X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 109,077 times.

Learn more...

Unemployed workers in the state of Ohio can file claims for compensation with the Ohio Department of Job and Family Services. While the state determines your eligibility and total payout for unemployment compensation, you can figure this out for yourself so you know what to expect. By taking your average wage and number of dependents into account, you can come up with an accurate calculation of your total benefits.

Steps

Part 1

Part 1 of 2:

Filing for Unemployment Benefits in Ohio

-

1Meet the criteria for unemployment insurance. There are a certain number of factors that determine whether or not you are eligible for unemployment compensation. If the following applies to you, then you are considered unemployed and are eligible for unemployment insurance and benefits.

- You are totally or partially unemployed at the time you file for unemployment. If you performed no services and received no pay for the entire week before you filed, then you are totally unemployed. If you lost your job before the end of a typical work week or had your hours reduced and are earning less than the weekly unemployment benefit, then you are partially unemployed.

- You must have worked a minimum of 20 weeks during the previous base period to be considered unemployed.

- A base period in Ohio consists of the past 4 quarters of three months each, not including the current one.

- You must have earned at least $237 per week during the base period.

- You must be unemployed through no fault of your own. For example, if you were laid off or fired unreasonably, you lost your job through no fault of your own. If, however, you were fired for fighting with your boss or coworkers, you are considered to have caused your own termination.

- Quitting your job is also covered if you quit for good reason. Ohio considers "good reason" to be: 1)Your employer failed to meet the terms of the employment agreement. 2) Your employer failed to provide proper safety measures required by law. 3) Your work violated accepted moral or legal standards. It is up to you to prove that you quit for one of these reasons.

-

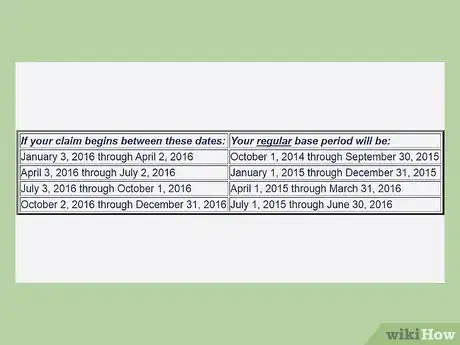

2Understand the base period. Unemployment insurance uses base periods to determine if you are eligible for benefits. In Ohio, the year is divided into 4 quarters of 3 three months each. The base period is the last 4 quarters that have gone by, not counting the current one.

- As of 2015, if you worked at least 20 weeks and earned more than $237 per week during the past 52 weeks and lose your job, you qualify for unemployment benefits.

- Your specific base period depends on when you are filing your claim.

- Weeks you work during the base period are called qualifying weeks.

Advertisement -

3Gather the necessary information and documents. When filing for unemployment, you will have to provide several pieces of information. Have all of this at hand when you file to make the process go by smoother.[1]

- Your Social Security number.

- Your driver's license or state ID number.

- Your name, address, telephone number, and e-mail address.

- Name, address, telephone number, and dates of employment with each employer you worked for during the past 6 weeks.

- The reason you became unemployed from each employer.

- Dependents' names, Social Security numbers, and dates of birth.

- If claiming dependents, your spouse's name, Social Security number, and birth date.

- If you are not a U.S. citizen or national, alien registration number and expiration date.

- Your regular occupation and job skills.

- If you had out of state employment, federal employment, or military employment, you may also have to provide Form DD-214, member 4 copy (for military service) and SF-8 or SF-50 form (for federal government employment).

-

4Apply for unemployment online. Ohio uses an online system for filing for unemployment. You can access the application here. The application is available 24 hours a day, 7 days a week.

-

5Call the unemployment office directly. If you don't have access to a computer or prefer to use the phone, you can alternatively file for unemployment by calling 1-877-644-6562 or TTY 1-888-642-8203. The office is open from 8-5, Monday through Friday.[2]

Advertisement

Part 2

Part 2 of 2:

Calculating Your Compensation

-

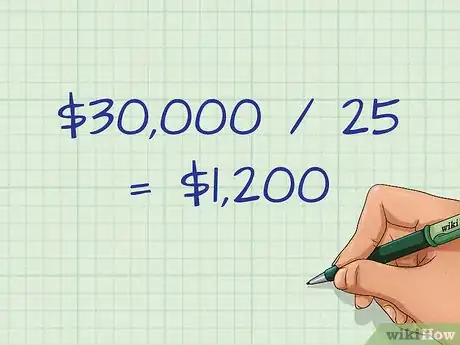

1Calculate your average weekly wage from the base period. Your unemployment compensation is based on your average wage during past employment. There is a simple process to calculating your average wage.

- Add up all of your earnings from the base period. If you worked multiple jobs, include all of them in this calculation.

- Divide the total wages by the number of weeks you worked. So if your total wages were $30,000 and you worked 25 weeks, your average weekly wage is $1,200.

-

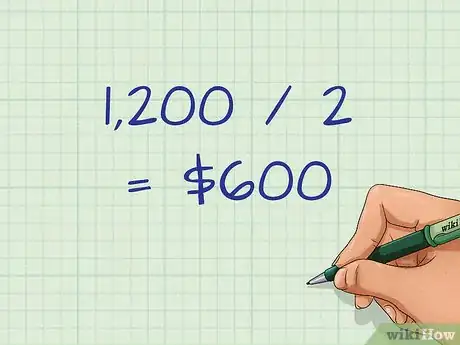

2Compute 50% of your average weekly wage. Your weekly unemployment compensation will either be 50% of your weekly wage or a maximum number based on the number of dependents you have, whichever is lower.

- To do this, just divide your average weekly wage by 2. So if your average wage was $1,200, this would be $600.

-

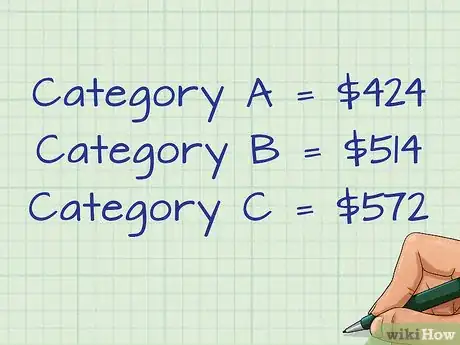

3Factor in the number of dependents you have. Based on your average weekly income and the number of dependents you have, the state of Ohio assigns a weekly amount that you will receive for unemployment compensation.

- As of 2015, there are 3 dependency categories. Category A means you have no dependents. Category B means that you have 1 or 2 dependents. Category C means that you have 3 or more dependents.

- The 2015 maximum amounts are as follows: Category A is $424, Category B is $514, and Category C is $572. This is the most you will receive per week in unemployment compensation.[3]

- Compare the weekly maximum to 50% of your average weekly wage. If the wage is less than the weekly maximum, then you will receive 50% of your average weekly wage. If it is more, then you'll receive the weekly maximum.

-

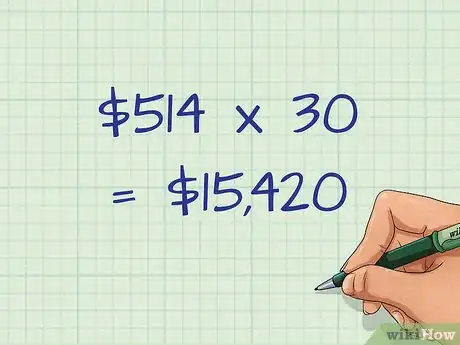

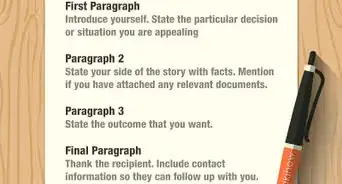

4Multiply the weekly amount by your number of qualifying weeks. The number of qualifying weeks is how long your payments will last. Once you determine a weekly maximum, then you can multiply it by the number of qualifying weeks to determine what your total payout will be.

- If you're in Category B, then your maximum payout is $514. If you have 30 qualifying weeks, then your total payout will be $15,420.

- If your weekly allowance gets reduced for any reason, your total payout remains the same. It will then take longer for your benefits to run out.

Advertisement

Community Q&A

-

QuestionHow do you calculate partial unemployment in Ohio?

Community AnswerThe amount of your benefit per week is reduced by the amount of your earnings for that week. If your benefit is $400 and your partial employment pays $200, your benefit for that week is $200. If you make more then your benefit your payment for the week is $0.

Community AnswerThe amount of your benefit per week is reduced by the amount of your earnings for that week. If your benefit is $400 and your partial employment pays $200, your benefit for that week is $200. If you make more then your benefit your payment for the week is $0. -

QuestionIf I am getting a severance package, should I wait until it runs out to apply?

Community AnswerNo, file for unemployment once you are unemployed. It may take 3-4 weeks to determine eligibility before you receive your first payment. Your severance package might be taken into account when determining your eligibility, however, so check with your local Department of Labor for details.

Community AnswerNo, file for unemployment once you are unemployed. It may take 3-4 weeks to determine eligibility before you receive your first payment. Your severance package might be taken into account when determining your eligibility, however, so check with your local Department of Labor for details. -

QuestionIf I received a severance package, can I collect unemployment after the severance period has ended?

Community AnswerYes, you can as long as it is within 10-15 days of it ending and you have a warrant for your severance package.

Community AnswerYes, you can as long as it is within 10-15 days of it ending and you have a warrant for your severance package.

Advertisement

References

About This Article

Advertisement