This article was co-authored by Jonathan DeYoe, CPWA®, AIF®. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 241,533 times.

The GDP is the Gross Domestic Product of a country or region over some chosen time period. This single figure represents the value (in local currency) of all of the goods and services produced within that region over a specific period of time.[1] To understand whether the country’s economy is improving or declining, you may wish to calculate the annual growth rate of the GDP. This is a direct comparison of the GDP from one year to the next. If the result is positive, the economy is said to be improving. If negative, then the economy is declining. Growth rates can be compared annually or over shorter or longer time periods, depending on the research you are doing.

Steps

Calculating an Annual Growth Rate

-

1Determine the time period you want to calculate. The annualized GDP growth rate is a measure of the increase or decrease of the GDP from one year to the next. Understanding this measurement is a way of knowing whether the general economy for the country (or other chosen location) is getting better, worse or staying stable over time.[2]

- GDP figures are generally made available on a quarterly basis. To calculate the “annualized” GDP growth rate specifically, use data for the full year, not just a selected quarter.

- This figure is always called the “growth” rate and uses a single formula, regardless of whether the GDP is increasing or decreasing. If the value of the GDP increases from one year to the next, the formula will produce a positive result. If the result is negative, the value is dropping, and you can say that there has been “negative growth” over the selected time period.

- You can use it to compare the performance of a country to other countries.[3]

- But it has its limitations. Many economists suggest including measures of well-being among the current measurements to determine the absolute and relative success of a country.[4]

-

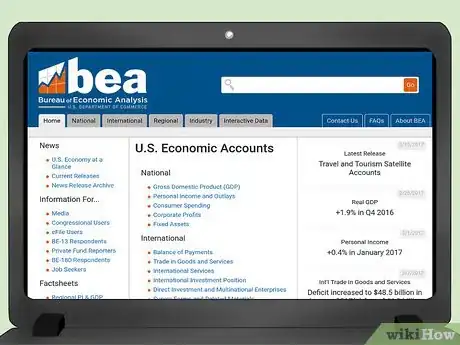

2Collect the data from reliable government resources. In the United States, the accepted source for GDP data is the Bureau of Economic Analysis (BEA).[5] The BEA is an agency of the U.S. Department of Commerce, which is charged with calculating the GDP for the United States. The BEA has the resources available to collect all the sales and employment data that becomes part of the GDP.[6]

- Visit the BEA website at http://www.bea.gov. From the home page, you can see numerous links to National GDP, Regional GDP, and a wide variety of press releases and data releases.

- For the annual GDP for the country, choose the link to “GDP.” You will be directed to a spreadsheet that contains the GDP, broken down by year and quarter for approximately the last 100 years.

Advertisement -

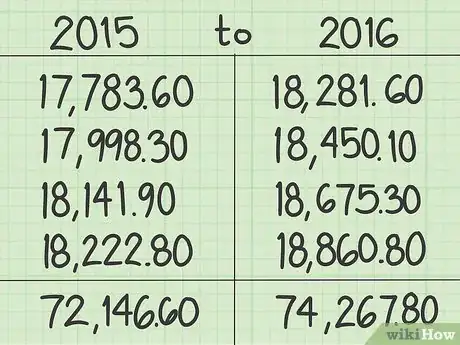

3Find the GDP for two consecutive years. To determine the annualized GDP growth rate, you need to know the GDP of two consecutive years. Using the data from the BEA, find the annual GDP for one year and the annual GDP for the next year.

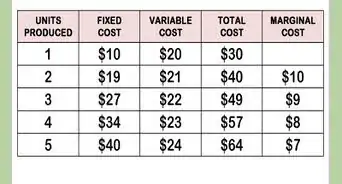

- If the GDP is reported quarterly, add together the four quarters for the year to find the annual GDP. For example, the BEA reports quarterly GDP data for the U.S. For the years, 2015 and 2016, add the quarters together as follows to find the annual GDP of each year. The data shown here is reported in terms of billions of dollars:

-

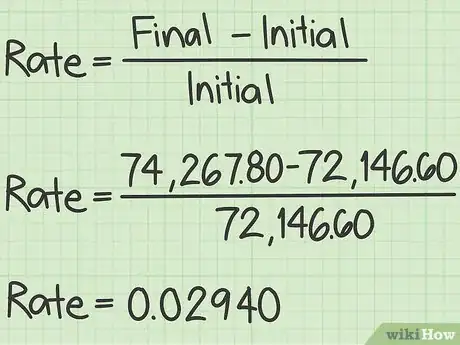

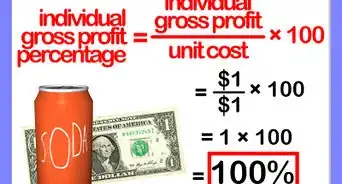

4Use the formula for growth rate. To calculate the growth rate over the chosen time period, use the formula:[7]

- For the example of calculating the annual growth rate from 2015 to 2016, insert the figures as follows:

-

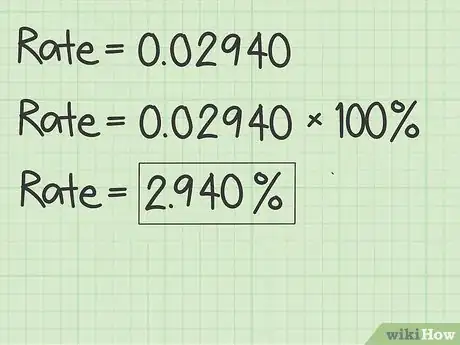

5Interpret your result as a percentage. The growth rate formula provides you with a final result as a decimal number. To convert this to a percentage form that makes sense to economists, multiply by 100%. You can then report the annual growth rate as a percentage figure.[8]

- For example, again using the data from 2015 to 2016, the calculation produced a result of 0.02940. Convert this to a percentage as follows:

- Thus, you can report that the annualized growth rate of the U.S. GDP from 2015 to 2016 is 2.940%. Because the figure is positive, the GDP is improving over that time period.

- For example, again using the data from 2015 to 2016, the calculation produced a result of 0.02940. Convert this to a percentage as follows:

Focusing on Growth Rates for Other Terms

-

1Collect the data for a chosen time period. A comparison of GDP growth rates does not have to be limited to annual data. In fact, economists often want to know results and see trends over smaller time periods.[9] In the U.S., the BEA calculates and reports GDP data each quarter.[10]

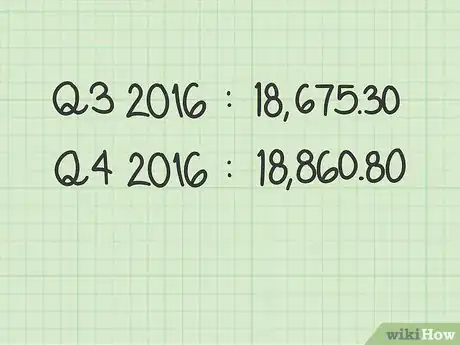

- You can use and manipulate the data in any way you wish, as long as you define your calculations appropriately. For example, you might want to measure a short-term GDP growth from the third quarter of 2016 to the fourth quarter of 2016.

- Alternatively, you might want to compare the third quarter of 2015 to the third quarter of 2016. Note that, while this is a measure of data from two different years, this is not an annualized calculation. It is a comparison of a specific portion of each year, perhaps to determine whether the time of year has any impact on spending or production.

- Finally, someone studying long range changes in economies might even want to compare decades. For example, you could compare the GDP from 1980-1989 to the GDP from 1990-1999. You would do this by adding together the GDPs of the ten individual years.

-

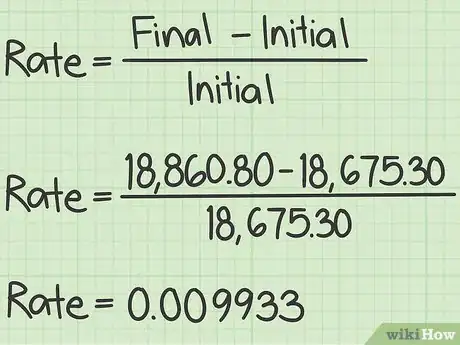

2Use the same percent change formula. Whether you want to calculate a growth rate over an annual range or for a shorter or longer time period, the formula remains the same. You find the difference of the two chosen time periods, divided by the GDP of the initial time period.[11]

- While you can measure quarters, years, decades or any other period you wish, you must be consistent. For example, it would be meaningless to compare the GDP of one quarter of a year, to the GDP of another full year.

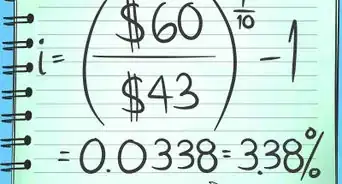

- Suppose, for example, you wish to find the growth rate of the GDP from the third quarter of 2016 ($18,675.30) to the fourth quarter of 2016 ($18,860.80). The calculation would be as follows:

-

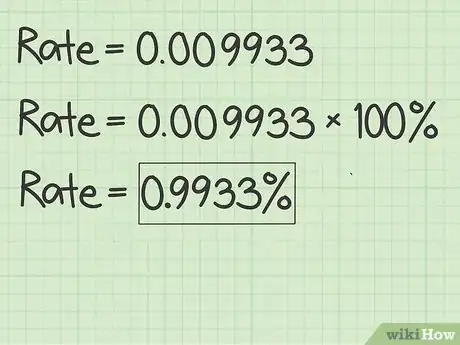

3Convert and interpret the result. Finally, use the figure that you obtain from the calculation and convert it to a percentage by multiplying by 100%. The result is the growth or decline of the GDP over your selected time period.[12]

- For the final two quarters of 2016, this calculation is:

- You would report that the GDP increased by 0.9933%, or almost 1% over the given two quarters.

- For the final two quarters of 2016, this calculation is:

Calculating the GDP

-

1Identify a location. The GDP is the gross domestic product of any identified geographic area. Usually, people measure and compare the GDP of individual countries. However, within the U.S., you might compare the GDP of separate states. On a broader scale, you may wish to find the GDP of North America or Asia.[13]

- Just as you need to define a location if you want to calculate GDP growth rates, you also need to understand what location is being represented when you read GDP data.

-

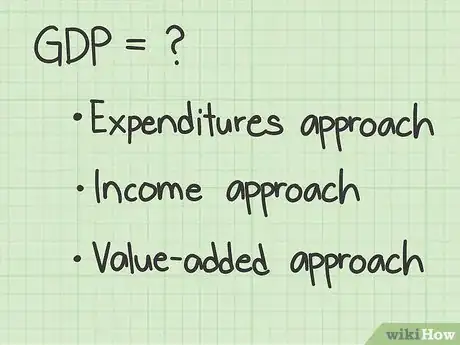

2Select a method for measuring GDP. The GDP can be calculated in one of three different ways. Each method is valid but describes a slightly different approach to viewing the economy. When you calculate the GDP, you need to define which method you are using. The three methods are:[14]

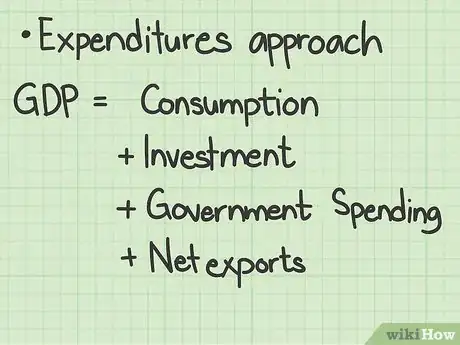

- Expenditures approach. This method calculates the sum of expenditures by final consumers of products. The traditional formula when calculating GDP in this way is:

- GDP = Consumption + Investment + Gov’t Spending + (Exports - Imports)

- Income approach. Less commonly used, this method accounts for all the incomes earned and costs incurred in the country’s production.

- Value-added approach. This calculation measures the total sales of an area minus the value of services or supplies added during the course of production. This approach is regularly used in measuring U.S. industrial production.

- Expenditures approach. This method calculates the sum of expenditures by final consumers of products. The traditional formula when calculating GDP in this way is:

-

3Research the data that comprises the GDP. The expenditures approach is the most direct calculation and the one most commonly used and studied by economists around the world. This calculation takes into account the following basic areas:

- Consumption. This first term accounts for personal consumption expenditures, which is basically the total amount of money that the population spends over the selected time period. The BEA breaks this down into two subcategories of goods and services. Goods are concrete items that can be bought and sold, and services are payments for other people’s labor or expertise.

- Investment. The investment figure constitutes the total of purchases that businesses make in the process of creating their products. This would include purchases of all supplies used in production as well as new equipment or machinery used to expand production. The investment category also includes materials used in residential construction projects.

- Government Spending. This item tracks what the government of the chosen region or country actually spends over the selected time period. Values are calculated at the prices that the government actually spends on items as diverse as office equipment, building supplies for government projects or weapons and items for the military.

- Net exports. Some formulas for GDP include a single term of “net exports,” while others will incorporate two terms, exports and imports. As long as both are included, the result will be the same. The calculation is to add all exports to the GDP and deduct the value of all imports. The net is the positive growth for the GDP.

-

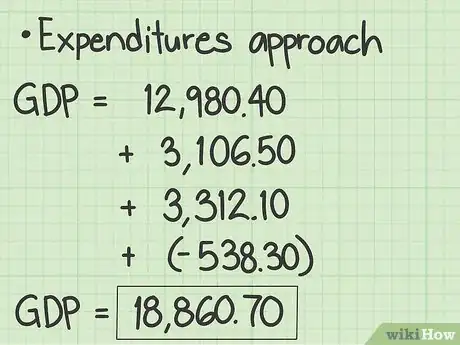

4Compile the data for the final calculation. The GDP, in basic terms, is the sum of the data that you calculated in the preceding step. When all the portions are determined, they are added to provide the final result.[15]

- For example, the BEA reports the following figures for the fourth quarter GDP of 2016 (figures are in billions of dollars):

- Consumption = $12,980.40

- Investment = $3,106.50

- Government = $3,312.10

- Net exports = -$538.30

- GDP = $18,860.70

- For example, the BEA reports the following figures for the fourth quarter GDP of 2016 (figures are in billions of dollars):

Expert Q&A

-

QuestionDoes GDP represent the overall success of a country?

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Author, Speaker, & CEO of Mindful Money The growth of GDP shows the economic success of a country. It has some limitations. Many economists suggest including measures of well-being among the current measurements to determine the absolute and relative success of a country.

The growth of GDP shows the economic success of a country. It has some limitations. Many economists suggest including measures of well-being among the current measurements to determine the absolute and relative success of a country. -

QuestionWhat does annualized GDP tell you about a country?

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Jonathan DeYoe, CPWA®, AIF®Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

Author, Speaker, & CEO of Mindful Money GDP is the value in local currency of all the goods and services produced within a specific geography (city, state, or country) over a specific period of time. It's often used to provide a picture of how a country is doing compared to other countries and to itself over time.

GDP is the value in local currency of all the goods and services produced within a specific geography (city, state, or country) over a specific period of time. It's often used to provide a picture of how a country is doing compared to other countries and to itself over time. -

QuestionWhat if the GDP growth rates for two time periods are negative and the final rate is more negative than the initial?

Ed RozmiarekCommunity AnswerThis would indicate a greatly declining economy. Apply the formula for calculating growth rate changes and just input the negative numbers that you have. Be careful with your calculations, so you don't get confused when subtracting negative numbers.

Ed RozmiarekCommunity AnswerThis would indicate a greatly declining economy. Apply the formula for calculating growth rate changes and just input the negative numbers that you have. Be careful with your calculations, so you don't get confused when subtracting negative numbers.

References

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

- ↑ https://www.bea.gov/

- ↑ https://www.omnicalculator.com/finance/gdp-growth

- ↑ https://www.omnicalculator.com/finance/gdp-growth

- ↑ Alex Kwan. Certified Public Accountant. Expert Interview. 1 June 2021.

- ↑ https://www.bea.gov/data/gdp/gross-domestic-product

- ↑ https://www.omnicalculator.com/finance/gdp-growth

- ↑ https://www.omnicalculator.com/finance/gdp-growth

- ↑ https://www.bea.gov/resources/learning-center/what-to-know-gdp

- ↑ https://www.bea.gov/national/pdf/nipa_primer.pdf

- ↑ https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/economic-iondicators-and-the-business-cycle/21/a/the-circular-flow-and-gdp

- ↑ Jonathan DeYoe, CPWA®, AIF®. Author, Speaker, & CEO of Mindful Money. Expert Interview. 15 October 2020.

About This Article

To calculate annualized GDP growth rates, start by finding the GDP for 2 consecutive years. Then, subtract the GDP from the first year from the GDP for the second year. Finally, divide the difference by the GDP for the first year to find the growth rate. Remember to express your answer as a percentage. To learn how to find or calculate GDP, scroll down!