also make managing your account easy, since you can monitor the activity online.

Steps

Opening a Checking Account

-

1Gather your personal information. To open an account, you need to have some personal information before you go into the bank. You will need your social security number. You will also need to present your driver's license and be able to tell them the number, issuing state, and expiration date. You also need your current employment information as well as your last job if you have worked at your current job for less than a year. You will also have to give them a valid e-mail address.[1]

-

2Apply for a checking account. To open an account, you need to fill out an application from your bank of choice. You need to request an application from an account manager at the local branch of the bank. Choose if you want an individual or joint account. Fill in the application with the information you collected. Make sure you let them know you want a debit card to go with your account. Once you finish filling in the application, sign it and give it to the bank employee. Once it is looked over and approved, you will have an account and you can get a card.

- You can also set up a joint account with someone else. If you want to do this, you need to have all the information you gathered for yourself about them as well.

- They sometimes ask you to make an opening deposit by cash or check when you open the account.

- You can also open an account online. You just fill out the application online and it is sent for approval.

Advertisement -

3Activate your card. If you open an account in person, you should be able to get a card right away. To activate your card, you first need to choose a PIN number for your card. Make sure you chose a number that isn't related to you and can't be easily guessed by others. You just want to make sure that you can remember it. You will need this PIN every time you use the card. Once you chose a PIN, the bank teller will make you swipe your card and then it is activated.

- Always use a PIN, even if the bank gives you a choice not to. It makes your card more secure.

- Your PIN should not be your social security number, birthday, phone number, or address. Don't keep a copy of it written anywhere and don't tell anyone what the number is. If they ever use your card, you will be responsible for the charges they make.[2] [3]

Getting a Debit Card in Other Ways

-

1Ask for one from the bank. If you already have a bank account, you can get a debit card from your bank. It is a relatively easy process. You just need to complete an application with the bank to get a debit card. Since you have already established your identity with the bank, the only paperwork is the application. The bank will review your application and, depending on your history with the bank, approve your account for a debit card.

- The bank typically mails you a card once you have been approved.[4]

-

2Activate your card. Once you have received your new card, you need to activate it. Activating the card is usually done with the help of a banking representative at your local branch. You will pick a PIN (Personal Identification Number) and make a simple transaction. Make sure you chose a unique number that isn't easy to guess but that is something you can remember. Once the PIN is chosen, the same one will be used for any debit transaction.

- If the bank gives you the choice of using or not using a PIN in your debit transactions, always choose to have one. It is an important safeguard for the security of your account.

- Your PIN should not be obvious, such as your birthday, social security number, address, or phone number. Don't write your PIN and keep it in your purse or wallet. Don’t share it with anyone. If they use it, you will likely be responsible, even if they didn’t have permission for that particular purchase.[5] [6]

-

3Consider a prepaid card. You can buy a prepaid, reloadable debit card at some major retailers, convenience stores, discount stores, pharmacies, or online. These locations sell Visa or MasterCard debit cards. These cards work much like the debit cards attached to other accounts. The difference is that you load them with a balance that is only accessible with the card.

- One problem with prepaid cards is that they typically require an activation fee when you put money on the card for the first time. However, the activation charge is a one-time fee and does not occur again while you are using the card.

- You can load money on them online, in person at a participating retailer, and through direct deposit from another account.[7]

Using Your Debit Card

-

1Buy items at the store. The debit cards use the same networks as the credit cards. Therefore, anywhere you could use a credit card you should be able to use a debit card, which is most places in the United States. You may have to give your card to the cashier to swipe. You may also be able to swipe it yourself. Then enter your PIN number into a keypad and press OK. Verify the amount once it appears on the screen and hit OK again.

- You can also use your debit card to purchase things online as well. You will just have to have the card number, the expiration date, your PIN, and the verification code on the back of the card handy.[8]

- Some vendors treat the debit card as a credit card, swiping the card without requiring a PIN number. Nevertheless, the card provider will deduct the payment from the bank account balance immediately.

-

2Keep track of your balance. In general, it's smart to check your balance online on a regular basis. That way, you'll always know how much money you have available.

- It may help to track of your purchases, either by writing them down or by recording them in a budget document or spreadsheet. Doing so will keep you from forgetting what you bought and help you avoid overdraft fees or insufficient funds.[9]

-

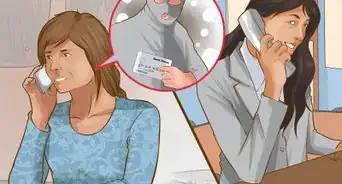

3Monitor your account. Once you start making purchases and putting money into your bank account, you need to make sure you review your account activity in your statement. This might come to you in the mail or you can do it online. This will help you be sure that there is no activity that is not yours. If you detect anything unusual or that you do not recognize, contact the bank.

- While fraud with a debit card is unlikely since you have to use a PIN, it is not impossible. Try to keep your card with you at all times. Do not let others see your PIN or write it down.[10]

- If you find that you have lost your card or it gets stolen, report it immediately to your bank. If you get an automated menu, choose the "report a lost or stolen card" option from the menu.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can a person who is not a citizen of the United States apply for a debit card?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

-

QuestionCan I have two debit cards at the same time?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor There is no legal maximum on the number of debit cards that can be issued on a single account. However, it is the account holder's responsibility to ensure funds are available when the card is used. Debit cards can be missed for any account of the bank customer. For example, one card might be tied to single personal account, a joint personal account, a business account, etc.

There is no legal maximum on the number of debit cards that can be issued on a single account. However, it is the account holder's responsibility to ensure funds are available when the card is used. Debit cards can be missed for any account of the bank customer. For example, one card might be tied to single personal account, a joint personal account, a business account, etc.

References

- ↑ https://www.wellsfargo.com/checking/

- ↑ https://www.wellsfargo.com/goals-banking-made-easy/activate-debit-card/

- ↑ https://www.consumer.gov/articles/1004-using-debit-cards#!what-to-do

- ↑ https://www.wellsfargo.com/checking/

- ↑ https://www.wellsfargo.com/goals-banking-made-easy/activate-debit-card/

- ↑ https://www.consumer.gov/articles/1004-using-debit-cards#!what-to-do

- ↑ http://usa.visa.com/personal/personal-cards/prepaid-cards/buy-online.jsp

- ↑ https://www.consumer.gov/articles/1004-using-debit-cards#!what-to-know

- ↑ https://www.consumer.gov/articles/1004-using-debit-cards#!what-to-do

About This Article

In order to get a debit card, first you have to open a checking account. To open a checking account, you will need to gather your social security number, driver’s license, and any current employment information. Bring this information as well as a valid email address to your bank, where you will then have to fill out an application. Once you are approved, you can request your debit card, set up your PIN, and activate your new card. To learn more from our Financial Advisor co-author, such as how to monitor your card's activity, keep reading the article!

-Safe-Step-8.webp)