This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 66,167 times.

A financial advisor is an expert in wealth management, helping you make decisions about the use of your money including investments, insurance, and planning for retirement. If you're considering engaging a financial advisor of any type, including a wealth manager, insurance specialist, or stockbroker, you'll need to find someone who fits your needs.

Steps

Deciding What Type of Advisor to Hire

-

1Decide whether you need an advisor. Financial advisors are an added expense, and many people do not hire one. But the decision to manage your own finances is a risky one. Deciding whether to hire a financial advisor involves carefully assessing your own abilities.

- If you have a working knowledge of investing and asset allocation and feel comfortable handling your own financial future, or if you have a financial plan that offers free investment advice, you might be able to forego a financial advisor.[1]

- You will also need time and discipline in order to monitor your portfolio and make changes when market conditions shift.[2]

- However, if the cost of having a financial advisor is not an issue for you; and/or if you have a complicated financial situation, have recently come into a large amount of money and need help managing it, or need help planning for retirement, a financial advisor can help you make the right choices to maximize your savings. One study found that 401(k) investors who had a financial advisor earned 3.32 percent higher on their investments than those who did not.[3]

-

2Choose the type of advisor you need. The type of advisor that you need depends on the complexity of your needs. Of course, a good advisor will help you understand your needs, but in general, you can assess what you're hoping to gain from a financial advisor and then have a better idea of what type to look for.

- A Certified Financial Planner® (CFP®) must have a significant amount of experience and pass numerous exams to earn the CFP® title. This person will be trained in financial planning, taxes, insurance, employee benefits, estate planning and retirement.[4] CFPs® are also required to maintain their certification with continuing education, meaning his information will be up to date. A CFP® is comparable to a master's degree in financial planning. To find a CFP® in your community, go to: http://www.cfp.net/search

- A Registered Investment Advisor (RIA) works with high-net-worth investors (usually someone with a net worth over one million dollars).[5] Your RIA will look at your long-term goals and offer advice while managing your portfolio. They charge a fee of about 1% of your invested assets per year, sometimes less.[6]

- A Chartered Life Underwriter® (CLU®) specializes in life insurance and estate planning.[7] A CFP® who wishes to set herself apart in these areas will earn a CLU® designation, which requires additional education and the successful passing of eight exams.[8]

- A Chartered Financial Consultant® (ChFC®) requires the same education as someone with a CFP®, but there is no board exam.[9]

- Robo-advisors are offered by online firms. This is just what it sounds like — instead of working with another human, an automated algorithm is used to help you manage your portfolio. You cannot use this service for estate planning or taxes.[10]

- Someone who goes by the title investment counselor, wealth manager, or investment advisor should not automatically be considered the same as a CFP® or RIA. Without those designations, they do not have the combined education, experience, and certifications of these other professionals. In order to give advice on investing in securities in exchange for payment, they must be registered with the Securities and Exchange Commission,[11] but be aware that general titles (like "wealth manager") don't tell you much about the person's qualifications.

Advertisement -

3Learn the difference between commission-based, fee-based, and fee-only advisors. Financial advisors are often called brokers or dealers if they work for a financial company and earn their incomes based on commissions. On the other hand, independent, registered financial advisors have no company affiliation or sales quotas and charge annual or monthly fees based on the amount of money they are managing for their clients. Fee-only financial advisors provide financial advice are compensated by fees only, and do not receive commissions. Some broker-financial advisors, who advertise themselves as "fee-based", get the best of both worlds (for them) by receiving both fees from their clients and commissions from products they sell. These salesmen are the worst of all possible worlds for the investor, since paying fees to a salesman receiving commission from selling products does not eliminate conflict of interest, but just allows him to be paid twice.

- Commission-based brokers and dealers are often more affordable because they take a commission, not annual or monthly fees, though costs are relative to the results. Until very recently, brokers and dealers were not legally obligated to work in your best interest (in other words, they did not fill a "fiduciary" role); they could sell you a product (such as stock) that was not optimal for you. As of April 2016, brokerage firms must act under a fiduciary standard — they must act with your best interests in mind when it comes to tax-advantaged retirement accounts (such as a 401k).[12] The rule will take full effect in 2018.[13]

- A fee-only, independent advisor might be more expensive, especially if you are managing a very large amount of money. But many experts think that the service provided by an independent advisor is higher quality, since she can never relax.[14] She has to make sure the client is always satisfied, year after year, or her fee will vanish with the client. Fee-only advisors claim that this arrangement could be expected to lead to a better performance by your investments.

- A "fee-based" advisor both charges fees to the client and receives commissions from selling investment products. It offers the worst of all possible worlds: high expense and conflict of interest.

Finding a Reputable Advisor

-

1Solicit referrals from your family or friends. If an advisor has done well by someone you trust and respect, she'll probably do well by you, too.[15]

- Consider asking friends or colleagues who are managing a similar financial situation to yours, or who seem to be doing well with wealth management issues.[16] Since asking about financial issues can be socially taboo, avoid asking about their financial situation or money management choices. Instead simply ask if they have a financial analyst that they are happy with that they feel comfortable recommending.

- While you're at it, check online and see if the advisor has consistently high reviews on Google, Yelp, and Better Business Bureau.[17]

-

2Get a recommendation from a professional. Certain professionals deal with financial planners on a regular basis and are well equipped to offer good recommendations.

- Consider asking an estate lawyer or a Certified Public Accountant (CPA), preferably one with whom you already have a professional relationship. That way, you can put a little more stock in their recommendation.[18]

-

3Look for someone with certifications. Seventy percent of the people representing themselves as financial advisors end their education after acquiring their licenses, except for required annual continuing-education credits. It's the other 30% that you are looking for.

- These are the people with initials behind their names representing professional designations. Look for CFPs®, CLUs®, RIAs, etc.

- Look for someone with at least a college degree, preferably in finance, economics, or business related field.

- Think long and hard before entrusting your money to someone who doesn't take his profession seriously enough to seek all the education available. Your search could result in a list of several hundred advisors if you live in a large city.

-

4Search for financial advisors in your community. Most financial advisors who have taken their professional advancement seriously will be members of one of the large professional associations.

- Look for fee-only certified financial planners through the Financial Planning Association or the National Association of Financial Advisors.[19]

Interviewing Prospective Advisors

-

1Ask a potential advisor about her approach. When you first sit down with a potential advisor, consider it an interview, with you as the prospective employer. After all, this is exactly what the situation comes down to. With this in mind, you need to ensure that she is a good fit for your needs.[20] Some questions to ask about her approach include:

- What types of clients does she normally work with? Does she have a lot of experience with people with a similar financial profile to yours, and who have the same financial goals?

- Who will be responsible for your account? Some financial advisors handle every aspect of their client's account, while others work with a team or even delegate decisions to other people. If you are hiring her as your advisor, you need to know if others will be involved.[21]

- What is her approach to financial planning or advising? Does she tend to stick to the client's suggestions and goals, or challenge the client to consider new approaches to investing?[22]

- Ask them how they use Modern Portfolio Theory to reduce risk, how much foreign exposure they recommend, their views on emerging market, and what they think about the value versus growth debate. If you suspect that the advisor’s knowledge consists of only buzzwords, head for the exit.

- Ask about their beliefs about market timing (also known as "tactical asset allocation"), stock picking, loss protection, or guaranteed returns. If they profess beliefs they can do any of these, avoid them like the plague.

- Ultimately, make sure that the advisor explains how everything works. There are a lot of companies out there who say something like "sign up, and then we'll take care of it," which isn't helpful.[23]

-

2Ask about his performance. Don't be shy about asking for proof that this financial planner has a successful track record managing accounts. You must also ask about any disciplinary action or sanctions he has had in his career. The following are industry-specific documents you should request:

- Ask for Form ADV. This is a standard report that can tell you whether this financial planner has any conflicts of interest.[24]

- Ask for a risk-adjusted performance record covering the last five years or more. He should be able to provide this in writing.[25] This will show you how much risk was required to get a return on previous investments.

- Ask for referrals. A good financial advisor can give you the names of satisfied clients, and you should feel perfectly comfortable asking for them.[26]

- Ask for a sample financial plan. This can be from a real client she has advised or a basic approach she might take to your own account.[27]

-

3Inquire about how the advisor is compensated. Though there are risks and advantages associated with both fee- and commission-based advisors, knowing which you are dealing with is crucial to understanding how she will handle your account.

- A good advisor should be upfront about whether she is compensated through a fee or commission.[28] [29]

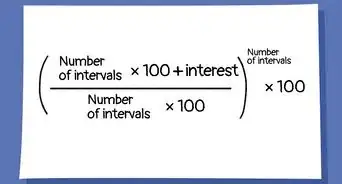

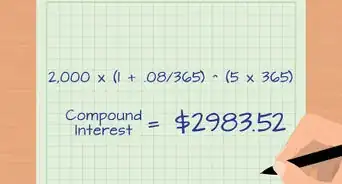

- Negotiate fees. Even if you have but a small portfolio, you should not pay over 1% asset under management (AUM). And if you have a large portfolio, you should be able to negotiate fees to 0.5% or less. A 1% AUM fee will cost one-third of your portfolio and a 2% AUM fee will cost over half of your portfolio over 40 years. If you invest $100,000 at age 25 at 7% return, you will have $1,497,446 at age 65 for retirement. But if you pay 2% AUM, you will end up with only $703,999. That could mean the difference between being able to retire versus having to continue working.

-

4Ask if he is legally bound to act in your best interest. This is a legal concept known as "fiduciary," and while some advisors are legally considered fiduciaries (generally, fee-based advisors), some are not. You must hire an advisor who will always act in your best interest, and a fiduciary agreement makes this legally binding.[30]

- Get it in writing. A fiduciary advisor knows that he cannot act outside your best interest without risking a lawsuit.

- Some professionals are not considered fiduciaries under the law, but under the bylaws of the their organization, such as a Certified Financial Planner.® As a consequence, a CFP® is not legally bound unless the responsibility is delineated in a contract between adviser and client.

-

5Trust your gut. Sometimes, after all the interview questions are finished, you have to simply ask yourself how you feel about this person. Is this someone you feel comfortable with? Do you feel that you can trust this person?

- If you have a lot of wealth or a complicated financial situation, you will spend a lot of time in conversation with this person. You need to feel comfortable with her communication style and personality.

Knowing When to Find a New Advisor

-

1Look for a new advisor if yours is inattentive. A good financial advisor should have multiple conversations with you, discussing your long term goals and assessing your plan.[31]

- The industry standard is two in-person conferences per year and several telephone calls or emails to assess your progress. Any less than that and your financial planner will not be able to offer you sound advice.[32]

-

2Look for a new advisor if yours doesn't meet goals. One purpose of a financial advisor is to help you set and achieve your financial goals. If you follow your advisor's advice and still do not meet your financial goals over time, find someone else.[33]

-

3Look for a new advisor if yours lets you be the dictator. While you are the boss, if your advisor acts as a true counselor, you should expect to hear a "no" from your advisor on occasion. While it is true that it is your money, a good advisor must act in your best interest, not kowtow to your every whim.

- She should decline to make any investment that she thinks is unwise, even if you want to make it.[34]

Warnings

- If it sounds too good to be true , it probably is. Always get a second opinion from a neutral third party if you feel suspicious.⧼thumbs_response⧽

- Choosing the best financial advisor can be as important as choosing a doctor, so do your homework, and take responsibility for your decision. As in managing your health, you have to take an active role in the management of your finances. Stay involved and understand everything.⧼thumbs_response⧽

References

- ↑ https://money.com/financial-adviser-pros-cons/

- ↑ http://time.com/money/3813571/financial-adviser-pros-cons/

- ↑ http://time.com/money/3813571/financial-adviser-pros-cons/

- ↑ http://www.investopedia.com/terms/c/cfp.asp

- ↑ http://www.investopedia.com/articles/financialcareers/06/whatisaria.asp

- ↑ http://www.investopedia.com/articles/financialcareers/06/whatisaria.asp

- ↑ http://www.investopedia.com/terms/c/clu.asp

- ↑ http://www.investopedia.com/terms/c/clu.asp

- ↑ http://www.investopedia.com/articles/professionaleducation/08/cfp-clu-chfc.asp

- ↑ http://www.investopedia.com/terms/r/roboadvisor-roboadviser.asp

- ↑ http://www.nasdaq.com/article/many-types-of-advisors-call-themselves-financial-advisors-cm562338

- ↑ http://www.cnbc.com/2016/04/06/investors-come-first-in-new-government-ruling.html

- ↑ http://www.cnbc.com/2016/04/06/investors-come-first-in-new-government-ruling.html

- ↑ http://time.com/money/3813571/financial-adviser-pros-cons/

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ http://www.cnbc.com/2014/10/15/10-tough-questions-you-need-to-ask-your-financial-advisor.html

- ↑ http://www.cnbc.com/2014/10/15/10-tough-questions-you-need-to-ask-your-financial-advisor.html

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ http://www.forbes.com/sites/janetnovack/2013/09/20/6-pointed-questions-to-ask-before-hiring-a-financial-advisor/

- ↑ http://www.forbes.com/sites/janetnovack/2013/09/20/6-pointed-questions-to-ask-before-hiring-a-financial-advisor/

- ↑ http://www.forbes.com/sites/janetnovack/2013/09/20/6-pointed-questions-to-ask-before-hiring-a-financial-advisor/

- ↑ http://www.cnbc.com/2014/10/15/10-tough-questions-you-need-to-ask-your-financial-advisor.html

- ↑ http://www.moneyunder30.com/when-is-it-time-to-hire-a-financial-advisor

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ http://www.forbes.com/sites/janetnovack/2013/09/20/6-pointed-questions-to-ask-before-hiring-a-financial-advisor/

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ http://www.investopedia.com/articles/basics/07/financial-advice.asp

- ↑ http://www.forbes.com/sites/janetnovack/2013/09/20/6-pointed-questions-to-ask-before-hiring-a-financial-advisor/