This article was co-authored by Natacha Ciezki. Natacha Ciezki is a US immigration lawyer. She became a member of the Texas Real Estate Commission in 2006 and has a JD in International Law from the Florida Coastal School of Law. She now works as a Senior Legal Advisor for the U.S. Department of State.

This article has been viewed 57,443 times.

The Office of Housing and Urban Development (HUD) offers mortgage assistance to low income and first time buyers. This assistance is called FHA mortgage insurance and ensures that a mortgage will be paid if the buyer defaults on the loan. When an owner forecloses on a mortgage covered by FHA mortgage insurance and HUD acquires the foreclosed residential property, the residential property becomes a HUD home. Finding out how to buy HUD foreclosures can help you get a home at a lower in price than other similar homes in the area.

Steps

Locating a HUD Home

-

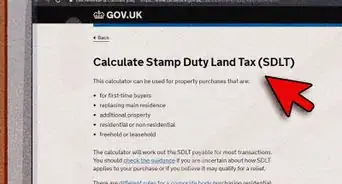

1Figure out how much you can afford and qualify for. Buyers with low debt may be able to afford about 29 percent of their income to go towards housing. Buyers with no debt may be able to afford monthly housing payments up to about 41 percent of their income. Take into account other expenses you may have to make sure you choose an amount that is comfortable. Realtors and realty listing sites usually offer mortgage calculators to determine what the monthly payment will be. These calculations are based on the down payment and interest.

- Keep in mind that online calculators will only give you an approximate value and the monthly taxes and insurance payments are not included in these calculations.

- For more on calculating how much house you can buy, see how to determine how much house you can afford.

-

2Determine what type of home you want. Narrow your home search by deciding on a general location first. Do you want to be in your city? Outside the city? In another location far from you? Then, think about whether you want a free-standing home or townhouse and how large you want it to be. Consider the needs of your family if you have one. Write down any other qualities you want in a home, like an attached garage, fireplaces, or office space. These decisions will help you narrow your search and find a home that meets your needs.[1]Advertisement

-

3Search for a foreclosed home in your area. The easiest way to locate a HUD home is to get in touch with a real estate agent who is licensed to deal with them. These realtors often advertise online or as HUD qualified agents. Additionally, listings for HUD homes are often placed online among regular home listings. The ad should have the name and contact information of the agent included.

- If you check the listing and still don't see any HUD agents, consider calling a local real estate office and asking about HUD listings. If they don't have any, they may be able to refer you to another office that does.[2]

-

4Call the agent on the listing to see the home. The listing agent, or any HUD-qualified agent, will be able to show you the house. Be sure to take photos of the property and take notes about any damages you see or changes you would make. This information can be used when comparing HUD homes or when calculating how much money you will need to borrow.[3]

Planning Your Purchase

-

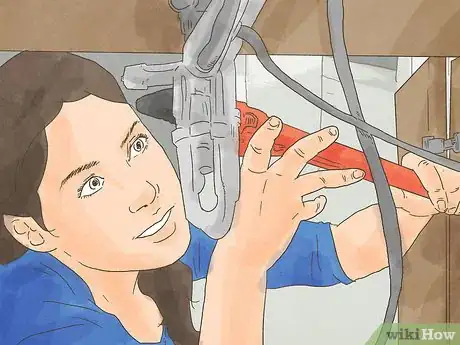

1Have the HUD home inspected. HUD doesn't cover inspection costs or repairs, and no warranty is offered on a foreclosed home. It's important to have the property inspected by a professional to get an accurate estimate of necessary repairs and gauge the true value of the home. FHA inspectors can be found on the HUD website.

-

2Apply for a rehabilitation loan if necessary. For homes that need repair, HUD offers a rehabilitation loan program that covers the cost of repair. This loan, the FHA 203(k) Rehabilitation Loan, combines the costs of the home and the repairs into one, long-term or adjustable mortgage loan. This is simpler than taking out separate loans for each expense.

-

3See if you qualify for special discounts. HUD offers discounted prices to teachers, firefighters, nonprofit groups, police and law enforcement officers, emergency service providers and other groups who seek to buy a home in designated areas (called revitalization areas). See the HUD website for more information on how to buy HUD foreclosures as part of this program.

-

4Consider getting an FHA mortgage insurance. This allows for a smaller down payment, and protects the lender by paying off the mortgage if the buyer defaults. It also combines the insurance premium into the price of the home. Buyers must meet credit requirements and be able to afford the home in question to be considered.[4]

Buying the Home

-

1Make an offer on the home. HUD properties are listed for a set period of time, usually ten days, called the initial listing period. The price is set according to an evaluation of the home's fair market value. During this period, only owner-occupants (those plan to live in the home rather than "flip" or invest in it) are able to bid on the home. After five days, all bids submitted to that point will be compared and the highest bid will be chosen. If no bid is selected, bids are considered each day through the tenth day.

- After this point, investors may make offers on the home. However, in some cases, investors may not be able to make offers until 30 days have passed.

- Offers may be lower or higher than the fair market value, depending on market conditions in the listing area and other factors.[5]

-

2Get a mortgage. Mortgages are not offered by HUD, but must be obtained through a mortgage lender. Mortgage loans are also available through the FHA. In either case, the buyer must meet income and credit standards to prove that they can afford the mortgage payments. In some cases, the buyer might be able to assume the mortgage being paid by the previous owner of the home.[6]

- HUD homes can also be purchased in cash. Just make sure to ask your agent about earnest money and proof of funds letters that may be required in this case.[7]

-

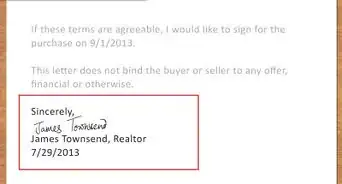

3Prepare to close the sale. If your bid is accepted, your agent will receive further instruction from the HUD on how to proceed. You may have up to sixty days to close on the house, but some houses close in as little as thirty days. Be sure to submit any paperwork requested by the HUD. You will need to submit a pre-qualification letter with the sales contract that specifies:

- Your ability to afford the cost of the home.

- The type of financing you will be using (if any).

- Any assets that have been verified for closing.[8]

-

4Take care of closing costs. In some cases, the HUD will help homebuyers with closing and escrow costs. They may pay up to 3 percent of the closing cost of the home, but this needs to be negotiated in the offer on the home. They will also sometimes pay the escrow fee, which can be between $350 and $900. This depends on the buyer's situation and their ability to afford these fees.

- The HUD may also pay your broker's commission.[9]

Expert Q&A

-

QuestionCan you buy a HUD foreclosure with cash?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Yes, you can buy a HUD foreclosure with cash.

Yes, you can buy a HUD foreclosure with cash.

References

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/

- ↑ http://blog.equifax.com/real-estate/4-tips-for-buying-a-hud-home/

- ↑ http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/ins/sfh203b

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/

- ↑ https://investfourmore.com/2013/03/20/the-investors-guide-to-purchasing-hud-homes/

- ↑ http://blog.equifax.com/real-estate/4-tips-for-buying-a-hud-home/

- ↑ http://www.realtytrac.com/real-estate-guides/how-to-buy-foreclosures/hud-homes/