X

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 143,483 times.

Workers who have become unemployed or who have had their hours reduced can apply for benefits while they search for a new position. These benefits can help ease financial strain during this time of unemployment. Before you apply, you should learn what amount of aid you can expect and if you are likely to qualify.

Steps

Part 1

Part 1 of 2:

Calculating Your Benefits

-

1Find out what your base-period wages are. Your base-period wages include the first four out of five fully complete calendar quarters that you worked. This period starts at the date you are applying for benefits, not when you became unemployed. You may receive a “statement of wages and potential benefits amounts” from the state of Texas. This statement will include the following information about your base-period wages:[1]

- Weekly benefit allowance (WBA)

- Maximum benefit amount (MBA)

- How the Texas Workforce Commission calculated your base-period wages.

- Ask for an alternate base period if you were out of work for at least seven weeks due to illness, injury, disability, or pregnancy within 24 months of the date you file.

-

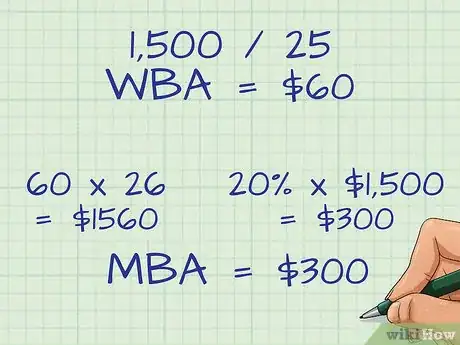

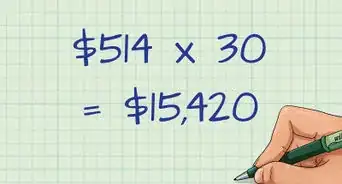

2Calculate your expected benefits. Use the information presented in your “statement of wages and potential benefits amounts” to calculate your benefit amounts. You will use your base-payments to discover your weekly benefit allowance (WBA) and maximum benefit amount (MBA). Take the following steps to learn what your benefits might be:[2]

- For your WBA, find your base period quarter with the highest wages. Divide those wages by 25 then round to the nearest dollar. This number cannot exceed the maximum allowed on your benefit statement.

- An example of finding your WBA would be $1,500/25, which is a WBA of $60.

- To find your MBA, multiply your weekly amount by 26 and find what 27% of all your wages in the base period would be. Whichever number is lower is your MBA.

- An example MBA might be 60*26=$1560 compared to 20% of $1,500 which is $300. $300 in this case would be the MBA.

- Multiply your WBA by 37. If this number is less than your base period wages, you won't qualify for a claim.

Advertisement -

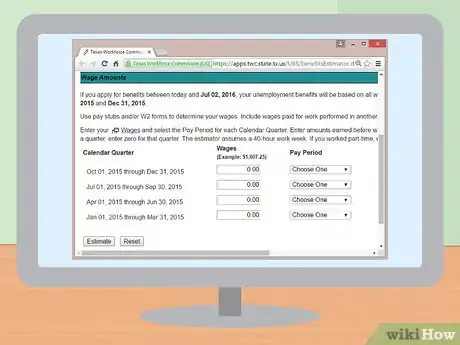

3Use the official on-line calculator. If you don't have your statement of wages and potential benefits amounts, but you know your basic income details, you can use the official on-line calculator. This calculator can be an easy way to get learn if you qualify and an get an estimate of how much you may receive.[3]

- Go to https://apps.twc.state.tx.us/UBS/benefitsEstimator.do to find the calculator.

- You will need your W2 tax forms to learn what wages you earned.

- Find your wages for each pay quarter. These amounts are the Gross Pay.

- The calculator assumes you worked full time. If not, estimate your monthly or quarterly wages.

- Enter this information into the calculator and click “estimate” to finish the process.

Advertisement

Part 2

Part 2 of 2:

Discovering Further Requirements

-

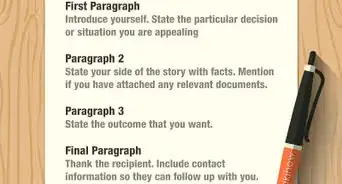

1Think of the reason you left your last job. If you are unemployed or are working reduced hours, due to no fault of your own, you will likely qualify for benefits. However, if you quit your position willingly, it is unlikely that you will be able to receive any benefits.[4]

- If you became unemployed or have received reduced hours due to your own actions, benefits may not be available.

- Personal reasons, such as quitting to care for your newborn, will exclude you from receiving benefits.

- If you quit due to a legal reason, such as not receiving pay, you will need to provide proof. You will also need to provide proof that you tried to remedy the problem before quitting.

-

2Register for work search requirements. You will be required to register as a job seeker within three days of applying for your benefits. You will also have to meet your minimum weekly work search requirements. By meeting these criteria, you will ensure that your benefits are paid out.[5]

- Register online.

- You can register in person at your nearest Texas Workforce Solutions office.

- If you move or live in another state, you will need to apply at that states workforce office.

-

3Meet the “able and available” requirements. In order to receive payments each time you request them, you will need to meet the able and available requirements. These requirements help ensure that you are actively seeking work and are able to perform that work when you find it. Review the following list to learn the requirements:[6]

- You must be both physically and mentally able to work.

- You must meet the requirements of the position.

- You must have open availability required by the position.

- You cannot be in jail.

- You will need working transport and childcare if applicable.

- You are required to accept customary wages in relation to your qualifications and experience.

- By the 8th week of your unemployment, you must lower your wage request to 75% of your normal wage.

-

4Apply. If you believe that you are eligible to collect unemployment benefits in Texas, you will want to apply for them. Before you apply, there are a few pieces of information you will need to collect and provide:[7]

- Name and address of your last employer.

- Start and end dates of your last employment period.

- If you worked the week you apply, you will need the amount of hours worked and pay rate.

- If you are not a U.S. citizen or national, you will need your Alien Registration Number.

Advertisement

Warnings

- Your benefits are taxable by the IRS.⧼thumbs_response⧽

- Tell the Texas Workforce Commission if you move.⧼thumbs_response⧽

- You must have wages for more than one base-period of pay.⧼thumbs_response⧽

- If you have qualified before, you must earn at least six times more than your new WBA.⧼thumbs_response⧽

Advertisement

Things You'll Need

- Your statement of wages and potential benefits amounts from the state of Texas.

- Your W2 tax forms for the last five months you worked.

References

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

- ↑ https://apps.twc.state.tx.us/UBS/benefitsEstimator.do

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

- ↑ http://www.twc.state.tx.us/files/jobseekers/unemployment-benefits-handbook-twc.pdf

About This Article

Advertisement