This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 14 testimonials and 92% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 260,169 times.

Dealing with auditors can be a pain because it does require tedious work on the part of those being audited. That might seem unfair, but in all actuality, the auditor has just about as much work to do. The difference is that the auditor has a lot of pre-work research and the audited has a lot of work to do during the audit. Being an auditor is a rewarding career; although the process might be the same, the job itself is always changing, and there is always something new and different every day. You of course have to know how to audit to be an auditor, but once you learn the basics, actually performing audit work as an auditor is fairly simple but very rewarding.

Steps

Planning the Audit

-

1Confirm that you are suitable for performing the audit. It needs to be certain that any auditor is absolutely objective in their assessment. Therefore, it is required that the auditor be completely independent from the company. This means that the auditor can have no relationship with the company outside of the audit. This includes that the auditor(s):

- Not hold any interest in the company (not own any of the company's stock or bond offerings)

- Not work for the company in any other capacity.

- Be rotated regularly during the audit process to get fresh opinions on the material.

-

2Assess the size of the audit. Before entering into the audit process, the auditor or auditing team should analyze the company and assess the scope of the work. This includes an estimate of how many team members should work on the audit and how long it will take. Additionally, it includes an assessment of any special or work-intensive investigations that must be made during the audit. Figuring this out can help the auditor assemble a team, if necessary, and can provide the company being audited with a timeframe for the process.Advertisement

-

3Identify potential mistakes. Before beginning the audit, the auditor should use their past experience and industry knowledge to attempt to predict areas where the company may have misstated financial information. This will require an in-depth knowledge of both the company and its current operating environment. Obviously, this is a very subjective assessment, so the auditor will have to rely on their own judgment.

-

4Build an audit strategy. Once preliminary assessments have been made, you will need to create a plan to carry out the audit. Lay out all of the different actions that need to be taken, including areas that you think may be of the most interest. Assign team members to each task, if applicable. Then, create a timeline for when each action needs to be completed. Know that this timeline may be changed significantly throughout the auditing process in response to new information.

Conducting the Audit

-

1Give advance notice. You will need to give the organization being audited plenty of time for them to get their records ready. Tell them the time period to be audited (the fiscal year, for example), and a list of documents that they need to have ready for review. These include:[1]

- Bank statements for the year being audited

- Bank account reconciliation reports. This is where bank statements were compared to cash receipts and disbursements.

- Check register for the time period being audited

- Canceled checks

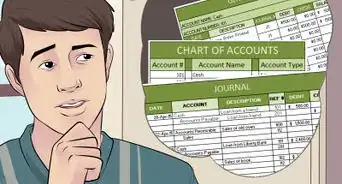

- A list of transactions that were posted to the general ledger (a manual or online system that tracks a company's transactions, including income and expenditures).

- Check request and reimbursement forms, including receipts and invoices for all expenditures

- Deposit receipts

- The annual budget and monthly treasurer reports

-

2Verify that all outgoing checks were properly signed, accounted for and posted to the correct accounts. If they can be substantiated, all the better. However, as an external auditor, that's not in your scope of influence. You just need to make sure everything was posted to the proper account.

- For example, there may be two different Accounts Payable, one for raw materials and one for office supplies.

-

3Ensure that all deposits were properly posted. This means they were entered into the correct accounts and ledger line in the general ledger. Very basically, these would be accounts receivables, but they should be further broken down (or could be) into specific receivables, depending upon the complexity of the organization.

- For example, revenue from the sale of a product would be entered into accounts receivable, while dividends issued might be entered into Retained Earnings.[2]

Auditing Financial Statements and Reports

-

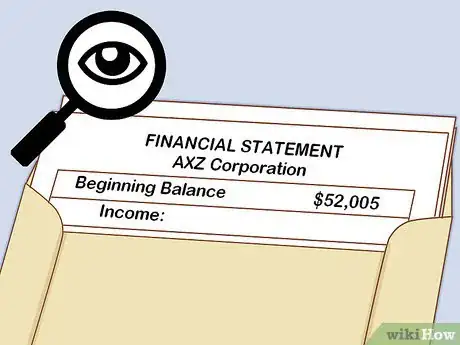

1Review all financial statements. These include balance sheets and income statements for the time period being audited. Ensure that all transactions are properly recorded and accounted for in the general ledger. Any unusual deposits or withdrawals must be noted and ensured that they were properly accounted for and legitimate. Check that all these accounts were reconciled monthly.

- An unusual deposit might be a very large amount or one from a business located outside the country. Unusual withdrawals would be if substantial amounts of money are going to one person or business over a long period of time.

- Reconciling means comparing two different reports or documentation. For example, cash and investments are compared to bank and brokerage firms' statements. Additionally, receivable and payable accounts should be compared to customer orders and bills, respectively. For inventory, a physical count and valuation can be done at least once a year to make sure the information in the general ledger is accurate.

- For reconciliation, the auditor doesn't need to look at every single transaction. Taking a statistical sample of the total number of transactions (analyzing a small number and applying the percentage error to the whole set) can provide similar results in a shorter time.

-

2Ensure compliance with all state and federal requirements. If you are auditing a non-profit organization, verify their 501 tax-exempt status and that the proper forms have been filed. Ensure federal and state taxes returns, incorporation renewal and state sales tax forms, example, have been filed as necessary.[3]

-

3Review all the treasurer's reports. Make sure that what was reported was recorded and the totals from report to ledger books match accurately. Check to see that an annual treasurer's report was prepared and filed.

Completing the Audit and Making Recommendations

-

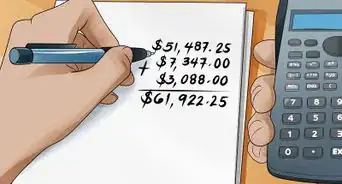

1Complete the financial review worksheet. This is a summary of all the activity for the period (usually annually, but could be quarterly as well). This includes:[4]

- The cash balance at the beginning of the period

- All of the receipts during that time

- Any and all of the payouts during that time

- The cash at the end of the period

-

2Suggest improvements to internal controls. Make sure to especially note when improprieties exist. If you are asked to do so, assess the organization's performance against their budget or other metrics.

- For example, you may want to suggest that two people sign every check, not just one. There may be documents that are disposed of at the end of the year, when they should be saved for a longer time period for tax purposes. Point out that originals need to be saved, not copies. Define the time period that all emails should be saved, usually for 7 years.

-

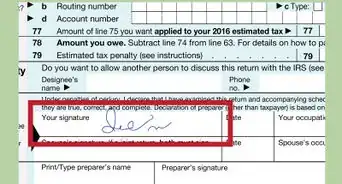

3Determine your audit opinion. At the conclusion of the audit, the auditor must draft an audit opinion. This document states whether or not the financial information provided by the company is free of error and reported correctly under generally accepted accounting principle (GAAP) standards. Whether or not the reports meet these criteria is up to the judgment of the auditor. If they are reported correctly and free of error, the auditor issues a clean opinion. If not, the auditor issues a modified opinion. Modified opinions are also used if the auditor feels as though they were unable to issue a complete audit (for any reason).

-

4Submit your signed document. This is a statement that you have completed the audit and you have found that either the ledgers are accurate or that there are issues. If you found any issues, such as missing checks or receipts (without explanation) or otherwise a math discrepancy, you should point those out in the report. It is also helpful to include any information you deem appropriate to assist in fixing those issues or preventing their recurrence for the next audit period.[5]

References

- ↑ http://www.ptotoday.com/pto-today-articles/article/396-annual-audit-how-and-why

- ↑ http://www.accountingcoach.com/stockholders-equity/explanation/6

- ↑ http://www.ptotoday.com/pto-today-articles/article/396-annual-audit-how-and-why

- ↑ http://www.ptotoday.com/pto-today-articles/article/396-annual-audit-how-and-why

- ↑ http://www.ptotoday.com/pto-today-articles/article/396-annual-audit-how-and-why

About This Article

To conduct an audit, start by giving the person or company you're auditing plenty of advance notice, including a list of documents they need to have ready for review. Then, once you're presented with all of the documents you requested, review all of their outgoing checks and incoming deposits, their financial statements, their treasurer's report, and whether they're in compliance with state and federal requirements. When you're finished reviewing everything, complete a financial review worksheet, and make your recommendations about how to improve internal controls. For more tips from our Financial co-author, like how to prepare for an audit, read on!