This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 87,960 times.

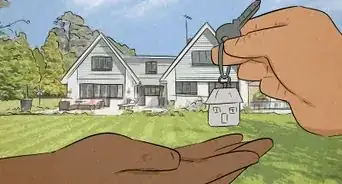

You want to sell or buy land, but you have no idea what is a reasonable price. Unfortunately, the only sure-fire way to determine the land’s value is to sell it on the marketplace. Nevertheless, you can still estimate its value by hiring an experienced appraiser. Alternately, you can try to estimate the value by looking at comparable properties or by asking a real estate agent.

Steps

Obtaining an Appraisal

-

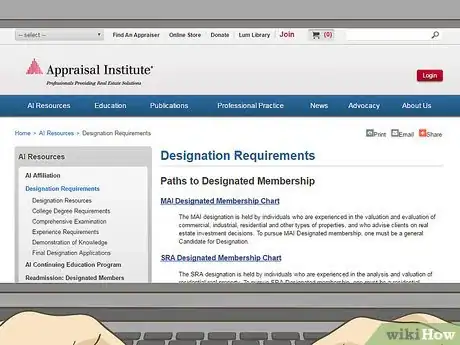

1Find a qualified appraiser. Look online or in the phone book. You can also get a referral from a bank or real estate agent. Check to see if the appraiser has a credential from one of the recognized professional societies, e.g., the MAI designation.[1]

- The appraiser should also have experience appraising property land and not simply homes. Appraising land is quite different from appraising a house.

- If you contact an appraiser and they can’t do the job, ask them to refer you to someone. Briefly describe the land you want valued.

-

2Check the appraiser’s license. Confirm that the appraiser is licensed with your state by asking for their license number. You can then call your state’s Department of Real Estate (or equivalent office) to check that the license is active.

- It is usually possible to check the status of their license online through your local licensing office.

Advertisement -

3Ask about the price for an appraisal. Before hiring the appraiser, get a quote in writing for the appraisal. Don’t be surprised if the cost is more than the cost for appraising a building. Appraisals of vacant lots require more extensive research and familiarity with land records.[2]

- If you don’t like the price quoted, shop around until you find a more affordable option. However, make sure the appraiser has sufficient experience.

-

4Schedule your appraisal. Try to schedule for a time when you will be available. You can answer any questions the appraiser has and possibly ask a few of your own.

- You also need to make sure the right plot of land is appraised. Often, confusion can crop up when an appraiser is looking at open land or a vacant lot. If they identify the wrong parcel, then your appraisal will be worthless.[3]

-

5Gather helpful documents. You can make the appraiser’s job easier by gathering information ahead of time and sharing it with the appraiser. Check if any of the following are available:

- The plot plan or survey, which you can get from the owner or hire a surveyor to create.

- The title report, which you can purchase from a title search company.

- The legal description of the property, which you can get from the County Recorder of Deeds or an equivalent office.

- The most recent tax bill, which you can get from the County Assessor’s office.

- The current listing agreement, if applicable.

-

6Read the appraisal. The appraisal should be well-organized and have information about local land use regulations. It should also explain how the appraiser investigated the current market conditions.[4] If you have any questions, follow up with the appraiser.

Estimating the Value of the Land

-

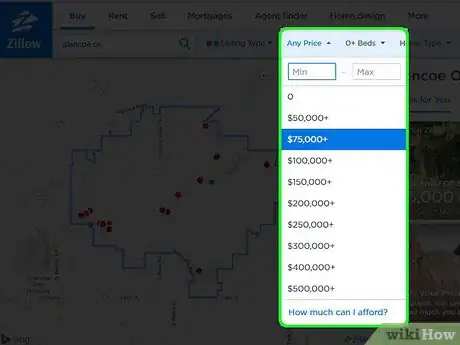

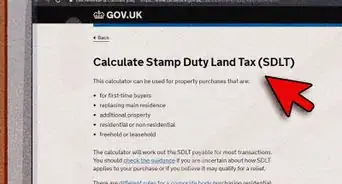

1Find other lots for sale. Search websites such as Zillow or Redfin and see what other lots are currently for sale or have sold in the past 6 months, or 1 year at the most. Remember to check the same geographic area as the property you are interested in appraising.[5] You’ll want to start within a close radius and only move out if you can’t find equivalent properties in that radius.[6]

- If you live in an urban area, limit your search to properties within a 0.5 mile (0.8 km) radius of your property. For suburban properties, use a 1 mile (1.6 km) radius. For rural properties, look within a 5 mile (8 km) radius.

- If you have to look beyond the typical radius for your property type, make sure the reasons are explained in the appraisal report.

-

2Look for comparable lots. You can estimate the value of the lot by finding what others have paid for comparable lots (called “comps”). However, the properties must be similar. After finding comps on Zillow, make sure to drive by the property so that you can see it for yourself. There are many factors involved in determining the value of a lot, so larger lots may not necessarily be worth more than smaller ones. Consider the following:[7]

- Accessibility. Look for lots that have the same road access.

- Size and shape. Check the acreage. The shape also matters because it limits what can be built on the land, if anything. Check for lots with a size difference no greater than 30% from the property you are appraising.

- Topography. Lots that are on a steep slope or have poor soil are worth less since you can’t build on them.

- Location. Is it near amenities such as grocery stores, schools, and hospitals? Also, is it near anything that might decrease its value, such as a pawn shop or public housing?

- Water availability. If you want to build a home on land, you need to know the nearest source of water. If a source of water is too far away, then the land will be much less valuable.[8]

-

3Find out how much comparable land has sold for. You might need to go to the land assessor’s office to find out the price that was paid for a comparable property. If none of your comps have sold, then at least look at the asking price, which should be listed on Zillow.

- In many areas, you can look up the most recent price for which a property was sold on the local assessor’s office website.

-

4Create an estimate based on your comps. You are unlikely to find a property that has recently sold that matches yours exactly. Instead, they will differ in size, location, etc. Nevertheless, this is the best information you have about market conditions.

- If you can’t find a comparable piece of land, then go further back in time to find something similar.[9]

- Adjust your estimate based on the details of the land. For example, you might have found a lot that is a similar size in the same county. However, the lot you want is on a steep incline and doesn’t have a great view. You should estimate that this lot will sell for much less than its comp.

-

5Consider how zoning will impact the value. Local zoning laws can have a huge impact on the value of a piece of land. Land is generally more valuable when you can develop it. However, zoning laws can restrict how the land can be developed.[10] Stop into your local zoning office to check how the parcel has been zoned.

- For example, some land can be developed for commercial purposes or for residential purposes only. Others allow mixed development.

- If your comparable properties allow commercial development, then they might be more valuable. You’ll need to lower your estimate if the land is only zoned for residential development.

-

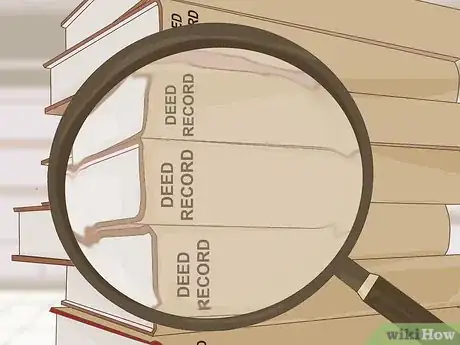

6Adjust the value based on deed restrictions. You should go to the County Recorder’s Office and find the deed for the land. You want to closely analyze the deed to see if there are any of the following, which can lower the value of the property:

- Liens. A lien is a legal right to payment. Someone might have placed a lien on the land if the owner hasn’t paid a debt. In some situations, the lien will stay attached to the property even if you buy it.

- Easements. An easement is a legal right to use the property. For example, a neighbor might have a right-of-way over the property. This can decrease the value of the land.

- Deed restrictions. There may be restrictions placed on how the land can be developed, which are in addition to zoning restrictions.[11] The deed might have a restriction which makes development impractical.

-

7Analyze how desirable the land is. Imagine you are creating your property listing on a website. Take pictures of the land and assess how beautiful it is.[12] Is it simply a vacant lot in a rundown part of town? Or is it a gorgeous wheat field with a view of the river?

- The more desirable the land, the more likely you can get a higher price for it.

- This is a subjective assessment, but it nevertheless is important. If your land is more desirable than your comps, then raise your estimate.

-

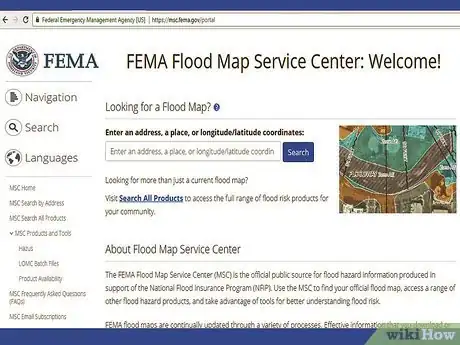

8Check if the land is in a flood zone. Flood insurance costs a lot, so you’ll need to include the costs of flood insurance to the value of the land. Land located in a flood zone is generally less desirable because people won’t want to build on it. Visit the Federal Emergency Management Agency (FEMA) website to check whether the land is in a flood zone: https://msc.fema.gov/portal.

Asking Real Estate Agents

-

1Find two or three agents. You want to talk to people that you can trust. If you don’t know anyone, then ask around. Talk to people who have bought undeveloped land and ask who their real estate agent was.

- Make sure the agents are familiar with the market for undeveloped land. Many agents only sell homes, so they might not have any idea what a vacant lot could be worth.

- You also need to talk to more than one agent. In fact, you should speak to as many as you can, since you will get a much broader perspective that way.[13]

-

2Ask for their opinion. Don’t be nervous. Real estate agents are approached regularly by sellers hoping to figure out how much they can ask for their property. Call up the agents and introduce yourself. Then ask how much you could get for the property if you put it on the market today.

- Say something like, “Let’s say I list this property with you today. What’s the most I can get if I need to sell it in the next 6 months?”[14]

- The agent probably needs to look at the property, so meet them to show them around.

- Your agent should do their homework and look at prices on comparable properties. Don’t go with a ballpark estimate they come up with on the spur of the moment.

-

3Hire the agent if you like them. The real estate agent might impress you with their knowledge and enthusiasm. If so, you should consider hiring them to help you buy or sell undeveloped land.

References

- ↑ https://masswoods.net/sites/masswoods.net/files/pdf-doc-ppt/DeterminingValue_Land.pdf

- ↑ http://www.liability.com/claim-alerts/claimalerts_vacantland.aspx

- ↑ http://www.liability.com/claim-alerts/claimalerts_vacantland.aspx

- ↑ https://masswoods.net/sites/masswoods.net/files/pdf-doc-ppt/DeterminingValue_Land.pdf

- ↑ http://retipster.com/valueofland/

- ↑ http://sacramentoappraisalblog.com/2014/10/30/how-to-pull-comps-like-an-appraiser/

- ↑ http://retipster.com/valueofland/

- ↑ http://www.nytimes.com/2001/09/09/realestate/avoiding-pitfalls-in-buying-raw-land.html

- ↑ http://sacramentoappraisalblog.com/2014/10/30/how-to-pull-comps-like-an-appraiser/

About This Article

If you want to estimate how much your land is worth, there are a few resources that are available to you. The easiest way to find out the value of your land is to hire a qualified appraiser. If you’d rather appraise the land on your own, try searching for similar lots on websites like Zillow or Redfin to see what those are going for. Make sure to look for lots in a close radius to your land, since the location can greatly affect land value. If your lot has any amenities, like easy road access, good soil, access to water, or level ground, these will add on value to the property. You should also consider zoning in determining your land’s value since land that can be developed for commercial purposes usually sells for more than land that can only be used residentially. To learn how to talk to real estate agents about land value, read on!