This article was co-authored by Jonathan DeYoe, CPWA®, AIF®. Jonathan DeYoe is a Financial Advisor and the CEO of Mindful Money, a comprehensive financial planning and retirement income planning service based in Berkeley, California. With over 25 years of financial advising experience, Jonathan is a speaker and the best-selling author of "Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend." Jonathan holds a BA in Philosophy and Religious Studies from Montana State University-Bozeman. He studied Financial Analysis at the CFA Institute and earned his Certified Private Wealth Advisor (CPWA®) designation from The Investments & Wealth Institute. He also earned his Accredited Investment Fiduciary (AIF®) credential from Fi360. Jonathan has been featured in the New York Times, the Wall Street Journal, Money Tips, Mindful Magazine, and Business Insider among others.

This article has been viewed 194,065 times.

There are several calculations that a country can make when trying to measure its economic progress. The gross domestic product (GDP) has become the foremost measure of economic activity for most countries. It is the measure of a nation's goods and services that it produces over a period of time. The goods and services that are measured are those that the country actually produces within its borders. The GDP is expressed in terms of its own local economy. Since the measurement of GDP is widely used and expressed it is important to know how to calculate the growth rate of nominal GDP.

Steps

Calculating Nominal GDP

-

1Understand the distinction between nominal and real GDP. Nominal GDP is the GDP of the country measured at current market prices. Real GDP, on the other hand, is adjusted for inflation or deflation. Many economist use real GDP instead of nominal GDP when determining the growth rate of an economy.[1]

- Nominal GDP represents the output of the country at current prices, and therefore is useless when comparing output for different periods.

- For example, knowing that a country's annual nominal GDP was $1 billion in 1940 but $200 billion now does not tell you much about the actual relative output between those two periods. You would have to convert the figures to real GDP to see how they compare.[2]

-

2Add together that period's consumer spending or consumption. Nominal GDP can be calculated by adding together the country's expenditures over the time period. Four categories of spending are added together, the first being consumption. This is the sum that consumers spend on durable goods, non-durable goods, and services. This would include personal items such as food, clothing, rent, and services like health care.[3]

- Consumption is the largest and most stable part of nominal GDP.

- However, imported goods are not included, as they are part of the final category, net exports.

Advertisement -

3Sum all investments. The second part of nominal GDP is investment. This represents all of the money spent on capital equipment, increases in inventory, and structures. Items that would fall into this category include the purchase of business machinery, new homes, and the construction of new factories.[4]

- Stocks and bonds are not included here since they do not add to any actual output.

-

4Add together all government spending. This is the accumulation of spending by all levels of government on goods and services. Examples include military purchases, teacher pensions and government salaries. Deducted from this amount are government transfer payments such as welfare or unemployment payments.[5]

-

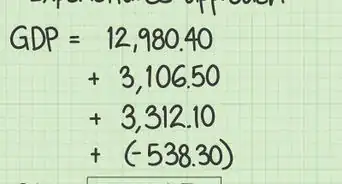

5Determine the net exports. The sum of all imports is calculated and then subtracted from the sum of all exports. The difference between the amount of foreign goods consumed domestically and the amount of domestic goods consumed in foreign countries makes up the net exports. When exports exceed imports, it adds to the amount of GDP.[6]

- Add up the four categories to arrive at nominal GDP for the time period.

-

6Calculate the GDP for the prior period. In order to calculate your nominal GDP growth rate, you'll need nominal GDP figures for more than one time period. These periods can be consecutive or removed by any number of periods, as long as you have reliable data for each. Check to make sure that your nominal GDPs are for the same time period, for the same nation, and expressed in the same currency.[7]

Calculating Nominal GDP Growth Rate

-

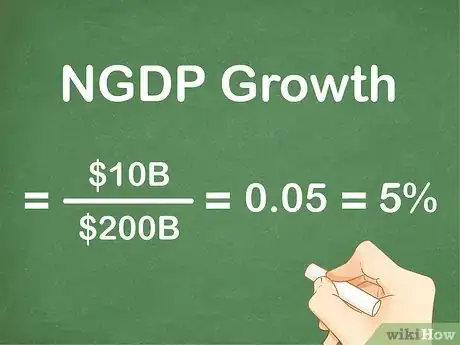

1Set up your equation. The simplest way to calculate nominal GDP growth is by analyzing two consecutive periods.[8] For this type of calculation, the formula is simply the one for percent change. Specifically, it is . In the formula, represents the later period and is the earlier.

- Enter your own data to calculate nominal GDP growth.

- For example, if NGDP were $200 billion one period and $210 the next, your equation would be:

-

2Calculate simple GDP growth. Simply perform the subtraction and division specified by the equation to solve. Your answer will be a decimal and must be multiplied by 100 to arrive at your growth rate in percentage form.[9]

- Using the previous example, the equation would first solve to .

- Then, dividing gives .

- Finally, multiply by 100 to get .

- Your nominal GDP growth rate between the two periods is 5 percent.

-

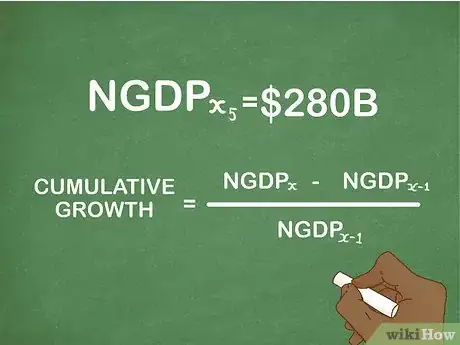

3Find cumulative growth over a longer time period. Cumulative growth refers to the total growth in nominal GDP between non-consecutive periods. It is calculated the same way as consecutive growth, by substituting for a later period and for the earlier one. Use the method described for calculating simple NGDP growth to find cumulative growth.[10]

- For example, imagine that a record of nominal GDP growth shows a value of $200 billion one year and $280 billion five years later.

- The cumulative growth can be calculated as 40 percent using the above method.

-

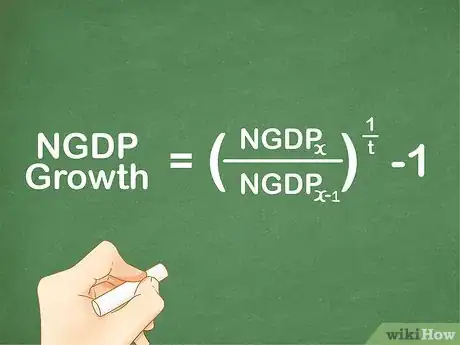

4Convert cumulative growth to average growth. Average growth can show you how much a figure grew each period during a longer time period. You might think that the average growth would simply be the cumulative growth divided by the number of periods, but this is not the case. Average growth is calculated using a different formula.

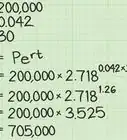

- The formula, specific to calculating NGDP, can be expressed as .[11]

- The variable represents the number of time periods.

- So, continuing with the cumulative growth example, we would have .

- This would then simplify to .

- Then, the exponent can be solved by raising 1.4 to the power of 1 divided by 5, or 0.2. This is done on a calculator using the exponent button or can be entered into a search engine as "1.4^0.2". The result is 1.0696 when rounded to four decimal places.

- This leaves the equation as .

- So, the result is .

- Multiplying by 100, we get the average growth rate over the time period, which is 6.96 percent.

- The formula, specific to calculating NGDP, can be expressed as .[11]

Using Nominal GDP Growth

-

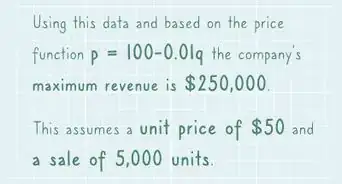

1Figure out the total output of a nation. The primary function of nominal GDP is to express the total output of a country over a time period (usually a quarter or year) at its present market value. Nominal GDP growth can then be used to find the growth or decrease in output between years with inflation or deflation included. While this growth may not serve as a reliable measure of actual output between years, comparing market values between years can be useful for other purposes.[12]

-

2Assess inflation. The primary use of nominal GDP growth is to measure inflation between years. Real GDP growth is calculated for the same set of years. Then, the two growth rates are compared to assess inflation. If nominal GDP is rising faster than real GDP, the country's currency is experiencing inflation. If nominal GDP is growing at a slower rate, the country is experiencing deflation.[13]

-

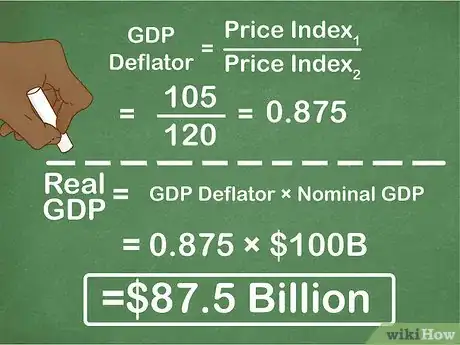

3Convert to real GDP. Real GDP adds one more step to the summation of nominal GDP by factoring out inflation or deflation from GDP. The nominal GDP is modified by the GDP deflator, a measure of relative prices, to arrive at real GDP. The GDP deflator is composed of price indexes for the two periods being compared. For example, the price indexes of two years might be 105 for a base year and 120 for the current.[14]

- The GDP deflator to convert nominal GDP for the current year to real GDP would then be , or 0.875.

- So, if the nominal GDP for that year were $100 billion, real GDP would be , or $87.5 billion.

Community Q&A

-

QuestionWhat is the formula of GNI?

Community AnswerGross National Income (GNI) is calculated a country's GDP plus net income received from overseas sources. It measures the country's total income from domestic and foreign sources for a given year. Overseas income might include employee compensation and property income received by residents from foreign sources.

Community AnswerGross National Income (GNI) is calculated a country's GDP plus net income received from overseas sources. It measures the country's total income from domestic and foreign sources for a given year. Overseas income might include employee compensation and property income received by residents from foreign sources. -

QuestionHow can I compare the GDP growth rates of two countries?

Community AnswerCalculate the GDP growth rate for each country. Then, compare the two rates over a period of years to assess how the growth rates stack up against each other.

Community AnswerCalculate the GDP growth rate for each country. Then, compare the two rates over a period of years to assess how the growth rates stack up against each other.

References

- ↑ https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/economic-iondicators-and-the-business-cycle/real-vs-nominal-gdp/a/lesson-summary-real-vs-nominal-gdp

- ↑ http://www.diffen.com/difference/Nominal_GDP_vs_Real_GDP

- ↑ https://www.cbinsights.com/research-how-to-calculate-nominal-gdp

- ↑ https://www.cbinsights.com/research-how-to-calculate-nominal-gdp

- ↑ https://www.cbinsights.com/research-how-to-calculate-nominal-gdp

- ↑ https://www.cbinsights.com/research-how-to-calculate-nominal-gdp

- ↑ https://www.cbinsights.com/research-how-to-calculate-nominal-gdp

- ↑ https://courses.lumenlearning.com/wm-macroeconomics/chapter/converting-real-gdp/

- ↑ https://courses.lumenlearning.com/wm-macroeconomics/chapter/converting-real-gdp/