This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Sophia Latorre. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 8,647 times.

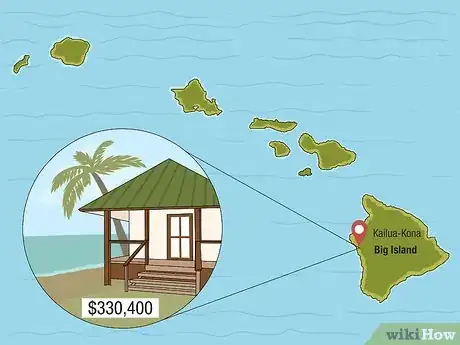

Are you dreaming of the sandy beaches and warm breezes of the tropical islands of Hawaii? Even if you’re on a budget, you can still retire in paradise and we’re here to show you how! We’ll start by walking you through the best places to live and then give you tips for saving money on everything from groceries to gasoline. No matter where you end up, the lovely weather and lush landscape will make enjoying life in Hawaii easy.

Steps

Expert Q&A

-

QuestionWhat is a solo 401k plan?

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Financial Planner A solo 401k is a qualified retirement plan. It is designed specifically for those people who are either self-employed or own a small business without full-time employees.

A solo 401k is a qualified retirement plan. It is designed specifically for those people who are either self-employed or own a small business without full-time employees. -

QuestionIs it necessary to plan for retirement?

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Financial Planner Yes, it is necessary to plan for retirement. You cannot rely on Social Security as there may be a crisis, and it may not be available.

Yes, it is necessary to plan for retirement. You cannot rely on Social Security as there may be a crisis, and it may not be available. -

QuestionWhat should I do so that I do not have to liquidate my assets?

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Dmitriy FomichenkoDmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

Financial Planner Try to build a portfolio of assets that produce passive income. So you will have assets that you will never have to liquidate. They will continue to generate money for you.

Try to build a portfolio of assets that produce passive income. So you will have assets that you will never have to liquidate. They will continue to generate money for you.

Tip

- While your pension and social security income won’t be taxed in Hawaii, distributions from IRAs and 401(k) plans will be.[22]

References

- ↑ https://realhawaii.co/blog/hawaiian-islands-which-island-to-live-on

- ↑ https://investmentu.com/best-places-to-retire-in-hawaii/

- ↑ https://www.onlyinyourstate.com/hawaii/affordable-cities-hi/

- ↑ https://realhawaii.co/blog/hawaiian-islands-which-island-to-live-on

- ↑ https://www.onlyinyourstate.com/hawaii/affordable-cities-hi/

- ↑ https://realhawaii.co/blog/hawaiian-islands-which-island-to-live-on

- ↑ https://investmentu.com/best-places-to-retire-in-hawaii/

- ↑ https://realhawaii.co/blog/hawaiian-islands-which-island-to-live-on

- ↑ https://realhawaii.co/blog/hawaiian-islands-which-island-to-live-on

- ↑ https://investmentu.com/best-places-to-retire-in-hawaii/

- ↑ https://www.onlyinyourstate.com/hawaii/affordable-cities-hi/

- ↑ https://www.hawaii-guide.com/moving-to-hawaii

- ↑ https://www.hawaii-guide.com/moving-to-hawaii

- ↑ https://www.hawaiilife.com/blog/offset-cost-living-tips-locals/

- ↑ https://www.hawaiilife.com/blog/offset-cost-living-tips-locals/

- ↑ https://onolicioushawaii.com/costco-hawaii/

- ↑ https://www.insider.com/15-insider-secrets-that-will-save-you-money-in-hawaii-2018-3#4-rent-the-perfect-car-for-less-4

- ↑ https://www.hawaiilife.com/blog/offset-cost-living-tips-locals/

- ↑ https://www.insider.com/15-insider-secrets-that-will-save-you-money-in-hawaii-2018-3#8-get-groupon-discounts-for-tours-and-more-8

- ↑ https://www.dwellhawaii.com/blog/what-cost-living-hawaii-2020/

- ↑ https://www.energy.gov/sites/prod/files/energy_savers.pdf

- ↑ https://www.aarp.org/money/taxes/info-2020/states-that-dont-tax-retirement-distributions.html

-Step-9-Version-2.webp)

-Step-9-Version-2.webp)