This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 106,810 times.

Whether you want to authorize an employee to use a company card or you're helping a family member through an emergency, adding someone to a credit card account is a relatively straightforward process. However, there are several considerations you should take before, after, and during the process to avoid any mishaps along the way.

Steps

Deciding Who to Add

-

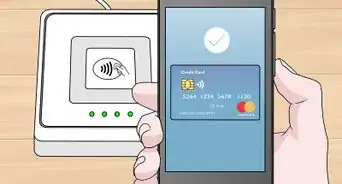

1Know the pros and cons of adding an authorized user. When you add someone to your credit card account, they are able to legally make charges using your card. Obviously, granting another person access to your finances is a major decision so you should know the pros and cons before beginning the process.

- Adding someone to your credit card account has many advantages. If someone cannot apply for a credit card on their own due to poor financial history, it may enable them to build a credit score depending on the credit card issuer or help them learn how to manage money if they are paying you back each month. You can make sure someone has money available in the event of an emergency. Having one credit card account is often more convenient than creating multiple ones.

- Adding someone to your credit card has its drawbacks as well. There is an added liability, as you're legally responsible for all actions an authorized user takes. Any missed payments or credit score damages affect both of you. Shared accounts have also lead to strained relationships between users, as blame comes into play if there are issues with payments.

-

2Distinguish between an authorized user and a joint account holder. When you add someone to your credit card, they're either a joint account holder or an authorized user. The responsibilities and rights of this person change greatly depending on their status.

- An authorized user is entitled to use the credit card issued to the card's holder but has no financial responsibility when it comes to paying back any accrued loans.[1]

- Joint account holders share ownership of the account and have as much liability when it comes to repaying the debt as the original card holder.[2]

- You must make a decision, depending on the financial situation of both parties involved, whether the person you're adding will be a joint account holder or an authorized user.

Advertisement -

3Know the effect on your credit score. Many people wonder, when adding someone to their credit card, how and if this action will affect your credit score. This is information you should understand before making any decisions.

- Credit reports generally don't supply information on authorized users. Adding a user in and of itself should not affect your credit score. However, you are responsible for any charges this person makes. If the new authorized user abuses their privileges, you could end up with large debts you are not able to pay. This will affect your score.

- The new user's credit score will actually be affected more directly. If the credit card issuer reports authorized users, the account will appear on their credit report and their credit score can change for better or for worse depending on your financial history.

- When you add a joint account holder, both parties will appear on each individual's credit report. Much like adding an authorized user, this will not affect your credit score in and of itself. However, a joint account holder cannot be easily removed from the account if there are outstanding charges. Your credit report might be affected more severely due to the potential longevity of any damage done.

Adding a User

-

1Know who can be added to an account. Many people are surprised to know that, with the necessary information, anyone can be added as an authorized user on a bank account. However, adding someone to your account gives them access to your finances and that puts you in an incredibly vulnerable position. It is not recommended you add anyone if you have not firmly established a personal or professional relationship with that person.

- You should select someone you can fully trust or someone who is as invested on keeping the account's integrity intact as you are.

- The majority of authorized user relationships are couples, parent/child, and employer/employee.

- Remember, the more established your relationship with the person the better.

-

2Find out your bank's policy. Most of the time, you can add authorized users over the phone or online. Bank policies do vary and your specific bank might have special requirements depending on your circumstances.

- Call your bank and ask them how to add a user. Some banks can do this over the phone or online, but you may have to go in to discuss the issue in person or fill out a paper application.

- Any questions you have should be addressed with the bank. Ask them how to remove an authorized user or joint account holder and what your exact financial responsibilities are in regards to the card's use. Remember, you're taking a risk by giving someone access to your finances. You should go in with as much information as possible.

-

3Gather the needed information. Make sure you have all the information necessary before attempting to add the user. Most banks require the following information to add a user to your account:

- The user's name

- Their date of birth

- Their social security number

- Your bank might want other information depending on their policies. Check their requirements beforehand to make sure you have everything you need before setting things up.

Discussing the Account with the New User

-

1Establish ground rules early on. Once you've added someone to your account, you need to lay out concrete rules for the card's use to avoid misunderstandings that lead to tensions between users. It's a good idea to put agreements in writing and have both parties sign and date to avoid misunderstandings later.

- Explain your requirements in terms of charges and payment. Do you expect this person to adhere to certain spending limits? How much money, if any, are they expected to pay when the bill comes? These are issues you should work through early on.

- When can they use the card? Some people expect their credit card to be for emergencies only while others are okay with charging rent and groceries to the card. Decide when the card can be used and for what purposes.

- If a rule is broken, how will you proceed? Is there anything the new user might do that would lead you to remove them from the account? Be clear about your comfort zone in terms of the card's use and when and why you might cut them off.

-

2Plan for the bad times. What if someone overspends or refuses to pay up? You should have a game plan in place ahead of time if any issues arise.

- It's possible to set up account alerts through your bank so you will be informed of any worrisome situations. If you have any concerns with the new user, this might be a good idea.

- If someone refuses payment, what will you do? Will you pursue legal action or simply remove them from the account and move forward? Depending on a variety of factors, such as your relationship with the new user, you need to have a plan in effect if anything goes awry.

-

3Have a continual dialogue with the new user. Do not simply let communication drop off once the account is set up. Make sure dialogue about the card's use is an ongoing matter.

- It's helpful for some people to schedule occasional sit-downs to talk about how and when the card is being used. If there are any disagreements, they can be talked out roughly once a month to avoid tensions from building.

- Any potential changes, such as the card's spending limit, should also be discussed. Open communication is key to avoiding animosity between you and the card's new user.

-

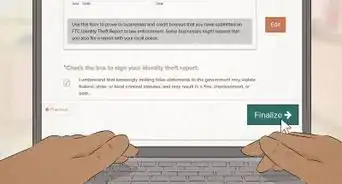

4Remove the user if necessary. If problems keep occurring, you might decide it's best to remove a user from your account.

- The procedure for removing an authorized user varies from bank to bank, but most places require a phone call or a written request. While most banks are either/or, some banks do require a phone call and a follow-up request in writing.

- Removing a joint account holder can take more time, especially if you're not the primary account holder. While this can occasionally be done in writing or with a phone call, a sit down meeting with the bank is often needed. Ask your bank about removing a joint account holder to find out their specific requirements.[3]

Warnings

- Once again, only authorize users you trust. You're putting yourself at great risk by giving out your financial information and you don't want to accrue damage to your credit.⧼thumbs_response⧽

References

About This Article

Before adding someone to your credit card, have a conversation laying out some ground rules to avoid misunderstandings and hard feelings in the future. Then, call the bank that issued the card and ask them how to add a user. If they say you can do it over the phone, be prepared to give them the additional user’s name, date of birth, and social security number. Alternatively, go into your bank and fill out the paperwork in person, especially if you have specific questions or concerns that need to be addressed. To learn how to remove a user from your credit card account, keep reading.