This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Jessica Gibson. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

There are 22 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 5,946 times.

Costa Rica consistently tops the list of popular places to retire. After all, it's beautiful, peaceful, and has great healthcare and amenities. Plus, your retirement money will go far since the cost of living is low. If you retire in Costa Rica, you'll probably become familiar with "pura vida" which means "pure life." This expression perfectly sums up the casual, relaxed attitude you're sure to find in this tropical destination.

Steps

Location and Culture

-

1Familiarize yourself with Costa Rica's demographics and government. If you don't know much about this democratic republic, you should know that it's a Spanish-speaking country that's about the size of West Virginia. Around 5 million people live there and 80% of people live in urban areas.[1] Many retirees settle in areas like:

- Montezuma beach

- Santa Teresa beach

- Guanacaste

- Puerto Viejo

-

2Move to Guanacaste if you want luxurious amenities and beaches. This is the northernmost province and it's also a popular tourist destination. You'll find great beaches, resorts, and golf courses, but you'll also be dealing with tourists throughout the year.[2]

- Cost of living prices might be a little higher in Guanacaste than other less popular parts of Costa Rica, so keep this in mind if you're on a budget.

Advertisement -

3Choose rural Costa Rica if you're looking for small-town life. A lot of Costa Rica is rural and you'll have access to affordable, beautiful towns. Many towns are scattered around national parks, haciendas, and farms. If you love the gorgeous geography of Costa Rica, you may enjoy retiring in a small town where you can truly be surrounded by the tropical environment.[3]

- Cost of living will also be lowest in rural communities as opposed to popular expat retirement spots or resorts.

-

4Check out Puerto Viejo in Limon if you're drawn to the Caribbean. If you love sandy beaches, the blue waters of the Caribbean, and the rainforest, you'll love Puerto Viejo on Costa Rico's northeastern coast. Residents enjoy a slower pace of life which can feel perfect for your golden retirement years![4]

- This area is popular with Canadian and European expats.

-

5Factor the climate into the area you choose. Costa Rica doesn't experience 4 distinct seasons throughout the year, so move to an area with weather you enjoy. For instance, if you prefer warm temperatures, pick a beach community. For cooler weather, move to the mountains.[5]

- Keep in mind that most of Costa Rica enjoys temperatures in the mid-70s, so you really can't go wrong!

- Costa Rica does get a lot of rain each year, so be prepared for precipitation.

-

6Take Spanish classes so you can understand Ticos (Costa Rican citizens). Sure, people frequently speak English in more popular touristy or expat communities, but you'll feel like part of the community if you learn Spanish. Take classes before you move or check out online language learning programs whenever you feel like it.[6]

- Being able to speak Spanish can also make it easier to make yourself understood by locals.

-

7Be prepared to walk or take public transit. Unfortunately, Costa Rica has some of the poorest quality roads in the world.[7] Since the roads aren't maintained very well, it can be tricky to drive on your own. Instead, walk throughout your city or take local buses and taxis.[8]

- It's also really easy to catch short, cheap flights throughout Costa Rica.

-

8Enjoy Costa Rica's clean water and reliable electricity. If you live in a city, the utility company pumps water for distribution while smaller communities use water tanks and gravity systems. Either way, you'll have access to clean drinking water. Costa Rica also uses water power to produce electricity. If you're renting, the landowner is usually required to pay the water and hydroelectric bill.[9]

- Cable is a utility you may want and you've got lots of choices! Cable providers offer broadband internet, fiber-optic networks, and wireless broadband. You'll probably spend around $70 USD a month to get over 100 cable channels and 100 Mbps broadband.

-

9Adjust to a slower pace of life. Many expats recommend developing patience when moving to Costa Rica. Ticos are well known for working and living at their own pace and there's no rushing them! Instead of stressing about punctuality and getting things accomplished, slow down and change your mindset.[10]

- Learn to go with the flow and not stress when you don't get something right away.

-

10Take time to enjoy the natural beauty of the country. From rainforests to beaches to nature reserves, Costa Rica has something for every retiree. Check out the volcanic region, La Fortuna, too! After all, you're in an incredibly beautiful part of the world so explore it as much as you can.[11]

- If you're looking to get away from the tourists, check out the southern region which is really remote.

Visa Logistics

-

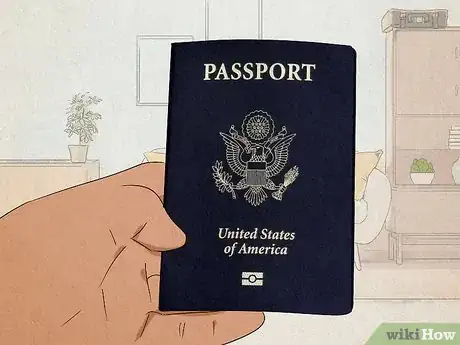

1Check that your passport is valid so you can travel to Costa Rica. Although you don't have to have a visa to get into the country, your passport must be current. You'll also have to show proof of a ticket to leave Costa Rica within 90 days. This means you'll have to apply for a residency visa within that time.[12]

- Your exit flight can be a ticket back to the U.S. or any other country.

-

2Register with the U.S. Embassy in order to apply for Costa Rican residency. Go to the Department of State's Smart Traveler Enrollment Program (STEP) website and create an online account. Simply fill in the details about your planned residency in Costa Rica and submit it online. Then, print off the profile page from your account and take it to the Costa Rican Immigration Office when you travel.[13]

- The program and registration for it are free. Enrolling in STEP makes it easier for the U.S. State Department to help you in an emergency.

-

3Bring your application materials to the nearest Costa Rican Embassy. To apply for a pensioner (pensionado) visa, take your passport, birth certificate, proof of financial means, 3 passport-sized photos, and your criminal record to the embassy.[14]

- You may also need to provide your fingerprints or proof that you've registered with the Costa Rican consulate. Check with the embassy for the most up-to-date requirements.

- If your documents aren't in Spanish, you'll need to have them translated.

-

4Provide financial proof that your income is at least $1,000 USD a month. This can include funds from a pension savings plan, retirement account, or Social Security. You'll also have to prove that these funds are available for the rest of your life. If the funds are issued in the U.S., you'll need to have the financial certification authenticated by the U.S. entity that's issuing the funds.[15]

- If you're moving as a couple, only one of you has to be receiving this amount in order to qualify.

-

5Apply for a 'rentista' visa if you plan on working freelance jobs. If you know you don't want to stop working completely, you can work in Costa Rica with the right visa. A rentista visa is a self-employment visa. You'll have to provide the same documents as the pensionado visa as well as proof of a higher income—$2,500 USD/month along with information about the company that hired you.[16]

- Keep in mind that proof of the unearned income has to come from savings, investments, or real estate property over a period of 2 years before you apply for the visa.

Expenses and Finances

-

1Open your own Costa Rican bank account. You can probably keep using your American banks if they have locations in Costa Rica. However, they may charge steep fees, limit transactions, or have waiting periods to access funds. To easily access your money, set up a checking account with a state or private Costa Rican bank. Usually, you have to show your visa or proof of residency.[17]

- Banco Nacional, Banco de Costa Rica, and Banco Popular are the biggest state-sponsored banks, so it's fairly simple to open an account at one of their branches.

-

2Get your Social Security funds directly deposited. Although the amount you'll get depends on your contributions over the years, most Americans get around $1,543 a month. Remember, these funds can count toward your residency visa so ensure your account is accurate.[18] In order to access these funds, set up a bank account so you can get direct deposits from the U.S.[19]

- You'll have to submit a Social Security questionnaire every 1 to 2 years so they know you're still eligible and living in Costa Rica.

-

3File federal taxes with the U.S. Up to 85% of your Social Security benefits are taxable, so you will have to file taxes annually.[20] Since it can get a little tricky if you're also earning income in Costa Rica, you may want to work with a financial advisor—in Costa Rica, citizens actually hire lawyers to file their taxes.

-

4Pay into the Caja healthcare system. Costa Rica has fantastic healthcare and as a retiree, you'll pay a monthly contribution based on the income amount you listed on your visa. Usually, this is between 7% and 11%, although most Americans pay no more than $100 USD a month. To sign up, take your visa to the local Caja office along with your passport, proof of residency approval, and notarized copies of your passport ID page.[21]

- You can still purchase private health insurance if you want more options or faster access to services.

-

5Budget around $2,000 USD a month for cost of living. While this amount can vary—you could certainly live more cheaply or splurge—a couple can usually rent a comfortable 2-bedroom home, plus cover groceries, entertainment, air conditioning, and healthcare all for around $2,000.[22]

- A luxurious budget can get you nicer accommodations and private health insurance. Figure around $2,500 to $3,000 USD a month for these additional comforts.

-

6Rent an apartment or house unless you're sure you want to buy. A lot of expats recommend renting in an area before you commit to the region. This way, you can be sure that you like the city. Plus, most residents find housing via word-of-mouth, postings in the community, and through local realtors, so being there and checking out your surroundings can really help![23]

- If you do decide to buy property, the good news is that you can buy whenever you like—you don't have to wait to meet residency requirements.

- Most landlords include utilities in the rent, so you probably won't be required to pay for these separately.

-

7Buy a home if you're committed to an area. Buying property is surprisingly easy for expats since there aren't any restrictions for foreigners. If you're positive that you've found an area of Costa Rica that you love, you can hire a real estate agent or make an offer on a property yourself. The only hitch is that foreigners can't get a mortgage, so be prepared to pay for the property out of savings or your pension.[24]

- Average condo prices are around $200,000 USD, plus $50 to $200 a month for Homeowners Association Fees.

- The minimum housing price in Costa Rica is around $100,000 USD.

-

8Decide if you want to change the utilities to your name when you buy a home. Surprisingly, many expats choose to keep the utilities and water bills in the original owner's name since it doesn't have an effect on how you pay and it's simpler. If you do decide to update the name, you and the original account holder will need to go to the electric and water companies in person to deactivate and reactivate the service. Then, you'll need to pay a security deposit.[25]

- Gas utilities aren't offered in Costa Rica, so you'll have electric power.

References

- ↑ https://www.worldometers.info/world-population/costa-rica-population/

- ↑ https://www.expatden.com/costa-rica/moving-to-costa-rica/#Guanacaste

- ↑ https://www.expatden.com/costa-rica/moving-to-costa-rica/#Rural_Costa_Rica

- ↑ https://www.expatden.com/costa-rica/moving-to-costa-rica/#Puerto_Viejo_in_Limon

- ↑ https://thecostaricanews.com/costa-rica-the-best-place-in-the-world-to-retire-where-the-weather-is-excellent-year-round/

- ↑ https://www.spendlifetraveling.com/ask-an-expat-living-in-costa-rica/

- ↑ http://reports.weforum.org/pdf/gci-2017-2018-scorecard/WEF_GCI_2017_2018_Scorecard_EOSQ057.pdf

- ↑ https://travel.usnews.com/Costa_Rica/Getting_Around/

- ↑ https://www.expatden.com/costa-rica/moving-to-costa-rica/#Utilities

- ↑ https://www.spendlifetraveling.com/ask-an-expat-living-in-costa-rica/

- ↑ Angela Rice. Travel Specialist. Expert Interview. 18 September 2020.

- ↑ https://cr.usembassy.gov/u-s-citizen-services/frequently-asked-questions/

- ↑ https://cr.usembassy.gov/u-s-citizen-services/local-resources-of-u-s-citizens/residing-costa-rica/applying-residency-costa-rica/

- ↑ https://www.internations.org/go/moving-to-costa-rica/visas-work-permits

- ↑ http://www.costarica-embassy.org/index.php?q=node/144#3

- ↑ https://www.internations.org/go/moving-to-costa-rica/visas-work-permits

- ↑ https://www.internations.org/go/moving-to-costa-rica/banks-taxes

- ↑ https://www.aarp.org/retirement/social-security/questions-answers/collecting-social-security-abroad.html

- ↑ https://www.ssa.gov/international/countrylist6.htm

- ↑ https://www.cnbc.com/2018/04/21/heres-how-to-retire-abroad--without-any-tax-surprises.html

- ↑ https://www.internations.org/go/moving-to-costa-rica/healthcare

- ↑ https://internationalliving.com/the-best-places-to-retire/

- ↑ https://www.internations.org/go/moving-to-costa-rica/housing

- ↑ https://www.internations.org/go/moving-to-costa-rica/housing

- ↑ https://www.internations.org/go/moving-to-costa-rica/housing

- ↑ Dmitriy Fomichenko. Financial Planner. Expert Interview. 28 June 2021.

- ↑ Dmitriy Fomichenko. Financial Planner. Expert Interview. 28 June 2021.