This article was co-authored by John Gillingham, CPA, MA. John Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 11 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 252,278 times.

An accounting audit is the process of examining a company's entire financial situation, with an emphasis on ensuring compliance with relevant reporting standards, and promoting adequate cash handling policies and internal controls. In most countries, regular audits by outside firms are required for publicly traded corporations. In contrast, small businesses are typically not subject to as rigorous a set of reporting standards and controls and therefore are often not subject to mandatory audits. Learning how to perform a basic internal accounting audit on your own small business can provide you with a comprehensive understanding of your company's financial strengths and weaknesses.[1]

Steps

Preparing To Perform a Basic Financial Audit

-

1Understand financial audits. Quite simply, financial audits exist to ensure that your business's financial information is "true and fair". For small businesses, the main concern is that all expenses and revenues are accurate so that the IRS knows exactly the financial status of the business and can confirm all deductions are valid. [2]

- A formal audit involves an examination of financial statements by a qualified third-party (typically a chartered public accountant, or CPA). With regards to small businesses, audits are typically performed by the IRS due to concerns over proper reporting, whereas large public corporations typically hire external auditors (and have internal auditors) to confirm financial information is valid for shareholders.[3]

- Despite this, you can still "self-audit" your business (or make sure your financial information and procedures are accurate and fair), to improve your business and protect yourself from an IRS audit.

-

2Learn the reasons for a financial audit. There are several reasons and benefits to regularly audit your finances. While a basic audit can be performed by the business owner (who should be regularly making sure financial information is accurate and procedures are efficient), it is wise to hire a CPA to do a systematic overview of your finances.[4]

- Financial audits can ensure information is valid and in accordance with accounting standards (like the Generally Accepted Accounting Principles, or GAAP).

- Financial audits make sure all legal and tax rules are being complied with, which can prevent an audit from the IRS, or different legal issues that can arise when fraudulent or incorrect information is presented to the public or investors.

- They can also provide education to the business owner about how their business is running and how it can be improved.

Advertisement -

3Prevent your small business from triggering an IRS audit. A basic accounting audit of your business can be an effective way to prevent yourself from receiving an IRS audit, which can be stressful and time consuming. Before looking deeper into your finances, there are several initial tips that can be used to improve your financial standing and prevent an IRS audit.[5]

- Ensure your deductions are realistic and not excessive (especially for business meals, travel, and entertainment).[6] For example, daily commuting to work at a regular job is not a valid deduction, nor is claiming any personal expense as a business deduction. A good rule is if the spending is required to make money, then it can be deducted.

- Be sure you have proper receipts and records for any and all deductions.

- Have explanations and proper documentation for any major discrepancies between years. If you contribute much more to charity one year than another, include an explanation as to why when you file your return, and include any receipts or other associated documents.[7]

Creating an Accounting Audit Trail

-

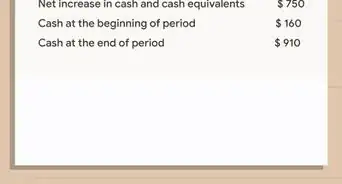

1Determine whether your business has a sufficient accounting audit trail. An accounting audit trail consists of the paper and electronic sources that document the history of a business's transactions. Audit trails are used to trace a business's financial data from the general ledger to the source of the transaction/funds. A strong audit trail provides a comprehensive chronological list documenting the steps taken to commence and complete transactions.

- Determine if your existing accounting practices enable you to track the complete process of a financial transaction with documentation. If not, your accounting processes must be strengthened in order to create a sufficient accounting audit trail. For example, if you are purchasing goods from a supplier, locate the documentation associated with the transaction (like an invoice), locate the transaction in the appropriate account (like the expense or accounts payable account), and identify what kind of transaction it was (buying goods from a supplier).

- Employ accounting software to create an electronic accounting audit trail for your business. Using accounting software to log your business’s financial activities will allow you to easily store and analyze accounting data with ease.

-

2Review your small business's existing record keeping policies. All financial information should be stored reliably, securely, and in an organized manner. All relevant information, such as bank statements, cancelled checks, and cash register tapes should be stored at least through the end of each reporting period. Having this information stored and readily accessible will help you resolve any issues or discrepancies that arise.[8]

- There should be associated documentation for every transaction, with relevant explanations for transactions that will be used for deductions. For example, if you spent $100 on gas to travel to meet a potential client, there should not only be receipts (or bank records) for the transaction, but it should also be recorded that the $100 expense was to recruit a new client, and is therefore a deductible business expense.

-

3Examine how financial documents are passed on to accounting personnel. The first step in your small business's accounting audit consists of gathering financial documents, such as invoices, receipts, and bank statements, and handing them off to the accountant or accounting department for processing. If this process is slow or unreliable, the accounting records will suffer and become unreliable.

- If you are self-employed, this step is simplified, and your task is instead to make sure that you take your own financial transaction records and process them quickly and regularly to ensure your records are up to date.

-

4Create a system for monitoring your company's internal controls. Internal controls are those provisions that help to protect against fraud, theft, and other internal accounting issues. They are the procedures your business uses to ensure your assets are protected and your information is accurate.[9]

- Separate accounting duties as much as is reasonable. For example, it is best not to allow the same person to both handle cash and do the bookkeeping, as this makes it easier to explain away missing cash.[10]

- Safes should be locked when not in use, and company software and computers should be password protected.

- Camera systems are beneficial for monitoring the execution of internal controls at retail businesses.

- Reconciliation of accounts, such as the reconciliation of bank statements with the checkbook, should regularly occur as a way to validate financial information.

- Techniques like numbering documents such as checks to prevent duplication are also a useful internal control.

-

5Consider the accounting and tax laws your business must follow. For tax purposes, you are typically required by law to keep comprehensive accounting records for your business. Preparing your accounting records to be in compliance with the law will make a potential federal revenue audit easier to comply with.[11]

- Make IRS procedures such as keeping accounting records for at least six years a part of your internal audit trail process. This way you already have the processes in place that are required to respond external audits from the IRS and other external parties.

- To find out what laws are relevant to you, the Small Business Administration website is a very helpful resource. In addition, you can also consult with your accountant or bookkeeper if you have one.

Conducting an Internal Accounting Audit

-

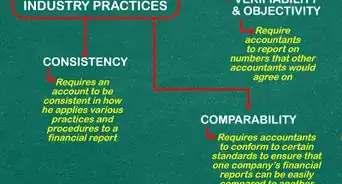

1Employ industry-accepted audit practices. Good audit practices should serve as your initial guide for conducting your internal accounting audit. Using a business accounting software program, a tax attorney, or an accountant is the best way to ensure that your internal accounting audit is in line with generally accepted accounting practices.[12]

- The General Accepted Auditing Standards (GAAS) are the most common auditing standards used to audit private companies. Consider the GAAS policies when commencing your internal accounting audit.

- GAAS are the basic rules and standards that are used when doing an audit. While these typically are used by professional auditors, consulting these basic principles can provide a helpful guideline for your own personal audit.

-

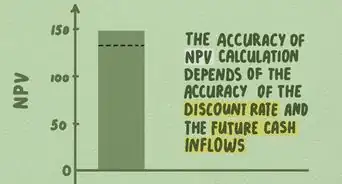

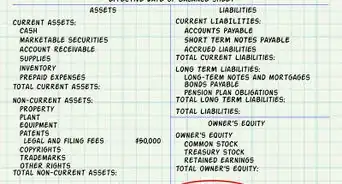

2Cross-reference each part of your company's accounting system. Review each place into which accounting information is input, including the general journal, the general ledger, and individual account balances. Account balances should be examined on a continual basis, rather than just before preparing the trial balance at the end of the accounting period.[13]

- Make sure that all entries have corresponding entries across each element of your system, and that any discrepancies are resolved quickly. For example, a purchase of merchandise to sell would require an debit entry to the inventory account, and a credit to your cash account.

- Use accounting documentation to verify your business’s gross income, expenses and costs.

- If you have a very large number of transactions, it is acceptable to take a statistical sample in order to examine individual transactions, rather than trying to examine all of them.

-

3Compare internal accounting records against external records. Check the fidelity of your own bookkeeping by comparing it against external records. For example, you can compare purchase receipts from your suppliers against your own purchase records. Note that issues that arise through this process may be due to external errors, such as miscalculations by a supplier or customer.

- If you encounter any errors, it is important to firstly correct the error. Any errors on the behalf of external factors (like a supplier error), should also be corrected by contacting the party involved. Next, it is important to document the error, and ask yourself why the error happened, and who is responsible. Is it a one-time mistake, or is there a problem with basic policy or procedure? From here, you can focus on ensuring the error is not repeated.

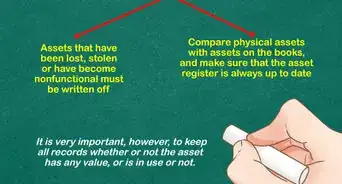

- If you have physical products or use equipment in your business, you will need to conduct physical audits as well. For example, inventory or equipment should be counted and visually inspected.

-

4Check internal tax records against your tax returns. Look through your recent government tax receipts and compare these against your internal records regarding taxes paid and tax liabilities. In the U.S., keep tax receipts on hand for at least 7 years, as this is the statute of limitations on tax fraud.

-

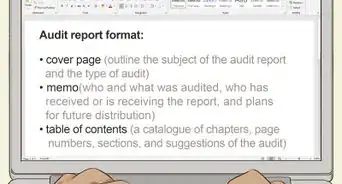

5Create an audit report. Compile a list of your findings into a succinct audit report. An audit report is simply a document that summarizes the findings of your audit. It will state problems you found, improvements that were made, and areas that were working well.

- Since this is your own audit, this does not need to be a formal document, and should simply be a useful document that you can refer to for your own usage, or that you can show the IRS in the event that your business is audited.

References

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ https://www.americanexpress.com/us/small-business/openforum/articles/7-audit-red-flags-small-businesses-need-to-avoid/

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ http://dubeconsulting.com/top-5-reasons-conduct-audit/

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Tax-Planning-and-Checklists/Top-Five-Ways-to-Avoid-a-Tax-Audit/INF19031.html

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ http://www.cpaaustralia.com.au/~/media/corporate/allfiles/document/professional-resources/business/internal-controls-for-small-business.pdf?la=en

- ↑ http://quickbooks.intuit.com/r/accounting-money/small-business-accounting-checklist-10-things

- ↑ John Gillingham, CPA, MA. Certified Public Accountant. Expert Interview. 3 March 2020.

- ↑ http://www.qualitydigest.com/june07/articles/05_article.shtml

- ↑ http://www.principlesofaccounting.com/chapter-2/

About This Article

To perform a basic accounting audit, read the Generally Accepted Auditing Standards and search for accepted audit practices in your specific industry. It is important to read these standards because to perform an audit, you may need to hire an accountant or other third party. If you are able to do the audit yourself, cross-reference all costs and expenses to ensure the information is consistent. From there, double check your receipts and tax returns and look for any discrepancies. Then, write your audit report. For tips from our Financial Advisor reviewer on how to prevent your business from triggering an IRS audit, keep reading.