Telecommunications in India

India's telecommunication network is the second largest in the world by number of telephone users (both fixed and mobile phones) with 1179.49 million subscribers as on 31 January 2021.[3] It has one of the lowest call tariffs in the world enabled by mega telecom operators and hyper-competition among them. India has the world's second-largest Internet user-base with 747.41 million broadband internet subscribers.[4]

| Communications in India | |

|---|---|

| Gross adjusted revenue (2019) | ₹160,814 crore (US$20 billion)[1] |

| Telephony | |

| Total subscribers | 1173.83 million (Dec 2020)[2] |

| Wireless subscribers | 1153.77 million (Dec 2020)[2] |

| Fixed line subscribers | 20.05 million (Dec 2020)[2] |

| Monthly telephone additions (Net) | -14,20,000 (Dec 2020)[2] |

| Teledensity | 84.90% (Dec 2020)[2] |

| Urban Teledensity | 134.44% (Dec 2020)[2] |

| Rural Teledensity | 58.85% (Dec 2020)[2] |

| Share of rural subscriber | 45.43% (Dec 2020)[2] |

| Share of Urban subscriber | 54.57% (Dec 2020)[2] |

| Broadband subscriber | 1014.9 million (Dec 2020)[2] |

| Broadband subscribers (Wireless) | 725.12 million (Dec 2020)[2] |

| country code top-level domain | .in |

Major sectors of the Indian telecommunication industry are telephone, internet and television broadcast industry in the country which is in an ongoing process of transforming into a Next-generation network, employs an extensive system of modern network elements such as digital telephone exchanges, Network switching subsystem, media gateways and Signaling gateway at the core, interconnected by a wide variety of transmission systems using Optical fiber or Microwave radio relay networks. The access network, which connects the subscriber to the core, is highly diversified with different copper-pair, Optical fiber and wireless technologies. Satellite television, a relatively new broadcasting technology has attained significant popularity in the Television segment. The introduction of private FM has boosted radio broadcasting in India. Telecommunication in India has greatly been supported by the Indian National Satellite System system of the country, one of the largest domestic satellite systems in the world. India possesses a diversified communications system, which links all parts of the country by telephone, Internet, radio, television and satellite.[5]

Indian telecom industry underwent a high pace of market liberalisation and growth since the 1990s and now has become the world's most competitive and one of the fastest growing telecom markets.[6][7]

Telecommunication has supported the socioeconomic development of India and has played a significant role in narrowing down the rural-urban digital divide to some extent. It also has helped to increase the transparency of governance with the introduction of e-governance in India. The government has pragmatically used modern telecommunication facilities to deliver mass education programmes for the rural folk of India.[8]

According to the London-based telecom trade body GSMA, the telecom sector accounted for 6.5% of India's GDP in 2015, or about ₹9 lakh crore (US$110 billion), and supported direct employment for 2.2 million people in the country. GSMA estimates that the Indian telecom sector will contribute ₹14.5 lakh crore (US$180 billion) to the economy and support 3 million direct jobs and 2 million indirect jobs by 2020.[9]

In today's period of progress and wealth, technological modernization is increasingly seen as a foreseen necessity for every country. With better technology and more competition from established businesses, telecommunications has entered a new era of development. The continuous rise of the mobile industry is linked to technological advancements in the telecommunications sector. The service providers' primary goal is to build a loyal customer base by measuring their performance and maintaining existing consumers in order to profit from their loyalty. The purpose of the paper is to address these concerns.[10]

History

The beginning

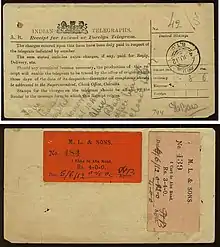

Telecommunications in India began with the introduction of the Telegraphy. The Indian postal and telecom sectors are one of the world's oldest. In 1850, the first experimental electric telegraph line was started between Kolkata and Diamond Harbour.[11] In 1851, it was opened for the use of the East India Company. The Posts and Telegraphs department occupied a small corner of the Public Works Department at that time.[12]

The construction of 4,000 miles (6,400 km) of telegraph lines was started in November 1853. These connected Kolkata (then Calcutta) and Peshawar in the north; Agra, Mumbai (then Bombay) through Sindwa Ghats, and Chennai (then Madras) in the south; Ooty and Bangalore. William O'Shaughnessy, who pioneered the Telegraphy and telephone in India, belonged to the Public Works Department, and worked towards the development of telecom throughout this period. A separate department was opened in 1854 when telegraph facilities were opened to the public.

In 1880, two Telephone company namely The Oriental Telephone Company Ltd. and The Anglo-Indian Telephone Company Ltd. approached the Government of India to establish Telephone exchange in India. The permission was refused on the grounds that the establishment of telephones was a Government monopoly and that the Government itself would undertake the work. In 1881, the Government later reversed its earlier decision and a licence was granted to the Oriental Telephone Company Limited of England for opening telephone exchanges at Kolkata, Mumbai, Chennai and Ahmedabad and the first formal telephone service was established in the country.[13] On 28 January 1882, Major E. Baring, Member of the Governor General of India's Council declared open the Telephone Exchanges in Calcutta, Bombay and Madras. The exchange in Calcutta named the "Central Exchange" had a total of 93 subscribers in its early stage. Later that year, Bombay also witnessed the opening of a telephone exchange.[14]

Further developments and milestones

- 1901 – First wireless telegraph station established between Sagar Island and Sandhead.

- Pre-1902 – Cable telegraph.

- 1907 – First Central Battery of telephones introduced in Kanpur.

- 1913–1914 – First Automatic Exchange installed in Shimla.

- 1927 – Radio-telegraph system between the UK and India, with Imperial Wireless Chain beam stations at Khadki and Daund. Inaugurated by Lord Irwin on 23 July by exchanging greetings with King George V.

- 1933 – Radiotelephone system inaugurated between the UK and India.

- 1947 - First Electronics and Telecommunications Engineering department started in India at the Government Engineering College, Jabalpur.[15]

- 1951 - First TV transmitter of India was installed at the Government Engineering College, Jabalpur, on 24 October.[16][15]

- 1953 – 12 channel carrier system introduced.

- 1960 – First subscriber trunk dialling route commissioned between Lucknow and Kanpur.[17]

- 1975 – First PCM system commissioned between Mumbai City and Andheri telephone exchanges.

- 1976 – First digital microwave junction.

- 1979 – First optical fibre system for local junction commissioned at Pune.

- 1980 – First satellite earth station for domestic communications established at Sikandarabad, U.P.

- 1983 – First analogue Stored Programme Control exchange for trunk lines commissioned at Mumbai.

- 1984 – C-DOT established for indigenous development and production of digital exchanges.

- 1995 – First mobile telephone service started on non-commercial basis on 15 August 1995 in Delhi.

- 1995 – Internet Introduced in India starting with Laxmi Nagar, Delhi 15 August 1995[18]

Development of Broadcasting: Radio broadcasting was initiated in 1927 but became state responsibility only in 1930. In 1937 it was given the name All India Radio and since 1957 it has been called Akashvani.[19] Limited duration of television programming began in 1959, and complete broadcasting followed in 1965. The Ministry of Information and Broadcasting owned and maintained the audio-visual apparatus—including the television channel Doordarshan—in the country prior to the economic reforms of 1991. In 1997, an autonomous body was established in the name of Prasar Bharti to take care of the public service broadcasting under the Prasar Bharti Act. All India Radio and Doordarshan, which earlier were working as media units under the Ministry of I&B became constituents of the body.[8]

Pre-liberalisation statistics: While all the major cities and towns in the country were linked with telephones during the British period, the total number of telephones in 1948 numbered only around 80,000. Post-independence, growth remained slow because the telephone was seen more as a status symbol rather than being an instrument of utility. The number of telephones grew leisurely to 980,000 in 1971, 2.15 million in 1981 and 5.07 million in 1991, the year economic reforms were initiated in the country.

Liberalisation and privatisation

Liberalisation of Indian telecommunication in industry started in 1981 when Prime Minister Indira Gandhi signed contracts with Alcatel CIT of France to merge with the state owned Telecom Company (ITI), in an effort to set up 5,000,000 lines per year. But soon the policy was let down because of political opposition.[20] Attempts to liberalise the telecommunication industry were continued by the following government under the prime-minister-ship of Rajiv Gandhi. He invited Sam Pitroda, a US-based Non-resident Indian NRI and a former Rockwell International executive to set up a Centre for Development of Telematics(C-DOT) which manufactured electronic telephone exchanges in India for the first time.[21] Sam Pitroda had a significant role as a consultant and adviser in the development of telecommunication in India.[22]

In 1985, the Department of Telecom(DoT) was separated from Indian Post & Telecommunication Department. DoT was responsible for telecom services in entire country until 1986 when Mahanagar Telephone Nigam Limited (MTNL) and Videsh Sanchar Nigam Limited (VSNL) were carved out of DoT to run the telecom services of metro cities (Delhi and Mumbai) and international long-distance operations respectively.[21]

The demand for telephones was ever increasing and in the 1990s Indian government was under increasing pressure to open up the telecom sector for private investment as a part of Liberalisation-Privatisation-Globalisation policies that the government had to accept to overcome the severe fiscal crisis and resultant balance of payments issue in 1991. Consequently, private investment in the sector of Value Added Services (VAS) was allowed and cellular telecom sector were opened up for competition from private investments. It was during this period that the Narsimha Rao-led government introduced the National Telecommunications policy (NTP) in 1994 which brought changes in the following areas: ownership, service and regulation of telecommunications infrastructure. The policy introduced the concept of telecommunication for all and its vision was to expand the telecommunication facilities to all the villages in India.[23] Liberalisation in the basic telecom sector was also envisaged in this policy.[24] They were also successful in establishing joint ventures between state owned telecom companies and international players. Foreign firms were eligible to 49% of the total stake. The multi-nationals were just involved in technology transfer, and not policy making.[20]

During this period, the World Bank and ITU had advised the Indian Government to liberalise long-distance services to release the monopoly of the state-owned DoT and VSNL and to enable competition in the long-distance carrier business which would help reduce tariff's and better the economy of the country. The Rao run government instead liberalised the local services, taking the opposite political parties into confidence and assuring foreign involvement in the long-distance business after 5 years. The country was divided into 20 telecommunication circles for basic telephony and 18 circles for mobile services. These circles were divided into category A, B and C depending on the value of the revenue in each circle. The government threw open the bids to one private company per circle along with government-owned DoT per circle. For cellular service two service providers were allowed per circle and a 15 years licence was given to each provider. During all these improvements, the government did face oppositions from ITI, DoT, MTNL, VSNL and other labour unions, but they managed to keep away from all the hurdles.[20]

In 1997, the government set up TRAI (Telecom Regulatory Authority of India) which reduced the interference of Government in deciding tariffs and policymaking. The political powers changed in 1999 and the new government under the leadership of Atal Bihari Vajpayee was more pro-reforms and introduced better liberalisation policies. In 2000, the Vajpayee government constituted the Telecom Disputes Settlement and Appellate Tribunal (TDSAT) through an amendment of the TRAI Act, 1997.[25][26] The primary objective of TDSAT's establishment was to release TRAI from adjudicatory and dispute settlement functions in order to strengthen the regulatory framework. Any dispute involving parties like licensor, licensee, service provider and consumers are resolved by TDSAT. Moreover, any direction, order or decision of TRAI can be challenged by appealing in TDSAT.[27] The government corporatised the operations wing of DoT on 1 October 2000 and named it as Department of Telecommunication Services (DTS) which was later named as Bharat Sanchar Nigam Limited (BSNL). The proposal of raising the stake of foreign investors from 49% to 74% was rejected by the opposite political parties and leftist thinkers. Domestic business groups wanted the government to privatise VSNL. Finally in April 2002, the government decided to cut its stake of 53% to 26% in VSNL and to throw it open for sale to private enterprises. TATA finally took 25% stake in VSNL.[20]

This was a gateway to many foreign investors to get entry into the Indian telecom markets. After March 2000, the government became more liberal in making policies and issuing licences to private operators. The government further reduced licence fees for [cellular service providers and increased the allowable stake to 74% for foreign companies. Because of all these factors, the service fees finally reduced and the call costs were cut greatly enabling every common middle-class family in India to afford a cell phone. Nearly 32 million handsets were sold in India. The data reveals the real potential for growth of the Indian mobile market.[28] Many private operators, such as Reliance Communications, Jio, Tata Indicom, Vodafone, Loop Mobile, Airtel, Idea etc., successfully entered the high potential Indian telecom market. In the initial 5–6 years the average monthly subscribers additions were around 0.05 to 0.1 million only and the total mobile subscribers base in December 2002 stood at 10.5 million. However, after a number of proactive initiatives taken by regulators and licensors, the total number of mobile subscribers has increased rapidly to over 929 million subscribers as of May 2012.

In March 2008, the total GSM and CDMA mobile subscriber base in the country was 375 million, which represented a nearly 50% growth when compared with previous year.[29] As the unbranded Chinese cell phones which do not have International Mobile Equipment Identity (IMEI) numbers pose a serious security risk to the country, Mobile network operators therefore suspended the usage of around 30 million mobile phones (about 8% of all mobiles in the country) by 30 April 2009. Phones without valid IMEI cannot be connected to cellular operators.[30]

India has opted for the use of both the GSM (global system for mobile communications) and CDMA (code-division multiple access) technologies in the mobile sector. In addition to landline and mobile phones, some of the companies also provide the WLL service. The mobile tariffs in India have also become the lowest in the world. A new mobile connection can be activated with a monthly commitment of US$0.15 only.

Licence cancellation

On 2 February 2012 the Supreme Court ruled on petitions filed by Subramanian Swamy and the Centre for Public Interest Litigation (CPIL) represented by Prashant Bhushan, challenging the 2008 allotment of 2G licenses,[31] cancelling all 122 spectrum licences granted during A. Raja (Minister of Communications & IT from 2007 to 2009), the primary official accused's term as communications minister.[31] and described the allocation of 2G spectrum as "unconstitutional and arbitrary".[32] The bench of GS Singhvi and Asok Kumar Ganguly imposed a fine of ₹50 million (US$630,000) on Unitech Wireless, Swan Telecom and Tata Teleservices and a ₹5 million (US$63,000) fine on Loop Telecom, S Tel, Allianz Infratech and Sistema Shyam Tele Services.[33] According to the ruling the then granted licences would remain in place for four months, after which time the government would reissue the licences.[34]

Consolidation

Post starting of the commercial operation of Reliance Jio in September 2016, the telecom market saw a huge change in terms of falling tariff rates and reduction of data charges, which changed the economics for some of the telecom players. This resulted in exit of many smaller players from the market. Players like Videocon and Systema sold their spectrum under spectrum trading agreements to Airtel and RCOM respectively in Q4 2016.

On 23 February 2017, Telenor India announced that Bharti Airtel will take over all its business and assets in India and deal will be completed in 12 months timeframe.[35] On 14 May 2018, Department of Telecom approved the merger of Telenor India with Bharti Airtel paving the way for final commercial closing of the merger between the two companies.[36] Telenor India has been acquired by Airtel almost without any cost.

On 12 October 2017, Bharti Airtel announced that it would acquire the consumer mobile businesses of Tata Teleservices Ltd (TTSL) and Tata Teleservices Maharastra Ltd (TTML) in a debt-free cash-free deal. The deal was essentially free for Airtel which incurred TTSL's unpaid spectrum payment liability. TTSL will continue to operate its enterprise, fixed line and broadband businesses and its stake in tower company Viom Networks.[37][38][39] The consumer mobile businesses of Tata Docomo, Tata Teleservices (TTSL) and Tata Teleservices Maharashtra Limited (TTML) have been merged into Bharti Airtel from 1 July 2019[40][41][42]

Reliance Communications had to shut down its 2G and 3G services including all voice services and only offer 4G data services from 29 December 2017, as a result of debt and a failed merger with Aircel.[43][44] Surprisingly, the shut down was shortly after completion of acquisition of MTS India on 31 October 2017.[45][46] In February 2019, the company filed for bankruptcy as it was unable to sell assets to repay its debt.[47] It has an estimated debt of ₹ 57,383 crore against assets worth ₹18,000 crore.[48][49]

Aircel shut down its operations in unprofitable circles including, Gujarat, Maharashtra, Haryana, Himachal Pradesh, Madhya Pradesh and Uttar Pradesh (West) from 30 January 2018.[50] Aircel along with its units - Aircel Cellular and Dishnet Wireless - on 1 March 2018, filed for bankruptcy in the National Companies Law Tribunal (NCLT) in Mumbai due to huge competition and high levels of debt.

Vodafone and Idea Cellular completed their merger on 31 August 2018, and the merged entity is renamed to Vi.[51] The merger created the largest telecom company in India by subscribers and by revenue,[51] and the second largest mobile network in terms of number of subscribers in the world. Under the terms of the deal, the Vodafone Group holds a 45.1% stake in the combined entity, the Aditya Birla Group holds 26% and the remaining shares will be held by the public.[51] However, even after the merger both the brands have been continued to carry their own independent brands.[51]

With all this consolidation, the Indian mobile market has turned into a four-player market, with Jio as the number-one player, with revenue market share of 34%, Airtel India in second position, with revenue market share of 28% and Vi, with revenue market share of 27%. The government operator BSNL/MTNL is in the distant 4th position, with an approximate market share of 11%[52]

Telephony

Market share of FixedLine telecom operators in India as of 31 August 2021 according to the Telecom Regulatory Authority of India (TRAI).[3]

Private-sector and two state-run businesses dominate the telephony segment. Most companies were formed by a recent revolution and restructuring launched within a decade, directed by Ministry of Communications and IT, Department of Telecommunications and Minister of Finance. Since then, most companies gained 2G, 3G and 4G licences and engaged fixed-line, mobile and internet business in India. On landlines, intra-circle calls are considered local calls while inter-circle are considered long-distance calls. Foreign Direct Investment policy which increased the foreign ownership cap from 49% to 100%. The Government is working to integrate the whole country in one telecom circle. For long-distance calls, the area code prefixed with a zero is dialled first which is then followed by the number (i.e., to call Delhi, 011 would be dialled first followed by the phone number). For international calls, "00" must be dialled first followed by the country code, TNP and local Telephone number. The country code for India is 91. Several international fibre-optic links include those to Japan, South Korea, Hong Kong, Russia, and Germany. Some major telecom operators in India include the privately owned companies like Vi, Airtel, and Reliance Jio and the state-owned companies - BSNL and MTNL.

Landline

Before the New Telecom Policy was announced in 1999, only the Government-owned BSNL and MTNL were allowed to provide land-line phone services through Copper conductor in India with MTNL operating in Delhi and Mumbai and BSNL servicing all other areas of the country. Due to the rapid growth of the cellular phone industry in India, landlines are facing stiff competition from cellular operators, with the number of wireline subscribers fell from 37.90 million in December 2008 to 20 million in October 2020.[2] This has forced land-line service providers to become more efficient and improve their quality of service. As of October 2020, India has 20 million wireline customers.[2]

Mobile telephony

On July 21, 1995,[53] then Chief Minister of West Bengal, Jyoti Basu made the first mobile phone call in India using Nokia handset, inaugurating Modi Telstra's MobileNet service from Writers' Building to then Union Telecom Minister Sukhram[54] at Sanchar Bhaban of New Delhi.[55] Sixteen years later 4G services were launched in Kolkata in 2012.[56]

With a subscriber base of more than 1151.8 million (31 Oct 2020),[2] the mobile telecommunications system in India is the second-largest in the world and it was thrown open to private players in the 1990s. GSM was comfortably maintaining its position as the dominant mobile technology with 80% of the mobile subscriber market, but CDMA seemed to have stabilised its market share at 20% for the time being.

The country is divided into multiple zones, called circles (roughly along state boundaries). Government and several private players run local and long-distance telephone services. Competition, especially after entry of Reliance Jio, has caused prices to drop across India, which are already one of the cheapest in the world.[57] The rates are supposed to go down further with new measures to be taken by the Information Ministry.[58]

In September 2004, the number of mobile phone connections crossed the number of fixed-line connections and presently dwarfs the wireline segment substantially. The mobile subscriber base has grown from 5 million subscribers in 2001 to over 1,179.32 million subscribers as of July 2018. India primarily follows the GSM mobile system, in the 900 MHz band. Recent operators also operate in the 1800 MHz band. The dominant players are Vi, Airtel, Jio, and BSNL/MTNL. International Roaming agreements exist between most operators and many foreign carriers. The government allowed Mobile number portability (MNP) which enables mobile telephone users to retain their mobile telephone numbers when changing from one mobile network operator to another.[59] In 2014, Thiruvananthapuram became the first city in India to cross the mobile penetration milestone of 100 mobile connections per 100 people. In 2015 three more cities from Kerala, Kollam, Kochi and Kottayam crossed the 100 mark. In 2017 many other major cities in the country like Chennai, Mysore, Mangalore, Bangalore, Hyderabad, etc. also crossed the milestone. Currently Thiruvananthapuram tops the Indian cities with a mobile penetration of 168.4 followed by Kollam 143.2 and Kochi 141.7.

Internet

Public, commercial Internet access in India was launched by Tata Communications (VSNL) on 15 August 1995,[61] though access was available via the Educational Research Network (ERNET) to educational institutions as early as 1986.[62] VSNL was able to add about 10,000 Internet users within 6 months.[63] However, for the next 10 years the Internet experience in the country remained less attractive, with narrow-band connections having speeds less than 56 kbit/s (dial-up). In 2004, the government formulated its broadband policy which defined broadband as "an always-on Internet connection with a download speed of 256 kbit/s or above."[64] From 2005 onward the growth of the broadband sector in the country accelerated but remained below the growth estimates of the government and related agencies due to resource issues in last-mile access which were predominantly wired-line technologies. This bottleneck was removed in 2010 when the government auctioned 3G spectrum followed by an equally high-profile auction of 4G spectrum that set the scene for a competitive and invigorated wireless broadband market. Now Internet access in India is provided by both public and private companies using a variety of technologies and media including dial-up (PSTN), xDSL, coaxial cable, Ethernet, FTTH, ISDN, HSDPA (3G), 4G, WiFi, WiMAX, etc. at a wide range of speeds and costs.

According to the Internet And Mobile Association of India (IAMAI), the Internet user base in the country stood at 190 million at the end of June 2013, rosing to 378.10 million in January 2018.[65][66] Cumulative Annual Growth rate (CAGR) of broadband during the five-year period between 2005 and 2010 was about 117 per cent.[64]

There were 204 Internet service provider (ISPs) offering broadband services in India as of 31 December 2017.[67] As of January 2018, the top five ISPs in terms subscriber base were Reliance Jio (168.39 million), Bharti Airtel (75.01 million), Vodafone (54.83 million), Idea Cellular (37.33 million) and BSNL (21.81 million).[68] In 2009, about 37 per cent of the users access the Internet from cyber cafes, 30 per cent from an office, and 23 per cent from home.[64] However, the number of mobile Internet users increased rapidly from 2009 on and there were about 359.80 million mobile users at the end of January 2018, with a majority using 4G mobile networks.[66]

One of the major issues facing the Internet segment in India is the lower average bandwidth of broadband connections compared to that of developed countries. According to 2007 statistics, the average download speed in India hovered at about 40 KB per second (256 Kbits/s), the minimum speed set by TRAI, whereas the international average was 5.6 Mbit/s during the same period. In order to attend this infrastructure issue the government declared 2007 as "the year of broadband".[69][70] To compete with international standards of defining broadband speed the Indian Government has taken the aggressive step of proposing a $13 billion national broadband network to connect all cities, towns and villages with a population of more than 500 in two phases targeted for completion by 2012 and 2013. The network was supposed to provide speeds up to 10 Mbit/s in 63 metropolitan areas and 4 Mbit/s in an additional 352 cities. In February 2018, the average broadband speed of fixed-line connection in India was 20.72 Mbit/s, which is less than the global average download speed of 42.71 Mbit/s.[71] In terms of mobile internet speed, India performed quite poorly, with average speed of 9.01 Mbit/s when compared with global average mobile broadband speed was 22.16 Mbit/s.[71]

As of December 2017, according to Internet and Mobile Association of India, the Internet penetration rate in India is one of the lowest in the world and only accounts for 35% of the population compared to the global average internet penetration is over 54.4%.[72][73] Another issue is the digital divide where growth is biased in favour of urban areas; according to December 2017 statistics, internet penetration in urban India was 64.84%, whereas internet penetration in rural India is only 20.26%.[72] Regulators have tried to boost the growth of broadband in rural areas by promoting higher investment in rural infrastructure and establishing subsidised tariffs for rural subscribers under the Universal service scheme of the Indian government.

As of May 2014, the Internet was delivered to India mainly by 9 different undersea fibres, including SEA-ME-WE 3, Bay of Bengal Gateway and Europe India Gateway, arriving at 5 different landing points.[74]

Net neutrality

In March 2015, the TRAI released a formal consultation paper on Regulatory Framework for Over-the-top (OTT) services, seeking comments from the public. The consultation paper was criticised for being one sided and having confusing statements. It was condemned by various politicians and internet users.[75][76][77] By 18 April 2015, over 800,000 emails had been sent to TRAI demanding net neutrality.[77][78][79]

The TRAI on 8 February 2016, notified the Prohibition of Discriminatory Tariffs for Data Services Regulations, 2016 which barred telecom service providers from charging differential rates for data services.[80]

The 2016 Regulation,[81] stipulates that:

- No service provider can offer or charge discriminatory tariffs for data services on the basis of content.

- No service provider shall enter into any arrangement, agreement or contract, by whatever name called, with any person, natural or legal, that the effect of discriminatory tariffs for data services being offered or charged by the service provider for the purpose of evading the prohibition in this regulation.

- Reduced tariff for accessing or providing emergency services, or at times of public emergency has been permitted.

- Financial disincentives for contravention of the regulation have also been specified.

- TRAI may review these regulations after a period of two years.

Television broadcasting

Television broadcasting began in India in 1959 by Doordarshan, a state-run medium of communication, and had slow expansion for more than two decades.[82] The policy reforms of the government in the 1990s attracted private initiatives in this sector, and since then, satellite television has increasingly shaped popular culture and Indian society. However, still, only the government-owned Doordarshan has the licence for terrestrial television broadcast. Private companies reach the public using satellite channels; both cable television as well as DTH has obtained a wide subscriber base in India. In 2012, India had about 148 million TV homes of which 126 million has access to cable and satellite services.[83]

Following the economic reforms in the 1990s, satellite television channels from around the world—BBC, CNN, CNBC, and other private television channels gained a foothold in the country.[8] There are no regulations to control the ownership of satellite dish antennas and also for operating cable television systems in India, which in turn has helped for an impressive growth in the viewership. The growth in the number of satellite channels was triggered by corporate business houses such as Disney Networks Group Asia Pacific group and Zee Entertainment Enterprises. Initially restricted to music and entertainment channels, viewership grew, giving rise to several channels in regional languages, especially Hindi. The main news channels available were CNN and BBC News. In the late 1990s, many current affairs and news channels sprouted, becoming immensely popular because of the alternative viewpoint they offered compared to Doordarshan. Some of the notable ones are Aaj Tak (run by the India Today group) and ABP News, CNN-News18, Times Now, initially run by the NDTV group and their lead anchor, Prannoy Roy (NDTV now has its own channels, NDTV 24x7, NDTV Profit and NDTV India). Over the years, Doordarshan services also have grown from a single national channel to six national and eleven regional channels. Nonetheless, it has lost the leadership in market, though it underwent many phases of modernisation in order to contain tough competition from private channels.[8]

Today, television is the most penetrative media in India with industry estimates indicating that there are over 554 million TV consumers, 462 million with satellite connections, compared to other forms of mass media such as radio or internet.[84] Government of India has used the popularity of TV and radio among rural people for the implementation of many social-programmes including that of mass-education. On 16 November 2006, the Government of India released the community radio policy which allowed agricultural centres, educational institutions and civil society organisations to apply for community based FM broadcasting licence. Community Radio is allowed 100 watts of Effective Radiated Power (ERP) with a maximum tower height of 30 metres. The licence is valid for five years and one organisation can only get one licence, which is non-transferable and to be used for community development purposes.

Radio

As of June 2018, there are 328 private FM radio stations in India.[85] Apart from the private FM radio stations, Akashvani, the national public radio broadcaster of India, runs multiple radio channels. AIR's service comprises 420 stations located across the country, reaching nearly 92% of the country's area and 99.19% of the total population. AIR originates programming in 23 languages and 179 dialects.[86]

Next-generation networks (NGN)

Historically, the role of telecommunication has evolved from that of plain information exchange to a multi-service field, with Value Added Services (VAS) integrated with various discrete networks like PSTN, PLMN, Internet Backbone etc. However, with decreasing average revenue per user and increasing demand for VAS has become a compelling reason for the service providers to think of the convergence of these parallel networks into a single core network with service layers separated from network layer.[87] Next-generation networking is such a convergence concept which according to ITU-T is:[88]

A next-generation network (NGN) is a packet-based network which can provide services including Telecommunication Services and able to make use of multiple broadband, quality of service-enabled transport technologies and in which service-related functions are independent from underlying transport-related technologies. It offers unrestricted access by users to different service providers. It supports generalised mobility which will allow the consistent and ubiquitous provision of services to users.

Access network: The user can connect to the IP-core of NGN in various ways, most of which use the standard Internet Protocol (IP). User terminals such as mobile phones, personal digital assistants (PDAs) and computers can register directly on NGN-core, even when they are roaming in another network or country. The only requirement is that they can use IP and Session Initiation Protocol (SIP). Fixed access (e.g., digital subscriber line (DSL), cable modems, Ethernet), mobile access (e.g. UMTS, CDMA2000, GSM, GPRS) and wireless access (e.g.WLAN, WiMAX) are all supported. Other phone systems like plain old telephone service and non-compatible VoIP systems, are supported through gateways. With the deployment of the NGN, users may subscribe to many simultaneous access-providers providing telephony, internet or entertainment services. This may provide end-users with virtually unlimited options to choose between service providers for these services in NGN environment.[87]

The hyper-competition in the telecom market, which was effectively caused by the introduction of Universal Access Service (UAS) licence in 2003 became much tougher after 3G and 4G competitive auction. About 670,000 route-kilometres (420,000 mi) of optical fibre has been laid in India by the major operators, including in the financially nonviable rural areas and the process continues. Keeping in mind the viability of providing services in rural areas, the government of India also took a proactive role to promote the NGN implementation in the country; an expert committee called NGN eCO was constituted in order to deliberate on the licensing, interconnection and quality of service (QoS) issues related to NGN and it submitted its report on 24 August 2007. Telecom operators found the NGN model advantageous, but huge investment requirements have prompted them to adopt a multi-phase migration and they have already started the migration process to NGN with the implementation of IP-based core-network.[87]

Regulatory environment

LIRNEasia's Telecommunications Regulatory Environment (TRE) index, which summarises stakeholders' perception on certain TRE dimensions, provides insight into how conducive the environment is for further development and progress. The most recent survey was conducted in July 2008 in eight Asian countries, including Bangladesh, India, Indonesia, Sri Lanka, Maldives, Pakistan, Thailand, and the Philippines. The tool measured seven dimensions: i) market entry; ii) access to scarce resources; iii) interconnection; iv) tariff regulation; v) anti-competitive practices; and vi) universal services; vii) quality of service, for the fixed, mobile and broadband sectors.

The results for India, point out to the fact that the stakeholders perceive the TRE to be most conducive for the mobile sector followed by fixed and then broadband. Other than for Access to ScarceResources the fixed sector lags behind the mobile sector. The fixed and mobile sectors have the highest scores for Tariff Regulation. Market entry also scores well for the mobile sector as competition is well entrenched with most of the circles with 4–5 mobile service providers. The broadband sector has the lowest score in the aggregate. The low penetration of broadband of mere 3.87 against the policy objective of 9 million at the end of 2007 clearly indicates that the regulatory environment is not very conducive.[89]

In 2013 the home ministry stated that legislation must ensure that law enforcement agencies are empowered to intercept communications.[90]

S-band spectrum scam

In India, electromagnetic spectrum, being a scarce resource for wireless communication, is auctioned by the Government of India to telecom companies for use. As an example of its value, in 2010, 20 Hertz of 3G spectrum was auctioned for ₹677 billion (US$8.5 billion). This part of the spectrum is allocated for terrestrial communication (cell phones). However, in January 2005, Antrix Corporation (commercial arm of ISRO) signed an agreement with Devas Multimedia (a private company formed by former ISRO employees and venture capitalists from USA) for lease of S band transponders (amounting to 70 MHz of spectrum) on two ISRO satellites (GSAT 6 and GSAT 6A) for a price of ₹14 billion (US$180 million), to be paid over a period of 12 years. The spectrum used in these satellites (2500 MHz and above) is allocated by the International Telecommunication Union specifically for satellite-based communication in India. Hypothetically, if the spectrum allocation is changed for utilisation for terrestrial transmission and if this 70 MHz of spectrum were sold at the 2010 auction price of the 3G spectrum, its value would have been over ₹2,000 billion (US$25 billion). This was a hypothetical situation. However, the Comptroller and Auditor General of India considered this hypothetical situation and estimated the difference between the prices as a loss to the Indian Government.[91][92]

There were lapses on implementing Government of India procedures. Antrix/ISRO had allocated the capacity of the above two satellites to Devas Multimedia on an exclusive basis, while rules said it should always be non-exclusive. The Union Council of Ministers was misinformed in November 2005 that several service providers were interested in using satellite capacity, while the Devas deal was already signed. Also, the Space Commission was kept in the dark while taking approval for the second satellite (its cost was diluted so that Cabinet approval was not needed). ISRO committed to spending ₹7.66 billion (US$96 million) of public money on building, launching, and operating two satellites that were leased out for Devas.

In late 2009, some ISRO insiders exposed information about the Devas-Antrix deal,[92][93] and the ensuing investigations resulted in the deal being annulled. G. Madhavan Nair (ISRO Chairperson when the agreement was signed) was barred from holding any post under the Department of Space. Some former scientists were found guilty of "acts of commission" or "acts of omission". Devas and Deutsche Telekom demanded US$2 billion and US$1 billion, respectively, in damages.[94]

The Central Bureau of Investigation concluded investigations into the Antrix-Devas scam and registered a case against the accused in the Antrix-Devas deal under Section 120-B, besides Section 420 of IPC and Section 13(2) read with 13(1)(d) of PC Act, 1988 on 18 March 2015 against the then executive director of Antrix Corporation, two officials of USA-based company, Bangalore based private multimedia company, and other unknown officials of Antrix Corporation or Department of Space.[95][96]

Devas Multimedia started arbitration proceedings against Antrix in June 2011. In September 2015, the International Court of Arbitration of the International Chamber of Commerce ruled in favour of Devas, and directed Antrix to pay US$672 million (Rs 44.35 billion) in damages to Devas.[97] Antrix opposed the Devas plea for tribunal award in the Delhi High Court.[98]

Revenue and growth

The adjusted gross revenue in the telecom service sector was ₹160,814 crore (equivalent to ₹2.3 trillion or US$28.2 billion in 2023) in 2017 as against ₹198,207 crore (equivalent to ₹2.8 trillion or US$35.7 billion in 2023) in 2016, registering a negative growth of 18.87%.[99] The major contributions to this revenue are as follows (in INR crores):[99]

| Service provider | Calendar year 2018-19

(in INR crores) |

Calendar year 2019-20

(in INR crores) |

% change | Q2 2020-21

(in INR crores) |

|---|---|---|---|---|

| Airtel | 80,780.2 [100] | 87,539.0 [100] | +08.37% | -- |

| Reliance Jio | 48,660 [101] | 68,462 [101] | +40.69% | -- |

| Vi | 37,823.6 [102] | 45,996.8[102] | +21.68% | -- |

| BSNL | 19,308 [103] | 18,906 [104] | -02.08% | -- |

Note:

| ||||

International

- Nine satellite earth stations – 8 Intelsat (Indian Ocean) and 1 Inmarsat (Indian Ocean region).

- Nine gateway exchanges operating from Mumbai, New Delhi, Kolkata, Chennai, Jalandhar, Kanpur, Gandhinagar, Hyderabad and Thiruvananthapuram.

Submarine cables

- LOCOM linking Chennai to Penang, Malaysia

- India-UAE cable linking Mumbai to Fujairah, UAE.

- SEA-ME-WE 2 (South East Asia-Middle East-Western Europe 2)

- SEA-ME-WE 3 (South East Asia-Middle East-Western Europe 3) – Landing sites at Kochi and Mumbai. Capacity of 960 Gbit/s.

- SEA-ME-WE 4 (South East Asia-Middle East-Western Europe 4) – Landing sites at Mumbai and Chennai. Capacity of 1.28 Tbit/s.

- Fibre-optic Link Around the Globe (FLAG-FEA) with a landing site at Mumbai (2000). Initial design capacity 10 Gbit/s, upgraded in 2002 to 80 Gbit/s, upgraded to over 1 Tbit/s (2005).

- TIISCS (Tata Indicom India-Singapore Cable System), also known as TIC (Tata Indicom Cable), Chennai to Singapore. Capacity of 5.12 Tbit/s.

- i2i – Chennai to Singapore. The capacity of 8.4 Tbit/s.

- SEACOM From Mumbai to the Mediterranean, via South Africa. It joins with SEA-ME-WE 4 off the west coast of Spain to carry traffic onward to London (2009). Capacity of 1.28 Tbit/s.

- I-ME-WE (India-Middle East-Western Europe) with two landing sites at Mumbai (2009). Capacity of 3.84 Tbit/s.

- EIG (Europe-India Gateway), landing at Mumbai(2011). Capacity of 3.84 Tbit/s.

- TGN-Eurasia Landing at Mumbai (2012), Capacity of 1.28 Tbit/s

- TGN-Gulf Landing at Mumbai (2012), Capacity Unknown.

- MENA (Middle East North Africa)(Announced).(due ?), Capacity of 5.76 Tbit/s.

See also

References

- The Indian Telecom Services Performance Indicators October – December, 2019 trai.gov.in Retrieved 8 August 2023

- "Telecom Subscription Data as on 31st October, 2020" (PDF). Telecom Regulatory Authority of India. 31 October 2020.

- "Telecom Subscription Data as on 31st August, 2021" (PDF). Telecom Regulatory Authority of India. 31 August 2021.

- "Telecom Subscription Data as on 31st December, 2020" (PDF). Telecom Regulatory Authority of India. 31 December 2020.

- "Highlights of Telecom Subscription Data as on 31 May 2012" (PDF). TRAI. 4 July 2012. Archived (PDF) from the original on 15 November 2012. Retrieved 5 July 2012.

- Dharmakumar, Rohin (19 October 2011). "India Telcos: Battle of the Titans". Forbes. Archived from the original on 21 October 2011. Retrieved 19 August 2011.

- Kannan, Shilpa (7 April 2010). "India's 3G licence bidders bank on big changes". BBC News. Archived from the original on 17 June 2010. Retrieved 11 June 2010.

- Raju Thomas G. C. (2006). Stanley Wolpert (ed.). Encyclopedia of India (vol. 3). Thomson Gale. pp. 105–107. ISBN 0-684-31352-9.

- "Telecom sector to contribute Rs 1.45 lakh crore to the public fund by 2020 - ET Telecom". ETTelecom.com. Archived from the original on 21 September 2017. Retrieved 22 July 2017.

- Mitra Debnath, Roma; Shankar, Ravi (1 January 2008). "Benchmarking telecommunication service in India: An application of data envelopment analysis". Benchmarking. 15 (5): 584–598. doi:10.1108/14635770810903169. ISSN 1463-5771.

- Joshi, Sandeep (12 June 2013). "Dot, dash, full stop: Telegram service ends July 15". The Hindu. ISSN 0971-751X. Retrieved 6 June 2021.

- "Public Works Department". Pwd.delhigovt.nic.in. Archived from the original on 25 March 2010. Retrieved 1 September 2010.

- Vatsal Goyal, Premraj Suman. "The Indian Telecom Industry" (PDF). IIM Calcutta. Archived (PDF) from the original on 31 March 2010. Retrieved 26 May 2010.

- "History of Calcutta telephones". Bharat Sanchar Nigam Limited. Archived from the original on 15 June 2012. Retrieved 21 June 2012.

- "Jabalpur Engineering Collage Has First High Voltage Lab Of Country - प्रदेश के इस पहले इंजीनियरिंग कॉलेज में है देश की पहली हाई वोल्टेज लैब, आप भी जानिए | Patrika News". Archived from the original on 21 May 2021.

- Annual report 2018 jecjabalpur.ac.in

- India Telecom Laws and Regulations Handbook. Int'l Business Publications. 3 March 2008. ISBN 978-1-4330-8190-3.

- "VSNL starts India's first Internet service today". Dxm.org. 14 August 1995. Archived from the original on 1 September 2015. Retrieved 15 August 2012.

- Schwartzberg, Joseph E. (2008), India, Encyclopædia Britannica

- Dash, Kishore. "Veto Players and the Deregulation of State-Owned Enterprises: The Case of Telecommunications in India" (PDF). Archived (PDF) from the original on 11 September 2008. Retrieved 26 June 2008.

- Vanita Kohli (14 June 2006). The Indian Media Business. SAGE. pp. 189–. ISBN 978-0-7619-3469-1. Archived from the original on 9 May 2013. Retrieved 19 June 2012.

- Marcus F. Franda (2002). China and India Online: Information Technology Politics and Diplomacy in the World's Two Largest Nations. Rowman & Littlefield. pp. 137–. ISBN 978-0-7425-1946-6. Retrieved 19 June 2012.

- J.G. Valan Arasu (1 April 2008). Globalisation And Infrastructural Development In India. Atlantic Publishers & Dist. pp. 105–. ISBN 978-81-269-0973-5. Archived from the original on 9 May 2013. Retrieved 19 June 2012.

- Rafiq Dossani (1 July 2002). Telecommunications Reform in India. Greenwood Publishing Group. pp. 106–. ISBN 978-1-56720-502-2. Archived from the original on 9 May 2013. Retrieved 19 June 2012.

- "TDSAT - profile". Archived from the original on 8 May 2012. Retrieved 20 May 2013.

- "TRAI Act" (PDF). Archived (PDF) from the original on 20 May 2013. Retrieved 20 May 2013.

- "Department of Telecommunications Ministry of Communications & IT". Archived from the original on 24 November 2011.

- "Draft Information Paper on Dial-up Internet Access" (PDF). Archived (PDF) from the original on 20 July 2011. Retrieved 1 September 2010.

- "GSM, CDMA players maintain subscriber growth momentum-Telecom-News By Industry-News-The Economic Times". Economictimes.indiatimes.com. 18 March 2009. Archived from the original on 26 July 2016. Retrieved 22 July 2010.

- "TTC DOT Directs ban on usage of Chinese", The Hindu! News

- "Supreme Court quashes 122 2G licences awarded in 2008". DNA. Archived from the original on 14 June 2012. Retrieved 3 July 2018.

- "Five crore fine for Unitech, Swan and Tata Teleservices". NDTV. Archived from the original on 25 December 2013. Retrieved 3 July 2018.

- "SC quashes 122 licences". The Times of India. 2 February 2012. Archived from the original on 15 July 2012. Retrieved 3 July 2018.

- "Licences to remain in place for 4 months". Times of India. Archived from the original on 6 May 2016. Retrieved 3 July 2018.

- "Bharti Airtel to take ownership of Telenor's operations in India". Telenor Group. 23 February 2017. Retrieved 13 January 2019.

- Aulakh, Gulveen. "{title}". The Economic Times. Archived from the original on 12 June 2018. Retrieved 20 July 2018.

- "Bharti Airtel to acquire Tata's mobile business on debt-free cash-free basis". www.businesstoday.in. 12 October 2017. Archived from the original on 15 November 2017. Retrieved 18 November 2017.

- "Tata and Bharti to combine consumer telecom business via @tatacompanies". tata.com. Archived from the original on 12 November 2017. Retrieved 18 November 2017.

- Kurup, Rajesh (12 October 2017). "Tata Tele hangs up on mobile business; Airtel picks it up". The Hindu Business Line. Retrieved 18 November 2017.

- bureau, Odisha Diary (12 October 2017). "Tata and Bharti to Combine Consumer Telecom Business". Odisha News | Odisha Breaking News | Latest Odisha News. Retrieved 27 February 2022.

- "Airtel's Tata merger deal". Business Line. 1 July 2019. Retrieved 3 July 2019.

- "DoT approved deal of Tata and Bharti Airtel". Economic Times. 11 April 2019. Retrieved 5 May 2019.

- "Reliance Communications to shut voice calls from next month". The Economic Times. 4 November 2017. Archived from the original on 1 December 2017. Retrieved 29 November 2017.

- "Debt ridden Reliance Communication to shut voice calls from December 1". The Times of India. 4 November 2017. Archived from the original on 6 November 2017. Retrieved 29 November 2017.

- "Reliance Communications Completes Merger With MTS". NDTV. Archived from the original on 1 December 2017. Retrieved 18 November 2017.

- "Reliance Communications completes merger with MTS". Zee News. 31 October 2017. Archived from the original on 8 November 2017. Retrieved 18 November 2017.

- Siddiqui, Danish (1 February 2019). "RCom goes to bankruptcy court to resolve debt burden". Reuters. Retrieved 28 February 2019.

- ET Bureau (2 February 2019). "RCom to move NCLT to offload assets, repay debt". The Economic Times. Retrieved 28 February 2019.

- "NCLT appoints Aneesh Nanavati of Deloitte as RP for Reliance Communications". www.livemint.com. 21 June 2019. Retrieved 16 August 2019.

- "Aircel to shut operations in six circles from January 30". Moneycontrol.com. 20 December 2017. Archived from the original on 3 January 2018. Retrieved 3 January 2018.

- "Merger of Idea Cellular and Vodafone India completed - creating India's largest telecom service provider" (PDF). Idea. Archived (PDF) from the original on 31 August 2018. Retrieved 31 August 2018.

- Parbat, Kalyan (28 August 2018). "Reliance Jio | Mukesh Ambani: Reliance Jio inches closer to Bharti Airtel in terms of revenue market share". The Economic Times. Retrieved 6 June 2021.

- "Special Issue: Photofeature: Mumbai". India Today. 18 December 2010. Retrieved 21 September 2022.

- "Kolkata connects India to 4G era". The Times of India. 11 April 2012. Archived from the original on 3 January 2013. Retrieved 1 July 2013.

- "25 Years Ago, the First Mobile Phone Call Was Made in India, Costing Over Rs 8/Minute". News18. 31 July 2020. Retrieved 21 September 2022.

- "4G launched in Kolkota". The Times of India. Times of India. Archived from the original on 9 June 2012. Retrieved 18 June 2012.

- "The death of STD". The Indian Express. 12 October 2006. Archived from the original on 24 February 2008. Retrieved 1 September 2010.

- "Free broadband, rent-free landlines likely: Maran". Rediff.com. 31 December 2004. Archived from the original on 26 March 2011. Retrieved 1 September 2010.

- "Mobile number portability: Switch tele operator!". oneindia.in. 20 January 2011. Archived from the original on 30 January 2012. Retrieved 22 October 2011.

- "Press Release on Telecom Subscription Data as on 31 August, 2020" (PDF). Telecom Regulatory Authority of India. 10 November 2020.

- "SEC Form 20-F (2009)". Archived from the original on 2 October 2015. Retrieved 30 September 2015.

- Ramani, Srinivasan (14 August 2015). "The story of how the Internet came to India: An insider's account". News18. Archived from the original on 10 October 2021.

- Sursh K. Chouhan, T. A. V. Murthy. "Digital divide and India" (PDF). p. 384. Retrieved 20 June 2012.

- "Broadband status in India" (PDF). TRAI. p. 21. Archived from the original (PDF) on 27 September 2013. Retrieved 20 June 2012.

- "India to have 243 million Internet users by June 2014: report". NDTV.com. Archived from the original on 2 February 2014. Retrieved 1 February 2014.

- "Highlights of Telecom Subscription Data as on 31st December, 2017" (PDF). TRAI. Archived (PDF) from the original on 18 February 2018.

- "LIST OF ISP LICENSEES AS ON 31.12.2017" (PDF). Department of Telecommunication, Government of India. Archived (PDF) from the original on 28 March 2018. Retrieved 28 March 2018.

- "Highlights of Telecom Subscription Data as on 31st January, 2018" (PDF). TRAI. Archived from the original (PDF) on 28 March 2018. Retrieved 28 March 2018.

- "Broadband speeds around the world". BBC News. 2 December 2007. Archived from the original on 6 December 2007. Retrieved 2 December 2007.

- "India Seeks Access to the Broadband Highway". Bloomberg BusinessWeek. Archived from the original on 20 November 2011. Retrieved 17 November 2011.

- "India ranks 67th in fixed-line, 109th in mobile broadband speed: Ookla". The Economic Times. 26 March 2018. Retrieved 28 March 2018.

- Agarwal, Surabhi (20 February 2018). "Internet users in India expected to reach 500 million by June: IAMAI". The Economic Times. Archived from the original on 24 March 2018. Retrieved 28 March 2018.

- "Internet Usage in Asia". International Telecommunications Unit: Asian Internet Users. ITU. Archived from the original on 30 January 2012. Retrieved 10 January 2011.

- "This is From Where and How Internet in India Comes From?" Archived 11 May 2015 at the Wayback Machine, Source Digit, 12 May 2014. Retrieved 4 June 2015.

- Singh, Saurabh (8 April 2015). "Politicos slam TRAI's stance on net neutrality". India Today. Archived from the original on 12 April 2015. Retrieved 12 April 2015.

- Gandhi, Rajat (8 April 2015). "Net neutrality: Why Internet is in danger is of being shackled". The Economic Times. Retrieved 12 April 2015.

- "Indians rally for Internet freedom, send over 1 lakh emails to TRAI for net neutrality". IBNLive. 13 April 2015. Archived from the original on 15 April 2015. Retrieved 13 April 2015.

- Roy, Prasanto (18 April 2015). "India's fight for net neutrality". India: BBC. Archived from the original on 20 April 2015. Retrieved 18 April 2015.

- "Over 3 lakh emails sent to Trai in support of Net Neutrality, so far". FirstPort. 14 April 2015. Archived from the original on 14 April 2015. Retrieved 14 April 2015.

- "India Chooses Net Neutrality, Facebook's Free Basics Is Nixed". 8 February 2016. Archived from the original on 8 February 2016. Retrieved 9 February 2016.

- "{title}" (PDF). Archived (PDF) from the original on 21 June 2018. Retrieved 7 April 2018.

- Kaminsky, Arnold P.; Long, Roger D. (30 September 2011). India Today: An Encyclopedia of Life in the Republic: An Encyclopedia of Life in the Republic. ABC-CLIO. pp. 684–692. ISBN 978-0-313-37462-3. Retrieved 12 September 2012.

- "India overview" (PDF). TAM Media Research. Archived (PDF) from the original on 14 August 2012. Retrieved 11 July 2012.

- "Indian Readership Survey 2012 Q1 : Topline Findings" (PDF). Media Research Users Council. Growth: Literacy & Media Consumption. Archived from the original (PDF) on 7 April 2014. Retrieved 12 September 2012.

- "The Indian Telecom Services Performance Indicators July – September, 2018" (PDF). TRAI. Retrieved 10 January 2019.

- "About All India Radio". AIR. Archived from the original on 20 September 2013. Retrieved 26 June 2018.

- "Consultation paper on NGN licensing" (PDF). TRAI. Archived (PDF) from the original on 10 March 2013. Retrieved 12 July 2012.

- "NGN Definition". ITU. Archived from the original on 11 September 2005. Retrieved 12 July 2012.

- Payal Malik. "Telecom Regulatory and Policy Environment in India: Results and Analysis of the 2008 TRE Survey" (PDF). LIRNEasia. Archived (PDF) from the original on 11 December 2009. Retrieved 14 June 2010.

- "Home ministry objects to proposed telecom security policy" Archived 26 September 2017 at the Wayback Machine, The Times of India (PTI), 15 September 2013. Retrieved 15 September 2013.

- Thakur, Pradeep (8 February 2011). "Another spectrum scam hits govt, this time from ISRO". The Times of India. New Delhi. Retrieved 23 January 2018.

- "Behind the S-band spectrum scandal". The Hindu. 28 September 2011. Retrieved 6 February 2015.

- "antrix-devas-news-lalit-shastri". Newsroom24x7. 20 March 2015. Retrieved 24 May 2016.

- Jethmalani, Ram (22 August 2013). "Antrix Devas and the second generation scam". The New Indian Express. New Delhi. Retrieved 6 February 2015.

- "CBI registers case in the huge Antrix-Devas scam". Newsroom24x7.com. Retrieved 16 May 2015.

- "Antrix-Devas Agreement, national security, and CBI". Newsroom24x7. 20 March 2015. Retrieved 24 May 2016.

- "ISRO's Antrix to pay Rs 4,432 crore damages to Devas for unlawfully cancelling contract". The Economic Times. 30 September 2015. Retrieved 15 December 2015.

- Mathur, Aneesha (10 October 2015). "Antrix opposes Devas plea over tribunal award in HC". The Indian Express. New Delhi. Retrieved 23 January 2018.

- "Yearly Performance Indicators of Indian Telecom Sector (Second Edition) 2017" (PDF). TRAI. Retrieved 11 September 2018.

- "Integrated Report and Annual Financial Statements 2019-20" (PDF). p. 52.

- "Annual Report for the year 2019-20". Reliance Industries.

- "Vodafone Idea Annual Results 2019-20" (PDF). vodafoneidea.com.

- "Annual Report 2018-19". Bharat Sanchar Nigam Limited. 31 March 2019. Retrieved 4 July 2019.

- "Annual Report 2020" (PDF). Bharat Sanchar Nigam Limited. 31 March 2020. Retrieved 4 July 2020.

- Pandey, Navadha (12 January 2018). "NCLT approves Idea-Vodafone merger". livemint.com. Archived from the original on 21 June 2018. Retrieved 24 January 2018.

External links

- Telecom Regulatory Authority of India

- Cellular Operators Association of India

- IRAM - Radio Audience Measurement in India from 2016.

- Internet Usage Stats and Telecommunications of India

- Accounting & Reporting in Telecom IndustryArchived 14 March 2012 at the Wayback Machine

- Mergers & Acquisitions in Indian Telecom Industry Archived 14 March 2012 at the Wayback Machine