This article was co-authored by Brian Stormont, CFP® and by wikiHow staff writer, Hannah Madden. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 7,015 times.

Retiring early is a goal for many of us, but figuring out how to allocate your money can be a little tough. Opening a Roth IRA is a great way to save for retirement and make your money work for you now so you can spend it later. In this article, we’ve detailed the process of opening a Roth IRA and making contributions, as well as ways you can withdraw your money early to retire when you want to.

Steps

Opening a Roth IRA

-

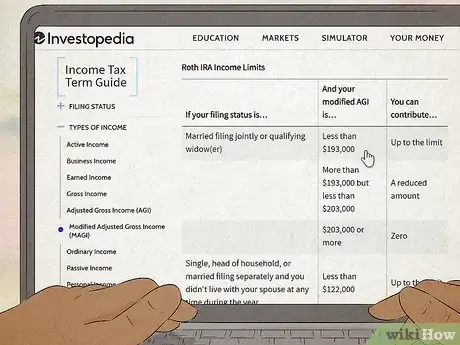

1Make sure your income is under the limit for a Roth IRA. To do this, calculate your modified adjusted gross income, or AGI. Use the AGI calculator provided by the IRS by visiting https://www.irs.gov/publications/p590a#en_US_2014_publink1000230988, or google “modified adjusted gross income calculator” to find one online. If your AGI is under $198,000 in 2021, you can open a Roth IRA.[1]

- The income limit exists to prevent highly paid workers from benefitting more than the average worker from the tax advantages they provide.

- The income limit to open a Roth IRA varies with inflation, so check the IRS’s website if you’re opening a Roth IRA after 2021.

- The income cap also varies if you file jointly versus if you file on your own. For a detailed list of income caps, visit https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021.

-

2Research a brokerage or financial institution to open a Roth IRA with. There are a lot of options for a Roth IRA, including online brokerages and in-person banks.[2] For more control over your investments, pick a brokerage; for a little less DIY action, go with a robotic-advisor or a bank.[3]

- If you want more control over your Roth IRA, go with E Trade or J.P. Morgan.

- If you don’t mind someone else picking out your investments, try SoFi, Betterment, or Ellevest.

- Although it’s uncommon, some employers do offer a Roth 401(k). If that’s the case, you can talk to your employer about starting an account through the workplace.

Advertisement -

3Pick out the investments you would like to purchase. If you’re a more hands-off person, you can let your advisor pick out your investments for you. However, if you want some control over your money, take a look at the investments that are available to you. You can look into individual stocks, mutual funds, exchange traded funds (ETFs), and money market investments.[4]

- The further away from retirement you are, the riskier you can be with your portfolio. However, if you plan to retire early, you probably want to choose the safest options that are guaranteed to make you money fast.

-

4Apply for a new account as soon as possible. If you plan to retire early, the more money you start saving now, the better. As soon as you pick out which brokerage or financial institution is right for you, go online and apply for an account or head to a brick-and-mortar bank to talk to someone in person. You’ll need to provide your Social Security Number (SSN), your checking or saving account routing number, and your income information.[5]

- The financial institution or bank will run a check on your financials to make sure you qualify to open a Roth IRA.

- There’s no minimum amount of money you need to have to open a Roth IRA, but some financial institutions have a fee associated with opening an account.[6]

Making Contributions

-

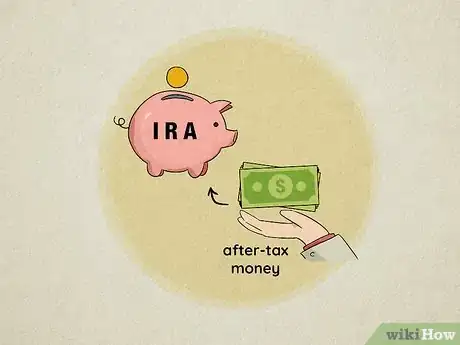

1Make contributions with after-tax money. The advantage of a Roth IRA is that you get taxed now to avoid paying taxes later. To do that, you can set up a contribution schedule with your financial institution as often as you’d like. Your contributions will be taxed when they go into your account, which means you won’t have to pay taxes on them when you withdraw later.[7]

- Roth IRAs are ideal for people who expect their tax rate to be higher during retirement than it is currently.

- The disadvantage to a Roth IRA is that since you’re putting less money in upfront, your account might grow a little slower than in a traditional IRA.

- You should also keep in mind that your Roth IRA contributions are not tax-deductible.

-

2Contribute up to $6,000 a year if you're under the age of 50 or up to $7,000 per year if you're over the age of 50. As of 2021, if you’re under 50 years old, you can only put up to $6,000 in your Roth IRA every year. If you’re above 50 years old, the annual limit is $7,000. These limits usually increase with inflation, so check with your financial institution every year to see if the maximum has been raised.[8]

- In order to meet your goal of retiring early, you should always try to contribute the maximum annual amount to your Roth IRA.

-

3Keep adding money even after you retire. Unlike traditional IRAs, you can keep making contributions to a Roth IRA for as long as you’d like to. This is very helpful if you’re planning to retire early—even if you’re no longer making money at a traditional job, you can put any extra cash you have into your Roth IRA. Your account will continue to grow, and you can have a little extra money for when you need it.[9]

-

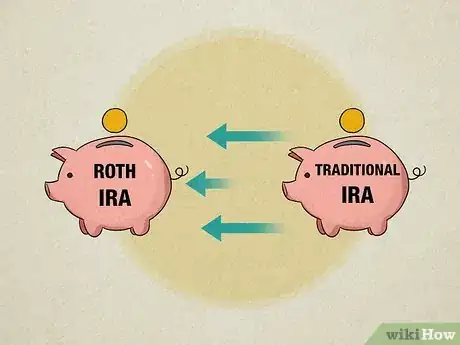

4Move money from a traditional IRA to a Roth IRA if your income is too high.[10] If your income is too high for a Roth IRA, you can still contribute to one, although it might take a bit of finagling. First, you’ll open a traditional IRA and deposit your money there. Then, request to transfer your traditional IRA into a Roth IRA (your IRA administrator can help you with the paperwork). When you file your tax return, you’ll have to pay taxes on the money you converted to a Roth IRA. After that, you’ll have a Roth IRA account that you won’t have to pay taxes for later on.[11]

- If you open your traditional IRA well in advance and it’s already made money, you’ll have to pay taxes on the profit once you transfer it to a Roth IRA.

Making Withdrawals

-

1Keep your account for at least 5 years. In order to avoid penalties, try to open your Roth IRA account at least 5 years before you plan to retire. Otherwise, you may have to pay a 10% fee on any withdrawals you make.[12]

- With a Roth IRA, the earlier you start contributing, the better (especially if you plan to retire early).

-

2Sign up for rule 72(t) distributions if you’re younger than 59.5. Just like traditional IRAs, you can’t take out money from a Roth IRA until you’re 59.5 without a 10% fee. However, there is an exception to this rule: if you sign up for 72(t) distributions, you can receive distribution payments from your Roth IRA without getting taxed. You must keep these payments going for at least 5 years (or until you turn 59.5—whichever comes first) without making any changes to them, or else you will get taxed 10%. The amount you will receive depends on your overall income and your account itself.[13]

- If you plan to retire early, this is the best way to take money out of your Roth IRA before you turn 59.5.

- For an estimate of what your distribution payments might be, visit https://www.irs.gov/pub/irs-irbs/irb02-42.pdf for a list of rules and regulations.

-

3Wait until you’re 59.5 to withdraw large sums of money. Just like a traditional IRA, you need to wait until you’re 59.5 years old to take any money out of the account without getting taxed by 10%. If you plan to take out a big chunk of money, you’ll want to wait until you’re old enough so you don’t get penalized.[14]

-

4Withdraw money early without penalties due to special circumstances. If you need to make a big purchase before you’re 59.5, there are a few things you won’t get taxed for. These include:[15]

- Withdrawals used to pay for medical expenses that are over 7.5% of your AGI.

- Withdrawals for a first-time home purchase (up to $10,000).

- Withdrawals for qualifying higher education expenses.

- Withdrawals for birth or adoption fees (up to $5,000).

References

- ↑ https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.nerdwallet.com/article/investing/how-and-where-to-open-a-roth-ira

- ↑ https://www.nerdwallet.com/article/investing/how-and-where-to-open-a-roth-ira

- ↑ https://www.nerdwallet.com/article/investing/how-and-where-to-open-a-roth-ira

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://investor.vanguard.com/ira/roth-ira

- ↑ https://investor.vanguard.com/ira/roth-ira

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.forbes.com/advisor/retirement/backdoor-roth-ira/

- ↑ https://investor.vanguard.com/ira/roth-ira

- ↑ https://www.irs.gov/retirement-plans/substantially-equal-periodic-payments

- ↑ https://hbr.org/2020/09/whats-the-point-of-saving-for-retirement-in-your-20s

- ↑ https://www.irs.gov/pub/irs-pdf/p590b.pdf

-Step-9-Version-2.webp)

-Step-9-Version-2.webp)