This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 94% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 223,766 times.

Learn more...

Dubai has become a popular place for foreign investors and expats. In recent years changes to the law have opened up the Dubai property market to foreigners. It is now relatively straightforward to purchase property, provided that you have the finance. Seek expert advice to help you negotiate the local laws and regulations.

Steps

Finding Property

-

1Determine what type of property you are interested in. Foreign buyers often choose to purchase either apartments, townhouses, or villas, which are generally located in secure complexes with communal leisure facilities such as tennis courts, swimming pools and gyms.

- Since 2002, when, by royal decree, foreign nationals first became eligible to own property, Dubai has enjoyed a construction boom.

- Ensure you are looking at an area in which foreigners are allowed to buy property.

- Some of the most popular, luxurious and expensive developments include Emaar Towers, Jumeirah Gardens, International City and Al Hamra Village.[1]

-

2Start searching online. As with any property search, a good place to start is online. There are numerous agencies and estate agents that list properties in Dubai online. You can buy properties from estate agents or from property developers. Estate agents generally sell resale properties, properties that have been built and have previous owners. Developers sell off-plan properties, which may be still under-construction.[2]Advertisement

-

3Contact specialist agents. If you want help with your search, and want to talk to someone with specialist knowledge about the property market in Dubai, it’s best to employ an estate agent to work with. Estate agents can help you find properties and explain your options to you. Big real estate companies will be used to dealing with foreign buyers and will speak English.

- Laws and regulations can change quickly in Dubai, so hiring an agent will help you avoid any potential pitfalls.[3]

- Usually if you hire an Estate Agent, you can expect to pay a fee of between 2% and 5% of the value of the property.[4]

- You should always check the credentials of anybody you hire. The regulatory body for Real Estate in Dubai is the Real Estate Regulatory Agency (RERA).[5]

-

4Attend property fairs. The property market in Dubai is still relatively young, although growing fast. As a result, a significant amount of property bought by foreigners is bought from developers who may not have built the development yet. Property fairs are a popular way for developers to present their work and meet potential buyers. These property fairs are held all over the world, so look for one visiting a city near you.

- You should always check that the developer you are considering is registered and licensed with the RERA.[6]

- You can browse a list of licensed developers on the Dubai Land Department website

-

5Visit Dubai. Before you think about making a move for a property be sure that you have spent a little time in Dubai. If you are buying a resale property ensure that you view as many properties as you can, and ask the same questions you would ask if you were buying property anywhere else in the world.

- If you are buying off-plan or construction is not complete, make sure you go to see similar properties by the same developer that are finished.[7]

- When you are in Dubai, you will also have access to paper listings in specialist local newspapers and magazines, and be able to attend the property fairs that continue all year.

Meeting Eligibility

-

1Have the required ID and visa documents. Since a change to the law in 2002, it has become much more straightforward for foreigners to buy and rent property in Dubai. You will, however, still need to present a valid passport to prove your identity. You are not required to hold any type of residency permit in order to buy property, but assuming you want to stay there you will have to take care of this.[8]

- The UEA government has a six month visa for property buyers, called the “Property Holders Visa.”

- This allows foreign investors to stay in Dubai for six months while they investigate investments.

- To qualify for this, the property you buy must have a value greater than 1 million dirham, which equates to around $272,000.

- You must be buying as an individual, not as a company.[9]

-

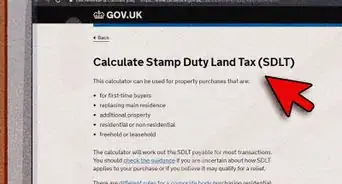

2Determine the full costs. You need to be certain that you can afford the property and meet all of the costs attached to the purchase. When you are determining the overall cost of the property you should include the purchase price, the deposit, transfer fees, estate agent fees and the potential for currency exchange rates to fluctuate.

- It is not legally necessary, but it is advisable to employ a lawyer to help you negotiate all the paperwork.

- Include the costs of a lawyer in your calculations.[10]

- A new-build property will likely require a land registration fee of around 2%.

-

3Get a mortgage in Dubai. Mortgages can be difficult to obtain in Dubai. Non-status/self-certification mortgages are not available and the amount of red tape and paperwork involved can be off-putting to those accustomed to a less rigorous system. In some cases, buyers may be required to put down between 20% and 50% of the value of the mortgage in cash.

- Mortgages in Dubai are paid in monthly instalments, with 15 years mortgages the most common. Residents of India cannot mortgage their property in Dubai and raise loans. Indian residents are also not permitted to give guarantee to the loan from a non resident.

- The maximum length of a Dubai mortgage plan is 25 years.

- Mortgage repayments, combined with any other monthly expenses, must not exceed 35% of net monthly income.

- As exchange control is a complex subject, it is advisable to obtain appropriate professional advice before deciding to take out a mortgage in a foreign currency.[11]

- Mortgage rules change often in Dubai, so try to keep up-to-date by consulting local news and the Central Bank of the UEA.

Buying “Off-Plan” Property

-

1Submit a reservation form. If you are buying property off-plan, the first step once you have decided on the property you want and secured all the financing, is to submit a completed reservation form. This form will summarise the basic terms and conditions of the sales agreement, including information on the payment plan, and personal information from all parties.[12]

- You will be required to submit your passport along with the reservation form.

- Be aware that some developers are still selling leasehold rather than freehold titles. If this is the case, the title is valid for the period stipulated in the lease agreement.

- Ensure you fully understand the details of the contract and have it checked by your lawyer.

- If the property is not yet complete, make sure you know what responsibilities the developer has if it is delayed for any reason.[13]

-

2Pay the reservation deposit. Once the reservation document has been agreed you will have to pay the reservation deposit. The amount will be stipulated in your reservation form, but it will typically be between 5% and 15% of the purchase price. Developers will often not draw up the official sales and purchase agreement until this deposit has been paid, and will sometimes charge up to 20% or more.[14]

- When buying off-plan, you should ensure that the deposits and payments you make are paid into a RERA-approved securities account.

- These payments are then transferred to the developer as the construction work is completed.[15]

-

3Complete a formal sales and purchase agreement. The formal and legally binding contract is the sales and purchase agreement. Make sure this documents the date by which the property should be completed, and what penalties the developer will incur if it is delayed. Have a lawyer look over the contract with you, and check all the details, terms and conditions.

- If the property is supposed to be furnished, ensure that a date for when that will be done is included in the agreement.[16]

-

4Transfer the deeds. To complete the purchase you must transfer the deeds. This is the point at which you will be required to pay 100% of the purchase price. The deeds will not be transferred, and you will not own the property until you have paid, so you must have financing in place.

- If the property has been completed, the transfer will happen at the Land Department Offices.

- If it is yet to be finished, you will transfer the deeds at the developer’s office.

- You will then generally be invited to inspect the property and highlight any final issues the develop needs to take care of.[17]

Buying “Resale” Property

-

1Make a Memorandum of Understanding. To purchase resale property in Dubai you must agree terms with the seller, and record this in a Memorandum of Understanding (MOU). This is a basic document that outlines the terms and conditions, including the date of the final purchase. It is not legally binding, but is a necessary first step to buying resale property.[18]

-

2Pay the initial deposit. Once the MOU is signed, the purchaser will have to pay the deposit, typically around 10% of the purchase price.[19] This deposit is normally non-refundable, unless there is a particular reason why the seller is unable to bring the transaction forward.

- At this point you will also have to pay the real estate commission, normally between 2% and 5%.

-

3Obtain the deeds. Once you have an agreement and financing in place, you can move on and complete the purchase. As an expat you will be required to pay 100% of the purchase price before the deeds are transferred, just as if you were buying an off-plan development. To do this, you may need to attend an appointment at the Land Department and present all the paperwork.

- The buyer, the real estate agent, and a somebody from the bank that is financing the purchase may all be required to attend the meeting at the Land Department.[20]

Community Q&A

-

QuestionCan I buy a house in Dubai if I am from Pakistan?

Community AnswerYes, as of 2002, foreigners, including Pakistanis, are allowed to buy and sell property in Dubai.

Community AnswerYes, as of 2002, foreigners, including Pakistanis, are allowed to buy and sell property in Dubai. -

QuestionCan I buy an apartment in Dubai if I only have a tourism visa?

Community AnswerYes, but there are a few conditions, depending on the type of property for which you are looking. Contact a buyer's agent.

Community AnswerYes, but there are a few conditions, depending on the type of property for which you are looking. Contact a buyer's agent. -

QuestionCan UK residents buy a home in Dubai?

Community AnswerYes. All you need is proof of identity and a passport with overseas visa card.

Community AnswerYes. All you need is proof of identity and a passport with overseas visa card.

Warnings

- You should always seek professional assistance when buying property.⧼thumbs_response⧽

References

- ↑ https://www.justlanded.com/english/Dubai/Dubai-Guide/Property/Finding-property

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ https://www.justlanded.com/english/Dubai/Dubai-Guide/Property/Purchase-process

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ https://www.gov.uk/guidance/how-to-buy-property-in-the-uae

- ↑ https://www.gov.uk/guidance/how-to-buy-property-in-the-uae

- ↑ https://www.justlanded.com/english/Dubai/Dubai-Guide/Property/Finding-property

- ↑ http://www.knightfrank.ae/residential-property/buying/dubai/dubai-guide

- ↑ https://www.gov.uk/guidance/how-to-buy-property-in-the-uae#visa-requirements-for-buying-a-property-in-the-uae

- ↑ https://www.gov.uk/guidance/how-to-buy-property-in-the-uae#visa-requirements-for-buying-a-property-in-the-uae

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ https://www.gov.uk/guidance/how-to-buy-property-in-the-uae#visa-requirements-for-buying-a-property-in-the-uae

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ https://www.justlanded.com/english/Dubai/Dubai-Guide/Property/Purchase-process

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ http://www.expatarrivals.com/dubai/buying-property-in-dubai

- ↑ http://www.knightfrank.ae/residential-property/buying/dubai/dubai-guide

- ↑ http://www.dubai.ae/mobile/en/Pages/SubLifeEvent.aspx?App=false&SubLifeEventID=61&IndLifeEvent=Buying+and+selling+land+and+property+in+Dubai&Category=2

About This Article

If you want to buy property in Dubai, but you live in another country, you will need to obtain a passport from your country. If you’re planning to purchase a property that’s at least 1 million dirham, or about $272,000 USD, you want to stay in Dubai while you look for properties, you will also need a “Property Holders Visa” from the UEA government. When you’re calculating your total cost for the property, be sure to include the purchase price, the deposit, transfer fees, estate agent fees, and currency exchange rates. For tips on finding properties to buy, read on!