This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 13,929 times.

The Self Assessment tax return is the form you use to submit your tax information in the United Kingdom. You submit it to HM Revenue and Customs (HMRC), which you can do online or through the mail. If you're doing it online, start by registering yourself for an online self assessment. Next, you'll need to fill in the various sections about your income, benefits, and tax relief. You also may need to fill in supplementary forms before you submit the whole thing and get your tax bill.

Steps

Getting Started on Your Self Assessment

-

1Register this year if you didn't send in a tax return last year. You may already be registered if you turned in a tax return last year. However, if you did not send in a self-assessment form last year, you'll need to register again this year.[1]

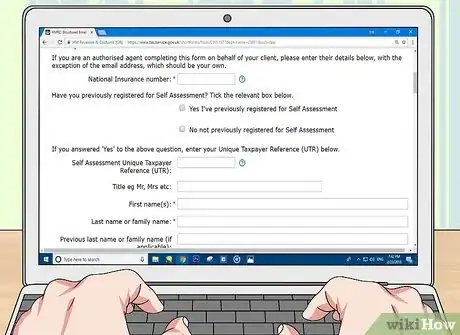

- Alternatively, if you have registered in the past and sent in a return last year, find the Unique Taxpayer Reference (UTR) number that was sent to you. You'll use this number when filing online.[2] It's also sometimes called the "tax reference."[3]

- If you don't have the number written down, look for it on a previous return. It will also be on documents you receive from the HMRC. If you know your login information, you can find it in your online account.

- Call the HMRC helpline if you can't find it. The main numbers are 0300 200 3310 and 0300 200 3319 from the UK or +44 161 931 9070 outside the UK.[4]

-

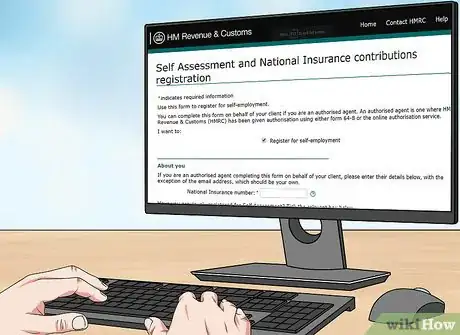

2Fill in and submit the correct form to register. Register as self-employed, not self-employed, or as a partnership. There's a separate form for each of these categories, and you'll need to pick the right one based on your status.[5]

- If you're self-employed, you'll need to use one of the forms on this page: https://www.gov.uk/log-in-file-self-assessment-tax-return/register-if-youre-self-employed.

- If you're not self-employed, you'll use the form on this page: https://www.gov.uk/government/publications/self-assessment-register-for-self-assessment-and-get-a-tax-return-sa1.

- If you're in a partnership, use a form from this page: https://www.gov.uk/government/publications/self-assessment-register-a-partner-for-self-assessment-and-class-2-nics-sa401.

Advertisement -

3Submit the registration form online or through the mail. You can submit the registration form online via the HMRC website. If you prefer, you can print the form off, fill it out, and mail it in instead.[6]

- You can mail it to the following address:

Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom

- You can mail it to the following address:

-

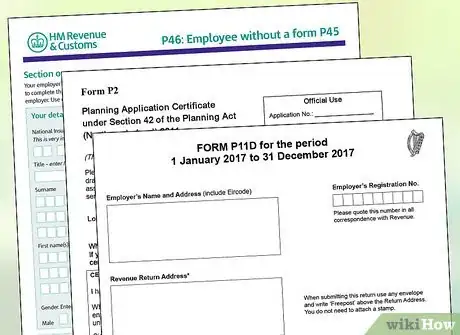

4Gather the documents you'll need for the self-assessment form. When filling out your tax return, you'll need the documents mailed to you by your employer, such as your P60 (End of Year Certificate), P11D (Expenses or benefits), or P45 (Details of employee leaving work) payslips. You'll also need the P2 (PAYE Coding Notice).

- If you're self-employed, you'll need your profit and loss statement or other business records.

- You'll also need items like investment brokers' schedules or dividend counterfoils, building society passbooks, and personal pension contributions certificates.

- Have your bank statements on hand.

-

5Check and enter your personal information. If you have a registered account, some basic information should be on your application, such as your name, address, and birthday, as well as a your National Insurance Number. If these are correct, leave them as they are. If they're wrong, correct them.

- If you're filling in the print form, you can cross out the address and write the correct address in.

-

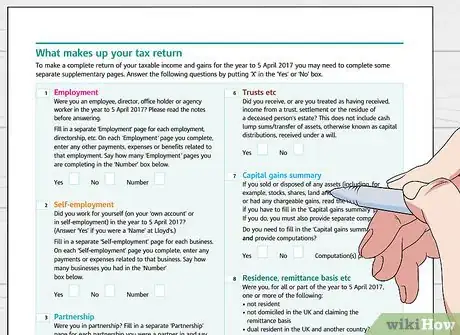

6Answer the "yes" or "no" questions about your income. This page asks you questions about your employment, partnerships, property, capital gains, and so on. Read the questions, and give a "yes" or "no" answer. If you answer "yes" on some of them, fill out the corresponding forms in the supplementary documents.

Filling in Your Income and Tax Reliefs

-

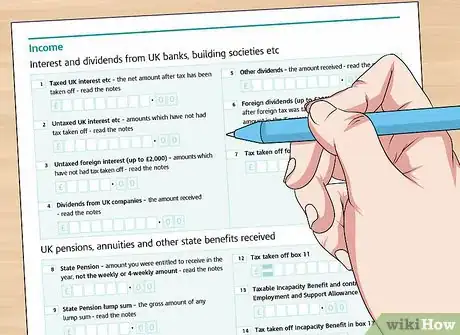

1Enter income you receive from interest or dividends. In this section, add interest you received from banks or building societies. Also, put in any dividends you received from UK companies, as well as income from life annuities. This section includes any non-cash interest.

- However, don't add interest from Ulster Savings Certificates, Individual Savings Account (ISAs), or Save as You Earn schemes.

- You also don't put in interest from damages you received in a UK court.

-

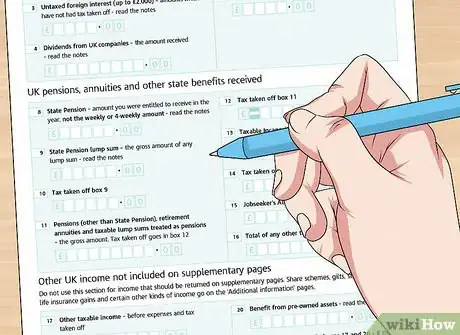

2Add in state benefits such as UK annuities and pensions. The next part of the income section is for UK state benefits. This section includes annuities, pensions, Jobseeker's allowance, and taxable Incapacity Benefit.

- In some boxes, you'll put in the amount you received, and in others, the amount of taxes taken off these amounts already.

- You can find your state pension income on the letter you received in the mail called "About the general increase in benefits."

-

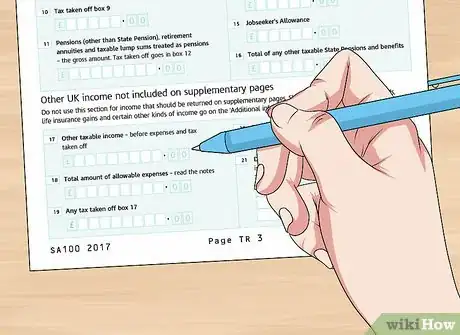

3Fill in other taxable income from the UK. Box 17 is for other types of taxable income. In this same area, you have a box to fill in taxable expenses, which is the amount you spent to get the job done, not including capital items, such as laptops.

- Use box 17 for things like property income distributions from real estate investment trusts or property authorized investment funds.

- You also need to fill in the amount for pre-owned assets that you benefit from.

-

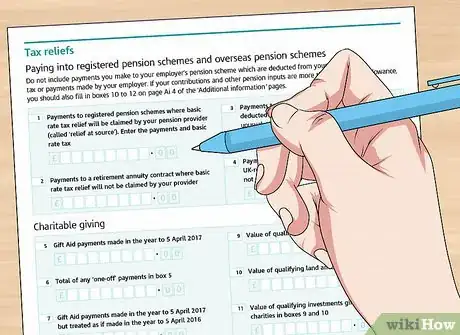

4Enter your payments to pensions and annuities. If you contributed to pensions and annuities, you can add the amounts here to get some relief on paying taxes. Enter only the amount you contributed, not the amount your employer put in, too.

- Pay attention to the limit for how much you can claim each year. For most pensions, that's up to the amount you make in a year in taxable earnings. However, for a "relief at source" scheme, you can only put in up to £3,600 gross.

-

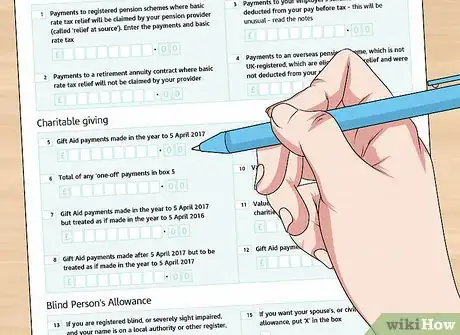

5Place charitable gifts next. You can also receive relief on your taxes for money you donated to charities. This area is divided into money amounts, land and building donations, shares and securities donations, and donations to foreign charities.

-

6Fill in the section on the Blind Person's Allowance. Check the box if you are blind and include the name of a local authority or register who verified it. If you live in Scotland or Northern Ireland, write in "Scotland" or "Northern Ireland" for your local authority.

- Check the box if you want to receive your partner's surplus or you want your partner to receive your surplus. Basically, that just means if you don't have enough income to use all of your surplus income, your spouse will receive it.

Putting Information in the Final Sections

-

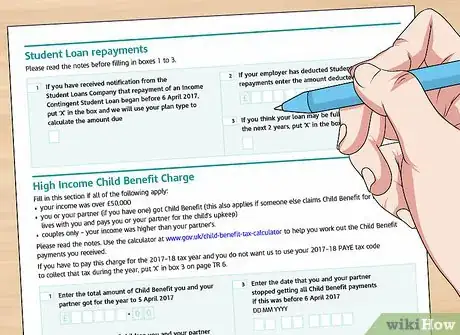

1Fill in the information on student loans. You just need to say that you've been asked to start paying your Income Contingent Student Loans back, and the UK government will figure out what you owe. Also, fill in any amount that your employer has already taken out.

-

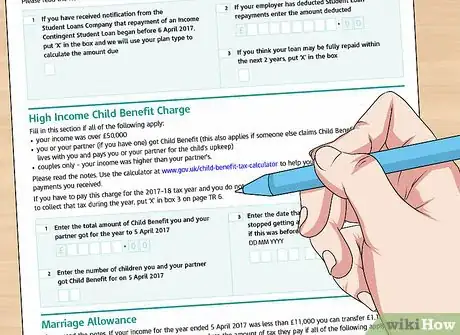

2Add information to the High Income Child Benefit Charge as needed. In this section, you enter how much you received in child benefits if your income is above £50,000 for the year for you and your spouse. Only enter information if your income is higher than your spouse's.

-

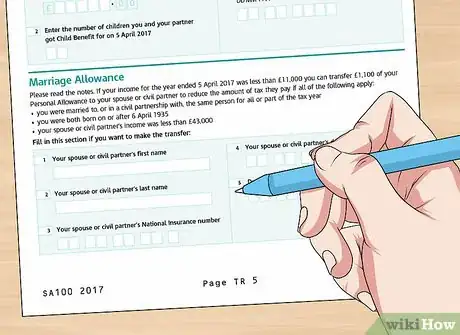

3Use the Marriage Allowance if you qualify. If your income was below £11,000 and your spouse's was below £43,000, you can allow your spouse to use £1,100 of your Personal Allowance. This allowance reduces the amount of taxes they owe.

- For this credit, you and your spouse must have been married for the full year, and you both must have been born after April 6, 1935.

-

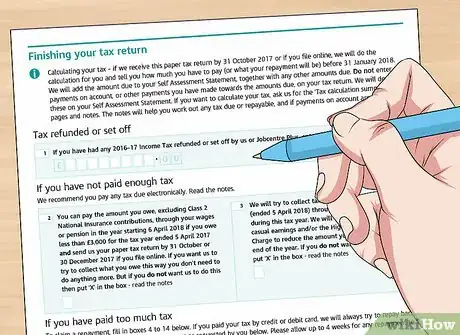

4Include information about former tax refunds. If you received a refund last year, put in that amount. If you didn't pay enough last year, you'll need to give the government permission to try to make up for it with this year's taxes and pensions. If you paid too much, put in your bank information for a refund, though they will try to refund it to any debit card you used first.

-

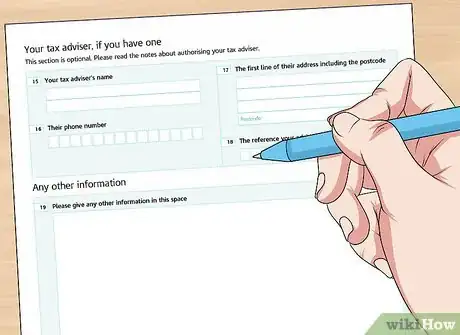

5Place the name of your tax preparer at the end. If you used a tax preparer, you'll need to include that person's biographical information. You'll also need their address, phone number, and any ID number they use for you.

-

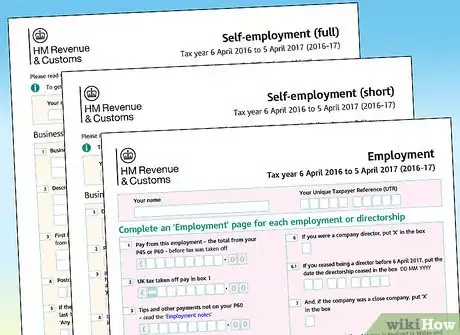

6Find any other supplementary documentation you need to fill out. The tax form has almost 20 supplementary documents that apply to special situations. Check the list to see which ones apply to you. The first page of your self assessment should have given you some indication of the supplementary forms you need to fill in.[7]

- For instance, the SA102 is for employment. You can find this form at https://www.gov.uk/self-assessment-forms-and-helpsheets.

- Supplementary forms SA103S or SA103F, on the other hand, are for self-employment. You can find these forms at https://www.gov.uk/self-assessment-forms-and-helpsheets.

- The forms include Parliament, partnerships, foreign, trusts, Scottish Parliament, The National Assembly of Wales, and capital gains summary.

Submitting a Self Assessment

-

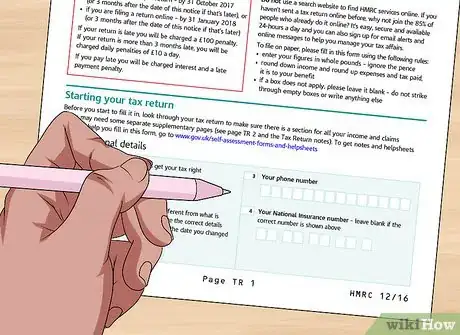

1File your return by October 31 if you're using paper. If you're filing on paper, you must complete your return and mail it in by October 31. If your return doesn't make it in time, you'll need to pay a penalty.

- Mail it to the following address:

Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom

- Mail it to the following address:

-

2File your return by January 31 if you're filing online. If you choose to file your return online, you have a bit of extension. You can wait to submit it by January 31 instead of October 31.[8]

-

3Pay your tax bill. Once you've submitted your tax form, the government will figure out how much you owe and send you a tax bill.[9] You can pay online with debit or credit card, with CHAPS, at your bank or building society, through direct debit, through Bacs, or by a check in the mail.[10]

- Your tax bill will usually show up online under "View Your Calculation" within 3 days of you submitting your return.

Warnings

- Fill in your form carefully. Make sure you're putting in all of your numbers very carefully. Any mistake may increase the amount you pay. On a paper form, you can strike out mistakes with a single line and write the correct number next to it.⧼thumbs_response⧽

References

- ↑ https://www.gov.uk/self-assessment-tax-returns/who-must-send-a-tax-return

- ↑ https://www.gov.uk/log-in-file-self-assessment-tax-return/register-if-youre-self-employed

- ↑ https://www.gov.uk/find-lost-utr-number

- ↑ https://www.gov.uk/government/organisations/hm-revenue-customs/contact/self-assessment

- ↑ https://www.gov.uk/self-assessment-tax-returns/who-must-send-a-tax-return

- ↑ https://www.gov.uk/self-assessment-tax-returns/who-must-send-a-tax-return

- ↑ https://www.gov.uk/government/publications/self-assessment-tax-return-sa100#supplementary-pages

- ↑ https://www.gov.uk/self-assessment-tax-returns

- ↑ https://www.gov.uk/understand-self-assessment-bill