This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 12 testimonials and 89% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 516,797 times.

An income statement is a key financial document in business. It shows the profitability of a company over a specific period of time. The following guide shows you how to prepare a simple multi-step income statement. A multi-step income statement separates operating income and expenses from non-operational gains and losses.

Steps

Setting Up Your Income Statement

-

1Choose a time period for your income statement. Income statements measure revenues and expenses during a certain period of time and are typically generated on a monthly, quarterly, or annual basis. Pick the duration that you want to use for calculating your income statement.[1]

- Businesses that are publicly traded must generate income statements on quarterly and annual basis to file with the Securities and Exchange Commission.

- Businesses also generate income statements on a periodic basis to identify business trends and evaluate financial results.

-

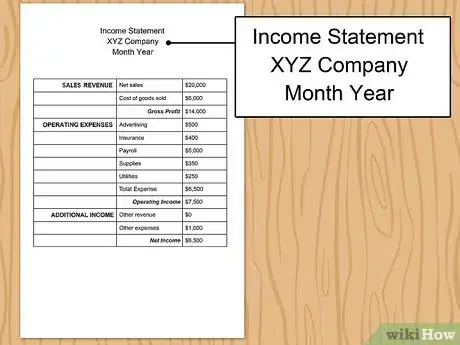

2Write the income statement header. At the top of the document, write the name of the company. On the line directly beneath the company name, write "Income Statement." On the next line, write the period of time that the income statement covers.Advertisement

-

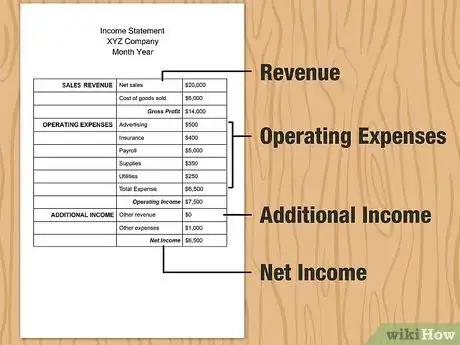

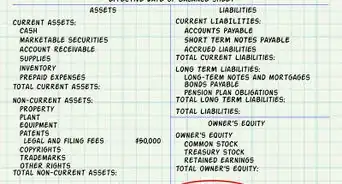

3Format the body of the income statement. Income statements have four distinct sections. [2]

- The first section of the income statement calculates gross profit, or the total amount of money made, from sales revenue and cost of goods sold.

- The second section calculates your total operational expenses.

- The third section calculates gains and losses unrelated to your operational costs.

- The fourth section calculates net income, or the money you’ve made in profit after subtracting your expenses from your revenue.

Preparing the Gross Profit Section

-

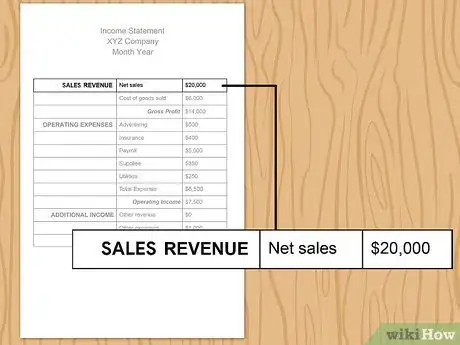

1Write "Sales Revenue" below the income statement header. Sales revenue includes all revenue earned from the sale of goods and services, regardless of whether or not the cash has been collected. List sales revenue for the period you selected.

- For example, say that you sold 10,000 units of inventory for $5 USD a piece. You would record sales revenue of $50,000 USD, even if your customers haven't all paid you yet.

-

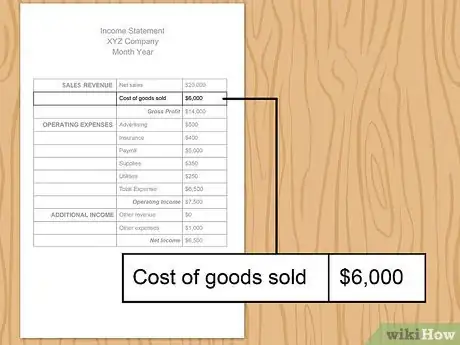

2Calculate your cost of goods sold. Cost of goods sold is comprised of the direct labor, direct materials, and manufacturing overhead expense you incurred to create the inventory that you sold. List cost of goods sold for the period underneath your sales revenue.

- For example, if you sold 10,000 units of inventory during the period and paid an average of $2 USD for each unit, you would record $20,000 USD for the cost of goods sold.

- If you're a reseller, cost of goods sold is typically the price that you paid to purchase the inventory.

-

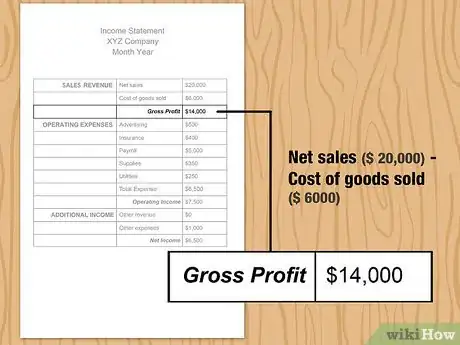

3Subtract the cost of goods sold from sales revenue to find your gross profit. Your gross profit is the total amount of money you made during the period before your expenses. Write the difference between your sales revenue and the cost of goods sold on the next line on your spreadsheet.

- For example, if sales revenue is $50,000 and the cost of goods sold is $20,000, you would record gross profit of $30,000 on the income statement.

- Use a green pen or change the font color to show that the number listed is a profit.

Totaling Your Operational Expenses

-

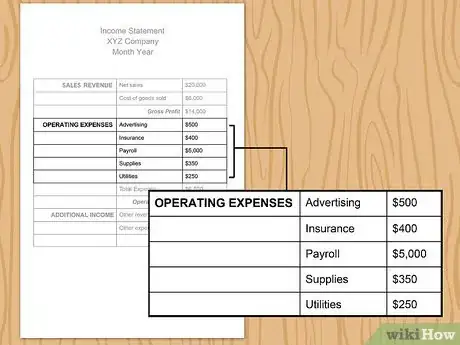

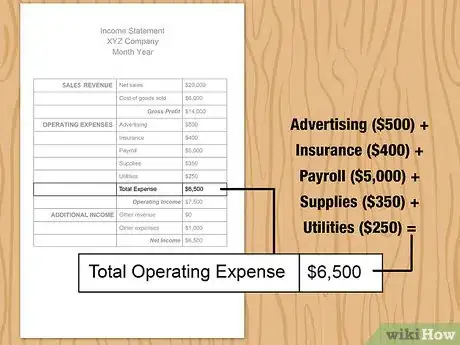

1Write all the types of operating expenses the business has. Operating expenses are expenses that directly relate to business administration. Next to each line item, list the amount of expense incurred during the period.[3]

- Common operating expenses include salary and wages for those employees not directly involved in the product of goods, rent, insurance, office supplies, professional fees, utilities, transportation expense, marketing, depreciation, and property taxes. Direct labor has already been deducted from the Cost of Goods.

- If the business has a large variety of expenses, you can group similar line items into one category to save space. For example, you can create an "Employee compensation" line item that includes salaries, health insurance premiums, retirement benefits, payroll taxes, worker's compensation, and payroll processing fees.

-

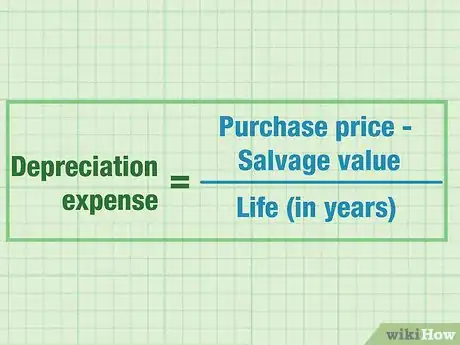

2Find the depreciation and amortization for your business. Depreciation and amortization are both methods that reduce the recorded cost of assets. Depreciation is most commonly calculated using a straight line method, which is gradually reducing the cost of a tangible asset over its useful life. Amortization is used for intangible assets and is calculated similarly to depreciation.[4]

-

3Add together the expenses to find how much money you’ve spent. Take all of the items in your expenses list and add them together with a calculator. Write your total expenses on the next line of your spreadsheet.

- Use a red pen or change the font color to red to signify that the expenses should be subtracted at the end.

Calculating Gains and Losses

-

1Write the non-operational gains the business has. Non-operational gains are revenues that don't directly relate to business operations, sales, and production. These revenues are from activities that are different or peripheral to normal operations, such as investments or unrelated sales. Next to each line item, list the amount of revenue incurred during the period.

- Common non-operational gains include interest revenues and gains from the sale of securities. These items add to the income of the enterprise while expenses reduce income.

-

2Add the gains together to find the total. Once you list all the non-operational gains your business has, add them together so you have one number for total gains. Put the total gains on the line directly underneath your list so you can easily find it later.[5]

- Write your gains in green so you know that they’re a profit.

-

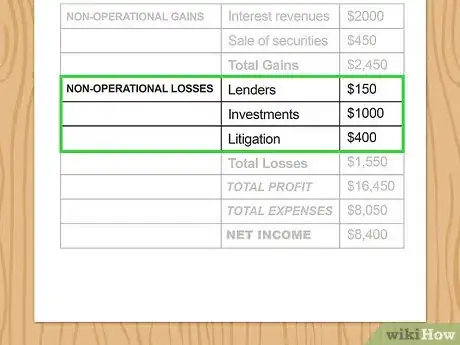

3Calculate the non-operational losses the business has. Non-operational losses also don't directly relate to the business operation or sales. Next to each line item, list the amount of expense incurred during the period.

- Common non-operational losses include interest expense paid to lenders, losses from the sale of investments, and losses from litigation.

-

4Combine your losses to find the total. Add together everything listed in your losses section of your income statement to get your total losses. Write the total on the next line of your statement so you can easily find it later.[6]

- List the total losses in red to color-code your spreadsheet. That way, you know to combine them with your other operational expenses.

Finding the Net Income

-

1Add the gross profit to your non-operational gains. Find the gross profit you calculated in the first section and the gains in the third section of your statement. Add the numbers together to find the total profit your business gained over the period of time.[7]

-

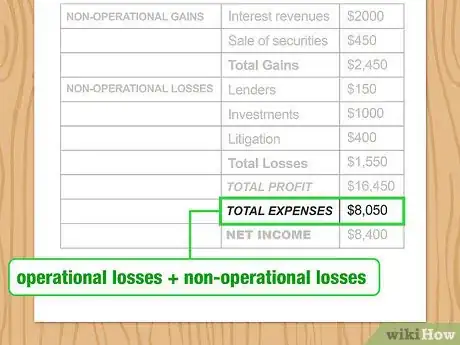

2Find the total expenses by combining operational and non-operational losses. Locate the total operating expenses from the second section and your non-operational losses from the third section of the income statement. Add the 2 numbers together to find the total amount of expenses your business had.[8]

-

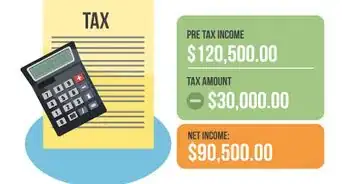

3Subtract the total losses from your total gains to find your net income. Take the expenses you just calculated and subtract them from the profits. Write down the net income at the bottom of your statement.[9]

- Your net income could be positive or negative depending on how much you spent and earned during the period of time.

Income Statement Template

Warnings

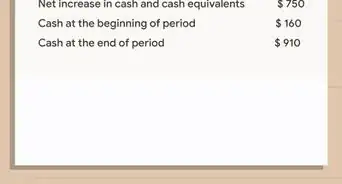

- An income statement shows income and expenses. It does not show money received or paid. This is done using a cash flow statement.⧼thumbs_response⧽

References

- ↑ http://quickbooks.intuit.com/r/bookkeeping/create-income-statement-4-easy-steps

- ↑ http://www.accountingcoach.com/income-statement/explanation/4

- ↑ http://www.accountingtools.com/questions-and-answers/what-are-examples-of-operating-expenses.html

- ↑ http://www.investopedia.com/ask/answers/06/amortizationvsdepreciation.asp

- ↑ https://www.investopedia.com/terms/i/incomestatement.asp

- ↑ https://www.investopedia.com/terms/i/incomestatement.asp

- ↑ https://www.investopedia.com/terms/i/incomestatement.asp

- ↑ https://www.investopedia.com/terms/i/incomestatement.asp

- ↑ https://www.investopedia.com/terms/i/incomestatement.asp

About This Article

To write an income statement, start by choosing a specific time frame to examine. Next, format the income statement to have 4 sections—Gross Profit, Operational Expenses, Gains and Losses, and Net Income. Then, input the correct numbers for each section based on your chosen time frame. For example, to calculate Gross Profit, subtract the cost of goods sold from sales revenue. For Operational Expenses, simply total up your expenses. Then, add up non-operational expenses for the Gains and Losses section. Calculate Total Profit by adding Gross Profit to Non-Operational Gains. Finally, subtract the Total Losses from the Total Gains to find your Net Income. For tips on identifying different kinds of expenses, read on!