This article was co-authored by Alan Mehdiani, CPA and by wikiHow staff writer, Jennifer Mueller, JD. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 33,654 times.

Many active investors are turning to tax liens to earn a little extra income. When you buy a tax lien in Illinois, you aren't buying the property. You're simply buying the right to collect the taxes that are owed. However, if the taxes aren't paid within 2 or 3 years, you may be able to go to court and foreclose on the property.[1] Although most property owners do pay their delinquent taxes, if you own the tax lien you can earn interest until they do.

Steps

Registering as a Tax Buyer

-

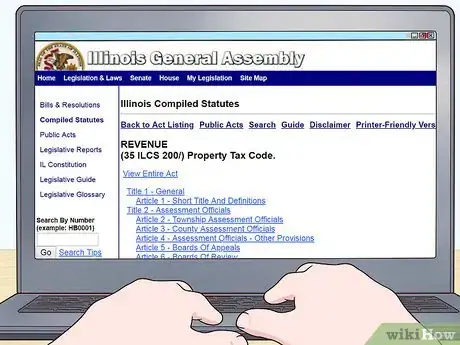

1Read the Illinois tax sale law. As a tax buyer, you are responsible for understanding the law and your responsibilities as a bidder and a buyer. This can be cumbersome reading, but it's essential for you to know what you're getting into.[2]

- You can find the law online and read it for free. Search for "35ILCS200." That's the entire tax code. For the purposes of tax sales, the most important part for you to understand is Title 7, which covers tax collection.

-

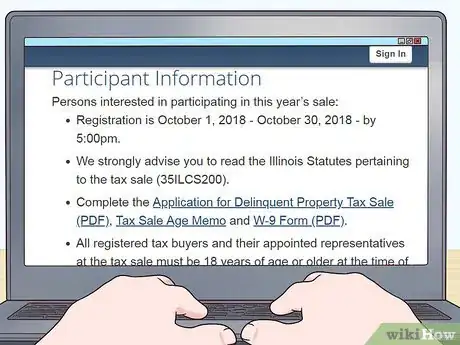

2Check deadlines in the counties where you want to participate. The website of the county treasurer's office has information on that county's tax sales. To participate in the tax sale, you must be registered by a certain date.[3]

- For example, Lake County's tax sale is in November. If you want to participate in the sale, you must register during the month of October.

Advertisement -

3Complete your application. The application to participate in a tax sale as a buyer is typically short and simple, requiring your name, address, and contact information. Sign and date it and return it to the county treasurer's office.[4]

- The application is accompanied by a memo you must sign, certifying that you are over the age of 18.[5]

-

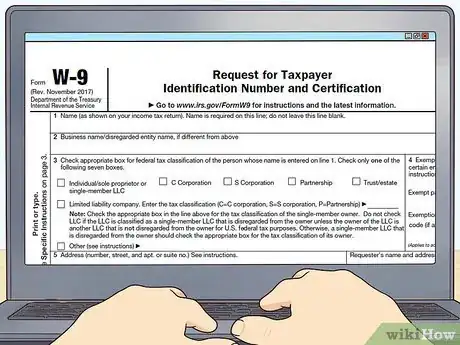

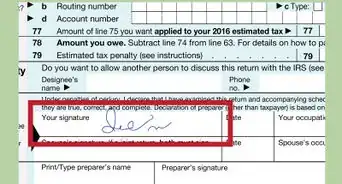

4Fill out a W-9. Since you will potentially be receiving income in the form of interest, you must also submit a completed W-9 to the county treasurers before you can participate in the tax sale. Any income you earn from tax liens must be reported on your state and federal tax returns.[6]

- You can download and fill out a W-9 at https://www.irs.gov/pub/irs-pdf/fw9.pdf.

-

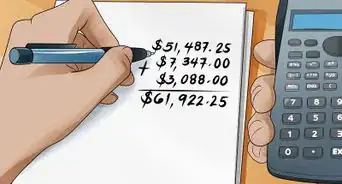

5Pay your deposit. All registration applications must be accompanied by a $500 deposit. This deposit will be applied toward any purchases you make at the tax sale. If you participate in the tax sale but end up not buying anything, your deposit will be refunded.[7]

- If you are a first-time buyer, you don't have to pay a $500 deposit. Instead, you must provide a certified check for the total amount you plan to purchase at the sale. If you end up not buying that much, the county will refund the balance to you.[8]

- Most counties have a minimum bid set. This amount may be higher than the $500 deposit. For example, the minimum bid in St. Clair County is $750.[9] If you're a first-time buyer, keep this in mind when you're calculating the total amount of your certified check.

-

6Get a delinquent tax list. The delinquent tax list lets you know what tax liens will be available at the tax sale you've registered for. You will be charged a fee of at least $100 for the delinquent tax list. The amount of this fee varies among Illinois counties.[10]

- If you're a first-time buyer, pay this fee separately from your certified check.[11]

- The delinquent tax list can help you plan your strategy for the sale and identify specific tax liens you're interested in buying.

Participating in a Tax Sale

-

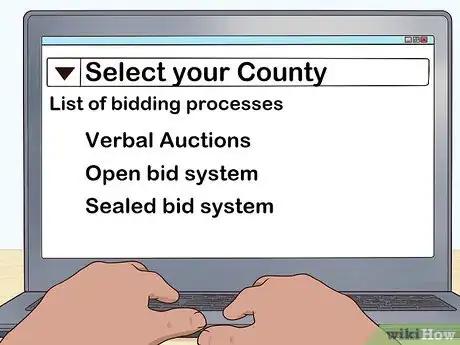

1Find out the bidding process in your county. Illinois tax sales are all administered by the same auction company. The company offers 3 different bidding processes. If you're participating in tax sales in multiple counties, you may also have multiple bidding processes.[12]

- With verbal auctions, each item has a minimum bid. Available tax deeds are called out live, and buyers may bid until the tax deed is sold. Then the next listed tax deed is called.

- If the county has an open bid system, you can purchase a tax lien at any time for the minimum bid listed.

- If the county has a sealed bid system, you offer your bid on a tax lien that is equal to or greater than the minimum listed. You don't have to appear in person at any auction site. You're only allowed to make one bid, so your sealed bid should be at or close to the maximum you're willing to pay for the property.

-

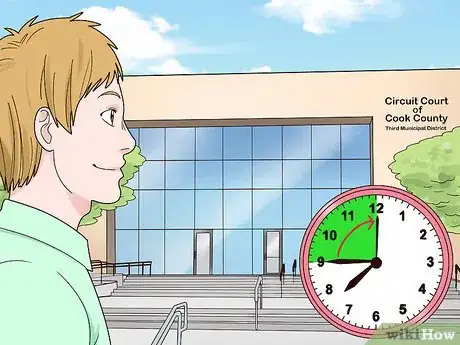

2Arrive at the courthouse early on the day of the sale. If the county has a verbal auction, you must go to the courthouse in person to participate in the tax sale. Since seating is typically first-come, first-served, you should arrive as early as possible.[13]

- If you purchased a delinquent tax list, bring it with you so you can follow along.

- Leave electronic devices at home. You may also be required to turn your cell phone off.

-

3Bid on properties called. Verbal auctions typically take place electronically, with buyers placing their bids over laptop computers. There will be a computer provided for you to use at your seat. You'll sign in for the auction with your registration information.[14]

- When you're actually bidding, you're bidding the interest rate you would charge on the delinquent taxes until they are paid. That interest rate is assessed every 6 months. The lowest percentage rate bid wins the sale.

-

4Make payment for your purchases. You typically have a day or two after the tax sale concludes to pay the county treasurer for any tax liens you won at the auction. Tax lien certificates aren't issued until after you've made your payment, so they aren't available immediately.[15]

- The county treasurer's office will notify you when your certificates are ready and you can go down to the treasurer's office to get them.[16]

Foreclosing on the Property

-

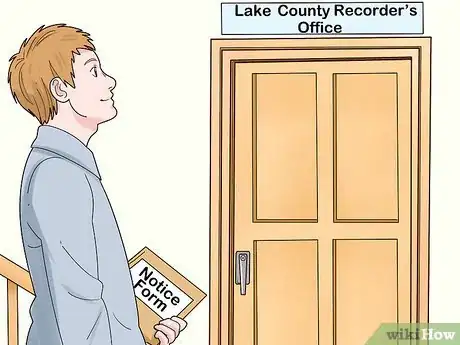

1Provide notice to the county clerk. After you have your tax lien certificate, go to the clerk's office in the county where the property is located to have a notice sent to the record owners of the property that you have a lien.[17]

- The wording of your notice must be exact, as stated in 35 ILCS 200, Article 22. Pull up a copy of the statute online and copy the words of the notice exactly, filling in the blanks with the appropriate information about yourself and the property.

- The county clerk will deliver notice to the record owners of the property, with instructions on how to redeem the property by paying the delinquent taxes plus interest.

-

2Wait out the redemption period. Illinois gives property owners between 2 and 3 years to pay delinquent taxes, depending on the type of property. If the property owner pays the taxes during that time, you will receive payment from the county clerk's office and your lien will be removed.[18]

- If the property owner fails to pay taxes over the course of the redemption period, you have the option of buying those taxes as well.

-

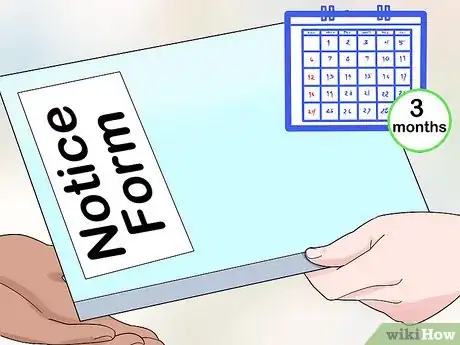

3Submit notice to the county clerk if the redemption period expires. Within 3 months of the date the redemption period will expire, file a second notice with the clerk, following the exact wording set forth in the statute.[19]

- This notice informs the property owner that the redemption period is expiring, and after the deadline you will petition the court for a tax deed.

-

4File a petition for a tax deed. If the redemption period expires and the owner has not paid the delinquent property taxes, start a lawsuit in the circuit court where the property is located. Ask the judge to order the county clerk to issue a tax deed in your name.[20]

- The owners of the property will be notified of your petition, as will anyone else, such as a mortgage company, that has an interest in the property.

-

5Participate in the court proceeding. The judge will schedule a hearing on your petition. The property owners or anyone else with an interest in the property may appear at the proceeding to argue against your petition being granted.[21]

- If the judge is satisfied that the redemption period has expired and that you have fulfilled all legal requirements as the tax buyer, the judge will order a tax deed in your name.

-

6Take possession of the property. Once you have the tax deed, you are the legal owner of the property. As the legal owner, you can do whatever you want with the property, including rehabilitating it or selling it.[22]

- Tax buyers seldom reach this stage. The vast majority of delinquent taxes are paid before the redemption period expires.

Expert Interview

Thanks for reading our article! If you'd like to learn more about investing in tax liens, check out our in-depth interview with Alan Mehdiani, CPA.

References

- ↑ https://www.lakecountyil.gov/200/Tax-Sales

- ↑ https://www.lakecountyil.gov/552/Tax-Sale-Information

- ↑ https://www.lakecountyil.gov/552/Tax-Sale-Information

- ↑ https://www.lakecountyil.gov/DocumentCenter/View/1366/Application-for-Delinquent-Property-Tax-Sale-Registration-PDF

- ↑ https://www.lakecountyil.gov/DocumentCenter/View/20145/Tax-Sale-Age-Memo

- ↑ https://www.lakecountyil.gov/552/Tax-Sale-Information

- ↑ https://www.lakecountyil.gov/DocumentCenter/View/1366/Application-for-Delinquent-Property-Tax-Sale-Registration-PDF

- ↑ https://www.lakecountyil.gov/552/Tax-Sale-Information

- ↑ http://www.iltaxsale.com/new/index.php

- ↑ https://www.dupageco.org/Treasurer/1834/

- ↑ https://www.lakecountyil.gov/552/Tax-Sale-Information

- ↑ http://www.iltaxsale.com/new/index.php/main/faq

- ↑ https://www.lakecountyil.gov/550/Tax-Sale-Proceedings

- ↑ https://www.lakecountyil.gov/550/Tax-Sale-Proceedings

- ↑ https://www.lakecountyil.gov/550/Tax-Sale-Proceedings

- ↑ https://www.lakecountyil.gov/557/After-the-Sale

- ↑ http://www.ilga.gov/legislation/ilcs/ilcs4.asp?DocName=003502000HArt%2E+22&ActID=596&ChapterID=8&SeqStart=77900000&SeqEnd=79900000

- ↑ https://www.lakecountyil.gov/292/Tax-Redemption-Process

- ↑ http://www.ilga.gov/legislation/ilcs/ilcs4.asp?DocName=003502000HArt%2E+22&ActID=596&ChapterID=8&SeqStart=77900000&SeqEnd=79900000

- ↑ http://www.ilga.gov/legislation/ilcs/ilcs4.asp?DocName=003502000HArt%2E+22&ActID=596&ChapterID=8&SeqStart=77900000&SeqEnd=79900000

- ↑ http://www.ilga.gov/legislation/ilcs/ilcs4.asp?DocName=003502000HArt%2E+22&ActID=596&ChapterID=8&SeqStart=77900000&SeqEnd=79900000

- ↑ https://www.lakecountyil.gov/292/Tax-Redemption-Process