X

This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 15,449 times.

If you have Original Medicare and you move to another state, your policy generally follows you. To switch, you don't have to do much more than notify Social Security of your new address. However, if you have Medicare Advantage or a Part D drug plan, you may have to choose a new plan during a special enrollment period (SEP). Medigap plans also may be state-specific.[1]

Steps

Method 1

Method 1 of 3:

Transferring Original Medicare

-

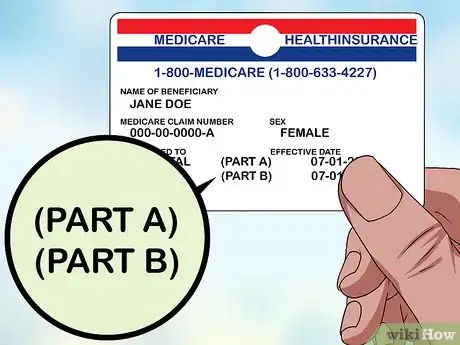

1Determine what type of Medicare you have. If you enrolled in Medicare through Social Security, you likely have Parts A and B. If you were automatically enrolled in Medicare and took no other actions, you have Parts A and B.[2]

- Under federal law, Parts A and B are standardized nationwide. Your Medicare will follow you automatically when you move to a different state. All you have to do is change your address.

-

2Notify Social Security of your change of address. Since the Social Security Administration (SSA) handles enrollment in Original Medicare, go online and log onto your account to update your address. You can also do this by calling 1-800-772-1213 or visiting your nearest SSA office.

- You'll generally get faster service if you make your address change online rather than over the phone or in person.

Advertisement -

3Choose a doctor in your new state. Fairly soon after you've moved, find a doctor near you who accepts Medicare so you don't have any gaps in your healthcare and treatment. If you require regular treatment for a chronic condition, you may want to find a doctor before you move.

- Use the Physician Compare tool on the Medicare website to locate doctors in your new state. Visit https://www.medicare.gov/physiciancompare/ and enter the location to get started.

- You can limit your results to doctors who accept assignment. These doctors charge only the Medicare-approved amount for their services, which will limit your out-of-pocket healthcare costs.

-

4Transfer your records to your new doctor. When you move out of state, most doctors will transfer your records to your new doctor as a professional courtesy. They typically won't charge you anything for the transfer.[3]

- If you get print copies of your medical records yourself and take them with you to your new doctor, your doctor may charge you a small fee for the copies. However, this may be a better option if you haven't chosen a new doctor before you move and want your records to be available immediately.

Advertisement

Method 2

Method 2 of 3:

Using a Special Enrollment Period

-

1Check your plan's service area. If you have a Medicare Advantage plan, also known as Medicare Part C, your plan may not be available in your new state. Plans vary among states and even among zip codes within the same state.

- The service area for a Part D drug plan is statewide. Therefore, if you move to a different state, you'll have to choose another Part D plan. The plan may be offered by the same insurance company, or you may choose to switch to a different insurance company.[4]

- Even if your new address is still within your plan's service area, you can still switch plans during a special enrollment period if there are new options available that would better suit your needs.

-

2Contact your insurance provider before you move. When you move to a different state and have Medicare Part C or Part D, you are eligible for a special enrollment period (SEP) to choose a new plan that will cover you after your move. The length of time you have varies depending on when you notify your insurance provider that you're moving.

- You get the longest SEP if you notify your insurance provider before you move. Your SEP begins a month before the date of your move, and continues for 2 months after you move.

- If you don't notify your insurance provider until after you move, you have the remainder of that month plus an additional 2 months.

-

3Evaluate doctors and hospitals in Part C plan networks. If you have Medicare Part C, your choices with doctors and hospitals can be extremely limited. Compare plans carefully and make sure you have coverage for the healthcare services and treatments you need, or anticipate you will need.

- This is especially important if you have a chronic condition that requires regular treatment from a specialist.

-

4Enroll in your new plan during your SEP. Once you've found the plan that you like, contact the insurance provider for the plan and enroll as soon as possible. You will be dis-enrolled from your old plan automatically on the date that your new plan takes effect.[5]

- If you fail to enroll in a new plan during your SEP, you will only have Original Medicare administered through the Social Security Administration.[6]

- A gap in Part C or Part D coverage may result in higher premiums or penalties when you decide to re-enroll.

-

5Switch to a Medigap plan if you can't find a suitable Medicare Advantage plan. Medigap plans don't work with Medicare Advantage plans. However, if you can't find a replacement Medicare Advantage plan, you can switch to a Medigap plan offered by your insurance provider.[7]

- Since Medigap plans are standardized, they typically move more easily than Medicare Advantage plans. There are three states that have their own Medigap plans, this includes Massachusetts, Minnesota, and Wisconsin.

-

6Work with a SHIP if you need guidance. The State Health Insurance Assistance Program (SHIP) in your new state can help you compare plans and costs so you can find a new Medicare Advantage plan that will work best for you. SHIP provides this assistance free of charge.[8]

- Since SHIP counselors don't work for any particular insurance company or insurance plan, you can count on getting unbiased advice.

- A SHIP counselor can be especially helpful if you're not familiar with the doctors and hospitals near the place where you're moving.

- To get contact information for the SHIP in your new state, visit https://www.shiptacenter.org/.

Advertisement

Method 3

Method 3 of 3:

Moving with a Medigap Plan

-

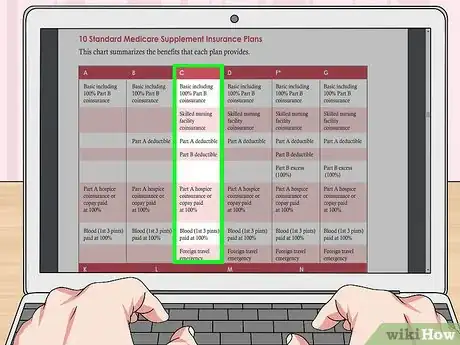

1Identify the Medigap plan you have. Medigap plans are standardized across most states and categorized under the letters A through D, F, G, and K through N. As long as you want to stay with the same letter plan, you usually won't have to do anything when you move.[9]

- Medigap plans are standardized differently in Massachusetts, Minnesota, and Wisconsin. If you're moving to or from one of those states, talk to your insurance provider about comparable plans.

-

2Check with your current insurance company. Even though you can usually keep the same Medigap plan without doing anything, moving does entitle you to a special enrollment period. However, in most cases your insurance company isn't legally required to sell you a different plan.

- Your insurance company may allow you to switch, but you may end up paying a higher premium. You also may have to answer some health questions or submit to an additional exam before you're approved for the new plan.

-

3Request a special enrollment period if you have a Select plan. Most Medigap plans don't require you to use healthcare providers in a particular network. However, Select plans do. Moving out of that network's service area entitles you to purchase a new Medigap plan.

- If you want to purchase a regular lettered Medigap plan from the same insurance company, that company is legally required to sell the policy to you.

- You can switch to a different insurance company, but you may have to complete a medical exam before you're approved.

-

4Notify your insurance company of your address change. If you've simply carried over your Medigap plan, you still need to make sure your insurance company has up-to-date contact information for you.

- If your insurance provider allows you to specify when the change will take effect, go ahead and make the change in advance of your move. This ensures you don't miss any important communications.

Advertisement

References

- ↑ https://www.medicareresources.org/faqs/will-my-medicare-coverage-follow-me-if-i-move-out-of-the-state/

- ↑ https://www.mymedicarematters.org/after-enrollment/time-to-re-evaluate/

- ↑ http://www.mbc.ca.gov/Consumers/Complaints/Complaints_FAQ/Medical_Records_FAQ.aspx

- ↑ https://www.aarp.org/health/medicare-qa-tool/if-my-part-d-plan-isnt-offered-where-i-move/

- ↑ https://www.mymedicarematters.org/after-enrollment/time-to-re-evaluate/

- ↑ https://www.medicare.gov/Pubs/pdf/11036-Enrolling-Medicare-Part-A-Part-B.pdf

- ↑ https://www.mymedicarematters.org/after-enrollment/time-to-re-evaluate/

- ↑ https://www.medicare.gov/pubs/pdf/10050-Medicare-and-You.pdf

- ↑ https://www.medicare.gov/pubs/pdf/10050-Medicare-and-You.pdf

About This Article

Advertisement