This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Nihal Shetty. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

This article has been viewed 40,390 times.

Curious how to calculate your retirement benefit? For Filipinos that have made 120 contributions to the Social Security System (SSS) over the course of their working years, one of those income sources will be a monthly pension paid by the government. We’ll walk you through how to compute SSS benefits in the Philippines, from calculating your monthly pension to getting the money in your account.[1]

Steps

Calculating Your Monthly Pension

-

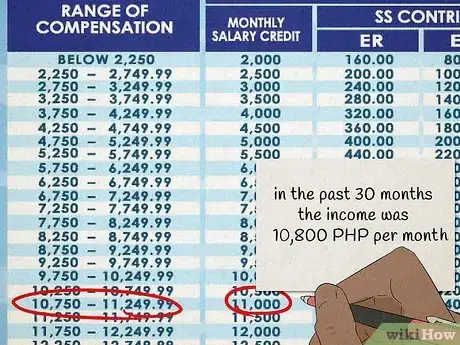

1Calculate your monthly salary credits for the past 60 months. Look through your records to find your monthly income during the past 5 years. Monthly salary credits are calculated through an income bracket system, where the more monthly income you have, the more salary credits you receive.

- In order to find your monthly salary credits, you’ll need to know what bracket your monthly income falls under. Take a look at this official chart to find the monthly income brackets: https://www.sss.gov.ph/sss/DownloadContent?fileName=CONTRIBUTION_TABLE_FLYER_June_7_2019_rev.pdf

- For example, if in the past 30 months you made an income of 10,800 PHP per month, the monthly salary credit would be 11,000 PHP, as 10,800 falls within the 10,750-11,249.99 bracket on the chart. If in the 30 months before this you made an income of 8,500 PHP, the monthly salary credit from those months would be 8,500 PHP, as 8,500 falls within the 8,250-8,799.99 bracket.

-

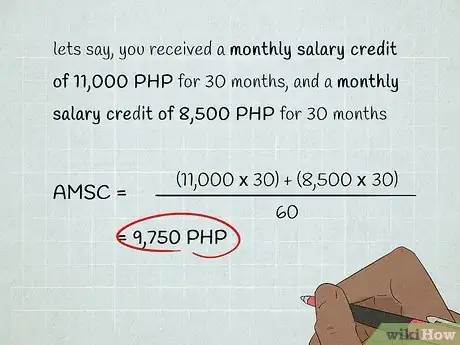

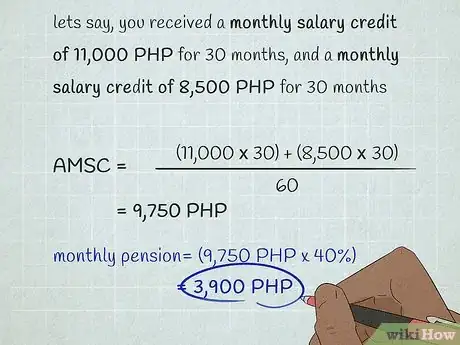

2Determine your Average Monthly Salary Credit (AMSC). The AMSC is the basis of some of the calculations needed for estimating your SSS pension. You can find your AMSC by adding your monthly salary credits from the past 60 months, and then dividing by 60. The amount of monthly salary credits you’ll earn in any given month depends on your income.[2]

- For example, in order to find your AMSC, you would perform the following calculation. Multiply each monthly salary credit by how many months you received this credit, add these numbers together, and then divide by 60. For example, if you received a monthly salary credit of 11,000 PHP for 30 months, and a monthly salary credit of 8,500 PHP for 30 months, calculate 11,000*30 + 8,500*30, then divide the result by 60. With these numbers, you will end up with an AMSC of 9,750 PHP.

Advertisement -

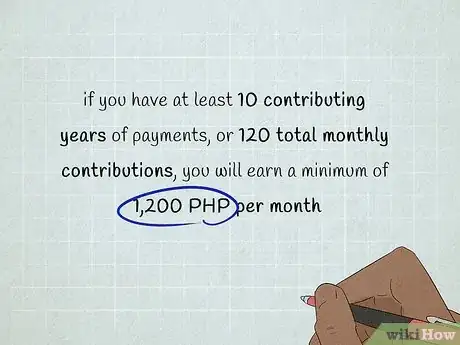

3Use the first formula for calculating your monthly pension. You will need to calculate three formulas in order to estimate your retirement pension. Luckily, this first formula is a simple rule. If you have at least 10 contributing years of payments, or 120 total monthly contributions, you will earn a minimum of 1,200 PHP per month. If you have at least 20 contributing years of payments, or 240 total monthly contributions, you will earn a minimum of 2,400 PHP per month.[3]

- For example, if you’ve made 30 years of payments, or 360 total monthly contributions, you will have a minimum pension of 2,400 PHP per month.

-

4Use the second formula for calculating your monthly pension. With this formula, you will need to calculate 40% of your AMSC. This will be the amount you receive as a monthly pension with this formula.[4]

- For example, if your AMSC is 9,750 PHP, multiply this by 0.4 to calculate 40%. The result will be 3,900 PHP, which will be your monthly pension.

-

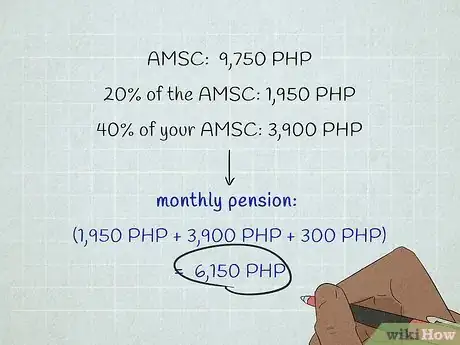

5Use the third formula for calculating your monthly pension. This formula is a bit more complicated, but you’ll need it to find out your monthly pension. You’ll need to take 20% of your AMSC, add 2% of your AMSC for every year you’ve made contributions to SSS, and then add 300 PHP.[5]

- For example, if your AMSC is 9,750 PHP, and you’ve made 30 years of contributions to SSS, we can calculate your pension under this formula in the following way. Start by multiplying 9,750 by 0.2 to find 20% of the AMSC: in this case, that amount will be 1950 PHP.

- Then, subtract 30 by 10, to find how many years of contributions you have beyond 10 years. In this case, that will be 20. Since we add 2% of the AMSC for each additional year past 10 years, we will multiply 2 by 20, to find that we’ll need to calculate 40% of your AMSC.

- To calculate 40% of your AMSC, multiply your AMSC by 0.4. In this case, that will be 9,750*0.4, which will give us a number of 3,900 PHP.

- Then, we’ll add our numbers together, along with an additional 300 PHP. In this case, that will be 1950 PHP + 3,900 PHP + 300 PHP. The total amount for our monthly pension is therefore 6,150 PHP.

-

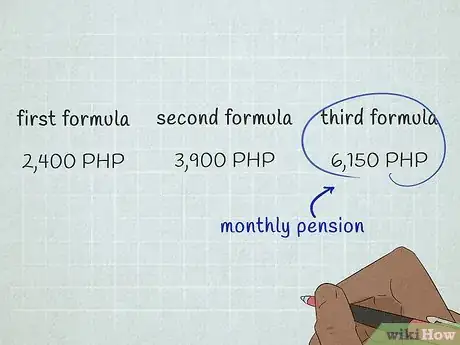

6Select the highest amount from the three formulas for your pension. After calculating all three formulas, the formula that gives you the highest number will be your monthly pension.[6]

- For example, if the first formula gave you a monthly pension of 2,400 PHP, the second gave you 3,900 PHP, and the third gave you 6,150 PHP, the third formula leads to the highest amount. Therefore, your monthly pension will be 6,150 PHP.

Calculating Additional Benefits

-

1Include the 13th month (Christmas) pension in your annual budget. Each year, SSS delivers pensioners an additional pension in December as a Christmas bonus. In recent years, the timing of when these pensions are disbursed has changed, but you should expect to receive your normal pension amount an additional time in December.[7]

-

2Take advantage of automatic enrollment in PhilHealth. If you’ve made the 120 contributions necessary to receive a monthly pension, you’ll also have your healthcare taken care of by the government. Paying in the required 120 contributions entitles you to care even if you’re hospitalized, so it’s a worthy investment. You are immediately enrolled in PhilHealth, so no additional steps are necessary.[8]

-

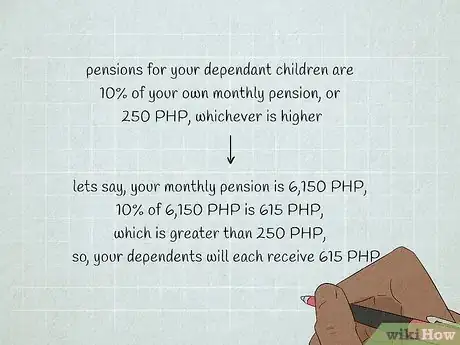

3Receive pensions for your dependent children. Up to 5 biological or adopted children, including illegitimate children, are also eligible to receive pensions, so long as they are under 21, unmarried, and not gainfully employed. These pensions are 10% of your own monthly pension, or 250 PHP, whichever is higher.[9]

- For example, if your monthly pension is 6,150 PHP, multiply this amount by 0.1 to find 10%. In this case, that will be 615 PHP, and since this amount is greater than 250 PHP, your dependents will each receive 615 PHP as a monthly pension.

Receiving Your SSS Benefits

-

1Submit your savings account information to the SSS. In order to start receiving a monthly pension, you’ll need to be sure that the SSS has access to a functioning savings account. You will need to submit to the SSS office your savings account number, as well as a photo of your passbook.[10]

- Contact a bank if you need help starting a savings account, or if you need help forwarding this information to SSS. Banks are experienced in helping clients get ahold of their pensions.

-

2Receive your monthly pension if you’ve made 120 payments. These pensions should be directly sent to your savings account. You can expect to receive your pension on the 19th of each month.[11]

-

3Receive a lump sum payment if you are short on contributions. If you haven’t paid 120 contributions into SSS, you can receive a lump sum payment instead at the beginning of your retirement. This amount will be equal to the total you and your employer put into the system, plus interest.[12]

- If you haven’t made the 120 contributions yet, you can also continue to contribute into SSS during retirement until you hit this number. Once you complete the 120 monthly payments, you can begin receiving a monthly pension.[13]

References

- ↑ https://www.sss.gov.ph/sss/appmanager/viewArticle.jsp?page=retirement

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Booklet_SS-ACT-OF-2018_05172019.pdf

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://businessmirror.com.ph/2020/12/09/the-13th-month-bonus-a-christmas-gift-for-all-sss-pensioners/

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- ↑ https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

-Step-9-Version-2.webp)

-Step-9-Version-2.webp)