This article was co-authored by Kendra Kinnison, CPA, MBA. Kendra Kinnison is a Certified Public Accountant in Texas. With over 20 years of experience, she has served in diverse roles in the finance space, and is now the COO of Allocations, a company that builds tools for economic freedom. She received her BBA in Accounting and Masters of Business Management (MBA) from Texas A&M University-Corpus Christi in 1999 and 2000. She is the youngest MBA graduate in the school’s history.

This article has been viewed 65,058 times.

Having a billing system is important for keeping track of bills for customers or other businesses. Many services and software programs exist to handle billing matters. Regularly using one of these services or programs can help you keep billing records and information up-to-date. Follow these steps to set up a billing system.

Steps

Choosing a Billing System

-

1Use an offline billing system. Odds are, you are already using some type of billing system. You may keep track of payments through a written list, a stack of invoice copies, or through a spreadsheet program like Excel. If you're organized enough, this type of system can work for a small business, especially if you are handling a relatively low volume of transactions. If you don't have any type of existing billing system, consider using this type of simple, offline system before investing in billing software.[1]

-

2Decide to use billing software. If tracking your billing with an offline system starts to take too much time, you should consider using billing software instead. These systems can performs tasks like organizing your invoices all in one place, separating them by customer and due date, and generating invoices. Some of them can also produce monthly and annual reports to give you an overview of your accounts receivable. Implementing this type of system can help you catch past-due payments you may otherwise overlook.[2]Advertisement

-

3Compare billing software packages. There are a lot of billing software systems out there, and each offers slightly different features for businesses of various sizes and complexities. Some of them are free, while others may charge an initial fee or a subscription fee. Each one also offers different features that may or may not be useful to you. For these reasons, it's important to investigate your software options and choose the one that best fits your needs and budget.[3]

- Some of the more popular options are:

- FreshBooks.

- Zoho.

- SliQ Invoicing.

- Intuit Quickbooks.

- Invoice2go.

- Express Invoice.

- kBilling.

- PaySimple.

- Try to find a billing software or service that allows you to track your invoices, provides means to resolve disputes, handle exceptions to regular billing practices, and lets you make notations.

- Make sure you can fulfill your potential billing software's necessary technical requirements before downloading and/or paying for the product. A software called Billing Organizer Pro, for example, only works for certain versions of Windows operating systems.

- Some of the more popular options are:

-

4Install your chosen billing system. If you have chosen to use billing software, pay for and install your new system. In many cases, it's best to have a professional install the software on your computer or computer system. This will ensure that all software is properly installed and functioning correctly.[4]

Setting Up Your Billing System

-

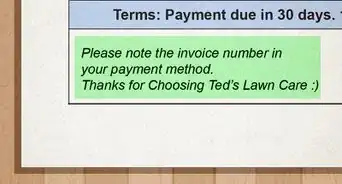

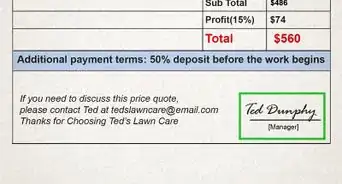

1Establish your payment terms. An important part of setting up a billing system, regardless of how you track payments, is to make clear your standard payment terms. If you don't have payment terms, customers will not know when their payments are due and will rely on you to remind them (often many times) before they will pay. Set up terms for how many days the customer has after a sale is made to pay for that sale.[5]

- For example, many businesses choose to make payment due within 15 or 30 days of the sale.

- You can also establish different payment lengths for different customers. Just make sure to include these terms in your contracts with them.

- Take into account how customers and your supply partners might like to pay their bills to you. Consider discussing your new or modified billing system with them to ensure their cooperation in using it.

- Whatever payment terms you choose, just be sure that you are consistent in applying them.[6]

-

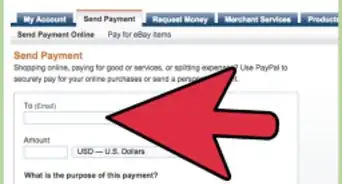

2Input customer information into your system. Include items such as credit card information, billing and mailing addresses, and existing payment due dates. Take all of the information you have spread out around the office, in your head, or in papers on your desk and put it into your new system. Organizing your information in this way may be time-consuming, but having everything in one place will greatly simplify your billing process.[7]

-

3Add any standard billing items and amounts you charge. You may be able to save time working on bills by only having to enter typical billing costs once into your system. For example, if you charge an hourly rate, you may be able to input this information so the software can calculate a total bill. Alternately, you may be able to put in materials fees or other standard fees that you frequently charge to save time when creating invoices.

-

4Prepare billing invoices. These invoices may be printed and mailed or emailed to customers. Some software packages also include automated invoice creation and emailing. Alternately, you can place an employee in charge of preparing and mailing invoices. Check your invoices for errors before sending them to customers to prevent problems or arguments later. An invoice should include the following:

- The products or services provided.

- The quantity provided (hours or number of products).

- Expenses involved (including copies of receipts in some cases).

- The amount due.

- When the payment is due.

- For your own purposes, you may also want to include an invoice number and/or a customer number.[8]

Tracking Payments

-

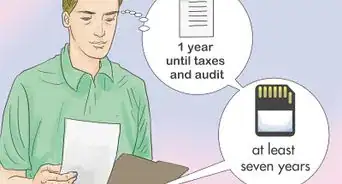

1Record the receipt of payments. Keep track of when you were paid by a customer and what the payment amount was. Always input this information into your billing system promptly so that you don't forget to do so. Failing to input this information could lead you to mistakenly accuse a customer of not paying their invoice.

-

2Send customers bill payment reminders. Send customers a friendly reminder before a bill is about to come due. Doing so is preferable to chasing down customers who have not paid a late bill yet and can ensure that you receive payment on time and in a regular fashion. Sending a reminder also gives you a chance to connect with your customers by requesting feedback, sharing news of your business, or expressing appreciation for customers.[9]

-

3Establish a late payment policy. In order to successfully handle late payments, you need to have a standard policy in place. Your policy should specify initial steps in handling late payments, such as sending a gentle reminder a few days after a due date if the payment has not been made. From here, you should specify more intense actions that will be taken if payments continue to go unpaid 30, 60, and 90 days out. For example, you can suspend shipments or service to customers with bills that are over 30 days late.

- Your policy should also specify a maximum number of late days allowed before legal action will be taken.[10]

-

4Perform age analysis. Age analysis tracks how many days past due your unpaid invoices are. Performing this type of analysis can allow you to recognize and act on unpaid bills according to how many days late they are. Age analysis is best performed by accounting or billing software, but can also be done manually by examining unpaid invoices each month to assess their lateness.[11]

References

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://blog.capterra.com/5-simple-steps-for-setting-up-an-accounts-receivable-management-system/

- ↑ http://blog.capterra.com/5-simple-steps-for-setting-up-an-accounts-receivable-management-system/

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://blog.capterra.com/5-simple-steps-for-setting-up-an-accounts-receivable-management-system/

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://www.inc.com/guides/accounts-receivable-setup.html

- ↑ http://blog.capterra.com/5-simple-steps-for-setting-up-an-accounts-receivable-management-system/