This article was co-authored by Nathan Miller and by wikiHow staff writer, Jennifer Mueller, JD. Nathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 14,418 times.

Real estate is not as liquid as other investments. Building up equity is great, but does you no good unless you can tap into it. The primary way to access equity in investment property is to mortgage (or re-mortgage) the property. Depending on your needs and the amount of equity you have, you can either do a cash-out refinance (cash-out refi) or get a home equity line of credit (HELOC). However, it can be far more difficult to access equity in investment property than it would be on your primary residence.

Steps

Getting a Cash-Out Refinance

-

1Choose a cash-out refi for a lump sum. The cash-out refi is better for property owners who need a larger amount of money all at once. You may have substantial repairs that need to be done to the property, or you may want to purchase additional investment property.

- A cash-out refi is also beneficial if you want to consolidate other debts. However, be careful if you've established an LLC to manage your investment properties – using the equity in those properties to pay off personal debts would be commingling.

-

2Gather financial documentation. You may already have a general idea of the kind of documentation you'll need to apply for a mortgage – 2 or 3 years of tax returns, bank statements, and documentation of other debts and assets.[1]

- For an investment property, you'll need additional documentation as well, such as rental agreements and tax information for the investment property and any other properties you own.

Advertisement -

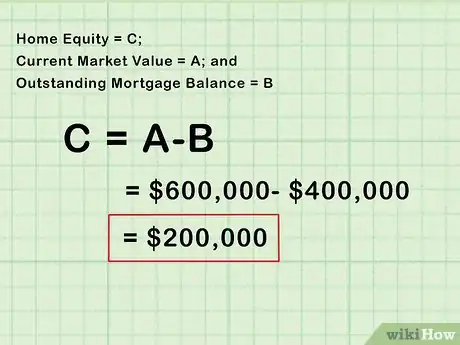

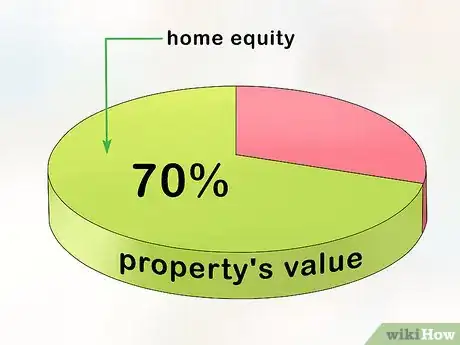

3Calculate your equity in the property. With your principal residence, you can finance as much as 80 or 90 percent of the property's total value. However, with an investment property, lenders typically only finance up to around 70 percent.[2]

- If you don't have a lot of equity in the property, a cash-out refi may not be of significant benefit to you. Generally, you want to have at least 30 if not 40 percent equity in the property before you apply for a cash-out refi.

- You'll typically need to get the property appraised. You can do this on your own, or you can wait until you find a lender and let them take care of it.

-

4Shop and compare lenders online. It can be difficult to find a lender for a cash-out refi on investment property. You may find it useful to get quotes from several lenders so you can make sure you're getting the best rates and loan terms that meet your investment goals.[3]

- Many lenders will pre-qualify you for a rate on a set amount, after you provide some basic information on an online form. You can compare these pre-qualifications to choose the lender you want. Just keep in mind that the final offer may be somewhat different from the pre-qualification offer.

- Some lenders are unwilling to offer cash-out refis to investors with more than 4 properties. If you have several investment properties, ask if the lender has this limitation.

-

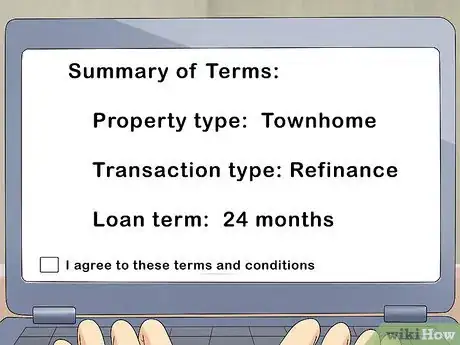

5Complete your application. Your application for a cash-out refi will be substantially similar to the original mortgage application you completed for the property. You'll have to provide information about your personal finances as well as the income earned through the investment property.[4]

- The lender will go through the process of reviewing the information and documents you provided. If they need any additional information to approve your loan, they'll let you know.

-

6Review the loan terms carefully. When the lender presents you with your final loan offer, review it in terms of your own plans for the property and your long-term investment goals. Don't be afraid to refuse it if you can't make the terms work for you.[5]

- If your mortgage payment will increase as a result of the refi, consider whether you can cover that increase by increasing the rent on the property.

-

7Receive your funds. If you accept the loan, you'll typically receive a check at closing for the difference between the amount of your previous mortgage on the property and the amount of your cash-out refi.[6]

- This money can be used for whatever purpose you originally intended. If you plan to hold onto it for awhile before using it, put it in an interest-bearing account so it will make a little money in the meantime.

Applying for a Home Equity Line of Credit

-

1Use a HELOC for home improvements. A HELOC is a revolving line of credit, similar to a credit card, secured by the equity in your investment property. If you plan to use the money on a regular basis for repairs, or to make improvements, a HELOC could be the best choice for you.[7]

- A HELOC could also benefit you if, for example, you own investment property on the coast that is often damaged by storms. With the HELOC, you have money to make repairs quickly so you don't lose as much rental income.

-

2Find a HELOC lender. While most major banks and mortgage companies offer HELOCs for primary residences, only some of them do for investment properties. You can still shop around, though, to find the best rates.[8]

- Some lenders will pre-qualify you for a HELOC. You can use this to compare lenders.

- You might also consider going with an online service that sends your information to multiple lenders and finds the best match for you.

-

3Fill out application forms. Applying for a HELOC is similar to applying for any mortgage. You'll need to provide information about your income and finances, as well as the income of your investment property.[9]

- For an investment property, the lender typically also wants to see copies of any active leases on the property. They may want to see other business documents as well, particularly if you've organized an LLC or corporation to manage your rental properties.

-

4Get a quote from the lender if approved. Once your application is complete, the lender will offer you an amount of money at a certain rate. You'll typically pay an annual maintenance fee, but generally speaking you don't make any payments on a HELOC unless you use part of the money.[10]

- If the first lender doesn't approve you, apply again with someone else. Find out why your application was denied and see what you can do to remedy that issue.

-

5Decide how to pay closing costs. You'll have closing costs with a HELOC, just as you would with any other mortgage. While they're typically lower than a traditional mortgage, they'll still probably be several thousand dollars.[11]

- If you add the closing costs to the balance of your HELOC, you'll start making monthly payments immediately. You can also choose to pay these as a lump sum at closing.

-

6Use your funds when needed. Your lender typically will set up an account and give you a debit card to use when you want to access the funds in the account. Your HELOC account operates very similarly to a credit card account.[12]

- Keep track of expenses you pay with your HELOC funds. In general, it's a good idea to avoid using HELOC funds to cover unnecessary purchases or expenses unrelated to the investment property itself.

Improving Your Chances of Acceptance

-

1Maintain a stellar credit rating. Home equity loans on investment properties are extremely risky for lenders. An excellent credit score and consistent credit history can help you get the best possible rates.[13]

- Your personal credit score as well as your debt-to-income ratio may effect your eligibility for either a cash-out refi or a HELOC.

- There are psychological reassurances for a loan on a primary residence that aren't there with a property you don't live in. Primarily, lenders realize people will do everything possible to avoid foreclosure that could result in them being homeless. On the other hand, it could be much easier to default on an investment property.

-

2Organize your finances meticulously. It should come as no surprise that applying for any kind of mortgage will require a lot of paperwork. When you're trying to access equity in investment property, however, lenders typically require more documentation than they might for a primary residence.[14]

- If your files are in order and documents are easy to access and understand, you make your mortgage broker's work easier.

- Organized finances demonstrate that you take responsibility, which may influence your broker into seeing you as less of a risk.

-

3Apply only when you have substantial equity. Since a HELOC or refi on investment property only takes up to 70 percent of the property's value, it makes sense to wait for equity to build. If your current mortgage only represents, say, 40 percent of the overall property value, you can tap into much more of the equity.[15]

- Allowing substantial equity to build also protects you in the event of another market downturn that lowers your property's value.

- Pay attention to any developments that could substantially increase (or decrease) your property's value.

-

4Hold property for several years before tapping equity. You'll be more likely to qualify for a refi if you can show a substantial history of on-time mortgage payments on the property. Many lenders won't refinance property you've held for 6 months or less.[16]

- There are some exceptions, but if you haven't owned the property for long, expect to access a smaller proportion of the equity at a higher rate.

-

5Keep adequate cash reserves. Especially if you apply for a HELOC, lenders may actually require you to keep several thousand dollars in savings. This reassures the lender that you'll still be able to make your payments, even if the property sits empty for several months.[17]

- As a general rule, plan on having about 6 months of expenses for your investment property in a savings account that you can easily access.

-

6Carry adequate insurance on the property. Being insured against loss is another way lenders can be reassured that they'll get their money back. You need landlord insurance, which provides increased protection for your rental property.[18]

- Landlord insurance also covers your loss of income if you are unable to rent the property for a period of time. The amount of time covered depends on the policy.

- Your lender may require specific levels of coverage as a condition for approving your loan.

Expert Q&A

-

QuestionHow do I pull equity out of my investment property?

Nathan MillerNathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.

Nathan MillerNathan Miller is an entrepreneur, landlord, and real estate investor. In 2009, he founded Rentec Direct, a cloud-based property management company. Today, Rentec Direct works with over 16,000 landlords and property managers across the United States, helping them manage their rentals efficiently.

Property Management Specialist It’s very similar to accessing it out of a primary residence, but traditional banks aren’t going to lend as high of a percentage of the property value on an investment property — you might get 80% instead of 90%. Traditional loans are the easiest way to pull equity out if you need to.

It’s very similar to accessing it out of a primary residence, but traditional banks aren’t going to lend as high of a percentage of the property value on an investment property — you might get 80% instead of 90%. Traditional loans are the easiest way to pull equity out if you need to.

References

- ↑ https://www.bankrate.com/finance/financial-literacy/when-is-cash-out-refinancing-a-good-option--1.aspx

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://www.bankrate.com/finance/financial-literacy/when-is-cash-out-refinancing-a-good-option--1.aspx

- ↑ https://www.zillow.com/blog/dos-donts-of-home-equity-loans-192836/

- ↑ https://www.zillow.com/mortgage-learning/how-to-get-a-heloc/

- ↑ https://www.zillow.com/mortgage-learning/how-to-get-a-heloc/

- ↑ https://www.zillow.com/mortgage-learning/how-to-get-a-heloc/

- ↑ https://www.zillow.com/mortgage-learning/how-to-get-a-heloc/

- ↑ https://www.zillow.com/mortgage-learning/how-to-get-a-heloc/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://mymortgageinsider.com/cash-out-refinance-investment-property/

- ↑ https://www.lendingtree.com/home/home-equity/heloc/investment-property/

- ↑ https://www.iii.org/article/coverage-for-renting-out-your-home