This article was co-authored by Madison Boehm. Madison Boehm is a Business Advisor and the Co-Founder of Jaxson Maximus, a men’s salon and custom clothiers based in southern Florida. She specializes in business development, operations, and finance. Additionally, she has experience in the salon, clothing, and retail sectors. Madison holds a BBA in Entrepreneurship and Marketing from The University of Houston.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 459,086 times.

Overhead costs are the expenses paid to keep your business running, whether you are in high demand or barely producing a product.[1] Having a solid record of your overhead costs will help you set a better price for your product or service, show where you can save money, and illuminate ways to streamline your business model.[2] But these benefits only come from careful bookkeepers, so read on to figure out the best way to calculate your business's overhead costs.

Steps

Sample Overhead Calculator

Finding Your Overhead Costs

-

1Understand that overhead costs are expenses that do not directly relate to your product. They are also known as indirect costs.[3] Indirect costs are things like rent, administrative staff, repairs, machinery, and marketing costs that are essential to your business operations and must be paid regularly.[4]

- In our example, indirect costs such as postal rates and insurance are necessary to run a business, but not making a product.

- As you calculate your overhead, make sure to consider whether something is a fixed cost or a variable cost as well.[5] Fixed costs are those that do not change, and variable costs are those that change according to your business's activity and level of production.[6]

-

2Know that direct cost is the cost of creating a good or service. These costs will fluctuate based on demand for your product and the market price of materials. If you are starting a bakery, direct costs would be labor wages and ingredients. If you are running a health clinic, they would be your doctors' salaries, stethoscopes, etc.[7]

- The most frequent direct costs, as illustrated above, are wages and materials.

- In simplified terms, direct costs pay for the things on the assembly line, while indirect costs pay for actual assembly line.

Advertisement -

3Make a list of every expense for one month, quarter, or year. While you can choose any time frame you'd like, most businesses break down their expense reports by month.[8]

- Be consistent with your time-frame -- if you calculate indirect costs monthly, you must calculate direct costs monthly too.

- Using computer programs like QuickBooks, Excel, or Freshbooks can help you keep your list organized and accessible.[9]

- Don't worry just yet about what expense goes where. You need the full picture of your expenses before you can calculate overhead.

-

4Account for common overhead (indirect) costs. All companies have inevitable expenses that include taxes, rent, insurance, licensing fees, utilities, accounting and legal teams, administrative staff, facility upkeep, etc.[10] Leave no stone unturned!

- Look over expense reports and receipts from the past to make sure you aren't missing anything.

- Don't forget about recurring expenses, such as renewing a license or filing permits, that occur infrequently. They still count as overhead.

-

5Use old costs or estimates if you don't know your exact expenses yet. If you are a new or aspiring businessperson, you'll need to do thorough research on the costs of supplies, labor and potential overhead.

- If you have old accounting books, you can use those to plan for next year's costs. Unless you are making large changes to your business plan, they are often similar numbers.

- Average your old costs over 3-4 months to adjust for any statistical anomalies.

-

6Divide your list into direct and indirect costs based on your business model. Every business is different and you may make a judgement call on certain expenses. For example, while legal expenses are generally overhead costs, they directly contribute to production if you run a law firm.

- If you are still confused, think of overhead costs as those you would pay if you stopped producing anything at all. What keeps your business running every day?

- Update this list every time you incur new expenses.

-

7Add all of the indirect costs together to get your total overhead costs. This is the amount of money that you need to stay in business. In the example above, our yearly overhead would be $16,800. Knowing this number is crucial when creating a business plan.

Understanding Your Business's Overhead Costs

-

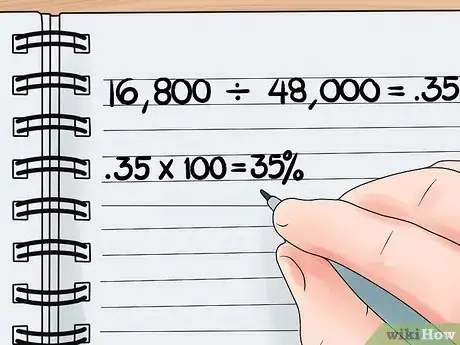

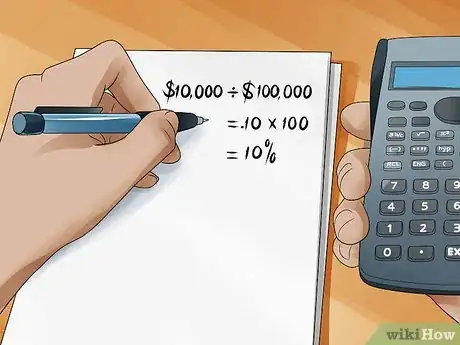

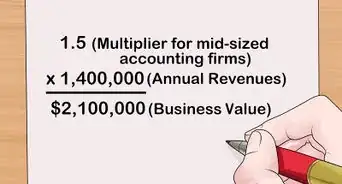

1Find your overhead percentage. An overhead percentage tells you how much of your business is spent on overhead and how much is spent making a product.[11] To find out your overhead percentage:

- Divided indirect costs by direct costs. In the example above, our overhead rating is .35 (16,800 / 48,000 = .35)

- Multiply this number by 100 to get your overhead percentage. Here, 35%

- This means that your business spends 35% of its money on legal fees, administrative staff, rent, etc. for every product it produces.

- The lower your overhead rating, the larger your profit. A low overhead rating is good!

-

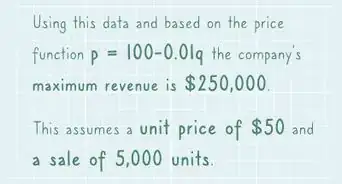

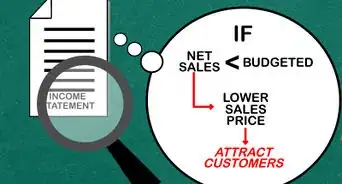

2Use your overhead rating to compare yourself to similar businesses. Assuming that all similar businesses pay roughly the same direct costs, companies with a lower overhead rating make more money when they sell their product.[12] By lowering your overhead rating, you can sell your product at a more competitive price and/or earn higher profits. [13]

Using Overhead Costs To Better your Business

-

1Divide your overhead costs by your labor costs to see how efficiently you use your resources. Multiply this by 100 to get the percentage of overhead used by each worker.

- When this number is low, it means your business spends its overhead costs efficiently.

- If this number is too high, you might employ too many people.

-

2Calculate what percentage of your revenue pays for overhead. Divide your overhead costs by the amount made in sales, then multiple by 100 to get your percentage.This is a simple way to see if you are selling enough goods/services to keep yourself in business.

- Ex. If my business sells $100,000 worth of soap a month, and it costs me $10,000 to keep my office running, then I spend 10% of my revenue on overhead.

- The higher this percentage, the lower your profit margin.

-

3Trim or manage your overhead costs if these numbers are too high. Know the difference between revenue and profit. Revenue is what you earn every month. But profit is what remains after paying for all the expenses.[14] Wondering why you aren't making a huge profit? You might be paying too much rent, or need to sell more products to cover overhead costs. Perhaps you have too many workers and are not spending wisely to keep them all employed. Use these percentages to take a closer look at your business model and make changes accordingly.[15]

- All businesses pay overhead, but those that manage their overhead costs wisely turn a higher profit.

- That said, having low overhead isn't everything. If you spend money on good equipment or worker satisfaction, for example, you might have higher productivity and higher profits.

Expert Q&A

-

QuestionWhat are fixed and variable costs?

Madison BoehmMadison Boehm is a Business Advisor and the Co-Founder of Jaxson Maximus, a men’s salon and custom clothiers based in southern Florida. She specializes in business development, operations, and finance. Additionally, she has experience in the salon, clothing, and retail sectors. Madison holds a BBA in Entrepreneurship and Marketing from The University of Houston.

Madison BoehmMadison Boehm is a Business Advisor and the Co-Founder of Jaxson Maximus, a men’s salon and custom clothiers based in southern Florida. She specializes in business development, operations, and finance. Additionally, she has experience in the salon, clothing, and retail sectors. Madison holds a BBA in Entrepreneurship and Marketing from The University of Houston.

Business Advisor, Jaxson Maximus Fixed costs are the ones that don't change per month, like rent, utilities, some of your payroll, etc. Variable costs, on the other hand, are things that change on a monthly basis, like inventory costs, marketing expenses, etc.

Fixed costs are the ones that don't change per month, like rent, utilities, some of your payroll, etc. Variable costs, on the other hand, are things that change on a monthly basis, like inventory costs, marketing expenses, etc.

Warnings

- The steps detailed here are designed to give you a better idea of how to get quantifiable data on your business. Every company is different, so how to maximize your overhead costs is not an exact science.⧼thumbs_response⧽

References

- ↑ https://www.investopedia.com/terms/o/overhead.asp

- ↑ https://www.inc.com/nina-ojeda/4-simple-ways-to-cut-your-company-overhead.html

- ↑ https://www.entrepreneur.com/encyclopedia/overhead

- ↑ Madison Boehm. Business Advisor, Jaxson Maximus. Expert Interview. 29 September 2021.

- ↑ Madison Boehm. Business Advisor, Jaxson Maximus. Expert Interview. 29 September 2021.

- ↑ https://strategiccfo.com/variable-vs-fixed-cost/

- ↑ https://www.investopedia.com/terms/d/directcost.asp

- ↑ https://www.investopedia.com/terms/b/businessexpenses.asp

- ↑ https://www.nerdwallet.com/blog/small-business/20-apps-small-business-owners/

- ↑ https://www.accountingtools.com/articles/what-is-indirect-overhead.html

- ↑ https://missouribusiness.net/article/calculating-overhead-and-price/

- ↑ https://www.investopedia.com/terms/o/overhead-rate.asp

- ↑ http://www.inc.com/articles/2000/05/18841.html

- ↑ Madison Boehm. Business Advisor, Jaxson Maximus. Expert Interview. 29 September 2021.

- ↑ https://hbr.org/2010/05/when-youve-got-to-cut-costs-now

About This Article

To calculate overhead, add up all of the indirect costs of running your business each month, like equipment, rent, and utility bills. Keep in mind that overhead is how much it costs to keep your business up and running without selling anything at all. Do not include direct costs, like the amount spent on wages or inventory. If you want, you can divide your overhead from your sales to see how much of your revenue is going to overhead costs. For instructions from our MBA reviewer on how to find your overhead percentage, read on!

-Step-04.webp)