This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 39,744 times.

Buying a foreclosed property can allow you to own a quality home for a fraction of its market value. However, while public foreclosure auctions are the most common type of foreclosure sale, they may be too fast-paced for some buyers. If this option isn’t right for you, Government foreclosures (GOV) might be better. GOV foreclosure homes are foreclosed homes owned by government agencies obtained in one of two ways: either the previous owner defaulted on a government loan used to finance the property, or the previous owner failed to pay property or income taxes. This guide will introduce you to the different agencies that may have GOV foreclosures for sale in your area and how to buy these foreclosures.

Steps

Buying HUD Foreclosures

-

1Learn about HUD Foreclosures. Among homes available in HUD foreclosure listings are home foreclosures from the IRS, FDIC and Customs. A common source of HUD foreclosures are when an owner defaults on a loan from the Federal Housing Administration (FHA).

- The process begins when a homeowner with an FHA backed loan defaults on their mortgage. After the home has been foreclosed on, HUD pays off the remaining debt on the homeowner’s FHA loan. Now that the lender has been reimbursed, ownership of the property is transferred to HUD.[1]

-

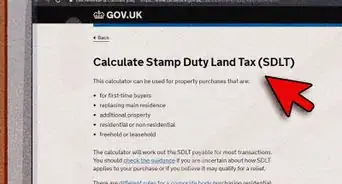

2Find HUD foreclosures. There are a number of ways to find HUD homes near you. First, you can access the HUD homestore at http://www.hudhomestore.com/Home/Index.aspx. This allows you to browse HUD homes by location and using a number of other criteria, like price, number of bathrooms, and number of bedrooms. Once you've located a home, you will have to work with a qualified HUD real estate agent to move forward with the buying process. The agent for the homes you want to look at further should be included on the listing for the home.

- You may also be able to find HUD homes by going to a real estate agent in your area that specializes in HUD homes. Try an online search for this type of agent in your area.

- Finally, HUD homes are generally listed with other homes in newspaper or local magazine listings.[2]

- The HUD Homestore Site lists the real estate brokers who are allowed to sell HUD homes. There is a button to search for an agent there if you do not know of any. Each Realtor must re-certify every year in order to qualify to sell HUD homes and their brokerage must have also become certified. For example, if the brokerage is not certified to sell HUD homes, then no agent or broker in that brokerage will be allowed to sell HUD homes. First the brokerage must qualify, then the individual agents or brokers can become certified.

Advertisement -

3Participate in a HUD auction. The silent auction is the most common way that HUD sells their foreclosed properties. During this time period, HUD approved agents will be accepting sealed bids on the property. First time foreclosure buyers or buyers inexperienced in GOV foreclosures will want to hire HUD-approved real estate agents to make their bids for them.

- For the first part of the bidding process, usually for 30 days, only "owner-occupants" may submit bids for the home. These are people who would live in the home full-time, as opposed to investors or those who plan to "flip" the property for a profit.

- Offers made on the house can be either above or below the listing value, depending on market conditions. Work with your real estate agent to determine a fair offer.

- The HUD will have already had a professional appraisal of the house done. The appraisal can be requested from the HUD so that you often don't have to pay for one to use in financing the house.[3] However, some lenders will still require you to get a separate appraisal report.

-

4Go through the purchase process. During the purchase process, you must secure financing for the house. You cannot close on the sale without proof that you can actually afford the house. You may be able to include the cost of any planned repairs or improvements to the house in your mortgage total. You can find out what repairs are needed by getting a home inspector to look at the property.

- Home inspectors typically do not estimate repair costs. They usually only report the problems. You will need to hire a licensed contractor to prepare a bid to get more accurate pricing of repairs.

- Do not be discouraged if your bid is rejected. If you researched the home and remembered not to bid over your maximum pre-set amount, you’ll know that bidding any higher wouldn’t have been worth it.[4]

- If no competing bids are accepted, HUD will usually set a minimum net offer. You can create a new bid using this minimum net amount, along with costs such as Realtor commissions and HUD concessions. You can possibly negotiate a lower commission with your buying agent, though the listing agent will earn a set 3%. Submit this new bid for a second chance at buying the property.

- You may be able to secure FHA financing for your purchase. These insured mortgage offer you some protection from default.[5]

- You will usually have 30 to 60 days after your bid is accepted to secure and prove your financing and have the home inspected.[6]

- Before bidding, find out what type of loan you will need to buy the property. In some cases, you may need a special rehab loan. A typical contract must specify the loan type and down payment. If this is changed while under contract without the seller's permission, the contract could be held in default of the buyer, so it is best to have the right loan type listed from the beginning. FHA loans have stricter property condition guidelines than other types of loans.

Purchasing a VA Foreclosure

-

1Know where Veterans Affairs (VA) foreclosures come from. These are houses that end up in the Department of Veterans Affairs' (VA’s) possession as a result of the owner defaulting on a VA backed loan. In a VA foreclosure:

- The homeowner defaults on their VA loan. Like in most other real estate foreclosures, the foreclosure process begins when the owner falls behind on their VA loan payments and defaults.

- If the owner fails to pay their default, obtain loan modification, or arrange with the lender to sell their home as a short sale during this time, the lender obtains ownership of the home.

- You do not need to be a veteran to buy a VA foreclosure.[7]

-

2Understand the benefits of VA foreclosures. VA homes will usually sell to the public at 30 to 50 percent off their market value. Keep in mind that a VA home may be in better condition than other foreclosed properties. This is because the VA takes an active part in preparing their foreclosed properties for sale.

- Even non-veterans can be eligible for VA loans, such as the VA Vendee Financing Program, when buying a VA foreclosure.

- VA loans offer a number of benefits. For example, they do not require a down payment, allow closing costs to be financed (included in the mortgage amount), and have no prepayment penalties.[8]

-

3Search for VA properties. The easiest way to find VA foreclosures is through a local real estate agency or in multi-listing system (MLS) listings or online at https://homesales.gov/. Once you have found a listing for a home you want to pursue further, contact the real estate agent on the listing.[9]

- Your Realtor can also set up search criteria in the MLS to automatically send you new listings that contain words like HUD, VA, Fannie Mae, bank, or distressed. This will help you find government foreclosures to buy.

-

4Submit a bid for the VA foreclosure. Work with the real estate agent on the listing to complete the proper paperwork needed to submit an offer for the VA foreclosure. You will be able to view an appraisal for the home and are able to tour the home with the agent. If your bid is accepted you will be able to work out details like financing closing cost and applying for a VA loan before closing the sale.[10]

Getting a USDA-Foreclosed Home

-

1Understand USDA home foreclosures. Even though the United States Department of Agriculture (USDA) is primarily responsible for regulating farms and food safety, they also award families a Rural Development loan. As with other GOV foreclosures, if the homeowner defaults on their loan or taxes, the USDA comes into possession of the home.

- If the homeowner doesn’t pay their back debt or come to another arrangement before a notice of sale is issued, the home goes into foreclosure.

- The homeowner will have a set amount of time prior to a foreclosure sale to pay what they owe, depending on the default terms, type of foreclosure, and state laws. Sometimes the homeowner will have an entire year to get back on track if they are working with their lender. Banks are required to give homeowners information to help them avoid a foreclosure.

- The USDA will pay the overdue balance on the homeowner’s Rural Development mortgage loan in order to obtain official ownership of the foreclosed property.

- Failure to pay certain taxes may also lead to government seizure of the property.[11]

-

2Know the benefits of buying USDA properties. USDA properties are perfect for foreclosure buyers interested in living in or flipping homes in rural communities. USDA homes are particularly ideal for low to moderate income families, exactly the people the USDA approves for loans in their Rural Development plan.

- Buyers of USDA foreclosures may also be able to apply for USDA loans that offer favorable terms and interest rates to borrowers.

- Qualifications for this type of loan depend on your area and include a maximum level of income.[12]

- You can obtain a USDA loan without having a down payment and may be able to get assistance with your down payment.

- However, USDA loans require more paperwork and a higher credit score. The qualifications for approval are also more stringent than with other loans.

-

3Locate USDA foreclosures. The USDA makes the foreclosed properties available for sale to the public. To search for properties, you can check your local listings for USDA foreclosures or visit the USDA's website at https://properties.sc.egov.usda.gov/resales/public/home. This site allows you to search for properties by type (single-family, multi-family, or farm/ranch) and use other criteria to locate properties close to you. Click on the links on the right of that web page to search for homes that meet your needs.[13]

-

4Make an offer for the property. If you have found a property that meets your needs, you will have to work with a USDA-qualified real estate agent to submit an offer. The real estate agent in charge of the property will appear in the listing, along with their contact information.[14] From there, you will have to determine a proper price for the property, make an offer, and, if your offer is accepted, apply for and obtain financing for the home.

- You can find who is certified to sell government properties at the hudhomestore.com website.

Expert Q&A

-

QuestionDo you have to live in the home or can you rent it?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker When purchasing a government owned property, there is a disclosure form that states whether you are an owner occupied or not. Typically owner occupied purchasers will get first chance to purchase the home before investors. If an investor lies on this form to give themselves a better chance, the punishment of falsifying information could lead to severe fines of up to $250,000 and imprisonment up to 2 years. If you are an investor, make sure you list this on your form. Also, investors cannot get FHA loans to buy properties. If you had intended on living in the home but have to leave and want to rent it out, it would be best to consult with an attorney if you have an FHA loan. You may want to consider refinancing to a conventional loan if you want to rent it out, but as long as you are not behind in the mortgage, there will likely be no issues.

When purchasing a government owned property, there is a disclosure form that states whether you are an owner occupied or not. Typically owner occupied purchasers will get first chance to purchase the home before investors. If an investor lies on this form to give themselves a better chance, the punishment of falsifying information could lead to severe fines of up to $250,000 and imprisonment up to 2 years. If you are an investor, make sure you list this on your form. Also, investors cannot get FHA loans to buy properties. If you had intended on living in the home but have to leave and want to rent it out, it would be best to consult with an attorney if you have an FHA loan. You may want to consider refinancing to a conventional loan if you want to rent it out, but as long as you are not behind in the mortgage, there will likely be no issues.

References

- ↑ http://www.fhaforeclosure.com/how-to-buy-fha-va-hud-foreclosures.html

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/

- ↑ http://ushud.com/top-five-mistakes

- ↑ http://ushud.com/top-five-mistakes

- ↑ http://www.fhaforeclosure.com/how-to-buy-fha-va-hud-foreclosures.html

- ↑ http://blog.equifax.com/real-estate/4-tips-for-buying-a-hud-home/

- ↑ http://www.realtytrac.com/real-estate-guides/foreclosure/veterans-affairs-foreclosures/faqs/

- ↑ http://www.realtytrac.com/real-estate-guides/foreclosure/veterans-affairs-foreclosures/

- ↑ http://www.valoans.com/faqs/buying-foreclosed-homes

- ↑ http://www.realtytrac.com/real-estate-guides/foreclosure/veterans-affairs-foreclosures/faqs/

- ↑ http://breenolsontrenton.com/usda-rural-housing-personal-guarantees-will-protected-arizona-anti-deficiency-statute/

- ↑ http://www.advfund.com/LoanPrograms/usda-loans/

- ↑ https://properties.sc.egov.usda.gov/resales/public/home

- ↑ https://properties.sc.egov.usda.gov/resales/public/home