This article was co-authored by Marcus Raiyat. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 18 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 53,125 times.

Assets are investments that will earn money over time. Anything that you buy that rises in value can be considered an asset. That said, assets most commonly refer to financial investments in stocks, bonds, or commodities. Each asset has its own risks and potential. It is often a good idea to buy different types of assets to maximize your investment.

Steps

Deciding What Type of Assets to Buy

-

1Purchase stocks for potentially high yields and easy liquidation. Stocks are easy to buy. They are also easy to liquidate, which means that you can convert them into cash easily compared to other assets. That said, stocks have much higher risk attached to them since their value can fluctuate based on the company and the stock market.[1]

- Look for stocks with a high dividend yield.

-

2Invest in bonds for a low-risk and low-yield investment. A bond is like loaning money to a company or government. The company will pay you interest on the debt. When the bond matures, you will get your principal or original investment back. This “maturation date” may be anywhere from 2 to 30 years. Bonds carry fewer risks than other types of investment, but you may not get as much of a return.[2]

- Choose bonds with a high dividend yield.

- There are a few risks to buying bonds, but they tend to be small. For example, if the company shuts down, you may not receive your principal back. Alternatively, a better interest rate might come once you have bought the bond.

Advertisement -

3Invest in commodities for potentially large yields with high risk. Commodities are resources that you can physically buy and sell. They include gold, oil, cattle, and other major products. The prices of commodities are very volatile, but they can be very profitable.[3]

- Commodity trading can be very complex. It is generally only recommended for people with established investment portfolios.

-

4Buy items and property that will gain in value over time. Art, stamps, antiques, and other products often rise in value over time. If you sell them, you may make some money. These are considered alternative assets. They are not very liquid, so it is harder to convert them to cash.[4]

- If you know much about art, you may be able to purchase some valuable pieces from known artists. These will likely increase in value over time.

- Real estate is often considered to be an alternative asset. This requires a high principal to start.

- Rare stamps and coins are a highly specialized type of asset. It may take a long time to find a buyer. That said, these popular collectibles can fetch high prices.

-

5Consult a financial planner for personalized assistance. A financial planner can evaluate your current finances to help you create a portfolio of assets. They can help you plan and achieve long-term investing goals. A good financial planner is one who will sit and talk with you about your needs, goals, and questions.[5]

- Look for a Certified Financial Planner (CFP). These consultants have passed a rigorous exam that proves they are an expert. You can find one at a bank or investment firm.

- Tell your financial planner if you have a specific goal that you want to save for, such as retirement or buying a house.

Buying Stocks

-

1Find a stock broker to open a brokerage account. The broker will buy and sell the stocks for you based on orders that you give them. You can find brokers at banks, brokerage firms, and investment firms. There are even online brokers that you can use.[6]

- Some brokers may charge a minimum. This means that you must invest a certain amount of money with them.

- Check the commissions that your broker charges on each transaction. These usually range from $5-10.

- Try to avoid a broker who will charge you inactivity fees if you don’t put in an order.

- If you're investing in stocks, make sure they pay a dividend, whether that's quarterly, monthly, semi-annually, or annually.

-

2Pick which stocks you want to buy. Research the companies carefully before you buy their stock. Instead of buying popular or quickly rising stock, look for stable, profitable companies who have a long history of managing their shares well.[7]

- If you’re interested in buying stock from a company, read their annual report to see how well they are currently doing in the market. This will help you learn if they are a good choice or not.

- If you buy international stocks, you'll pay additional costs like exchange fees that you wouldn't have if you buy domestic stocks. Also, make sure you research the economy and the company in the country you're buying stocks in.

-

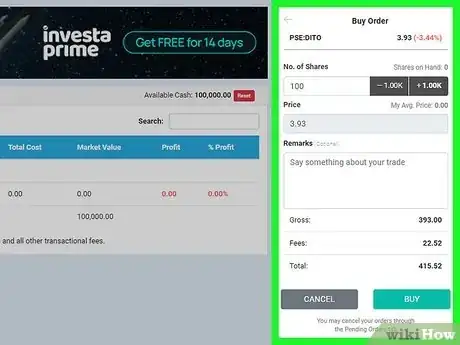

3Put in an order with your broker. The 2 most common types of orders are a market order and a limit order. A market order states that you want to buy a stock right away at whatever price it is currently at. A limit order tells the broker not to buy the stock until it reaches a certain price.[8]

- For example, if you put in a market order for 10 shares of stock, the broker will buy those stocks immediately.

- If you put in a limit order of 10 stocks at $50, the broker will wait until the stock costs $50 or less before buying those stocks.

-

4Buy just a few shares to begin with. When you first buy stock, start small. Buy a few shares and start watching the markets. How many shares you buy depends on what you can afford, but it is good to start with between 1 and 10. As you watch the markets, you may feel comfortable buying more.[9]

- Buying only a few shares will minimize your losses if you make a mistake at the beginning.

-

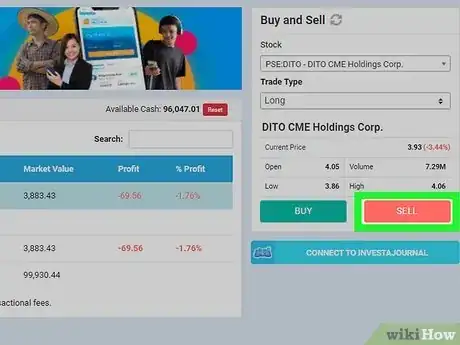

5Tell your broker when you are ready to sell. If you are using an online broker, there should a “sell” button on your online portfolio. Usually, investors do not sell their stocks until at least a few months after they bought them, but you can hold onto your stocks for as long or short as you like.[10]

Purchasing Bonds

-

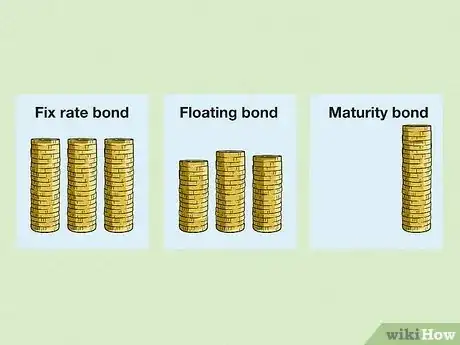

1Pick what type of bond you want to buy. There are 3 types of bonds that you can buy from issuers. These are fixed rate bonds, floating bonds, or payable at maturity bonds. Each one has a different payment schedule and interest rate.[11]

- Fixed rate bonds will earn money based on an interest rate set when you bought the bond. You will receive payments once or twice a year from the interest that the issuer owes you. You will receive the face value (or original value of the bond) back when the bond matures.

- Floating bonds will also pay out once or twice a year, but the issuer can change the interest rate based on the current market. This could benefit you if the interest rates go up but not if rates fall. You will receive the face value back when the bond matures.

- Bonds that are payable at maturity will not pay anything until the bond matures. Once it does, you will receive the face value and any accumulated interest. These bonds are often cheaper to buy, but it takes longer to get your investment back.

- Different from stocks, bonds typically pay a yield that comes as income that cannot be reinvested into the fund or the bond.

-

2Check the bond rating to see how risky the bond is. Higher ratings mean that the bond is lower risk. Triple A (AAA) rating is the highest. Bonds with a rating of BB or below are very risky. When you buy the bond, you should be told what the bond rating is.[12]

- There are 3 agencies that rate bonds. These are Moody’s Investors Service, Standard & Poor’s Corporation, and Fitch Ratings. You can visit their websites and look up the company to find the rating.

-

3Buy low risk, fixed-rate bonds directly from the government. Treasury bonds are fixed rate bonds that pay out every 6 months. They mature in 30 years. To buy treasury bonds, go to https://treasurydirect.gov/. Create an account. Once a month (usually around the 15th), the government releases more bonds. You can then buy the bonds through the website.[13]

- The schedule of bond releases can be found here: https://www.treasurydirect.gov/instit/annceresult/annceresult.htm.

-

4Hire a broker to buy corporate or municipal bonds. You cannot buy bonds from companies or towns directly. You must have a broker. You can find a broker online or at a local bank, brokerage firm, or investment firm.[14]

- Brokers will charge a percentage of the cost of the bond as a fee.

- Some brokers may require you to spend a certain amount of money on bonds to hire them.

-

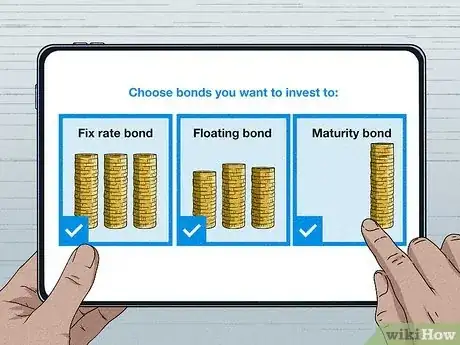

5Diversify the bonds that you buy. If you want to invest in bonds, it is a good idea to buy different types of bonds. Get many bonds with different interest rates, maturation dates, and face values. You may even get bonds with different levels of risk. The safer bonds will protect you against the riskier investments.[15]

- It is a good idea not to have all of your bonds mature at the same time. For example, you might have a 2-year bond, a 10-year bond, and a 20-year bond.

Investing in Commodities

-

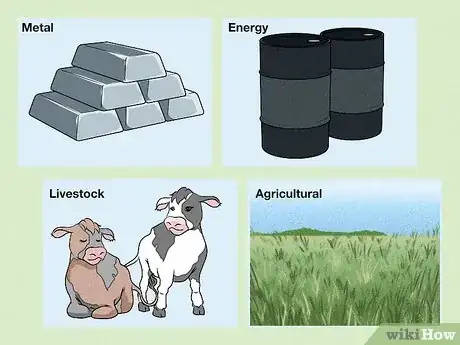

1Choose which type of commodity you want to buy. There are 4 types of commodities that you can buy. These are metals, energy, livestock, and agricultural products.[16]

- Metals are traditionally considered to be a safe investment, especially during regressions and volatile markets. Metals include gold, silver, aluminum, copper, and platinum.

- Energy can be very profitable, but there are many political and economic factors that can affect its potential return. Energy includes oil and natural gas.

- Livestock and agricultural products are easy to buy and sell. Population growth might increase the value of agricultural products, but these investments suffer during the summer months or after natural disasters.

-

2Purchase the physical commodity if you have storage for it. Metal is the easiest for investors to buy physically, as you can keep coins, jewelry, and bars in a bank or home safe. If you have a farm, livestock or agricultural products may be another physical asset that you can buy and store.[17]

- Energy tends to be something you cannot buy physically.

-

3Buy shares in companies if you can't store the commodity. The easiest way to invest commodities is to buy stock in companies that produce commodities. You will need to hire a broker if you would like to invest. Put in an order for shares of a company's stock.[18]

- For example, if you want to invest in natural gas, you might put in an order to buy shares in Petrohawk Energy Corporation (HK), Stone Energy Corporation (SGY), or SandRidge Energy (SD). These firms all specialize in natural gas.[19]

-

4Invest in an exchange-traded fund (ETF). An ETF is a fund that specializes in a type of investment. ETFs tend to specialize in one commodity, such as oil or metal. The ETF will buy a wide range of shares from different companies in the industry. An ETF is useful because it will diversify your investment for you. That said, they are as risky as the stock market is.[20]

- To invest in an ETF, visit a stockbroker. You can also use online brokers. Put in an order for ETF shares the same way you would for stock.[21]

References

- ↑ https://www.investopedia.com/articles/basics/08/stocks-bonds-performance.asp

- ↑ https://www.marketwatch.com/story/how-to-buy-bonds-2016-07-24

- ↑ http://www.nasdaq.com/article/should-i-invest-in-commodities-cm329839

- ↑ https://www.investopedia.com/terms/a/assetclasses.asp

- ↑ http://guides.wsj.com/personal-finance/managing-your-money/how-to-choose-a-financial-planner/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.fool.com/investing/general/2015/06/21/how-to-buy-a-stock-for-the-first-time.aspx

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-buy-a-stock/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-buy-stocks/

- ↑ https://www.investopedia.com/university/simulator/selling-stocks.asp

- ↑ http://www.projectinvested.com/markets-explained/bond-basics/#topic-what-factors-should-you-consider-when-investing-in-bonds-part-1

- ↑ https://www.investopedia.com/financial-edge/0612/how-to-invest-in-corporate-bonds.aspx

- ↑ https://www.treasurydirect.gov/indiv/products/prod_tbonds_glance.htm

- ↑ https://www.investopedia.com/financial-edge/0612/how-to-invest-in-corporate-bonds.aspx

- ↑ https://www.marketwatch.com/story/how-to-buy-bonds-2016-07-24

- ↑ https://www.investopedia.com/investing/commodities-trading-overview/

- ↑ http://www.moneyobserver.com/how-to-invest/how-to-invest-commodities-beginners-guide

- ↑ http://www.moneyobserver.com/how-to-invest/how-to-invest-commodities-beginners-guide

- ↑ http://commodityhq.com/commodity/energy/natural-gas/#stocks

- ↑ http://www.nasdaq.com/article/should-i-invest-in-commodities-cm329839

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-choose-an-exchange-traded-fund-etf/