wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 135,879 times.

Learn more...

A surety bond is a type of agreement often used between contractors and their clients. A bond agreement consists of three parties: the principal (the contractor), the obligee (the contractor's client), and the surety, which is the company that underwrites the bond agreement. Surety bonds function a bit like insurance. In the case that a claim against you is ever filed, the surety bond covers any damages, although you'll eventually have to pay those damages back to the surety. Becoming bonded essentially gives your customers the insurance that if anything were ever to happen, they wouldn't be left in the lurch because you couldn't pay.

Steps

Becoming Bonded

-

1Ensure that you need a surety bond. Although "becoming bonded" usually means securing a surety bond, many contractors think they mistakenly need surety bonds when in fact the law says that they don't. Check with the government branch responsible for policing your industry; if you're trying to become a car dealer, check with the DMV, for example. Contractors who do not need surety bonds for their enterprise may be better suited with a fidelity bond, for instance. (More on fidelity bonds later.)

-

2Ensure that you qualify for a surety bond. By underwriting your bonds, your surety is vouching for your performance. If you fail to perform the work as specified, they are liable for meeting the obligations set forth in the contract. Therefore, sureties will inspect your business carefully before bonding you.[1]

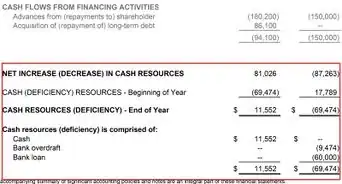

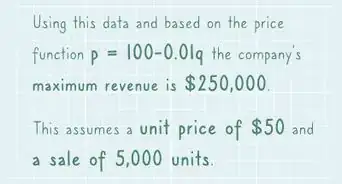

- The most important component of your bonding capacity is your company's financial stability. If you don't have professional financial statements prepared by a certified public accountant (CPA), prepare them before approaching a surety. Sureties will also look at your assets, cash flow, and credit history.[2]

- A surety will also assess the integrity of your company. This is typically done by contacting your business associates, such as suppliers and customers. If these parties recommend you, you are more likely to secure a bond.

- Finally, a surety will evaluate your company's longevity and capacity. If your company has a stable and long history, this will look favorable. Sureties are also interested in making sure you do not contract more work than you have the capacity for.

Advertisement -

3Choose a surety bond company. There are many surety bond companies operating throughout the world, with many specializing in certain industries or certain contract sizes.[3]

- A useful way to compare surety bond companies is through their credit rating. A.M. Best is an agency that rates surety bond companies, much like Moody's and Standard & Poor's rate businesses. Your obligee may have a minimum credit rating requirement for your bondsman.

- You should also examine the turnaround time for your bond company. Companies that typically bond large construction contractors may have too slow a turnaround time to bond projects on a smaller basis, for example.

- Finally, you should compare rates between different sureties. Even a small difference in your rate can mean a big difference in the premium you pay if the contract amount is sufficiently large.

-

4Apply for a surety bond. You can usually get a quote from bond companies for free or for a small fee. If the quote is favorable, you can apply for a bond using the bonding company's form. You will have to provide information about your business and specify the amount of bonding needed. You will also have to sign a credit release agreement.

- It is essential to seek the right type of bond for your project; there are 3 common types of contract bonds. Bid bonds ensure that the contractor will enter the contract if awarded the job; performance bonds ensure that the contractor will perform the work as specified; and payment bonds ensure that the contractor will pay their subcontractors and suppliers. Many construction project owners will require all 3 of these bonds.[4]

-

5Sign the indemnity agreement. Once a surety approves your application, you will need to sign the indemnity agreement. This agreement governs what the surety is and isn't liable for; a common provision is that you will be responsible for covering any claims and legal costs the surety incurs from your claims. You will usually have to pay your premium upon signing this agreement.[5]

-

6Sign the bond agreement and send it to your client. After signing the indemnification agreement, you can sign the legally binding bond agreement. After this agreement is signed by both the contractor and the surety, you should send it to your client (the obligee) for approval. Work can begin upon approval of the bond agreement.

Educating Yourself about Liability and Other Options

-

1Know what happens when a claim is filed. If a customer files a claim against you, the bonding company will review the claim and decide whether they think you are at fault or the customer is filing a spurious claim. If they side with you, then they'll back you as you decide to fight the claim. If they side with the customer, then they pay the cost of the claim in order to settle it.[6]

-

2Be prepared to pay the bonding company back for every cost of yours they cover. Sadly, a bonding company, or surety, isn't the magical answer to all your liability problems. If a bonding company sides with a customer filing a claim and pays the cost of the claim, you are ultimately responsible for paying the bonding company back the cost of the claim as well as any legal fees.

- Think about the surety as a credit card. In case you need to pay any claims, the government mandates that you have a credit card so that you actually have the money to pay. This gives the customer insurance that they will get financial reparations if you break the law. Otherwise, contractors could claim insolvency and never give the customers a cent, throwing a wrench in the system. So bonding is an insurance mechanism, except the insurance isn't for you — it's for your customers.

-

3Avoid claims at all costs! Because sureties are a hassle, it's best to avoid needing them in the first place. Of course, you pay a premium for the surety each month, but you never want to actually have to use it. It's a fail-safe in case the worst happens, not a fallback for when you're in tough times.[7] Here are two easy things you can do to avoid claims from triggering your surety bond:

- Follow all regulations and laws set forth by the government for your industry. Get current with everything your federal, state, and local governments have mandated you follow. The easiest way to incite someone to file a claim against you is to break the law, however small the indiscretion.

- Settle any and all disputes before they come to a boil. This is a lesson in customer service. Make sure all your customers, even the craggy, mean ones, feel like you respect them. Because if they don't, they're far more likely to file a claim against you. Nip the problem in the bud before it becomes an avalanche you can't stop.

-

4Know what to expect if you are a high-risk applicant. When you are considered a high-risk applicant, usually it means that your FICO credit score is lower than 650 or you've gone through bankruptcy, or a combination of the two.[8] The good news is that you can still apply for and get a surety bond, even as a higher-risk applicant. The only difference between a high-risk and a low-risk applicant is the premium they pay for the service. If you're higher-risk, for whatever reason, expect to pay a higher premium in order to get bonded.

-

5Consider other types of insurance if you don't need a surety bond. Surety bonds aren't optional; other types of insurance depend wholly on your tolerance for risk. For example, what if you find out that starting your private security service doesn't require being bonded? Do you still want to offer management, investors, as well as your customers, the peace of mind of insurance?

- One way to offer insurance apart from surety is a so-called fidelity bond. Fidelity bonds are insurance policies that protect against fraudulent or dishonest acts by someone in your company. This way, the company's assets aren't seized if someone who intentionally harms the company decides to incur liability on behalf of the company.

Community Q&A

-

QuestionDo pet sitters need to be bonded?

Community AnswerGenerally, no.

Community AnswerGenerally, no. -

QuestionCan I get a bond that would effectively include both my personal and business travel?

Community AnswerYes, you can get a bond that would effectively include both your personal and business travel.

Community AnswerYes, you can get a bond that would effectively include both your personal and business travel. -

QuestionI want to start cleaning houses by myself, what do I need to do? I will not have any employees.

Community AnswerAlways give a free estimate and be responsible for the quality of your work. Being licensed would help as well.

Community AnswerAlways give a free estimate and be responsible for the quality of your work. Being licensed would help as well.

References

- ↑ https://www.sba.gov/funding-programs/surety-bonds

- ↑ https://www.slocounty.ca.gov/getattachment/fabb0137-af5e-4960-8e39-353ec6d551bf/How-Surety-Bonds-Work.aspx

- ↑ https://www.sba.gov/funding-programs/surety-bonds

- ↑ https://suretyinfo.org/?wpfb_dl=57

- ↑ https://suretyinfo.org/?wpfb_dl=57

- ↑ https://www.youtube.com/watch?v=Q7YqGnPhZ6Q

- ↑ https://suretyinfo.org/?wpfb_dl=158

- ↑ http://www.suretybonds.org/bad-credit-surety-bonds

- ↑ https://fiscal.treasury.gov/surety-bonds/circular-570.html

About This Article

If you have a business and you want to become bonded, research various surety bond companies, comparing their credit ratings, their turnaround times, and the rates they charge. Once you’ve chosen the company, fill out a bond application, which will include information about your business and a credit report on the company. Sign the indemnification agreement, then sign the bond agreement and send it to your client. To learn what happens if a claim is filed, keep reading!

-Step-04.webp)