This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 66,598 times.

Learn more...

Stock compensation is a way for companies to pay employees in shares of stock or stock options. Stock options are the most common type of stock compensation and allow an employee to purchase the company's stock at a set price during a set vesting period. Accounting for stock compensation is significantly more complex than doing so for traditional compensation. The company is required to properly value the stock or stock options and then make accounting entries to record stock compensation expense.

Steps

Calculating Compensation Value

-

1Distinguish between important dates. There are several important dates associated with stock compensation plans. Each one is essential to properly recording and reporting options plans. In order, they are:

- The grant date. This represents when the date at which employee is compensated.

- The vesting date. The date at which, in a stock option plan, an employee can exercise their options (to buy stock shares).

- The exercise date. The date at which the employee chooses to exercise his or her options. If they choose to not exercise their options, there will not be an exercise date recorded.

- Expiration date. The date at which any remaining, unexercised options expire.[1]

-

2Choose a method for determining the value of the stock-based compensation. In order to be recorded in journal entries, the stock compensation must be appropriately valued. The two most common methods recognized by the Financial Accounting Standards Board (FASB) are intrinsic value and fair value methods.

- Intrinsic value refers to the difference between the stock price when the stock is granted and the price of the stock at the earliest date the stock vests and can be sold.

- Fair value bases the value of stock on a complex model of factors that estimates the value of the stock or option at the time of the grant.[2]

- Publicly-traded companies are required to use the fair value method. Non-public companies may use either method.[3]

Advertisement -

3Find the value of restricted stock. Restricted stock, also known as non-vested stock, includes stock compensation that has not yet become vested. This means that employees given this stock are currently unable to exercise their options or sell the stock that they have been compensated with. The fair value of this stock is recorded as the market price of a share of the stock on the grant date. The total value of each plan's restricted stock is the number of shares multiplied by the fair value.

-

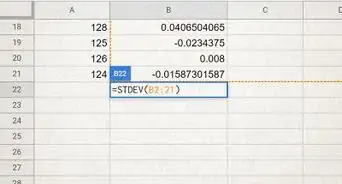

4Calculate stock option value. Stock option fair values are somewhat more complicated to calculate than the fair values of stock shares. Option values are calculated using a model that takes into consideration the market price at the grant date, the price at which the option is exercised, volatility, expected dividends, and the risk-free interest rate. The Black-Scholes model is one of the more common methods for fair-value estimation of options. This calculation is typically handled by accounting or financial modeling software.[4]

Making Journal Entries

-

1Make an entry to record compensation. Original stock compensation is recorded according to when the stocks or options become vested (available to the employee). The specifics of when this occurs are specific to individual employee stock compensation plans and are created at the discretion of the company. The entries made on the vesting date(s) are a debit to Compensation Expense and a credit to Additional Paid-In Capital, Stock Options, both for the fair value of the vested options or stocks.

- For example, imagine that an employee is granted a stock option plan on the first day of 2014 that gives them the option to purchase 1,000 shares of stock after a 2-year vesting period.

- The options included in the plan are valued at $35,000 through the use of a fair value model.

- The entries made on the vesting date, which would be the last day of 2015 (12/31/2015) are a debit of $35,000 to Compensation Expense and a Credit of $35,000 to Additional Paid-In Capital, Stock Options.[5]

-

2Record exercised options. All other entries for stock compensation plans will likely be made on the expiration date. Any exercised options will be recorded to reflect the increase in cash and change in common stock and options accounts. Continuing with the previous example, imagine that the employee decides to exercise 400 of his options. This would mean that he buys 400 shares of the stock at the option price.

- The option price is $50, this would represent $20,000 () in cash coming in to the company. In addition, it would represent 40 percent (400 of 1000 total) of the stock options originally granted leaving the company.

- However, this also means that the common stock shares created in the purchase must be recorded. This will be done at the par value. So, if the par value of the shares is $5, this would mean that the company has gained $2,000 () in common stock.

- This transaction would be recorded at the expiration date of the options as a debit to Cash for $20,000, a debit to Additional Paid-In Capital, Stock Options, for $14,000, a credit to Common Stock for $2,000, and, finally, a balancing credit to Additional Paid-In Capital, Common Stock, for $32,000.[6]

- The balancing entry at the end represents the difference between the debits to Cash and Stock Options ($34,000 total) and the common stock credit ($2,000).

-

3Write off expired options. At the expiration date, any unexercised options are also recorded. In this case, having exercised 40 percent of their options over the vesting period, the employee has elected not to exercise the remaining 60 percent. This means that 60 percent of the original $35,000 value, or $21,000, will be written off as expired stock options. Specifically, a debit to Additional Paid-In Capital, Stock Options, will be made along with a credit to Additional Paid-In Capital, Expired Stock Options, both for the $21,000 fair value of the expired options.[7]

-

4Account for the employee stock-based compensation when completing your financial statements. How financial statements are presented is your prerogative, but you must include all stock-based compensation when distributing statements to your stockholders. Stock compensation should be recorded as an expense on the income statement. However, stock compensation expenses must also be included on the company's balance sheet and statement of cash flows.[8]

Recording Compensation As an Employee

-

1Find your grant price. Determine the price at which you could purchase a share under the terms of your employee stock-based compensation plan. This is known as the par value or the grant price for stock options. Repeat this process for each "batch" of stock if you received stock-based compensation at different price points. This information should be listed in your employment contract or can be found by contacting your HR department.

- For example, an employee might have a grant price of $10. This represents how much he or she would pay for a share, regardless of the current market price.[9]

-

2Calculate the difference between the grant price and market price at the exercise date. If you choose to exercise your options at any point, you need to record the full market value of the stock shares at the time at which you exercised the options. This is because the difference between the market price and the grant date at the exercise date is taxable as income if you do not hold the stock for a long enough period of time.

- This period of time, generally one or two years, is determined by federal and state law and varies between states and options plans.[10]

- For example, if your grant price is $10 and the current market price at the date of exercise is $50, you would need to calculate the difference, which here is $40 per share.

- If you sell before the waiting period is over, you will be responsible for paying income tax on that difference. This would be calculated as your marginal tax rate times the total amount of the compensation.

- So, if you exercised 100 options, you would need to pay income tax on the per share difference ($40) times 100 shares, which would be $4,000.[11]

-

3Determine capital gains on the sale of the stock. When you sell the stock provided by your stock compensation plan, you must pay capital gains on your returns from the sale. These taxes are all that you will owe on your stock compensation gains if you have already reached the end of the required waiting period when you sell. Capital gains are determined as the difference between the market value at exercise and the market value at the selling date.[12]

- For example, if you sold the 100 shares from the previous example when the price hit $70, you would experience a taxable capital gain or $20 per share, or $2,000.[13]

-

4File your taxes properly. Make sure to disclose all capital gains and losses on your income taxes. You should also include any stock sold before the required waiting period. Speak to a financial professional if you are unsure of when this waiting period ends. Failure to properly to report these gains can result in fines or criminal penalties.

References

- ↑ http://accounting.utep.edu/sglandon/c19/c19a.pdf

- ↑ http://accounting.utep.edu/sglandon/c19/c19a.pdf

- ↑ http://rsmus.com/pdf/stock-based-compensation-at-a-glance.pdf

- ↑ http://www.quickmba.com/finance/black-scholes/

- ↑ http://accounting.utep.edu/sglandon/c19/c19a.pdf

- ↑ http://accounting.utep.edu/sglandon/c19/c19a.pdf

- ↑ http://accounting.utep.edu/sglandon/c19/c19a.pdf

- ↑ http://www.investopedia.com/articles/06/fas123r.asp

- ↑ http://personal.fidelity.com/products/stockoptions/exercise.shtml

- ↑ http://www.foundersworkbench.com/hiring/stock-based-compensation/

- ↑ http://personal.fidelity.com/products/stockoptions/exercise.shtml

- ↑ http://www.foundersworkbench.com/hiring/stock-based-compensation/

- ↑ http://personal.fidelity.com/products/stockoptions/exercise.shtml

- ↑ http://rsmus.com/pdf/stock-based-compensation-at-a-glance.pdf

-Step-3.webp)