This article was co-authored by Lydia Stevens and by wikiHow staff writer, Jennifer Mueller, JD. Lydia Stevens is the author of the Hellfire Series and the Ginger Davenport Escapades. She is a Developmental Editor and Writing Coach through her company "Creative Content Critiquing and Consulting." She also co-hosts a writing podcast on the craft of writing called "The REDink Writers." With over ten years of experience, she specializes in writing fantasy fiction, paranormal fiction, memoirs, and inspirational novels. Lydia holds a BA and MA in Creative Writing and English from Southern New Hampshire University.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 20,353 times.

By self-publishing, you can get your book into the hands of readers immediately and build a following for your work. British authors have many self-publishing services to choose from, each of which offers different levels of editorial and legal assistance. Once your book is on the market, you must set up as a sole trader and register to file a self-assessment tax return so you can pay taxes on your earnings.[1]

Steps

Choosing Your Publisher

-

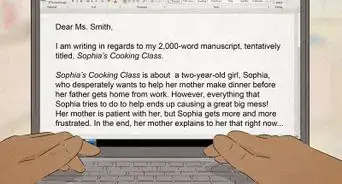

1Evaluate your manuscript. Read your manuscript objectively, or have someone else read it for you. Think about how much editing the manuscript will need before it is ready for publication, and whether you can handle it on your own.[2]

- There are self-publishing companies that provide editing services at different levels, although their fees vary. You also could try hiring an independent editor directly, although this may not save you any money.

- You also might have several people read your book before you finalize it for publication. They can give you valuable feedback on the pacing, flow, and readability of your book.

-

2Compare design services. Whether print or digital, a handsome cover will drive sales of your book, especially initially. Many self-publishing company offer professional design services that will create a unique cover for your book.[3]

- If you intend to use these services, check to see who ultimately owns the rights to the cover. If your book gets bought by a traditional publisher or you otherwise part ways with the self-publishing company, you want to make sure you don't lose your cover design.

- You also can hire your own artist or graphic designer to design your book, including the front and back cover, but this may cost more than using the design services offered by a self-publishing company.

Advertisement -

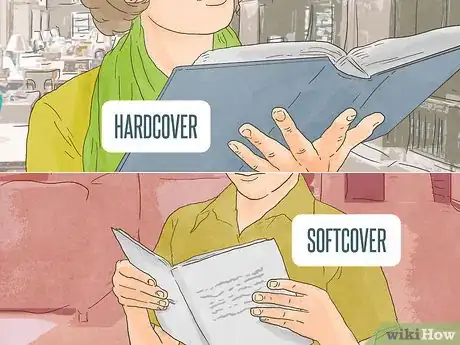

3Decide what publishing formats you want to use. Which self-publishing service you choose may depend on whether you want to publish a print book, and eBook, or both. Ebooks themselves come in several different formats, so you need to think about which devices you want your book to appear on.[4]

- For example, if you want to sell an eBook on Amazon, it must be formatted so that it can be read on the Kindle, Amazon's eReader.

-

4Review the legal services offered. Some self-publishing companies will handle all the legal work for you, including registering copyrights. If you are a UK author who also plans to sell your book in the U.S., you may need to register a copyright there as well as in the UK.[5]

- When your book is published, you must send one copy of the book to each of the five Copyright Libraries in the UK. Some self-publishing companies take care of this for you.

- You'll also need to get an ISBN for your book. While this isn't a legal requirement, it's necessary if you want your book to be sold in any stores. Some self-publishing services will get your ISBN for you, while for others you have to purchase an ISBN yourself.

Using U.S. Publishers

-

1Get an EIN. If you choose to use a self-publishing service in the U.S., 30 percent of your royalties will be withheld for taxes unless you get a tax number from the IRS. Since self-published authors are considered businesses in the U.S., you can get an "employer identification number" even if you don't technically have any employees.[6]

- The U.S. and the UK have a tax treaty, so as a British author with an EIN you can change your withholding from 30 percent to zero.

- To get an EIN, call the IRS at +12679411099. When someone answers, tell them you want to get an EIN. Tell them you are a "sole trader" self-publishing eBooks.

- They will ask you for some information about yourself. Spell everything out and make sure it's correct and matches the information you will use to set up your eBook accounts.

- The operator will give you an EIN over the phone. Write the number down and keep it in a safe place.

-

2Download a W-8BEN form. Some services that withhold taxes will require a copy of this form from you before they change your withholding. You can download it from the IRS website so you have it ready.[7]

- The form states that you are the owner of the royalties subject to withholding, and you are not a U.S. citizen.

-

3Update your tax information with your publishers. For most eBook publishers, once you get your EIN you can simply access your account on their website and enter your EIN to correct the withholding.[8]

- You may be asked if you have an EIN or if you have a "U.S. tax identification number (TIN)." Indicate that you do, and enter the number when prompted.

- Check your name and address information on your account and make sure they match the information you gave to receive your EIN.

-

4Submit your W-8BEN form if necessary. With many eBook self-publishing services, such as Amazon and CreateSpace, you can provide the information included on the official form online, but others may ask you to send in a physical copy of the form.[9]

- Find out ahead of time if the self-publishing service you want to use needs you to mail them a physical form. You'll want to allow time for that before your book is published, if possible, so they aren't withholding royalties in the meantime.

-

5Confirm that your withholding has changed. After you get your EIN, it might take a couple of weeks before the IRS updates its records. Keep with your self-publishing services to make sure your tax information was updated correctly.[10]

- If the company attempts to verify your EIN before IRS records are updated, it may reject your tax information. Simply enter the same information again until it is accepted.

Reporting Your Earnings

-

1Register for self-assessment tax returns. If you are earning royalties from a self-published book, you are considered self-employed in the UK and must file self-assessment tax returns to account for and pay taxes on your profits.[11]

- You don't necessarily have to sit up a separate business for your self-published books. You can operate as a business under your own name.

- You can register for self-assessment taxes online. Go to www.gov.uk/set-up-sole-trader and click on the link to register. Follow the prompts and you can file and pay your taxes online.

- When you register, you'll receive a 10-digit Unique Taxpayer Reference (UTR). Keep this number in a safe place along with your EIN and other information related to your self-publishing venture.

-

2Keep records of your book royalties and related expenses. As a sole trader, you are entitled to deduct from your royalties many of the expenses related to self-publishing. This includes any fees you paid for editing and any marketing or promotion expenses.[12]

- For example, if you have a website and blog to promote your self-published book, you may be able to deduct the registration and hosting fees required to maintain that website.

- If you have any questions about what expenses may be deductible, talk to a tax professional before you file your self-assessment.

-

3File self-assessment tax returns each year. At the end of each tax year on April 5, you must complete and send in a self-assessment tax return that includes information about the royalties you earned and your business expenses related to that income.[13]

- You must file a self-assessment tax return even if you have a day job. While taxes are taken out of your paycheck, they are not taken out of your royalties.

- If you registered online, you also can fill out and submit your tax return online.

-

4Pay for National Insurance. If your only income comes from your self-published books, you typically must pay either for Class 2 or Class 4 National Insurance, depending on your profits. To find your profits, deduct your expenses from your royalties.[14]

- You'll pay £2.85 per week for Class 2 National Insurance if your profits are more than £6,025 for the year. If your profits are more than £8,164, you'll pay at the rate of 9 percent on profits between £8,164 and £45,000, and 2 percent on all profits over £45,000.

-

5Pay income tax on your profits. In April of each year, you'll owe taxes on the profits you've made from self-publishing. Your profits are the amount of royalties you earned above and beyond any expenses you incurred to self-publish your book.[15]

- Consult a lawyer or tax professional if you're unsure which expenses you should include, or if you have any further questions about the self-assessment tax return.

References

- ↑ https://selfpublishingadventures.com/paying-uk-income-tax-on-book-royalties-uk-authors/

- ↑ https://www.writersandartists.co.uk/self-publishing/advice/How-Our-Comparison-Service-Works

- ↑ https://www.writersandartists.co.uk/self-publishing/advice/How-Our-Comparison-Service-Works

- ↑ https://www.writersandartists.co.uk/self-publishing/advice/How-Our-Comparison-Service-Works

- ↑ http://www.troubador.co.uk/matador.asp?s=How%20to%20Publish

- ↑ http://regevelya.com/royalty-withholding-tax/

- ↑ https://www.irs.gov/uac/form-w-8ben-certificate-of-foreign-status-of-beneficial-owner-for-united-states-tax-withholding

- ↑ http://regevelya.com/royalty-withholding-tax/

- ↑ http://regevelya.com/royalty-withholding-tax

- ↑ http://regevelya.com/royalty-withholding-tax/

- ↑ https://www.gov.uk/log-in-file-self-assessment-tax-return/register-if-youre-self-employed

- ↑ https://www.gov.uk/set-up-sole-trader

- ↑ https://www.gov.uk/self-assessment-tax-returns

- ↑ https://www.gov.uk/self-employed-national-insurance-rates

- ↑ https://www.gov.uk/set-up-sole-trader