This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 74,143 times.

Investing in preconstruction real estate can prove to be worthwhile. It enables you to buy real estate at a fraction of the cost of a completed property. In some areas, real estate will appreciate in value before the project is even complete. This is why this type of investment is ideal for property investors and farm owners. In addition, preconstruction real estate enables future homeowners to get a deal on property that you would like to one day live in. However, it can take several years, or even decades, for the construction project to be completed. While this may be a wise investment for those with long term stability, it isn’t recommended for those expecting to make a quick profit.

Steps

Laying the Groundwork

-

1Compare different types of properties. When it comes to investing in preconstruction real estate, you have a variety of options. For one, properties might be undeveloped, "raw" land without any planning or improvements performed by the current owner. However, develop-owned properties may be zoned or fully planned, with utilities and/or streets already in place. In addition, further properties might be already slated for construction, with existing plans for the buildings that will be constructed there. In general, less-developed land will be cheaper. However, this means that you'll have to organize utilities and work out zoning laws on your own as you develop the property.

- Buying raw land will also require a large amount of due-diligence to make sure the land is surveyed properly, free of criminal activity (like drug growers or poaching), and to work out local regulations governing land use.[1]

- Developers generally purchase large land sites for development. In most cases, the project is developed with streets and utilities, the sold to individual builders who then construct houses for sale or rent to home buyers or renters.

- As each stage of development is completed, the cost of the property generally increases.

-

2Understand why builders sell preconstruction real estate. If the profits are so much better after construction, why sell earlier? Any time you buy something, it is a good idea to know why it is for sale. The reasons are often straightforward, but you want to make sure the builder isn’t concealing a fact about the property they discovered after breaking ground.

- Builders sometimes need the money to complete their project on time. Selling preconstruction real estate gets them quick cash without having to worry about their credit or accruing interest on a loan.

- Other times, they may need to have outside investors like you to get approved for a loan.

Advertisement -

3Know your competition. If you are interested in investing in a hot property in an up-and-coming neighborhood, this may not be as inexpensive as you thought. Why? Investors and 'flippers' who have been doing this to make extra money for years monitor housing markets for the most profitable preconstruction projects. However, on the bright side, competition from seasoned investors may indicate that the project is worthwhile.[2]

- The competition will depend upon the size of a development and its use.

- For example, commercial developments for offices, apartments, and retail sites can be very expensive when compared to a single, undeveloped residential lot.

-

4Understand today's housing market. The 2008 market crash burst every area of the housing bubble, including preconstruction real estate. As a result, builders are much more cautious about projects. While investors may get terms on large purchases, most sellers of single lots in a residential development require full payment.

- By nature, preconstruction real estate requires you to do some speculation about the market value of the property not now, but after completion. However, keep in mind that you can't predict something cataclysmic like a housing market crash, which would likely mean that you lose your investment.

- You may have to choose between signing a contract that means losing a deposit if the builder has to pull the plug, and walking away. This is a big reason why preconstruction real estate is such a risky investment.

- Look for an experienced, reputable builder. The chances of a seasoned company calling off a construction problem are much lower than with a hot startup.[3]

- As an investor, look for a builder that will contract your house or buy your lot to construct a house to sell. Generally, the lot market price will increase as the supply of vacant lots increase.

Finding a Property

-

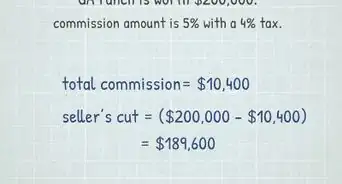

1Find a local realtor. Some realtors specialize in preconstruction real estate. They will assist you in setting up appointments with builders. If you are savvy enough with navigating real estate listings and contracts, you may be able to do this on your own. However, this is a cost-cutting measure that may not pay off in the long run.[4]

-

2Look for Phase 1 pricing. The less you pay for the property, the more your profit margin will be once the construction is complete. The first phase of selling is the cheapest. The downside is that it is much more difficult to determine if the construction will be completed in a timely manner, if at all.[5]

-

3Check zoning restrictions. Before investing in a property, you'll need to be sure that it can be used for your intended purpose. Ask the selling agent about zoning restrictions and land use laws for the property to make sure that they mesh with your plans. Contact the city or county government if the agent seems unsure about any aspects of the zoning laws. Even if a neighboring property has a certain kind or extent of construction on it, this does not necessarily mean that your land can be used for the same purpose, so always check zoning laws carefully before proceeding with your investment.

- If you're purchasing raw land, have the land re-surveyed to be sure about where your property line is.[6]

-

4Do your own research about the area. Real estate agents are working with you to find the best property. However, they get paid off commission, whether they close tomorrow or a year from now. Make sure they aren’t sugar coating the truth about a supposedly up-and-coming area. Do some internet searching and ask local businesses if the area is growing.

-

5Give yourself options. Your real estate agent will want to close a deal with you as quickly as possible. You may only get a few days to make your decision. However, make it clear to them that you want to have a couple preconstruction real estate properties to choose from when the day comes for you to decide. This gives you a chance to weigh up-front costs versus long-term returns.

Purchasing Preconstruction Real Estate As an Investment

-

1Choose the project(s) that you wish to invest in. The first 3-6 months of the pre-selling phase of preconstruction consists of the reservation stage. When you sign up for the project of interest you will a receive contract from the developer. If you are working with a consultant firm they will coordinate the delivery of the necessary paperwork.

-

2Identify the property's ideal end-user. As an investor, you're purchasing a property with the intention of eventually selling or renting that property to an end-user. To get the best return on investment, you'll need to identify your ideal end-user and then focus your property choices and selling efforts on that end-user. End-users might be other investors, renters, homebuyers, or vacation renters. Before investing, make sure that there is a sizable local market of end-users for your property. Then, look at the supply of similar properties. If there are too few end-users or too many properties like yours, it may be difficult to sell the property down the road.

-

3Obtain financing. Financing for investment properties can vary based on developer preferences and the attributes of the property. However, the average deal starts with a down payment of 5 or 10 percent of the purchase price. The balance, or a large portion of it, is then due upon completion of the property. Some investors choose to flip these properties before the total amount is due, betting on the fact that the property's value will have appreciated significantly before this point. Others pay for and hold the property until a buyer can be found a the appropriate price.

- In either case, you will need money for the down payment. This is usually paid for with the investor's own money, as obtaining a loan for investment purposes can be difficult.

- Purchasing raw land is slightly more expensive. For this type of transaction, you will typically need to be put about 25 percent down. Finding a lender may also be challenging. Try using a mortgage broker to locate an affordable land purchase loan.[7]

-

4Finalize the purchase. Work with the seller of the property to draft an agreement for the sale of the property. The agreement should include a timeline for building milestones with clauses that allow you to pull your investment or reduce the amount paid if these milestones are not met. This reduces your risk in the event that the property goes uncompleted or partially completed.[8]

Purchasing a Property for Your Future Home

-

1Think about the financing. You won’t have the option of selling your current home and moving into the new property yet. Unless your personal wealth is enough to cover the cost of the real estate, you will have to take out a loan. Though the cost of your current home will not be exactly the same as the new property, imagine doubling the amount you pay for housing each month.

- If you do have enough money to cover the costs up front, think about the risk of losing your nest egg. Rainy day money is always good to have around, and you may think twice about risking it.

- The good news is that you may have paid off the home loan for the new property by the time construction is completed. This means you will be the property owner with no payments or strings attached.

-

2Talk to your bank. Tell them you are considering investing in preconstruction real estate in the next few months. You will likely need a loan, but you don’t have the specific numbers yet. They will walk you through the home loan process and hopefully give you an idea, or even an estimate, of the interest rates you would qualify for. You will be able to consider loans from other financial institutions when you actually buy the property, but this will help you know what rates you can expect. It will also give you more precise estimate of the cost of this investment.

-

3Decide on a location. If you are doing this merely as an investment, look at financial periodicals for up-and-coming housing markets. You want to get in on a property whose value will rise. If you are buying preconstruction real estate instead as a place you will one day live, this is completely up to you. Keep in mind, however, that the area will not be the same after the construction project is complete, which may take several years.

- Beachfront properties are an alluring buy, but factor in the added environmental dangers that would require an expensive insurance policy.

-

4Do some life planning. Depending on the project you decide to buy in on, this chapter of your life may last several years. Do you have the stability for that kind of undertaking? Are you thinking about making major changes to your life in the meantime, such as having kids? Smart investments may be a way to make future life changes easier on you, but remember that unexpected developments may make you regret this expenditure.

- Unfortunately, there isn't anything you can do to speed up the project. You can't strap on a hard hat and operate one of the cranes. You will need to accept that you are at the mercy of the builder's pace.

-

5Check into the building materials. A good way to determine the value of a property after the construction is complete is asking about the building materials. Unless you're an architect or an experienced realtor, you may not be aware of the relative advantages of certain materials. Talk with your real estate agent or another realty investment consultant. A basic internet search may give you an idea of the value of the material, but you should do more exhaustive research.[9]

- If you are buying the property to eventually live in, look at the materials of your current home. If you like the materials your current home is made of, look for similar materials in the new property.

-

6Ask about adding a walk-through contingency. This is a stipulation in the contract that entitles you to seeing the property in person. You can specify that you want to look through it now, before you sign the initial contract, or before you sign the final sales papers when construction is complete. You will need to be escorted by the builder, and probably wear a hard hat.[10]

- For initial walk-throughs, this is a good way to look for drawbacks you don’t notice over the phone or looking at a map, such as strange smells, poor soil, road noise, etc. There may be little or no fee for backing out at this point.

- Final walk-throughs are a good way to spot construction flaws. Are the building materials actually what they described initially? Depending on the terms of your contract, you may have a bigger fee for backing out at this stage.

-

7Review and complete the required paperwork. The sales contract will be accompanied by a refundable deposit, usually 10% of the purchase price. The deposit is held in escrow with a selected title company and is fully refundable should you wish to cancel your reservation. The reservation stage of a project usually lasts until the project is at least 70% sold out.

-

8Review all documents with your accountant or lawyer. The reservation period can last anywhere from several days to 6 months. However, once the final contract is delivered, the buyer typically has 15 days to review the documents. At that point you can choose to commit to move forward or cancel. Have the experts make sure the contract is not exploitative in any way.

-

9Navigate the post-contract period. After signing, you will be asked to provide roughly 20% of your purchase price or the balance of your earnest money. This balance should subtract your initial reservation deposit. It takes approximately 18-24 months after you submit your hard contract for construction and closing to be completed.

-

10Proceed to closing. At approximately 18-24 months after hard contract when the project is at or almost fully completed, you will be issued a Certificate of Occupancy (CO). At this point you are granted access to inspect your unit and create a list of any faults you find. If everything is satisfactory, you will go to closing. At closing you should have financial arrangements made regarding the balance of the unit or units. This is done by securing financing or having available cash or transferable assets.

Warnings

- There is always a chance that a preconstruction project will not follow through to completion or finish development. This occurs when developers cannot meet their goals of financing for construction of the project. If this occurs, owners will receive their returned escrowed deposits. You may be offered incentives and deep discounts to fill empty spots in other projects. Before moving forward it is best to ensure that the considered project is well funded and meets all of your critical needs.⧼thumbs_response⧽

- Look for projects with reputable developers and evaluate their projects that have already been built to determine quality.⧼thumbs_response⧽

References

- ↑ http://www.bankrate.com/finance/real-estate/buying-raw-land.aspx

- ↑ http://www.forbes.com/sites/investopedia/2013/12/03/buying-a-house-sight-unseen-good-deal-or-bad-mistake/2/

- ↑ http://www.brickunderground.com/blog/2012/07/how_to_buy_pre_construction_smart

- ↑ http://www.forbes.com/2010/05/25/why-you-need-real-estate-agent-personal-finance-commission.html

- ↑ http://www.brickunderground.com/blog/2012/07/how_to_buy_pre_construction_smart

- ↑ http://www.nytimes.com/2001/09/09/realestate/avoiding-pitfalls-in-buying-raw-land.html?pagewanted=all

- ↑ http://www.bankrate.com/finance/real-estate/buying-raw-land.aspx

- ↑ http://www.investmentpropertiesinfo.com/buying_pre_construction.html

- ↑ http://www.brickunderground.com/blog/2012/07/how_to_buy_pre_construction_smart

-Step-1.webp)