This article was co-authored by wikiHow staff writer, Dan Hickey. Dan Hickey is a Writer and Humorist based in Chicago, Illinois. He has published pieces on a variety of online satire sites and has been a member of the wikiHow team since 2022. A former teaching artist at a community music school, Dan enjoys helping people learn new skills they never thought they could master. He graduated with a BM in Clarinet Performance from DePauw University in 2015 and an MM from DePaul University in 2017.

Learn more...

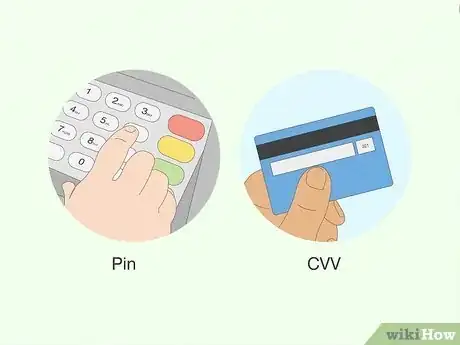

You’ve got your credit card number and expiration date memorized to make online purchases in a flash, but you can never seem to remember that pesky CVV code. Is it really necessary? As it turns out, that little code provides a lot of protection, and the risks of trying to bypass it far outweigh the inconvenience of digging through your wallet to pull out your card. In this article, we’ll take a look at how CVV codes keep your information safe, plus show you how scammers might try to find it and what you can do to protect your personal data. Let’s dive in!

Things You Should Know

- It’s illegal to bypass a CVV code when a merchant requires it for a purchase. If a CVV code isn’t required, the transaction is probably not secure.

- Scammers may attempt to get your CVV code through phishing schemes or keylogging malware.

- Protect your CVV code by only entering it on secure websites, ignoring unsolicited requests for your personal information, and checking your card statements regularly.

- If you need your CVV code but can’t locate your physical card, call your card issuer. They can look up your CVV code after verifying your identity.

Steps

Warnings

- Do not give out any personal information to CVV generating or CVV bypassing software, as these are typically scams meant to mine your personal information.⧼thumbs_response⧽

References

- ↑ https://www.thebalancemoney.com/how-to-find-your-credit-card-security-code-4773641

- ↑ https://www.nerdwallet.com/article/credit-cards/find-credit-card-cvv-number

- ↑ https://www.cvvnumber.com/

- ↑ https://www.cvvnumber.com/

- ↑ https://www.forbes.com/advisor/credit-cards/what-is-a-credit-card-cvv-number/

- ↑ https://www.forbes.com/advisor/credit-cards/what-is-a-credit-card-cvv-number/

- ↑ https://www.valuewalk.com/use-card-without-cvv/

- ↑ https://www.thebalancemoney.com/how-to-find-your-credit-card-security-code-4773641

- ↑ https://www.thebalancemoney.com/how-to-find-your-credit-card-security-code-4773641

- ↑ https://www.valuewalk.com/use-card-without-cvv/

- ↑ https://www.forbes.com/advisor/credit-cards/what-is-a-credit-card-cvv-number/

- ↑ https://www.forbes.com/advisor/credit-cards/what-is-a-credit-card-cvv-number/

- ↑ https://www.thebalancemoney.com/how-to-find-your-credit-card-security-code-4773641

- ↑ https://www.usa.gov/identity-theft