This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 364,791 times.

If you are due money back on your federal or state taxes, you'll want to know when you can expect that refund check or direct deposit to arrive. If asking about a tax return filed with the United States federal government, you can check either online (www.irs.gov/refunds), via an IRS smart app (IRS2Go), or by phoning the IRS refund information hotline directly (800-829-1954). Similar services are available for gathering information about your state taxes, but each U.S. state operates a separate website for handling taxes and refunds.[1] In all cases, you will need to have specific information about your tax filing handy in order to get information about the status of your refund.

Steps

Checking the Status of a Federal Tax Return Online

-

1Give the IRS time to receive and process your return. It takes time for the IRS to process your taxes. Give them adequate time before checking on the status of your refund.

-

2Have the necessary information ready. When you go on the IRS website to get your tax return, the system will ask you for a variety of information. Have a copy of your federal tax return on hand so you can enter the information easily. The system will ask for the following:

- Your Social Security Number, or your Individual Taxpayer Identification Number

- Your filing status (Single, Married Filing Joint Return, Married Filing Separate Return, Head of Household, or Qualifying Widow(er))

- The exact whole dollar refund amount shown on your tax return[4]

Advertisement -

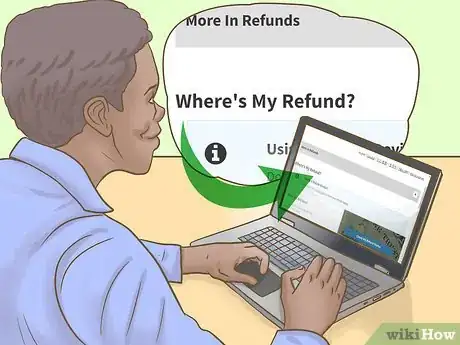

3Use the "Where's My Refund?" tool. When you go to irs.gov, there will be an icon that says "Where's my Refund?" When you click on this tool, it will ask for information about you and your tax return and give you a response based on that information. Possible responses may include, but are not limited to:

- An acknowledgement that your return is processing, meaning you'll have to wait a big longer to get any further information.[5]

- The mailing or direct deposit date when your refund is scheduled to arrive.[6]

- A notice that your address was incorrect, so your refund could not be delivered. You may be able to correct this issue by updating your address through the Where's My Refund? Tool, or you can call the IRS and get it straightened out.[7]

-

4Customize your search if necessary. The "Where's My Refund" tool may be limited for some. If you need to customize your search, there are options.

Checking the Status of a Federal Tax Return over the Phone

-

1Call the toll-free number. If you do not have access to the Internet or simply prefer doing things over the phone, there is a number you can call to check on your tax refund.

- The IRS has 2 toll-free numbers you can call. The first is the IRS Refund Hotline, which can be reached at 800-829-1954. This number, available 24/7, is specifically for calls regarding tax refunds. If you don't have other questions regarding your taxes, try this number first.[10]

- The TeleTax system at 800-829-4477 provides general tax information as well as your current refund status. It is also available 24/7.

-

2Get your information ready. The automated system or the representative you speak to will need certain information in order to help you. Have a copy of your federal tax return on hand. You will be asked for the following:

- Your Social Security Number, or your Individual Taxpayer Identification Number

- Your filing status (Single, Married Filing Joint Return, Married Filing Separate Return, Head of Household, or Qualifying Widow(er))

- The exact whole dollar refund amount shown on your tax return

-

3Use a mobile phone app if you prefer. You can also use your mobile phone to check the status of a tax return. Recently, the IRS released IRS2Go, a smart phone application that allows you to handle taxes online.

- If you are an Apple user, you can download IRS2Go from the Apple App Store. If you have an Android, visit the Android Marketplace.[11]

- You will still need to enter some basic information into your phone when using the IRS2Go app, but you may be able to preload and save information in the app to speed up the process.[12]

Checking the Status of State Tax Return

-

1Make sure your state collects a state income tax. Not every state collects a state income tax. If you live in any of the following states, your state does not collect income taxes and therefore does not provide tax refunds:

- Alaska, Florida, Nevada, South Dakota, Texas, and Wyoming do not have an income tax. You do not need to file a tax return in these states and you will not receive a refund.[13]

- New Hampshire and Tennessee do collect an income tax, but only tax dividends and not wages or earnings. If your dividends do not exceed a certain amount, you will not be taxed. Visit the New Hampshire or Tennessee tax division website for further information on whether or not you will be taxed.[14]

-

2Visit your state's tax division website. Each state has different means of providing information on tax refunds. In order to find out how to locate information in your state, you'll need to visit your state's tax division website. This can usually be found through an internet search engine. The site should provide a number you can call to talk to a representative if you have any questions.

-

3Gather the necessary information. The information you need varies from state to state. You should have a copy of your state tax return on hand, in case you need to enter the exact dollar refund amount. Be prepared to enter your social security number or individual tax ID number, as well as your filing status.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionI've been waiting longer than three to four weeks on federal return and has been saying processing the whole time. Is there any way to find out why?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant If you electronically filed your return and it has been longer than 3 weeks since you filed, you can call the IRS to speak with a representative to help identify what the hang up is for your refund. If you filed your return on paper, you will need to wait until it has been 6 weeks to call the IRS to follow up.

If you electronically filed your return and it has been longer than 3 weeks since you filed, you can call the IRS to speak with a representative to help identify what the hang up is for your refund. If you filed your return on paper, you will need to wait until it has been 6 weeks to call the IRS to follow up. -

QuestionHow do I find out if someone has fraudulently filed my taxes?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

-

QuestionHow do I find out my refund amount?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

Warnings

- Entering private information into a public computer may expose you to risk of identity theft. On any computer, log out of the IRS website and close your browser after you are finished. Only access the IRS website through an ethernet cable or a password protected wi-fi network.⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/state-links-1

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ http://www.irs.gov/uac/Checking-the-Status-of-Your-Refund

- ↑ https://ttlc.intuit.com/questions/1901267-which-states-don-t-collect-income-tax

- ↑ https://ttlc.intuit.com/questions/1901267-which-states-don-t-collect-income-tax

About This Article

Before you check the status of your federal tax refund, get a copy of the tax return you filed. Then go online to the IRS website and click the “Where’s My Refund?” icon. Use the information from your tax return, including your filing status and the amount of your refund, to answer the questions on the screen. Finally, read the site's response to see if your refund is still being processed or when you can expect it to arrive. For more from our reviewer on checking the status of your tax refund, including how to check on your state refund, scroll down!