This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Danielle Blinka, MA, MPA. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 29,333 times.

Are you dreaming of retirement? You’re probably picturing yourself relaxing, enjoying hobbies, and spending time with your family. Fortunately, your retirement benefits can help you live a wonderful life after you leave the workforce. But how much money will you have? In Kenya, you might have a civil servant pension, an occupational pension scheme, or a personal pension scheme. We'll show you how to calculate your retirement benefits using the formula for the kind of pension scheme you have.

Steps

Government Officers and Teachers

-

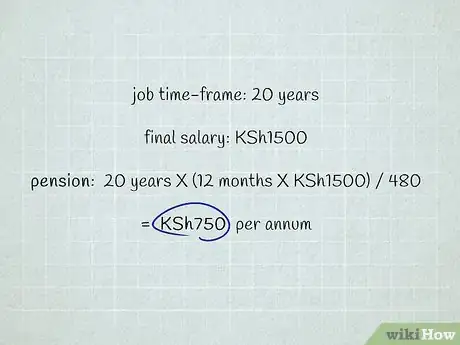

1Use the formula years in service X 12 months X final annual salary / 480.[1] Government officers who served the Kenyan government are entitled to a good pension. Additionally, teachers are considered government officers under Kenyan law.[2] How much you’ll receive depends on how long you served and your final salary. Fortunately, it’s pretty easy to calculate your pension amount using the formula.

- For example, let’s say you worked at your job for 20 years, and your final salary is KSh1500. Here’s how you’d calculate your pension: 20 years X 12 months X KSh1500 / 480 = KSh750 per annum.

- Per annum means annually.

-

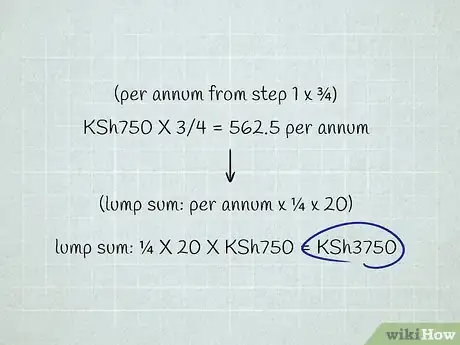

2Take a reduced pension if you want a gratuity at retirement. You can get a big lump sum when you retire if you’re okay with receiving a smaller pension. You’ll get lower pension payments each month, but you’ll get a lot of money when you retire. This might make sense if you have a big expense you want to cover now, like paying off your home. Here’s how’d you calculate your pension:[3]

- Multiply your per annum amount from the previous step by 3/4. In this case, you’d multiply KSh750 X 3/4 = 562.5 per annum.

- Then, calculate your lump sum by multiplying your per annum payment by 1/4 and then by 20. The formula is 1/4 X 20 X per annum. So, you’d multiply 1/4 X 20 X KSh750 = KSh3750.

- If you opt for a reduced pension with a gratuity, you'll receive both the lump sum and the reduced per annum. In the case above, you'd receive a lump sum of KSh3750 and KSh562.5 per annum.

Advertisement -

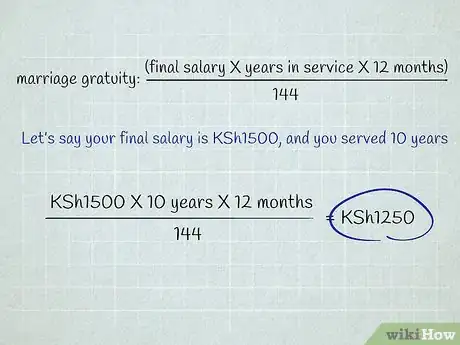

3Use final salary X years in service X 12 months / 144 to calculate a marriage gratuity. If you’re retiring because you’re a woman who’s getting married, you’re entitled to a pension if you’ve served at least 5 years. You’re only entitled to this gratuity if the reason you’re retiring early is marriage. Additionally, this benefit is capped at the amount of your final salary.[4]

- Let’s say your final salary is KSh1500, and you served 10 years. You’d multiply KSh1500 X 10 years X 12 months / 144 = KSh1250. This would be your gratuity.

- On the other hand, let’s say you made KSh1500 and served 13 years. You’d multiply KSh1500 X 13 years X 12 months / 144 = KSh1625. In this case, your gratuity would be capped at KSh1500, since that’s your annual salary.

-

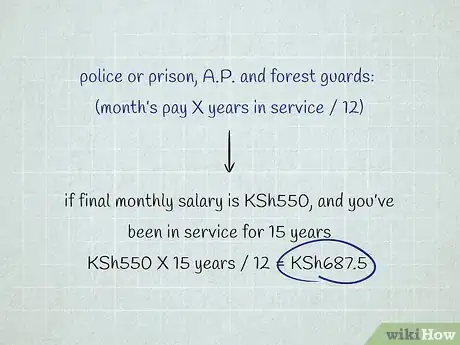

4Use month’s pay X years in service / 12 for police or prison, A.P. and forest guards. Your pension will actually be based on your monthly pay, not your annual salary. Because of this, the formula for calculating your benefits is super easy to use. Fortunately, there’s no cap for your pension, so you'll receive good benefits if you served for a long time.[5]

- As an example, let’s say your final monthly salary is KSh550 a month, and you’ve been in service for 15 years. You’d calculate your pension by multiplying KSh550 X 15 years / 12 = KSh687.5.

National Social Security Fund

-

1Check if you have an NSSF account if you’re self-employed. Create an account on the NSSF website or visit your local NSSF office to find out if you have an account. As a self-employed person, your participation in the NSSF is voluntary. You can only receive retirement benefits through the NSSF if you contributed.[6]

- Go here to create an NSSF account: https://www.nssf.or.ke/benefits

-

2Review your yearly statement from the National Social Security Fund. Every year, the NSSF sends every member of the fund, which includes all working citizens in Kenya who contributed, a statement that details their contributions, credits, and earned interest for that year. This statement will also show you how much benefits you have available for your retirement.[7]

-

3Access your statement on the NSSF website if you lost it. Create an account on the NSSF website to check your retirement benefits at any time. You’ll be able to see up-to-date information about contributions made by both you and your employer. When you’re ready to retire, you’ll also be able to apply for your benefits through this account.[8]

- Register for an account on the NSSF website here: https://www.nssf.or.ke/benefits.

Occupational and Personal Pensions

-

1Check your pension balance to find out your current benefit amount. Some pension schemes send you annual reports about your account contributions and balance. If you don’t have your benefit statement, go to your pension scheme’s website and make an account. Then, you’ll be able to check your retirement benefits anytime you like.[9]

- If your pension scheme is through your job, your human resources representative may be able to help you. They can at least tell you how to access your retirement benefits account.

-

2Plan to receive full benefits if you retire at age 60 or later. Your benefits will include all of your contributions to your pension, any contributions your employer made, and the interest your pension money has earned over time. Your pension’s current account balance is how much your can expect to receive.[10]

- Some pensions or businesses may have a different retirement age. If that’s the case, your employment or pension contract will state that age. In general, the official retirement age is 60.

-

3Expect to receive only your contributions if you retire early. Chances are, you and your employer both contribute to your pension. Additionally, your money will earn interest for you, which increases your retirement benefits. However, the Kenyan government passed a law in 2019 that prevents you from accessing all of your money if you retire early. Fortunately, you’ll receive the rest of the benefits you paid into your pension scheme when you reach full retirement age, which is 60 years old.[11]

- You may be able to receive your full benefits if you are retiring early due to illness.

- If you have a personal pension, your employer won’t make any contributions. However, your money will still earn interest.

- The reason why you can’t access your employer contributions or interest earnings is to protect you from running out of money later in life. You’ll still have benefits to claim at the traditional retirement age of 60.

-

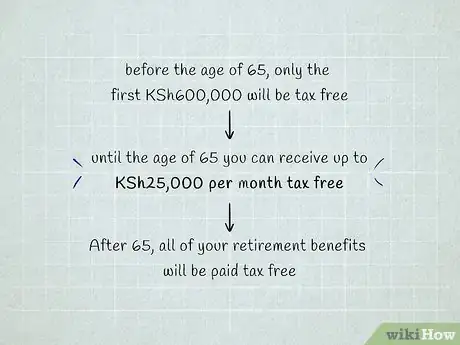

4Choose monthly payments if you want to maximize your benefits. Generally, regular monthly payments are the best option for many retirees. You’ll receive a monthly benefit for the rest of your life.[12] After you turn 65, all of your retirement benefits will be paid tax free. If you retire early, you may owe taxes on your benefits.

- If you take a lump sum before the age of 65, only the first KSh600,000 will be tax free.

- If you take payments, you can receive up to KSh25,000 per month tax free until the age of 65.[13]

-

5Take a lump sum if you need to cover a big expense. Some pension schemes allow you to take a lump sum. Often, this is a lower amount than you would normally receive. If you contributed to your plan, you can take up to 1/3 of your benefits as a lump sum. You can take up to 1/4 of your benefits as a lump sum if you didn’t contribute to your plan.[14]

- You might choose this option if you need money at the time of your retirement to pay off your home or cover a major expense. Similarly, it might be a good idea to get some of your benefits in a lump sum if you have multiple retirement accounts.

- With some plans, you’ll still receive low monthly benefits after you receive the lump sum.[15]

Warnings

- You will lose your pension if you retire early or are dismissed from service. Similarly, you may lose your pension if you’re found guilty of a crime or neglect, misconduct, or irregularity. The only exception to this rule is women who are retiring early to get married.[18]⧼thumbs_response⧽

- If you declare bankruptcy or owe a court settlement, your pension will be redirected to pay for your outstanding debts.[19]⧼thumbs_response⧽

References

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ http://kenyalaw.org:8181/exist/kenyalex/actview.xql?actid=CAP.%20189

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ https://www.nssf.or.ke/voluntary-member

- ↑ http://kenyalaw.org:8181/exist/kenyalex/actview.xql?actid=No.%2045%20of%202013

- ↑ https://www.nssf.or.ke/benefits

- ↑ http://www.iopsweb.org/resources/Kenya-IOPSWebsite-Country-Profile-2018-Final-2.pdf

- ↑ https://ogletree.com/international-employment-update/articles/november-2019/kenya/2019-11-04/kenyas-new-laws-on-pension-reform-and-registration-requirements/

- ↑ https://ogletree.com/international-employment-update/articles/november-2019/kenya/2019-11-04/kenyas-new-laws-on-pension-reform-and-registration-requirements/

- ↑ http://www.iopsweb.org/resources/Kenya-IOPSWebsite-Country-Profile-2018-Final-2.pdf

- ↑ https://cytonn.com/blog/article/how-occupational-pension-schemes-work

- ↑ http://www.iopsweb.org/resources/Kenya-IOPSWebsite-Country-Profile-2018-Final-2.pdf

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ https://www.treasury.go.ke/wp-content/uploads/2020/11/Pensions-Act-CAP-189.pdf

- ↑ http://kenyalaw.org:8181/exist/kenyalex/actview.xql?actid=CAP.%20189

- ↑ http://kenyalaw.org:8181/exist/kenyalex/actview.xql?actid=CAP.%20189