This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 105,983 times.

Prepaid credit cards are an increasingly popular method of paying bills and managing money. There are several ways to load money onto these cards, including direct deposit of your paycheck and using cash at approved locations. For increased convenience, you can also use mobile apps to load a check or money order onto your card electronically, and have the money available in just a few minutes.

Steps

Choosing a Prepaid Card

-

1Decide what the purpose of this card is. Prepaid credit cards serve a variety of purposes, depending on what the user's need is. Some people use them if they have bad credit and don't qualify for a credit card, while others use them to teach teenagers fiscal responsibility. By deciding your purpose for the card, you can come to a better conclusion of which card to choose.[1]

-

2Look at the fees involved. Almost all prepaid cards involve some fees, but not all cards have the same fees. Read all fine print when choosing a card to see what fees the card will charge you. Add up all associated fees to see which card is best for you.

- See what fees are avoidable and unavoidable. For example, you can avoid high ATM fees by not withdrawing money often. However, you can't avoid a monthly fee for keeping the card open.

Advertisement -

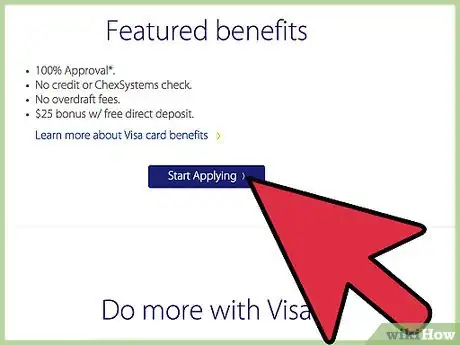

3See what features the card offers. Just like cards have different fees, they also offer different features and services. By narrowing down what is important to you, you'll be able to decide which features are necessary and which ones aren't. Some typical features of prepaid cards are:[2]

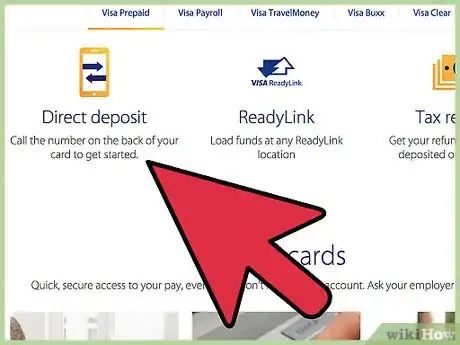

- Direct deposit of your paycheck.

- Connection to a bank account.

- Theft and fraud protections.

- Reward points.

-

4Find out if a card is compatible with mobile banking apps. The way to electronically load checks and money orders onto your card instantly is with apps. If a card isn't compatible with mobile apps, you won't be able to deposit money orders electronically.

-

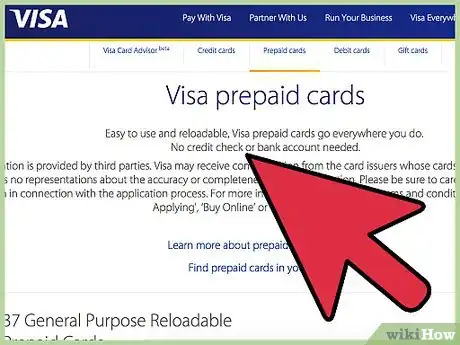

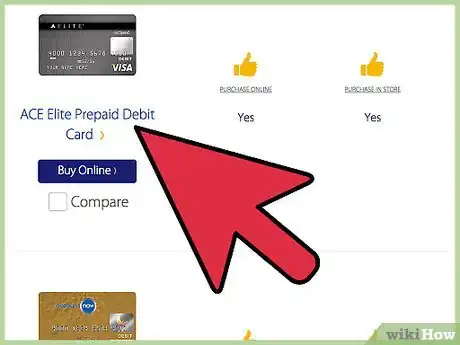

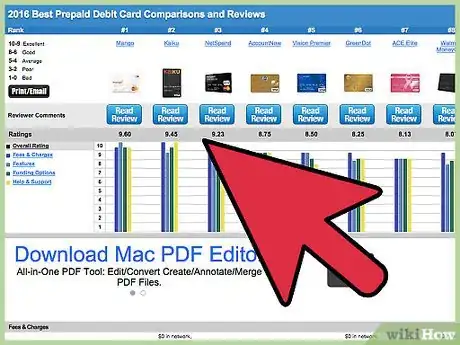

5Use a side by side comparison tool. Some websites offer comparisons of the numerous prepaid cards that are available. You can answer a few questions about what you're looking for out of a prepaid card, and with that information the site will give you a few cards that would be good matches for your needs. Try one of these if you're stumped about which prepaid card to get.[3]

Loading a Money Order onto Your Card

-

1Download a mobile banking app. Some apps allow you to photograph checks and money orders and load them onto your prepaid card. You'll need this ability to electronically load money orders to your card. Search for one of these apps in the app store and download it onto your smartphone.

- The Ingo app is the most popular of these apps. It can be linked to most of the major prepaid cards.[4]

-

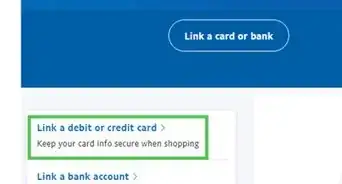

2Link your card to the mobile app. Once you download the app, it is usually just a matter of typing the card number into the app. It is then synched to your card, and you can electronically load checks and money orders.

-

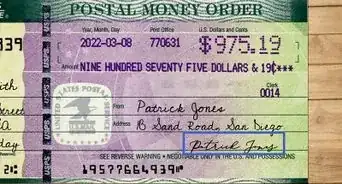

3Purchase a money order. Money orders can be purchased at US Post Office locations, banks, credit unions, retail stores like Walmart, and some grocery stores. There is usually a fee between $1 and $2, depending on how much the money order is worth.[5] [6]

- Money orders have an area to fill out who the money is for, just like a check. In this case, you would make it out to yourself, so fill in all the necessary information. Write as neatly and clearly as possible.

- Money orders must be purchased with cash or a debit card. Credit cards are usually not accepted.

- Read Get a Money Order for more details on buying and filling out a money order.

-

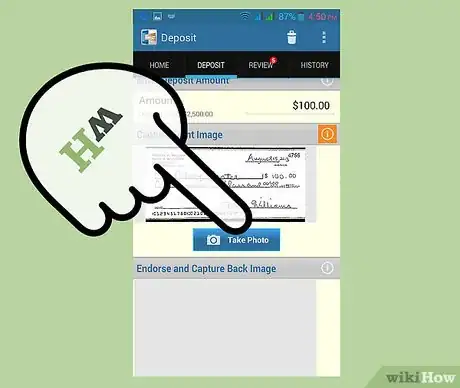

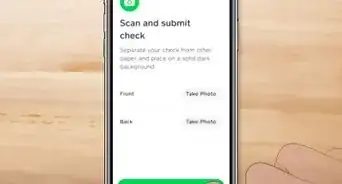

4Photograph the money order. With a mobile app, you can photograph checks and money orders to instantly load them onto your card.

- Lay the money order on a flat, well-lit surface.

- Line up the money order with your smartphone camera. Then photograph the front and back of it.

- Submit the photo.

-

5Wait a few minutes. After you submit the photo, the app must approve it and load it onto your card. This usually takes a few minutes. Check your balance before making any purchases to make sure the money loaded onto the card successfully, then go use your card normally.

References

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.creditcards.com/credit-card-news/help/9-things-you-need-to-know-about-prepaid-cards-6000.php

- ↑ http://www.businessinsider.com/this-prepaid-debit-card-comparison-tool-helps-you-choose-the-right-card-for-your-lifestyle-2012-1

- ↑ http://ingomoney.com/

- ↑ https://www.usps.com/shop/money-orders.htm

- ↑ https://www.westernunion.com/us/en/money-order.html