This article was co-authored by Carla Toebe and by wikiHow staff writer, Jennifer Mueller, JD. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

This article has been viewed 20,325 times.

If you're in the market to buy a home, you've probably dealt with the frustration of expired and outdated listings – especially in a high-demand market. One way to circumvent this frustration is to buy an off-market house directly from the owner. The process may seem daunting, but you can always get help from an attorney or real estate agent. It may require a little extra effort on your part, but it will be worth it if you can find a house you really like.[1]

Steps

Finding a Property

-

1Drive around and look for places you like. Perhaps the easiest way to find an off-market property is to go to a neighborhood where you want to live and look at houses. Write down the addresses of the homes that catch your eye so you can look at them more closely.[2]

- You might also talk to friends and family, particularly if they live near a house you're interested in. Frequently homeowners will talk to their neighbors, and they may have heard someone say something like "I'd sell my home if I was offered the right price, but I don't really want to put it on the market."

- Neighbors also may know if someone nearby was recently talking about wanting to move to a different neighborhood.

-

2Approach the owner and ask if they want to sell. If you want to gauge a homeowner's interest in selling their home, knock on the door and ask if they'd be interested in selling. Most of the time you'll probably be told no, but it doesn't hurt to ask.[3]

- If you want to be more formal about it, send the homeowner a letter. Keep your letter brief, and simply state that you saw their home and are interested in purchasing it.

- You might also let the owner know that you're interested in the neighborhood generally. Even if they aren't willing to sell, they may be able to tell you about a neighbor who they heard was thinking about moving.

Advertisement -

3Track down the owner of a vacant house. If you're interested in a house that is clearly unoccupied, search deeds and property tax records to find the owner. It may take a little extra effort, but owners of abandoned homes typically are more willing to sell the property.[4]

- When you find the owner, send them a polite letter and tell them that you're interested in buying the property.

- Find out how long the house has been unoccupied. Houses that have been vacant for a long time may be more costly to renovate and repair.

-

4Browse auctions and public records. Bank-owned properties and other properties up for auction are still considered "off-market" in the sense that they aren't listed on the major real estate listings services (in the US, the Multiple Listings Service, or MLS). These properties may be distressed, so research carefully before you put in a bid.[5]

- Typically, you can get a better sales price for a house at auction than through other means. However, these houses are typically sold "as is," and may require a lot of work to get them in livable condition.

-

5Get a real estate agent to help you. Many real estate agents know about properties that aren't listed for one reason or another. They may have been previously listed and then taken off the market.[6]

- Real estate agents can also network for you to help you find a property you want. This can be particularly helpful if you want a house in a particular neighborhood. A real estate agent familiar with the neighborhood may know which homeowners are most likely to bite on an offer.

- In the UK and other countries, this real estate professional is called a "property sourcing agent." Their job is to find an off-market property for you that matches your needs, based on the criteria you provide.

-

6Network to find investment properties. If you're looking to invest in real estate, networking with estate attorneys and real estate agents, and other real estate investors is a good way to find off-market properties to buy.[7]

- Builders and contractors also often have inside information on houses and other property for sale. For example, you may be able to get a great deal on a custom home that the builder didn't have the money to finish.

Making an Offer

-

1Get formal appraisals. A professional appraisal can give you an accurate look at the value of the home, as well as any work that you may need to have done. You and the seller may each want to have independent appraisals done.[8]

- If you and the property owner each get appraisals, you can come to a fair price by simply averaging the two figures.

-

2Talk to a real estate agent. A real estate agent will have more information about comparable homes in the area that have recently sold or are currently on the market. The price of these homes can tell you more about the value of an off-market property.[9]

- You may want to save on commissions by not having a real estate agent represent you in the sale as a whole. However, many real estate agents are willing to offer advice on the value of a property for a smaller flat fee, rather than taking a standard commission.

-

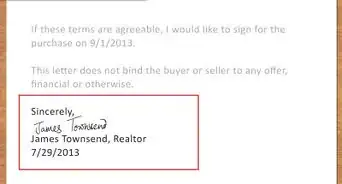

3Draft a letter of intent. A letter of intent is a slightly more official offer that puts the basic terms and conditions of the sale in layperson's terms. It's not a legally binding document, but it is a way to make sure both you and the homeowner are on the same page.

- Letters of intent are more common when neither you or the current homeowner are represented by a real estate agent.

- At this point, either you or the current homeowner can change your mind and walk away from the deal. You can't enforce a letter of intent in court, as you could the more formal purchase and sale agreement.

-

4Get a purchase and sale form. Once you and the homeowner have agreed in principle on the sale and are ready to take the transaction to the next level, draft a purchase and sale agreement for both of you to sign.[10]

- You can find forms to download online, or buy them at office supply stores. Make sure the form you use is legally valid in your state.

- You may want to have a real estate attorney look over your agreement before you sign it, just to make sure everything's been covered.

Closing the Sale

-

1Find a mortgage broker. You'll likely need financing before you can buy the property. Most mortgage brokers are willing to handle the purchase of an off-market property, but you may want to shop around to get the best rates.[11]

- Give the mortgage broker a copy of your purchase and sale agreement so they can evaluate the deal.

- The mortgage broker may want a separate appraisal done on the house, or need additional information before they agree to finance the transaction.

-

2Deposit earnest money. Most property buyers deposit money in an escrow account to show the homeowner that they're serious about buying the house. This money is held by an independent third party (typically a bank or attorney) until closing.[12]

- If you back out of the deal without a contingency, the homeowner may get the earnest money, depending on what's stated in your contract. Any additional money you've placed in escrow (typically up to the amount of the down payment) may be returned to you if the transaction fell through, unless your contract stipulates otherwise.

- If the homeowner happens to back out of the sale, you would get all of your money back, including your earnest money.

-

3Get title insurance. A title insurance company does a title search on the property you want to buy and insures you against any possible defects in the title. This protects you by ensuring that someone else can't appear later and claim the property is theirs.[13]

- Title insurance is especially important if you're dealing with an abandoned property, or a home that has been sitting vacant for a significant period of time.

-

4Complete final inspections. Inspections identify structural repairs as well as other problems that might require maintenance later on. These problems may be structural defects that threaten the safety of the property, or they may be relatively minor issues such as a loose doorknob or a broken cabinet knob.[14]

- Real estate agents typically arrange inspections. If you're not working with a real estate agent, talk to your lender. They may have an inspector they could recommend.

-

5Renegotiate as necessary after inspection. Depending on the outcome of the inspection, you may decide that you want to pay less for the property to account for repairs that need to be made. The homeowner also may agree to complete the needed repairs before closing.[15]

- If the homeowner completes repairs, have the inspector come back and do another inspection to make sure the repairs were done correctly, and no new problems have surfaced.

-

6Sign the closing paperwork. The closing paperwork may include more than 100 pages of documents that need to be signed. Hire an attorney to complete the closing for you to ensure all documents are in order.[16]

- Bring valid identification and citizenship documentation with you to the closing. You'll also need proof of homeowner's insurance.[17]

- Transfer any funds needed for closing, including closing costs, so that they are available.

- Read over your final paperwork before you sign it. Make sure that all credits and debits are listed accurately and as agreed, such as the down payment and earnest money. Double check that the taxes and utilities have been prorated, necessary repairs have been accounted for, and any seller concessions are provided.

- The closing paperwork will also need to be reviewed and approved by your lender.

Warnings

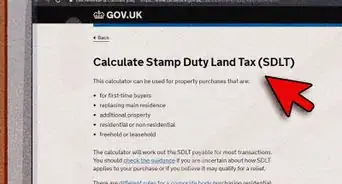

- Closing procedures are based on the process of finalizing a real estate sale in the US, and may differ in other countries. Speak to a property attorney or licensed real estate agent near you.⧼thumbs_response⧽

References

- ↑ https://www.marketwatch.com/story/dear-homeowner-can-i-buy-your-house-2014-03-17

- ↑ https://www.marketwatch.com/story/dear-homeowner-can-i-buy-your-house-2014-03-17

- ↑ https://www.marketwatch.com/story/dear-homeowner-can-i-buy-your-house-2014-03-17

- ↑ http://ypnlounge.blogs.realtor.org/2017/07/05/4-ways-to-find-off-market-deals-for-buyers/

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/should-you-buy-at-an-auction.asp

- ↑ http://ypnlounge.blogs.realtor.org/2017/07/05/4-ways-to-find-off-market-deals-for-buyers/

- ↑ http://ypnlounge.blogs.realtor.org/2017/07/05/4-ways-to-find-off-market-deals-for-buyers/

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/08/fair-price-on-home.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/08/fair-price-on-home.asp

- ↑ https://www.quickenloans.com/blog/buying-sale-owner-property-need-know

- ↑ https://www.quickenloans.com/blog/buying-sale-owner-property-need-know

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.quickenloans.com/blog/buying-sale-owner-property-need-know

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.investopedia.com/articles/mortgages-real-estate/10/closing-home-process.asp

- ↑ https://www.quickenloans.com/blog/buying-sale-owner-property-need-know