This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 16 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 167,306 times.

A personal financial crisis can come from many things -- a lost job, a divorce, bankruptcy, a sudden medical emergency, or any situation in which your financial security crumbles beneath you. Regardless of the cause, the consequences are often similar: emotional stress, confusion, perceived loss of control, and loss of confidence. While enduring a financial crisis may be challenging, know that you can regain your financial stability once again. Your situation can be remedied by regaining your composure and taking concrete action.

Steps

Regaining Control

-

1Be aware that negative emotions are normal. Before addressing the financial elements of a personal financial crisis, it is important to address the emotional elements. You have to recognize that emotional turmoil is a normal component of the process. Depending on the cause of your situation, you may experience stress, depression, or anxiety. This may be accompanied by a sense of guilt or failure. You may also feel as if you have no control over your situation.

- These emotions are a normal component of going through a financial crisis. While it may be difficult at first, these emotions will likely pass over time as you adjust to your new circumstances, and re-gain control of the situation by taking action.

-

2Focus on accepting your financial situation. When faced with a difficult situation, people often try to deny or ignore the situation. While it may feel better to do this, it does not help in the long run. Accepting your situation can empower you to face your difficulties as they are and conquer them head-on.[1] [2]

- Accepting the situation is the first step to resolving it. Try to channel any negative energy about the situation into positive, solution-focused actions. For example, instead of dwelling or blaming yourself for a scenario, try taking that negative energy and using it to make a commitment to solve the situation once and for all.

Advertisement -

3Talk about your situation. Confide in close friends or family members to talk out your worries and work out possible solutions aloud. Your confidants may be able to offer advice from their own experiences or those of their friends. Not only does this provide emotional support, but it exposes you to different and potentially more productive ways of approaching and dealing with the situation.

- In extreme cases, you should consider seeking the help of a professional therapist. You should certainly seek professional help if your financial crisis is causing you to struggle with depression, have anxiety attacks, or consider harming yourself or others.

-

4Be honest with your family. Let your loved ones know that you are going through a financial crisis. You may be surprised who might offer you a loan, and even if your family is not in the position to provide you with financial assistance, letting them know what’s going on could result in significant stress relief.

- In many cases, it can be beneficial to let children know that the family is experiencing tough times. This is because some extracurricular activities (music lessons, summer camp) might have to be sacrificed for the good of the family. Just be sure to reiterate the temporary nature of these sacrifices.

- You can also encourage older teenagers to get part-time jobs. If they are over age 18, consider having them pay rent.

-

5Commit to staying positive. Before making a plan to remedy your situation, make a commitment to focus on the positive. Think about it this way: while the cause of your situation may not be in your control, how you choose to react to it is. Thinking positively can improve your mood, reduce your stress, and help you approach the situation in a way that is conducive to solving it.

- Remember that regardless of your situation, others have faced and solved it before.

- Focus on being grateful for what you currently do have. For example, if you lost a job and have a large amount of debt, you could, perhaps, focus on support systems you have (like friends or family).

Assessing Your Financial Situation

-

1Determine your assets. The first step to resolving a financial crisis is to get a clear picture of your entire financial situation. Begin by looking at your assets, which can be simply defined as what you own. Assets are a source of financial strength. They typically include any value you have in your home, cash in checking or savings accounts, any value you have in a car, and any money in retirement or investment accounts.

- Assets can also include any other valuables that may be worth money like jewelry, collectibles. Consider taking your valuable assets to an appraiser or researching them online so that you can know how much your assets are really worth. That way, if you decide to sell them, you'll know if you're getting a good deal.

- Create a column on a piece of paper that lists these assets and their values. At the bottom, sum up the values to determine what the total value of your assets is.

- For more information, see how to make a list of personal assets.

-

2Determine your liabilities. Liabilities refer to your debt, or more simply "what you owe". They are the opposite of assets. Liabilities include credit card debt, lines of credit, mortgages, unpaid bills, student loans, and your car loan.

- Using the same piece of paper you used for your list of assets, create a column that lists all your liabilities, and their values. At the bottom of the column, include the sum of your total liabilities.

-

3Calculate your net worth. Your net worth is simply your total assets minus your liabilities. This is the figure that represents how much is left if you were to sell all your assets to pay off your debt, and is a good figure to describe your current financial situation.

- For example, if you have $10,000 in assets (perhaps in equity on your car) and $50,000 in various forms of debt, if you were to sell your car and used the proceeds to pay down your debt, you would have $40,000 in debt. Therefore, your net worth would be -$40,000.

- Knowing your net worth helps you understand options. For example, it may be necessary to sell assets in order to satisfy creditors if you are in debt, or to use any accumulated savings for the same purpose. Typically, any assets that are not absolutely essentially could be sold to satisfy essential debts. For example, selling a car to pay off a credit card can improve your credit rating, reduce your debt payments every month, and get creditors off your back.

- Even during a bankruptcy proceeding, creditors and courts may demand that you sell off certain unnecessary assets before your liabilities can be settled. Therefore, it's best to sell off these assets beforehand.[3]

-

4Determine your income. Once you know your net worth, it is now necessary to look to your income and expenses. Knowing what these are can help you determine whether or not your net worth is shrinking or growing, and affects your path to recovery. Income is fairly simple to calculate by simply adding together any and all sources of revenue. For most people, this will be their wages from work and any regular government payments (like social security or other forms of assistance).

- Remember to include necessary automatic deductions so that your income figure represents how much cash you actually have available to use. Deductions include any taxes, insurance, or withheld amounts on your paycheck.

-

5Determine your expenses. In order to alleviate your financial crisis you need to have a good idea about where and how you spend your money.[4] The best way to determine how much money you are spending is to review your bank account statements from the last two months. Make a list of how much money you spend on utilities, food, housing, gas, clothing and entertainment. Once you know where your money is going you can make adjustments geared towards decreasing the amount of money you spend so that you can get back on your feet.[5]

-

6Determine your monthly net income. If you subtract your expenses from your income, the resulting number is your net income. This represents how much you have left over at the end of the month. If this number is negative, it is a sign that reducing your expenditures will need to be a critical component of your overall plan to restore your financial well-being.[6]

- However, if your monthly net income is negative because you are receiving a very small amount of income each month, it's more necessary to increase your income than cut your expenses.

-

7Assess the consequences of your situation. In order to motivate yourself to get out of this financial crisis, you'll have to remind yourself why you want to improve your situation. In other words, what will you be unable to do because of your current situation? Be realistic about your life goals and calculate the costs of achieving those goals. Think about how just sitting back and settling into your new financial situation will hurt you and those around you in the long run.

- For example, if you have children and want to one day give them the opportunity to go to college, think about how you will be unable to do so unless you turn around your current situation.

Developing a Recovery Plan

-

1Create a plan suited to your needs.[7] The exact nature of your recovery plan will have to remedy the problem that got you into the financial crisis in the first place. Put simply, you will have to reduce debt if you have it and earn more income to replace your lost assets and financial security. This may mean getting a new job, getting another job, cutting your expenses, applying for government assistance, or seeking debt forgiveness.

- For example, if your financial crisis was caused by a divorce, you will have to find income to replace the joint income you had in marriage.

- The simplest way to dig yourself out of debt and live sustainably off of your income is to reduce expenses and increase your income. Other options, like bankruptcy, while necessary in some cases, can also ruin your credit and cause a large amount of hassle.

-

2Determine your fixed and discretionary monthly expenses. Fixed expenses refer to expenses that do not vary between months. Discretionary expenses refer to expenses that are not essential and vary from month to month. Knowing the difference is important, since reducing discretionary expenses can be much simpler than reducing fixed ones.

- Your fixed monthly expenses are those bills and other costs that must be paid regularly so that your basic needs are met. Fixed monthly expenses include rent, mortgage payments, utilities, education, insurance, food, and transportation. Other fixed monthly expenses include any debt or other payment obligations.

- Variable or discretionary expenses include anything that you don't need to spend to survive, like eating out at restaurants, gym memberships, entertainment, and clothing.[8]

-

3Reduce your variable expenses. The first place to start with reducing expenses is with your variable expenses. These are you wants, as opposed to your needs, and cutting them can free up significant room in your budget for debt repayments. Ensure that your not confusing your wants with your needs. For example, a cell phone may be a need, but a 3GB data plan with cell phone is almost certainly a want.[9]

- Decide now that you won't go out to eat at a restaurant until your situation changes (for example, when you get a new job). This can save you a large amount on food costs.

- Watch for small purchases that add up, like buying coffee everyday. Eliminating these can save significant amounts of money each month.

- Cancel unnecessary memberships to fitness centers, clubs, and other monthly recurring-cost entertainment. Check to make sure that you don't incur more charges if you must break a contract early.

- Consider canceling cable TV. With the internet and smartphones, cable is often redundant.

- Don't shop unless you need to. You can probably postpone buying clothes for many, many months. If you must buy something, go to a second-hand store or to a close-out store.

-

4Reduce your fixed expenses. Expenses like housing, food, or transportation are traditionally considered fixed, but that does not mean you can't significantly reduce your costs in these areas to free up space in your budget each month.[10] [11]

- If you are renting and your housing is too expensive, consider re-locating to a more affordable apartment, or to a different area of town. Keep in mind what you want, versus what you need. For example, if you are single, a one bedroom apartment may be ideal, but a studio is likely all you need, and downsizing can save you considerable amounts.

- Consider getting a roommate if possible.

- Consider visiting a food bank or soup kitchen, and using food stamps. If qualify, temporarily using these resources can significantly reduce your costs until you are in a better place financially.The Supplemental Nutrition Assistance Program (SNAP), once known as the food stamps program, provides low-income Americans with supplemental funds to purchase food. Eligibility for SNAP is based on household monthly income, as well as other factors such as the number of children in a household. Contact your state’s government assistance program to learn about applying for SNAP.[12]

- Ride share or take the bus to reduce transportation costs.

-

5Pursue additional sources of income. In a perfect world a 40 hours a week full-time job would provide you with the funds you need to cover your costs and expenses. In reality, you may need to get creative in order to locate additional sources of income, especially if you've fallen on hard times.[13]

- If you don't already have a full-time job, immediately start going out to businesses that may be hiring and submit your application. Apply to as many places as possible.

- Find a part-time job. Search in craigslist and consult with friends in order to locate part-time job opportunities.

- Focusing on jobs that provide seasonal employment may be a great option in that seasonal employers often hire people only looking for short-term employment ie. working at the mall during the Christmas season, or as a lifeguard during the summer.

- Take on odd jobs like landscaping, baby-sitting, waiting tables, or bartending.

- Register at several temporary employment agencies. They might not have regular work or career-related work, but sometimes short assignments will help when you're in a pinch.

-

6Apply for government assistance programs. The U.S. federal government provides a wide range of services for American’s in need that are governed and dispensed by state governments. However, accessing government assistance programs requires patience because of varying application processes and bureaucratic delays. As a result, government assistance programs can provide additional funds for when you are going through a long-term financial crises, but you shouldn’t expect to receive quick financial aid from government assistance program.[14]

- Unemployment insurance is a great option for those workers who are in a financial crises because they have lost their job, or are otherwise unable to work. An unemployment insurance claim can be filed if you fulfill specific requirements, which vary by state.

- Check with your local state department of social services to determine which other governmental assistance programs that you may be eligible to access.

- If you live outside of the United States, contact your local government to inquire about government assistance. Most developed countries offer unemployment assistance and subsidized necessities to those in need.

-

7Consider selling assets and using the proceeds to pay off debt. Any assets you don't absolutely need can and should be sold to pay off your debt. This is because the value of your assets is likely decreasing and the value of your debt is always increasing. The simplest thing you can do to improve your net worth is pay off as much of your debt as possible as quickly as possible.

- If you are in a very dire debt situation, it can be a good idea to use retirement savings to pay off debt, or sell assets like a car. You can replace the car with a cheaper one or use public transportation instead, if possible.

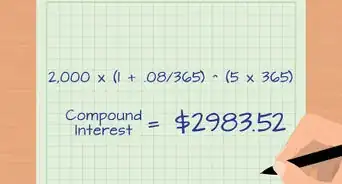

- If using savings to pay off debt, it is important to consider a few things. Firstly, only use savings to pay off very high-interest debt (like credit card debt). Not only is paying off this debt with savings financially reasonable (due to the fact it is extremely costly and it is unlikely an equivalent amount of interest is being earned on savings), it can improve your credit rating, get creditors off your back, and reduce your monthly expenses.

- While planning your recovery, make a schedule of how much you can pay off each debt each month. This should also include when you estimate to be able to pay off each debt completely.

-

8Consider filing for bankruptcy. If you lack sufficient assets and income to pay for basic necessities and pay off your debt at the same time, filing for bankruptcy can be your only option. Bankruptcy can erase your debts and give you a financial clean slate, but is not without its downsides. The process also destroys your credit score and can force you to sell off certain assets deemed unnecessary, even if you don't want to.

- Most people will file for what is known Chapter 7 Bankruptcy. This allows the court to settle your debts by selling off some of your assets. See how to file for Chapter 7 bankruptcy for more information or see how to file Chapter 7 Bankruptcy without a lawyer if you want to file for bankruptcy by yourself.

- Protected assets are those that cannot be sold during bankruptcy proceedings. These typically include your primary residence, primary transportation, and personal items like wedding rings. Specific protected asset always vary by state.[15]

Following Your Plan and Managing Your Debt

-

1Implement your recovery plan. After you've decided on a recovery plan, whether that is getting a new job, reducing debts, bankruptcy, or some combination of those, get started as quickly as possible. The longer you delay, the more your debt will pile up. Take every step you decided on as quickly as possible.

- Most of these will be abrupt changes that will negatively impact your quality of life. As states previously, the most important thing is to remain positive throughout this situation change and try to see the light at the end of the tunnel.

-

2Prioritize your debt repayment. Understand that in a financial crisis situation, not all debt is valued equally. If after reducing expenses, you only have a fairly small amount remaining to pay off debt, it is important to use that amount to pay off debts in the following order of importance[16] :

- Pay off any secured loans first. These include mortgages or car payments. Not paying these loans can result in foreclosure or repossession.

- Focus next on unsecured loans, specifically on high-interest accounts like credit cards.

- Finally, focus on unsecured loans with low debt. For any debts you cannot afford to pay, ensure that you contact them and explain your situation. You may be able to renegotiate repayment in these cases.

-

3Understand the importance of staying in touch with your creditors. While it may be tempting to ignore your creditors, this will only worsen your situation. Often, creditors will begin garnishing wages (automatically taking a cut of your pay) simply because they have not been able to make contact with borrowers [17] .

- Be aware that creditors will not stop attempting to contact you, nor will they forget about you. Therefore, being proactive and working with, rather than against creditors is critical. [18]

-

4Contact your creditors and explain your situation in open and honest terms. Phone your creditors, and make sure you have with you all your financial information, as they will likely ask. Honestly explain to your creditors that you are unable to make payments, and that you would like to work with them to come upon a solution.[19]

- Ask for a rate reduction, deferred payments for several months, or a reduced payment plan. Creditors are very eager to work with borrowers, since it is more costly for a creditor to utilize debt collection services and risk losing principle than to work constructively with a borrower.

- Suggest that you are willing to pay the ongoing interest during any period of debt relief, this signals to creditors that you are serious about your obligation

- Inform your creditors that you are planning on staying in touch every month. By contacting them and staying readily available, they will be more likely to extend favorable terms and be more flexible in their needs.

-

5Consider debt consolidation loans and/or balance transfer cards to reduce payment amounts. Both of these solutions involve transferring debt balances to new loans with more favorable terms[20]

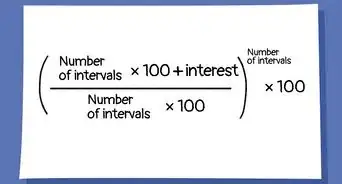

- A debt consolidation loan involves taking out a new loan with lower interest, like a line of credit, and transferring your higher interest debts to that loan. For example, you would transfer all your credit card debts to a line of credit, which rolls all of your payments into one payment, that will often cost less than the previous payments combined due to lower interest rates. Be aware that although interest rates are lower, the loan terms are often longer, which means you may actually spend more in interest over time.

- A balance transfer card is another solution for credit card debts. A balance transfer card is credit card which offers very low to no interest rates for the first 12-24 months for individuals who transfer their balances from another credit card. Doing this can give you a much needed break on payments until your financial situation is in order.[21]

-

6Consider debt counseling. If you feel overwhelmed, consider consulting not-for-profit debt counseling services. These services can help you make and plan and work with creditors to restructure your debt in a way that fits within your current means to pay.

Recovering Your Financial Stability

-

1Maintain your recovery habits. As you begin to pay off debt and increase your income, you will begin to feel more financially secure again. However, this feeling can be quickly reversed if you get ahead of yourself and spend your newfound excess as quickly as you earn it. Make sure that even when you feel your financial health returning, you keep your spending low and don't incur any new debt until all of your old debts are repaid.

- Consider allowing yourself one luxury each time you pay off a debt. For example, you might have cancelled your Netflix subscription to save money. You can set an allowance where you can renew your subscription once your credit card debt has been paid off. Allowance one luxury like this can help keep you on track.

-

2Rebuild your credit. If you ever had significant debt and were late on payments or went through bankruptcy proceedings, there is a good chance that your credit is very low. In order to secure your financial future, you will have to rebuild a good credit score. This will allow you to take on lower cost loans in the future. Even though unpaid debts or a bankruptcy can remain on your credit report for years, it is possible to begin building a good credit score once you get back on your feet.[22]

- Build credit by paying off credit card in full and on time. This should be simpler now that you've reduced your discretionary spending.

- You can also build credit by paying back other loans on time and in the full amount. These include mortgage and car payments.

- Again, be sure to avoid taking out any new loans like these until you've paid off your old ones.

-

3Apply lessons you've learned. Examine the practices and situations that got you into the financial crisis that you've just struggled to climb out of. Were you living above your means? Were you often using expensive forms of debt to finance purchases? Perhaps you realize now that you can get by with spending much less than you did before, especially on discretionary expenses. Apply these experiences to your new financial situation to become even more financially sound than you were before.

-

4Save or prepare to prevent another crisis.[23] If your financial crisis was due to an unavoidable cause, like a lost job or a medical emergency, you should take steps to be ready if it happens again. Once you're back on your feet with debts paid, be sure to save the money you have been using to pay off debts. Part of this saved money can be your "emergency fund." An ideal amount to save is enough to cover your fixed expenses for around six months. Having this money set aside will give you a financial buffer if you ever find yourself in a similar crisis.

Expert Q&A

-

QuestionHow do you determine what spending is justified and what is not?

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Certified Financial Planner You just have to be honest with yourself. If you sit there and look at your budget and see that you spend a large portion of your money on eating out, think about if you really need to be doing that each month. Every single person is different, but nearly everyone can find something in their budget that they need to cut back on. Make sure you look honestly at what your cost of living is and think about how you can reduce it by even a small amount.

You just have to be honest with yourself. If you sit there and look at your budget and see that you spend a large portion of your money on eating out, think about if you really need to be doing that each month. Every single person is different, but nearly everyone can find something in their budget that they need to cut back on. Make sure you look honestly at what your cost of living is and think about how you can reduce it by even a small amount. -

QuestionHow do you start an emergency fund?

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Certified Financial Planner First and foremost, you need to be able to figure out a way to have some discretionary savings in your cash flow. That means you cannot be living paycheck to paycheck. Instead, you need to figure out a way to set aside a little bit of money each month to go towards your emergency fund. To do this, think about what you can cut back on, such as eating out.

First and foremost, you need to be able to figure out a way to have some discretionary savings in your cash flow. That means you cannot be living paycheck to paycheck. Instead, you need to figure out a way to set aside a little bit of money each month to go towards your emergency fund. To do this, think about what you can cut back on, such as eating out.

References

- ↑ http://www.bankrate.com/brm/news/sav/20000926.asp

- ↑ http://www.quickanddirtytips.com/money-finance/credit/survive-a-financial-crisis-and-still-get-a-home-loan-with-bad-credit

- ↑ http://www.nolo.com/legal-encyclopedia/selling-nonexempt-property-before-filing-bankruptcy.html

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://www.theorganicprepper.ca/how-to-survive-a-personal-economic-collapse-11252013

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://www.bankrate.com/brm/news/sav/20000926.asp

- ↑ http://www.moneytalksnews.com/10-ways-save-money-when-youre-making-minimum-wage/?all=1

- ↑ http://www.fns.usda.gov/snap/eligibility

- ↑ http://www.fns.usda.gov/snap/eligibility

- ↑ http://www.lifehack.org/articles/money/top-10-side-jobs-that-can-make-money-easily.html

- ↑ http://www.cbpp.org/research/policy-basics-introduction-to-the-supplemental-nutrition-assistance-program-snap

- ↑ http://www.nolo.com/legal-encyclopedia/bankruptcy-exemptions-overview.html

- ↑ http://www.bankrate.com/brm/news/sav/20000926.asp

- ↑ http://www.bankrate.com/brm/news/sav/20000926.asp

- ↑ http://www.quickanddirtytips.com/money-finance/credit/survive-a-financial-crisis-and-still-get-a-home-loan-with-bad-credit?page=1

- ↑ http://www.entrepreneur.com/article/226911

- ↑ http://money.usnews.com/money/blogs/my-money/2013/04/12/4-debt-consolidation-traps-to-avoid

- ↑ http://www.thesimpledollar.com/a-step-by-step-guide-to-getting-your-credit-card-interest-rates-reduced/

- ↑ http://www.bankrate.com/finance/debt/bankruptcy-timeline-rebuilding-credit-1.aspx

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.