This article was co-authored by Clinton M. Sandvick, JD, PhD and by wikiHow staff writer, Jennifer Mueller, JD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 161,791 times.

If you've thought about buying a house as an investment property, you've probably heard that you can get a good deal on a probate property. The reality is that you can, but you have to be willing to take on a lot of risk for that to happen. If you want a quick and easy transaction, buying a probate property is probably not the way to go. But if you have the resources at your disposal and are willing to be patient, you could definitely find a good deal.[1] Read on to learn everything you need to know about buying a house in probate, from finding the house all the way to closing.

Steps

Finding Probate Properties

-

1Call local real estate agents who specialize in probate sales. Probate sales are a bit of a niche in real estate so there aren't a lot of agents who take them. Search listings on any real estate website for local probate properties and take note of the names of the agents. Then, call them up and tell them you're in the market for a probate property.[2]

- If you get your contact information to an agent, they'll let you know when they have new properties that are about to go on the market. You might have a better chance at a good deal if you can be the first to make an offer.

- You might also want to hire an agent to represent you. Probate courts don't require it, but having someone with experience on your side can help the process go a little more smoothly.

-

2Search online listings for probate sales. Since probate homes for sale are marketed just like any other home, you can find them on real estate sites, such as Zillow or Redfin. Include the word "probate" in your search to narrow your returns to homes that include that word in the listing.[3]

- When you look for homes this way, pay attention to the date they were listed. Homes that were listed more recently are less likely to already have offers.

Advertisement -

3Check the probate court's website. Search "probate court" with the name of the county to find your local probate court's website. Probate property auctions are open to the public—upcoming auctions will usually be listed on the website.[4]

- The homes listed on the website are likely being auctioned off very soon—potentially within the week. This doesn't give you a lot of time to research the property before you put a bid in on it, so be careful.

- The court might also post public notices about probate sales in local newspapers or on bulletin boards at the courthouse itself.[5]

-

4Do walkthroughs of properties you're interested in. Ask the agent who listed the property if you can do a walkthrough. Look for repairs that you'd need to make as well as any updating or remodeling you'd want to do. This gives you an idea of how much money you'll need to sink into the home after you buy it so you can set your budget for your offer.

- Sometimes walkthroughs aren't allowed for probate properties. If you can't get a walkthrough, ask for plenty of pictures of the inside and outside of the house. You can use those to look for problems as well.[6]

- Most properties have been appraised, so ask if you can look at the appraisal.[7] If you're applying for financing, keep in mind that most lenders won't cover more than the appraised value of the home.

- This is a long shot, since sometimes you can't even get a walkthrough, but you might also try to bring an inspector along. Their take on the property can help lower some of the risks you face buying the house "as is" with no contingencies or conditions on the sale.

Bidding on Probate Properties

-

1Make an offer to the estate representative. If you've done your due diligence on the property and you're convinced you want it, submit your written offer to the estate representative. If you've hired a real estate agent to work with you on this, they'll submit the offer for you.[8]

- If the estate representative accepts your offer, they'll file a petition with the court to approve the sale. The hearing will typically be set 30-45 days after the petition is filed.

- Even if the estate representative turns down your offer, you still might be able to buy the property. Watch the probate court website to see when the hearing is scheduled, and you can go and place a bid.

-

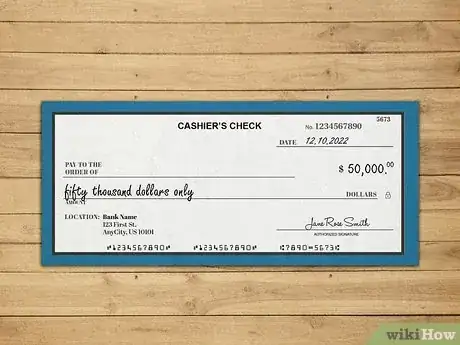

2Pay a 10% cash deposit on the property. This is one thing that sets probate sales apart from traditional real estate sales. You're expected to immediately put down a nonrefundable deposit if your offer is accepted. Get a cashier's check for 10% of the amount you offered and have it ready.[9]

- You might also enter into a contract with the estate representative to purchase the property at this time. But keep in mind that even if you have a contract, the probate judge will still have to approve the sale, and other people will still be able to bid on the property.[10]

-

3Attend the probate court hearing disposing of the property. An accepted offer doesn't mean the house is yours—at least not yet. The probate judge still has to approve the sale. On top of that, anyone else who's interested in the property can come to the hearing and try to outbid you.[11]

- This is called the "overbid" process, and it typically proceeds like an auction, with the judge raising the price for the property incrementally until there's only one buyer left standing.

- Even if you didn't make an offer to the estate representative (or if you made an offer but it wasn't accepted), you can still attend the hearing and bid on the property.

- If you don't have a currently accepted offer, you might need to file a petition with the probate court to participate in the overbid process. Contact the clerk of the probate court—they'll have a form you can use if this is required.[12]

-

4Outbid any other buyers at the hearing. If there are any other people at the hearing who are interested in buying the property, the judge will start the bidding at a set amount higher than the current offer. If you or another person calls that price, the judge raises the price again, and so on until a single buyer remains.[13]

- Judges raise the price of the property by specific increments set by probate law. Sometimes it's simple, such as raising the price by increments of $5,000 with each round of bidding, but some probate laws call for more complicated formulas.

- To win a round, you have to match the price called by the judge. You can't simply raise the previous price by a different amount and win, like you might in an open auction setting.

- If you're outbid, you will get back any deposit you've made. This is usually the only way you're going to get that money back. So if you've changed your mind and don't want the house anymore, cross your fingers that someone else shows up at the hearing to overbid.

Finalizing Your Purchase of Probate Property

-

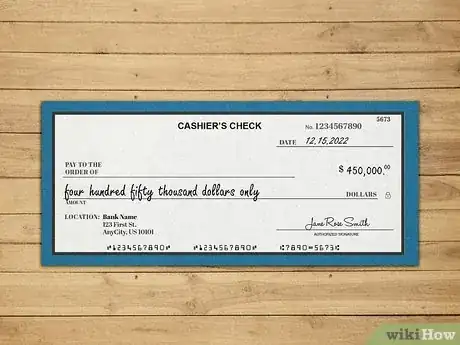

1Provide a cashier's check for any remaining deposit due. Once the dust has cleared on the overbid process, you might end up with a higher price than your initial offer. Most courts expect you to immediately provide a cashier's check for the difference so that your total deposit is 10% of the full purchase price.[14]

- The judge will tell you exactly how much you owe, and probably give you some time to go to the bank if you need to get a cashier's check to finalize everything.

-

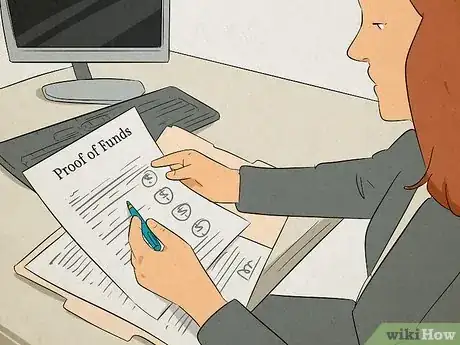

2Show proof of funds to the court if required. Some probate courts require you to show that you can pay the purchase price of the home in full before you'll be allowed to sign a sales contract. If you have cash for the full price, you're good to go. Otherwise, you'll need to get your financing in place.[15]

- If your mortgage lender backs out and you can't find other financing, the deal will fall through and you'll lose your deposit. This is why it's so important to make sure you have funds in place before you start bidding on a property.

-

3Sign a sales contract with the estate representative. The estate representative will typically have a contract already drawn up, or one may be provided by the judge. You'll sign the contract before you leave the courthouse, although technically, the house still isn't yours.[16]

- The contract sets the terms in place so that the judge can approve the sale. But even after the judge approves the sale, it remains subject to regular probate proceedings, which can drag on for quite some time depending on the size and complexity of the estate.

-

4Close on the house after the court's waiting period has elapsed. The process for closing on a probate property is the same as any regular real estate deal, but you do have to wait for it. The house is yours—you don't have to worry about anyone else bidding on it at this point—but you still can't close on it right away. The length of the waiting period varies, but it will usually be at least 30 days.[17]

- Expect the entire process to take a minimum of 6 to 12 months—although it often takes even longer.

Expert Q&A

Did you know you can get premium answers for this article?

Unlock premium answers by supporting wikiHow

-

QuestionCan a probate property be purchased as a 'lease/purchase' where the seller holds the mortgage?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage You can participate in a lease purchase with a property in probate, but there is more risk to you if the owner that leases to you turns out to either not be the owner, or has excessive liens filed after probate. Remember, in a lease purchase you must secure your own mortgage when you execute the purchase option.

You can participate in a lease purchase with a property in probate, but there is more risk to you if the owner that leases to you turns out to either not be the owner, or has excessive liens filed after probate. Remember, in a lease purchase you must secure your own mortgage when you execute the purchase option.

Warnings

- This article is about buying probate properties in the US. The process might be different in other countries. Contact a local attorney or real estate agent for more information.⧼thumbs_response⧽

- Bid on properties at your own risk. Probate properties are always sold as is with no contingencies. If you back out of the deal, you'll lose any deposit you've already put down on the property.⧼thumbs_response⧽

- If you can't secure financing for the remaining purchase price of the property, you will lose the 10% deposit you've placed.⧼thumbs_response⧽

References

- ↑ https://www.realtor.com/advice/buy/what-is-a-probate-sale/

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.marincounty.org/depts/df/divisions/public-administrator/real-property-probate-sale

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=PROB&division=7.&title=&part=5.&chapter=18.&article=6.

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.sandiegocounty.gov/content/sdc/hhsa/programs/papg/real-estate.html

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.realtor.com/advice/buy/what-is-a-probate-sale/

- ↑ https://www.clarkcountynv.gov/government/elected_officials/county_public_adminstrator/information_on_real_estate_bidding.php

- ↑ https://www.realtor.com/advice/buy/what-is-a-probate-sale/

- ↑ https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=PROB&division=7.&title=&part=5.&chapter=18.&article=6.

- ↑ https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=PROB&division=7.&title=&part=5.&chapter=18.&article=6.

- ↑ https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=PROB&division=7.&title=&part=5.&chapter=18.&article=6.

- ↑ https://www.floridarealtors.org/news-media/news-articles/2020/10/probate-real-estate-what-you-need-know

- ↑ https://www.floridarealtors.org/news-media/news-articles/2020/10/probate-real-estate-what-you-need-know

About This Article

Probate properties are owned by the estate of a deceased homeowner and are frequently sold below market value. If you’re interested in buying a probate property, the process could take 6 months to several years, so plan accordingly. To find probate properties, contact local real estate agents or your local probate court. You can make an offer at any point, but you’ll need to give a 10 percent deposit of the offer price at that time. If the seller accepts your offer, the attorney for the estate will have to apply for a court date to confirm the sale. To confirm the sale, you’ll need to attend the court hearing. To learn how to outbid other buyers on a probate property, keep reading!