This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 14 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 297,285 times.

Losing a job might stress your finances, but the government provides unemployment benefits to cushion the blow. You can apply for unemployment by contacting your state’s unemployment office and providing requested information. If approved, you will need to request benefits every week that you are unemployed. As of 2017, unemployment benefits in most states last for a maximum of 26 weeks.[1]

Steps

Checking If You Qualify

-

1Make sure you’ve worked enough. Each state has its own requirements, but you generally must have earned a certain amount of money before you become eligible for unemployment benefits. This period is called your “base period,” and states measure it differently.[2]

- For example, in Illinois, you must have made at least $1,600 in your base period, and you must have earned at least $440 in one of those quarters.

- If you’re unsure whether you’ve earned enough, go ahead and apply. Let the office reject you if you haven’t earned enough.

-

2Analyze why you lost your job. To qualify for benefits, you must have lost the job through no fault of your own. Consider the reason why you are now unemployed.

- Layoff. You will typically qualify for benefits if your employer was downsizing or if they just didn’t have enough work for you.

- Firing. Generally, you can’t collect benefits if you were fired for serious misconduct, such as intentionally neglecting your duties. However, you might qualify for benefits if you were fired because the company thought you weren’t a good fit.[3]

- Quitting. You probably can’t get benefits if you quit because you disliked your job or because your boss annoyed you. However, you might qualify if you quit for “good cause.” Each state defines good cause differently, but harassment, discrimination, or fraud usually qualify. You might also qualify if you quit because of health or family concerns, such as domestic violence or because you needed to take care of a sick relative.[4]

Advertisement -

3Be willing and able to work. Your state wants you out and looking for work. For this reason, you can only get unemployment benefits if you are willing to accept a job when one is offered to you. You might not qualify as willing and able to work in the following circumstances:[5]

- You probably won’t qualify if you are sick and cannot work.

- You won’t qualify if you don’t have transportation. You aren’t required to travel hundreds of miles to a potential job, but you must be able to get to one reasonably nearby.

- You might not qualify if you are mainly a student.

-

4Call your state’s unemployment office with questions. Your state’s office is happy to answer any questions you have. No question is too small. Find contact information for your state’s unemployment office at https://www.careeronestop.org/localhelp/unemploymentbenefits/unemployment-benefits.aspx. Select your state.

- Always write down the name of the person you spoke with and the date/time of your conversation. Summarize what the office has told you.

- You might also be able to ask questions by email.

Applying for Benefits

-

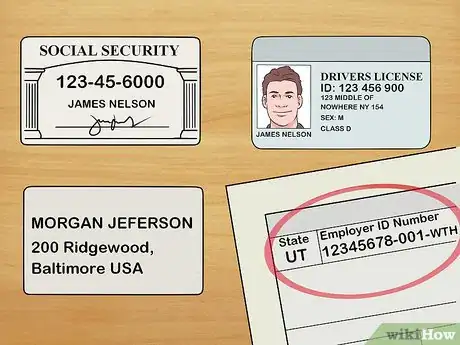

1Gather required information. You’ll need quite a bit of information to apply for benefits. Gather this information ahead of time. Each state might require slightly different information, so check online with your state’s unemployment office. For example, you will probably need the following:[6]

- Social Security Number

- State-issued ID, such as your driver’s license

- Alien Registration Number, if you aren’t a citizen

- Names and addresses for your most recent employers

- Each employer’s Federal Employer Identification Number

-

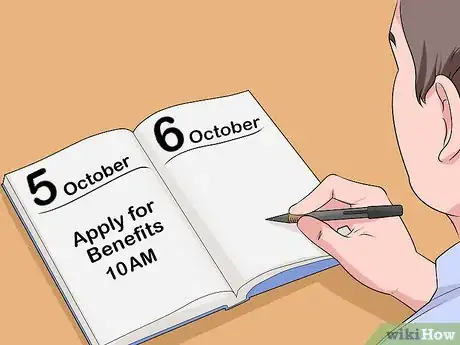

2Avoid delay. You should file for benefits during the first week you are completely or partially unemployed. You will usually have to serve a waiting period that is equal to one week.[7] If you wait too long to apply, you’ll lose out on potential benefits.

-

3Apply for benefits. Most states offer several methods for applying. Check with your state’s unemployment office to find out the methods available, and choose the one that is most convenient. You’ll need to provide personal information, such as your name and Social Security Number, and answer some questions. Typically, you can apply in the following ways:

- Online. You will need to create an online account, so create a username and password.

- Over the phone. The phone number should be listed on your state’s unemployment office website.

- Paper application. Your state should have an application for you to fill out. If you need help completing the form, you can schedule an appointment with the office.

-

4Complete an interview in person or by phone. To cut down on unemployment insurance fraud, many states require that people be interviewed over the phone or in person before benefits can begin. Be sure to have copies of your pay stubs, your most recent tax return, your birth certificate, and your Social Security Number in case verification is needed.

- The interview is a simple, fact-finding interview. You'll be asked questions about your previous employment, along with basic questions about your application.

-

5Register with a state work agency. In some states, you must register with a state agency before you can be approved for benefits. In Illinois, for example, you must register with the Illinois Employment Service.[8] Check if your state has a similar requirement.

- Usually, you’ll need to submit an updated resume. Spend some time making the resume as good as possible. You never know—you might actually find a job through the service.

-

6Receive your results. Processing times will vary by state. The unemployment office will send your last employer a letter, notifying that you have applied for benefits. Your employer can respond and challenge the reason you gave for why you were let go.[9] When the office has made a decision, it will send you a letter.

-

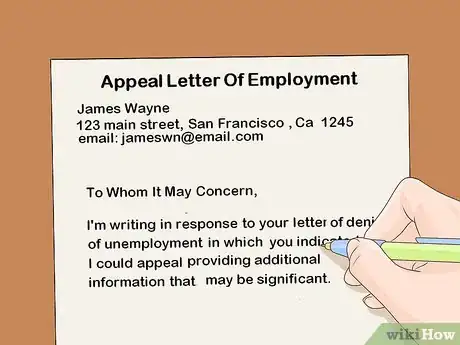

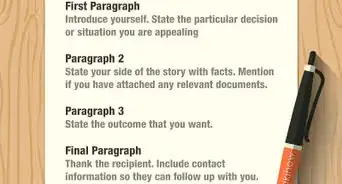

7Appeal a denial. Every state allows you to bring an appeal if you feel you have been unfairly denied benefits. Your denial letter should tell you how to appeal. In some states, such as Iowa, you can appeal online.[10] Other states will ask you to submit either a letter or an appeal form. Regardless of the method of bringing an appeal, remember that you must proceed quickly. States usually only give you 30 days to bring an appeal.[11]

- Your chances of success will depend on the reason why you were denied. For example, if you were denied because you didn’t earn enough in your base period, then you will be lucky to win the appeal unless the office incorrectly calculated your wages.

- Some other denials are easier to appeal. For example, you might have been fired from your most recent job. If your employer claims your poor performance was intentional, you might be denied benefits. However, you can argue you just weren’t good at the job, and your poor performance wasn’t intentional or malicious.

Requesting Benefits

-

1Check your schedule. Even after you’re approved for unemployment benefits, you still must apply for benefits weekly or biweekly. This is usually called “certifying” benefits for those weeks.[12] You should receive a schedule in the mail telling you when to certify. Be on the lookout.

- If you don’t receive any notification, contact your state’s unemployment office.

-

2Certify your eligibility for benefits. You’ll probably certify either online or possibly by phone or through the mail. You will need to report any income you have earned for the weeks you are claiming benefits. You will also need to confirm you have not turned down any jobs.

- You typically have a limited amount of time to certify a week. For example, in Wisconsin, you only get 14 days after the week ends. You also can’t certify a week before it ends.[13]

-

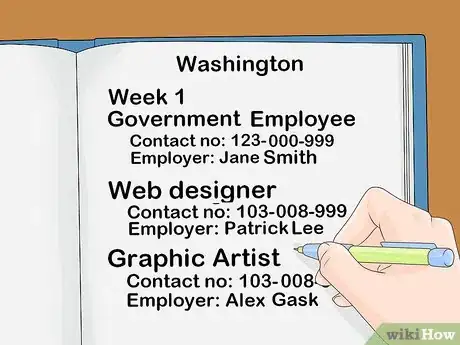

3Keep track of your job search. You must continue to look for jobs while you are unemployed. Depending on your state, you may need to keep a log of your job search. Write down the name of the employer, when you contacted them, and who you spoke with.

- You might have to apply for a certain number of jobs during every benefit period. For example, in Washington, you must make at least three contacts every week.[14] Check with your state’s unemployment office.

-

4Meet with the unemployment office. The office might call you in to discuss your job search. You should ask ahead of time what information they will need to see. Typically, they’ll want to see your job search log.

Community Q&A

-

QuestionWhat if I was falsely accused of sexual harassment?

Community AnswerTry to get an attorney and prove yourself innocent.

Community AnswerTry to get an attorney and prove yourself innocent. -

QuestionCan I collect unemployment if my hours were reduced?

Community AnswerThis depends on the state that you live in and also if you have a contract. Also, if you asked that your hours be reduced (such as changing your availability), then it was your decision. However, if you were working full-time hours, consistently, and your hours were reduced dramatically, then, typically, yes.

Community AnswerThis depends on the state that you live in and also if you have a contract. Also, if you asked that your hours be reduced (such as changing your availability), then it was your decision. However, if you were working full-time hours, consistently, and your hours were reduced dramatically, then, typically, yes. -

QuestionHow do I collect unemployment if I live in Texas, was working in Maryland, and my employer is based in Nebraska?

Community AnswerBeginning in your current home state, Texas, visit the unemployment office and they will tell you how to proceed.

Community AnswerBeginning in your current home state, Texas, visit the unemployment office and they will tell you how to proceed.

References

- ↑ https://www.cbpp.org/research/economy/policy-basics-how-many-weeks-of-unemployment-compensation-are-available

- ↑ http://www.nolo.com/legal-encyclopedia/unemployment-compensation-understanding-base-period-32444.html

- ↑ http://www.nolo.com/legal-encyclopedia/unemployment-benefits-when-fired-32449.html

- ↑ http://www.nolo.com/legal-encyclopedia/unemployment-benefits-when-quit-32450.html

- ↑ http://www.nolo.com/legal-encyclopedia/collecting-unemployment-are-you-able-32445.html

- ↑ https://labor.ny.gov/ui/how_to_file_claim.shtm

- ↑ https://labor.ny.gov/ui/how_to_file_claim.shtm

- ↑ http://www.nolo.com/legal-encyclopedia/collecting-unemployment-benefits-illinois-32506.html

- ↑ http://www.twc.state.tx.us/jobseekers/learning-result-your-application-benefits

- ↑ https://www.iowaworkforcedevelopment.gov/ui-appeal

- ↑ http://www.nolo.com/legal-encyclopedia/denied-unemployment-benefits-appeal-process-32446.html

- ↑ https://edd.ca.gov/en/unemployment/certify/

- ↑ https://dwd.wisconsin.gov/uiben/handbook/english/contentspart3.htm

- ↑ https://esd.wa.gov/unemployment/job-search-requirements

About This Article

Although collecting unemployment can seem like a complicated process, the best place to start is by applying for benefits online, or by calling your state’s unemployment office. Before you apply, make sure you have the required information, including your Social Security number, state-issued ID, and the names and addresses for your most recent employers. After submitting your application, wait for the approval or denial letter. If you’ve been denied and feel that the decision was unfair, file an appeal according to the instructions in your denial letter. For more advice, including how to certify your eligibility for benefits after you’ve been approved, keep reading.