This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 213,349 times.

Need to check the balance of your debit card? Fortunately, there are multiple ways to find out the balance, whether you have a bank-issued or prepaid card. In this article, we'll walk you through all of your different options so you can quickly and securely find out how much money you have.

Things You Should Know

- The easiest way to check the balance of your debit card is through your bank's website or mobile app.

- You can also check your balance by visiting an ATM or a local branch of your bank.

- If you have a prepaid debit card, visit the card issuer's website or use their mobile app to check your balance.

Steps

Checking Bank Debit Cards

-

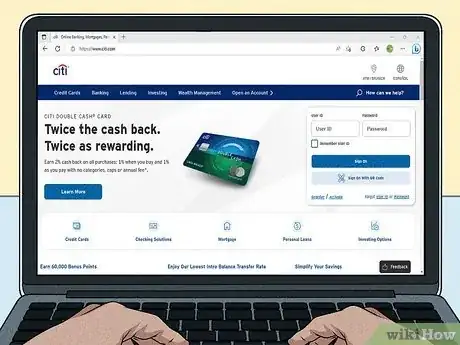

1Log into your bank’s website. Go to the official website of your bank. If you haven’t yet, you’ll have to connect your account information to a User ID and password. Use these to log into the website. Your account summary will be listed prominently on the page.[1]

-

2Download a banking application. Most banks now have official applications for banking on the go. For example, Huntington Bank has Huntington Mobile and Ally Bank has Ally Mobile. Log into the application using the same User ID and password you use to access the bank’s website, or register for one if you haven’t already.[2]Advertisement

-

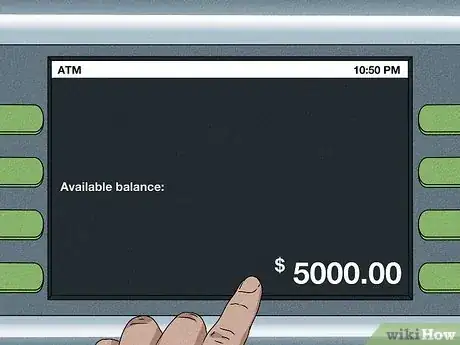

3Check your account balance at an ATM. Any ATM should work, since they’re all linked to the financial system and your debit card is your checking account. Simply put your card in the machine, enter your pin, and navigate to the balance option.[3]

- Any ATMs not affiliated with your card issuer may charge a fee for usage.

-

4Sign up for text alerts. Many banks will send you text messages to signify changes to your account, such as deposits and withdrawals. You will have to log into your account through the website or application, then sign up for the messages. Follow the text prompts to see your balance.[4]

- Many banks also allow you to send these alerts to your email address instead of your phone.

- When using text messages, message and data rates still apply as determined by your phone carrier.

-

5Ask a bank teller. When you go into the bank, the teller will be able to help you. Speak to them about getting your balance or an account statement. They can provide you with the detailed information you get on statements sent to you by snail mail or email once a month.

- For some prepaid cards, such as the U.S. Bank ReliaCard, the teller most likely won’t be able to see your balance.[5]

-

6Call the bank’s service line. Check your bank’s website or on official mail from the bank to find their phone number. Your bank may have an automated system in place where you can follow the system’s prompts to navigate to your balance. However, the system will also tell you that you can press a number, often 0, to speak to a bank representative.[6]

- The bank representative will require personal identification, such as the last four digits of your social security number, before accessing your account.

Checking Prepaid Debit Cards

-

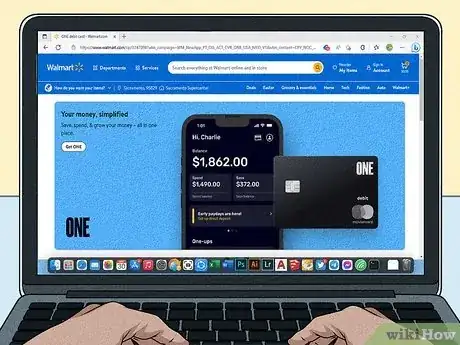

1Go to the card issuer’s website. Make sure you go to the card issuer’s website. For example, go to Walmart for a debit card you got from there. Log in to check your balance. You will need to register your card by inputting your card number and security code.[7]

- Typically, the security code is three to six digits on the back of the card under a security strip you’ll have to scratch or peel off. The card number is a string of 16 numbers on the front or back of the card.

-

2Use the card at an affiliated merchant. A quick way to check your card when away from home is to use it where you know it will be accepted. For example, if you have a VISA prepaid debit card, a cashier at a place that accepts VISA may be able to show your balance when they scan your card.

-

3Log into the card issuer’s phone application. Some card issuers, mostly large store chains and credit companies, have come out with applications. Walmart has Walmart Moneycard and Bluebird by American Express has the Bluebird mobile application. Use the application to register your card and log in with the User ID and password you choose.[8]

-

4Send a text message to the card issuer. Some card issuers allow you to send a text after you’ve registered your phone to your cardholder account. For example, text BAL followed by the last four numbers of your card to 96411 to check the balance of a Walmart card. Look on your card issuer’s website for texting options.[9]

- Remember, message and data rates through your phone carrier apply.

Expert Q&A

-

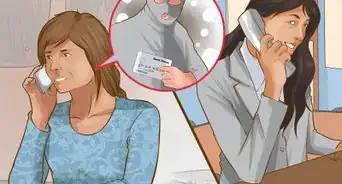

QuestionHow can you get your money back on a debit card for unauthorized purchases?

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Derick VogelDerick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

Credit Advisor & Owner, Credit Absolute Make sure that you call the police and report identity theft so they can file a report. Then, call your bank and let them know about the fraudulent activity so they can run their processes to block and refund the money that was charged.

Make sure that you call the police and report identity theft so they can file a report. Then, call your bank and let them know about the fraudulent activity so they can run their processes to block and refund the money that was charged. -

QuestionHow long does a bank account last if I never put money in the account?

DonaganTop AnswererNormally a bank will require at least a minimal deposit in order to open an account. In any case, an account with no money in it will remain open until the bank decides to close it (and so notifies the account's owner).

DonaganTop AnswererNormally a bank will require at least a minimal deposit in order to open an account. In any case, an account with no money in it will remain open until the bank decides to close it (and so notifies the account's owner). -

QuestionHow do I check the account balance on my phone?

DonaganTop AnswererEnter your account number and password. Then a voice machine or live representative will give you the account balance and perhaps other related information.

DonaganTop AnswererEnter your account number and password. Then a voice machine or live representative will give you the account balance and perhaps other related information.

Expert Interview

Thanks for reading our article! If you'd like to learn more about debit cards, check out our in-depth interview with Derick Vogel.

References

- ↑ https://www.pnc.com/en/personal-banking/banking/debit-and-prepaid-cards/pnc-bank-visa-debit-card.html

- ↑ https://www.dbs.com/digibank/in/articles/pay/how-to-check-debit-card-balance

- ↑ https://www.dbs.com/digibank/in/articles/pay/how-to-check-debit-card-balance

- ↑ https://www.huntington.com/Personal/mobile-banking/view-alert-types

- ↑ https://dss.sd.gov/childcare/childcareassistance/faq.aspx

- ↑ https://www.commercebank.com/about/contact/account-information-line.asp

- ↑ https://www.mastercard.us/en-us/frequently-asked-questions.html#prepaid

- ↑ https://www.bluebird.com/#money-management-tools

- ↑ https://www.walmartmoneycard.com/account/faqs#mob

About This Article

To check your debit card balance, log into your bank’s website and check the account associated with your debit card. You can also find this information by downloading and logging into your bank’s official phone app, if they have one. If they don’t have an app, call your bank’s customer service line, where an automated system should offer you the option to check your balance. When you don’t have access to your phone or computer, you can still check your balance by inserting your card into an ATM machine and following the prompts on the screen. Keep in mind, however, that you may be charged a fee if you use an ATM that’s not associated with your bank. To learn more, including how to check the balance on a prepaid debit card, scroll down.

-Safe-Step-8.webp)