This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 38,029 times.

A Roth Individual Retirement Arrangement (Roth IRA) is subject to special rules that do not apply to other types of retirement accounts. Once you open a Roth IRA, you may be able to make contributions into the account up to a certain limit. When you want to take money out of your Roth IRA (i.e., withdraw or distribute funds), you need to understand the federal tax consequences of doing so. Once you have calculated your potential tax liability for making a distribution, you can withdraw funds from your Roth IRA if you would like.

Steps

Contributing to Your Roth IRA

-

1Open a Roth IRA. You can open a Roth IRA at any point in your life. To be a Roth IRA, the account must be designated with the word "Roth."[1] To open one, contact a number of brokers or financial advisers and ask about your options. Look for Roth IRAs that do not include any opening fees or maintenance fees. In addition, look for account options that include minimal trading fees, which are assessed when your money is invested in different markets.[2] Shop around to find the best deal.

- Some other factors to consider when choosing a bank could be ease of use, the trading platform overall, and the investment choices that are available.[3]

- Roth IRAs can help you save for retirement, minimize tax liability, and the money contributed can be used at any time and for any reason. Roth IRAs provide you with more flexibility than other retirement accounts.[4] [5]

- Roth IRAs are also unique because you can make contributions at any age and you are not required to take any distributions.[6]

- Roth IRAs are the exact opposite of traditional IRAs. With a traditional IRA, you get tax deductions with the money you put into your account, but you have to pay taxes on the money you withdraw. With a Roth IRA, you pay taxes on the money you contribute, but not on the money you withdraw.[7]

-

2Determine your eligibility to contribute to a Roth IRA. To contribute to a Roth IRA, you must have taxable compensation (i.e., an income) and your modified adjusted gross income (MAGI) must be below a certain threshold.

- Taxable compensation includes, among other things, wages, salaries, tips, professional fees, bonuses, commissions, and self-employment income.[8]

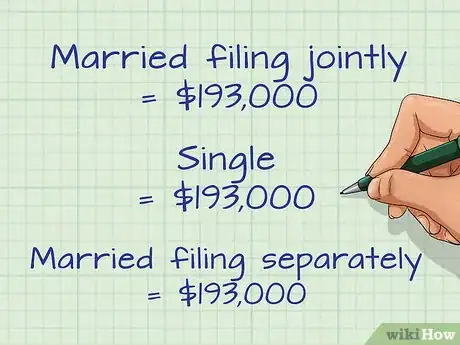

- To calculate your MAGI, you need to take your adjusted gross income (AGI) from your tax forms and add back your deductions for various things like student loan interest and higher education expenses.[9] To contribute, your MAGI must be less than $193,000 if you are married filing jointly or are a qualified widow; $131,000 if you are single, head of household, or married filing separately and you did not live with your spouse at any time during the year; or $10,000 if you are married filing separately and you did live with your spouse.

- If your MAGI is above the limits set out by the Internal Revenue Service (IRS), you are not eligible to contribute to a Roth IRA at all.[10]

- Remember to check the IRS website for the most up-to-date information on eligibility and contribution limits for Roth IRAs. Congress often considers raising the limits on income as well as the contribution limits to meet cost of living increases. This information can be found on the IRS's website at https://www.irs.gov/retirement-plans/traditional-and-roth-iras.

Advertisement -

3Calculate how much you can contribute. If you are eligible to contribute to a Roth IRA, you can only contribute a limited amount. Generally, you will be able to contribute the lesser of $5,500 ($6,500 if you are over 50 years old) or your total taxable compensation in one year. However, if your MAGI is above a certain level, your contribution limit will be gradually reduced.

- If you are married filing jointly and your MAGI is less than $183,000, you can contribute the full amount. If your MAGI is at least $183,000 but less than $193,000, your contribution limits are reduced.

- If you are married filing separately and your MAGI is $0, you can contribute the full amount. If your MAGI is more than $0 but less than $10,000, your contribution limits are reduced.

- If you are single and your MAGI is less than $116,000, you can contribute the full amount. If your MAGI is at least $116,000 but less than $131,000, your contribution limits are reduced.

- You will reduce the contribution limit using a specific formula laid out by the IRS (Worksheet 2-2 in Publication 590-A). The formula uses your MAGI, specific dollar amounts based on how you file taxes, and other IRA contributions you make.[11]

- As an example, assume you are a 45 year old single adult with taxable compensation equaling $117,000. Your MAGI is also $117,000. Assume you want to make the maximum allowable contribution to your Roth IRA. You have not contributed to any other traditional IRAs so your base contribution limit is $5,500. However, due to your MAGI and using the formula, your reduced contribution limit will be $5,140.[12]

-

4Avoid contributing too much. If you contribute more than your allowable limit in any one tax year, the excess contributions will be subject to a 6% excise tax. You may be able to withdraw the excess contributions from your Roth IRA and avoid the excise tax. However, for this to count, you must also withdraw any earnings on the excess contributions.[13] Unless the earnings distribution is qualified, you may incur another tax for taking a non-qualified distribution.

- Due to these complicated tax issues, avoid contributing more than you are allowed.

-

5Understand how contributions are taxed. Roth IRA contributions are not taxed when you contribute them to your Roth IRA. However, because any amount you contribute comes out of your taxable compensation, your contributions will always come from post-tax income.[14]

Calculating Your Federal Tax Liability on Distributions

-

1Make qualified distributions whenever possible. One of the most attractive characteristics of a Roth IRA is that a number of distributions (withdrawals) are tax free. However, there are limits to that rule. The first type of distribution that is not taxed (or penalized) is a qualified distribution. To have a qualified distribution, it first must have been five years since you opened the Roth IRA and made an initial contribution. In addition, you must meet any one of the following conditions:

- You must be at least 59.5 years old when you make the distribution;

- You must use the distribution to buy or rebuild your first home;

- You must be disabled; or

- You must be deceased and the distribution must be made to your beneficiary's estate or beneficiary.[15]

-

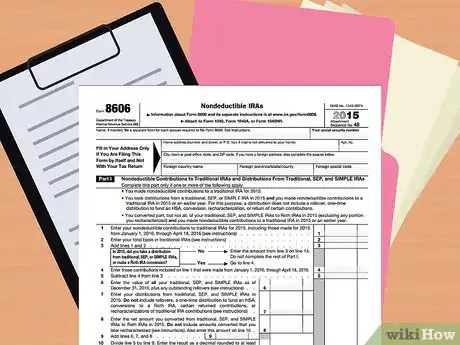

2Find IRS Form 8606. In order to calculate the taxable part of your IRA distributions, you will need IRS Form 8606. This form is titled "Nondeductible IRAs."[16]

- The most applicable part of Form 8606 is Part III, which deals with distributions from Roth IRAs.[17]

- Gather instructions. Each IRS form comes with a set of directions to help you fill the form out correctly.[18] IRS Form 8606's instructions should be followed in detail in order to calculate your taxable amount correctly.

-

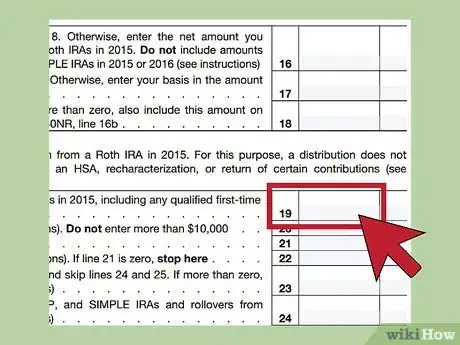

3Enter your total non-qualified distributions in line 19. Be sure you include qualified first-time homebuyer distributions as well. However, do not include rollover distributions, returns of contributions, re-characterizations, and other distributions laid out in the instructions for Form 8606.[19]

- For example, assume you made $30,000 in non-qualified distributions from your Roth IRA. Enter this number in line 19.

-

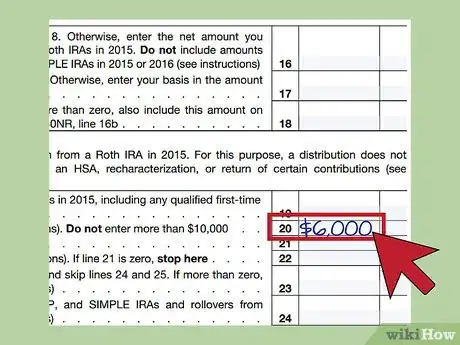

4Enter any qualified first-time homebuyer expenses in line 20. So long as you made a contribution to your Roth IRA between 1998 and 2010, enter the amount of any qualified expenses. However, these expenses cannot exceed $10,000.[20]

- For example, assume you purchased your first home last year and had qualified expenses equaling $6,000. You would enter that number in line 20 of IRS Form 8606.

-

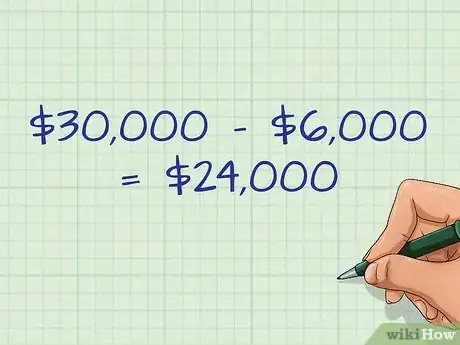

5Subtract line 20 from line 19 and put that number in line 21. If this amount is zero or less, simply put zero.[21]

- For example, if line 19 was $30,000 and line 20 was $6,000, your line 21 would equal $24,000 ($30,000 - $6,000).

-

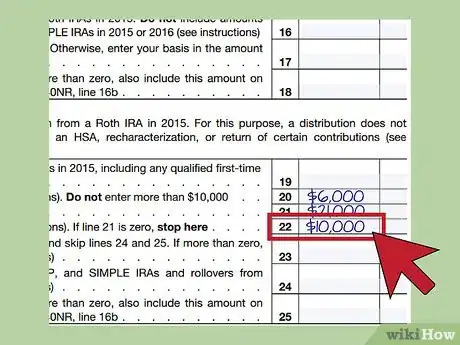

6Enter your basis in Roth IRA contributions in line 22. This line will equal the amount of all your Roth IRA contributions adjusted for any re-characterizations. For help calculating this amount, you can use a specific IRS worksheet.[22] You will increase or decrease your value in line 22 for various scenarios, which can be found in the instructions to Form 8606.[23]

- For example, assume you have used the worksheet and the instructions and calculated your basis to be $10,000. This is the number you will enter on line 22.

-

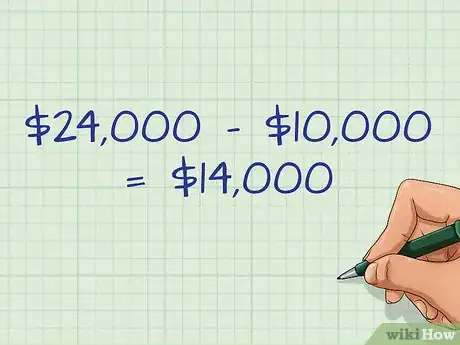

7Subtract line 22 from line 21 and place that number in line 23. If this number is more than zero, you will likely be subject to an additional 10% tax on that amount. If this number is zero or less than zero, you do not have to pay any taxes on your non-qualified distributions.[24] As you can see, you will not be taxed for withdrawing (distributing) your contributions (the amount in line 22). You will also not be taxed for making various qualified distributions (the amount in line 20).

- For example, if your line 21 equals $24,000 and your line 22 equals $10,000, your line 23 would equal $14,000 ($24,000 - $10,000).

-

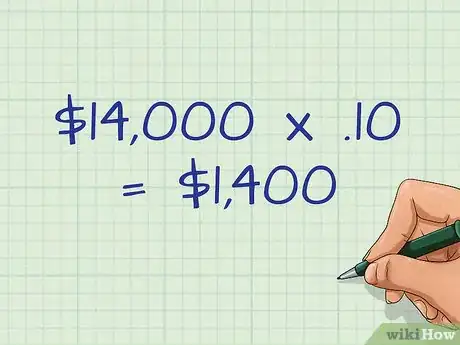

8Calculate your federal tax liability for non-qualified distributions. In general, you are taxed 10% for these distributions. Therefore, you can calculate your tax liability by multiplying the total from line 23 by .10.

- For example, if line 23 equals $14,000, you would multiply that by .10. In this scenario, your tax liability would be $1,400 for making various non-qualified distributions.

Withdrawing Contributions

-

1Determine how much you have contributed. Check your Roth IRA online, by phone, or by looking at the last statement you received in the mail. Most statements will break down your investment into contributions, earnings, and distributions. The amount contributed will not be the full balance, so be sure you get the right number.

-

2Call your broker or financial advisor. Each financial institution will have a different process for withdrawing money. If you have a financial advisor, you work with on all of your accounts, call that person, and let him or her know that you would like to take some money out of your Roth IRA. If you do not have a contact person, call the brokerage or the bank that holds your Roth IRA, and explain that you would like to talk with someone about your account.

-

3Choose how much money you would like to withdraw. Think about what you need the money for, and whether you want to take out all the funds you have contributed, or just a portion of them. Due to yearly contribution limits, you may not be able to immediately replace the money you take out.

- For example, assume you take out $10,000 from your Roth IRA. If your yearly contribution limit is $5,500, it will take you at least two years to replenish your Roth IRA to where it was before your withdrew money.

-

4Instruct the brokerage or financial institution how to pay you. Once you have worked out your budget and determined your needs, let the bank know how much you will be taking out, and how you would like to receive the funds. Some banks will give you a check, and other banks may offer to direct deposit the money into another account. Ask how quickly it will be available to you.

-

5Keep all records and documents for tax purposes. Withdrawing your contributions from a Roth IRA will not result in any taxes or penalties. Hold receipts, records, and correspondence from this transaction, in case if there are errors during tax time.

References

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000230988

- ↑ https://www.fidelity.com/retirement-ira/roth-ira

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.fidelity.com/viewpoints/retirement/nine-reasons-roth

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ http://www.rothira.com/roth-ira-rules

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000230988

- ↑ http://www.rothira.com/roth-ira-rules

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000230988

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000231012

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000231012

- ↑ https://www.irs.gov/publications/p590a/ch02.html#en_US_2015_publink1000230988

- ↑ http://www.rothira.com/roth-ira-taxes-and-tax-issues

- ↑ https://www.irs.gov/publications/p590b/ch02.html#en_US_2015_publink1000231057

- ↑ https://www.irs.gov/pub/irs-prior/f8606--2015.pdf

- ↑ https://www.irs.gov/pub/irs-prior/f8606--2015.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf

- ↑ https://www.irs.gov/pub/irs-prior/f8606--2015.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf#en_US_2015_publink1000196085

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8606.pdf

-Step-9-Version-2.webp)

-Step-9-Version-2.webp)