This article was co-authored by Anna Colibri. Anna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 19 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 287,668 times.

Market research is a technique used both by prospective entrepreneurs and established business people to gather and analyze useful information about the market their business operates in. Market research is used for developing effective strategies, weighing the pros and cons of a proposed decision, determining the future path of the business, and much more. Keep your business's competitive edge sharp with keen market research skills! See Step 1 below to get started.

Steps

Planning Your Market Research

-

1Have a goal for your research in mind. Market research should be designed to help you and your business become more competitive and profitable. If your market research efforts couldn't eventually give your company some benefit, they would be wasted and your time would have been better spent doing something else. Before you begin, it's important to define exactly what you want to figure out through your market research. Your research may lead you in unexpected directions — this is perfectly fine. However, it's not a good idea to start your market research without at least having one or more concrete goals in mind. Below are just a few of the types of questions you may want to consider when designing your market research:

- Is there a need in my market that my company can fill? Researching the priorities and spending habits of your customers can help you determine whether it's a good idea to attempt to do business in a certain market in the first place.

- Are my products and services meeting the needs of my customers? Researching your customers' satisfaction with your business can help you increase your business's competitiveness.

- Am I pricing my products and services effectively? Researching your competition's practices and wide-scale market trends can help ensure you're making as much money as possible without hurting your business.

- For example, you could set a goal of doing 10% better than your competitors.[1]

-

2Develop a plan for gathering information efficiently. Just as it's important to know what you want your research to accomplish ahead of time, it's also important to have an idea of how you can realistically reach this goal. Again, plans can and do change as research progresses. However, setting a goal without having any idea of how to achieve it is never a good idea for market research. Below are questions to consider when making a market research plan:

- Will I need to find extensive market data? Analyzing existing data can help you make decisions about the future of your business, but finding useful, accurate data can be difficult.

- Will I need to do independent research? Creating your own data from surveys, focus groups, interviews, and more can tell you lots about your company and the market it operates in, but these projects require time and resources that can also be spent on other things.

Advertisement -

3Be prepared to present your findings and to decide on a course of action. The purpose of market research is to have an effect on the actual decisions of your company. When you do market research, unless your business is a sole proprietorship, usually, you'll need to share your findings with other people in the company and have a plan of action in mind. If you have superiors, they may or may not agree with your plan of action, but few will disagree with trends displayed by your data unless you've made errors in the way you gathered your data or conducted your research. Ask yourself the following questions:

- What do I predict my research to reveal? Try to have a hypothesis before you begin your research. Drawing conclusions from your data is easier if you've already considered them rather than if you're reacting to a complete surprise.

- What would I do if my assumptions are proven right? If your research goes the way you think it will, what ramifications does this have for your company?

- What would I do if my assumptions are proven wrong? If your results take you by surprise, what should your company do? Are there any "back-up plans" you can make in advance in the event of startling results?

Getting Useful Data

-

1Use government sources of industry data. With the advent of the information age, it's become easier than ever for business people to access enormous quantities of data. However, ensuring that the data being accessed is accurate is another story entirely. To be able to draw conclusion from your market research that reflect the actual state of the market, it's crucially important to start with reputable data. One safe bet for accurate market data is the government. Generally speaking, market data provided by the government is usually accurate, well-reviewed, and available for cheap or free, which makes it a great choice for businesses that are just starting out.

- As an example of the type of government data you might want to access during your market research, the Bureau of Labor Statistics offers detailed monthly reports regarding non-farm employment in addition to quarterly and yearly reports.[2] These reports contain information on wages, employment rates, and more and can be broken down by area (such as state, region, and metropolitan area) as well as by industry.

- As you research, focus on understanding what the competitive landscape looks like and what you can expect out of the industry.[3]

-

2Use data from trade associations. Trade associations are organizations formed from groups of businesses with similar activities and interests for collaborative purposes. In addition to engaging in activities like lobbying, community outreach, and advertising, trade associations also often participate in market research. The data from this research is used to increase competitiveness and boost profits for the industry. Some of this data may be freely available, while some may be only available to members.

- The Columbus Chamber of Commerce is an example of a local-level trade association that offers market research data. Yearly reports detailing market growth and trends in the Columbus, Ohio marketplace are available to anyone with an internet connection. The Chamber also handles specific data requests made by its members.[4]

-

3Use data from trade publications. Many industries have one or more magazines, journals, or publications dedicated to keeping members of the industry up-to-date on news, market trends, public policy goals, and much more. Many of these publications conduct and publish their own market research for the benefit of the members of the industry. Raw market research data may be available to non-industry members to varying degrees. However, nearly all major trade publications will, at the very least, offer some selection of articles online that offer strategy tips or analyze market trends. These articles often incorporate market research.

- For example, ABA Banking Journal offers a wide selection of articles online for free, including articles discussing marketing trends, leadership strategy, and more. The Journal also offers links to industry resources which can incorporate market research data.

-

4Use data from academic institutions. Because the marketplace is so important to global society, it is naturally the subject of much study and academic research. Many colleges, universities, and other academic institutions (especially business schools) regularly publish the results of research that is either based entirely off of market research or incorporates it in someway. This research is available in academic publications or from the university directly. However, it's worth noting that much academic research is behind a paywall — that is, accessing it requires paying a fee, subscribing to a specific publication, etc.

- As an example, Wharton University of Pennsylvania offers free access to a variety of market research resources, including academic papers and periodic market reviews.[5]

-

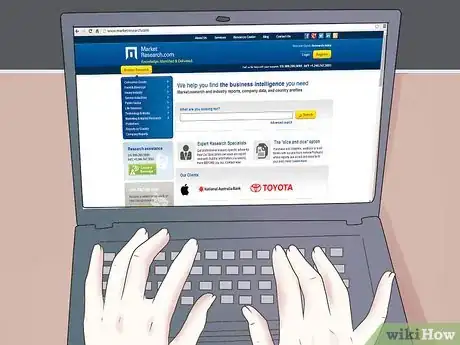

5Use data from third-party sources. Since a good understanding of the marketplace can make or break a business, an industry of third-party analysts, firms, and services have arisen specifically to help businesses and entrepreneurs with the complex task of market research. These types of agencies offer their research skills to businesses and individuals who need definitive, specifically-tailored research reports. However, because these types of agencies are for-profit, accessing the data you need will usually cost a fee.

-

6Leverage the power of market research services. Note that, due to the complexity of much market research, some third-party agencies will help business people find and source information which can not be obtained elsewhere or is customized reporting. As a general rule,there are many market research service however finding unbiased and trustworthy information is good investment for your business. (listed above).

- As an example, the aptly named MarketResearch.com offers access to a large wealth of market research data, studies, and analyses at a cost. The price per report can vary, but good insight can be valuable. The site also offers the ability to consult with expert analysts and to pay only for specific needed pieces of long, detailed reports. The usefulness of some of these purchases is invaluable.[6]

Performing Your Own Research

-

1Use available data to determine the supply/demand situation in your market. Generally speaking, your business stands a good chance of being successful if it can satisfy a need in the market that is going unfulfilled — that is, you should aim to supply products or services that the market has a demand for. Economic data from government, academic, and industry sources (as detailed in the section above) can help you identify the presence or absence of such needs. Essentially, you will want to identify markets where a clientele exists that has both the means and the desire to patronize your business.

- As a running example in this section, let's say that we hypothetically want to start a landscaping service. If we investigate a wealth of market and data from local government sources, we might find that people in one affluent neighborhood of our town have, on average, a great deal of disposable income. We could also go as far as to use government water usage data to estimate the area with the greatest percentage of houses with lawns.

- This information might lead us to open up shop in a rich, affluent area of town where people's houses have large yards, rather than in an area where people generally have neither large yards nor the money to pay for landscapers. Using market research, we've made an intelligent decision about where (and where not to) to do business.

-

2Perform surveys. One of the most basic, time-tested ways of determining the attitudes of your business's customers is to simply ask them![7] Surveys offer market researchers a chance to reach out to large samples of people to gain data that can be used to make broad strategy decisions. However, because surveys result in relatively impersonal data, it's important to ensure that your survey is designed in a way that allows data to be easily quantified so that you can derive meaningful trends from it.

- For instance, a survey that simply asks customers to write about their experience with your business may not be the most effective choice, as this requires reading and analyzing each response individually to derive meaningful conclusions. A better idea might be to ask your customers to assign a number rating to multiple aspects of your business, like customer service, price, and so on. This makes it quicker and easier to identify your strengths and weaknesses in addition to allowing you to quantify and graph your data.

- In our landscaping company example, we might try surveying our first 20 clients by asking each to fill out a small ratings card when they pay their bill. On this card, we might ask our clients to give a rating from 1-5 in the categories of quality, price, speed, and customer service. If we get lots of 4's and 5's in the first three categories but mostly 2's and 3's in the last, some sensitivity training for our employees might improve our customer satisfaction and increase our referral rate.

- Try to check in with your customers on a regular basis.[8]

-

3Conduct focus groups. One way to determine how your customers might react to a proposed strategy is to invite them to participate in a focus group. In a focus group, small groups of customers gather at a neutral location, try a product or service, and discuss it with a representative. Often, focus sessions are observed, recorded, and analyzed later.

- In our landscaping company example, if we want to consider upselling lawn care products as part of our service, we might invite loyal customers to participate in a focus group. At this focus group, we'd have them receive the sales pitches for some of these lawn care products. Then, we'd ask them which ones, if any, they would be most likely to buy. We'd also ask them how the sales pitches made them feel — were they friendly or condescending?

-

4Conduct one-on-one interviews. For the most intimate and qualitative market research data, one-on-one interviews with customers can be useful. Individual interviews don't provide the broad, quantitative data sets that surveys do, but, on the other hand, they allow you to dive relatively "deep" in search of relevant information. Interviews allow you to understand why specific customers like your product or service, so they're a great choice for learning how to most effectively market to your customer base.

- In our landscaping company example, let's say that our company is trying to design a short ad that will run on local TV. Interviewing a few dozen customer can help us decide which aspects of our service to focus on in the ad. For instance, if most of our interviewees say that they hire landscapers because they don't have the time to maintain their lawns on their own, we might make an ad that focuses on the time-saving potential of our service. I.E., "Sick of wasting all weekend stomping through your overgrown weeds? Let us do the work for you!" (and so on).

-

5Conduct product/service tests. Companies considering implementing new products or services often let potential customers try their product or service for free so that they can iron out any problems before rolling it out. Bringing in a selection of customers for testing can help you determine whether your plans to offer a new product or service are in need of further review or not.

- In our landscaping company example, let's say that we're considering offering a new service where we plant flowers in the customer's yard after doing our landscaping. We might let a few "test" customers choose to have the chance to receive this service for free under the condition that they discuss it with us afterwards. If we find that our customers appreciate getting the service for free but would never pay for it, we might reconsider our roll-out of this new program.

Analyzing Your Results

-

1Answer the original question that led to your research. At the very beginning of the market research process, you set goals for research. These are typically questions relating to your business's strategy that you are attempting to answer — for instance, whether or not to pursue a certain investment, whether or not a certain marketing decision is a good idea, and so on. The primary goal of your market research should be to answer this question. Because the goals of market research projects vary so greatly, the exact information required to give a satisfying answer for each will vary. Typically, you're looking for predicted trends in your data that imply that a certain course of action is better than others.

- Let's return to our landscaping company example in which we're trying to decide whether it's a good idea to offer a flower-planting service with our standard lawn care package. Let's say that we gathered government data that revealed that the majority of people in our market are wealthy enough to afford the added cost of the flowers, but that a survey we conducted revealed that very few were actually interested in paying for the service. In this case, we'd probably conclude that it isn't a good idea to pursue this venture. We might want to modify our idea or even scrap it entirely.

-

2Perform SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. One common use of market research is to determine these aspects of a business. If it is applicable, the data gained from a market research project can be used to assess the health of the company as a whole by pointing out strengths, weaknesses, and so on that are not necessarily the target of the initial research.

- Let's say, for instance, that as we tried to determine whether our flower planting service was a reasonable idea or not, we found that a significant number of participants in our testing noted that they liked the look of the flowers but didn't have the resources or know-how to care for them once planted. We might classify this as an opportunity for our business — if we do eventually implement the flower planting service, we might try including gardening tools as part of the package or as a potential upsell.

-

3Find new target markets. In simple terms, a target market is the group (or groups) of people your business promotes, advertises, and ultimately attempts to sell its products or services to. Data from market research projects that reveals that certain types of people react preferentially to your business can be used to focus your business's limited resources on these specific people, maximizing competitiveness and profitability.

- For example, in our flower planting example, let's say that, although the majority of respondents reported that they wouldn't pay for the flowers if given the opportunity, most elderly people reacted favorably to the idea. If backed up by subsequent research, this might lead our business to specifically target the elderly market — for instance, by advertising at local bingo halls.

-

4Identify further topics of research. Market research often begets more market research. Once you've answered one pressing question, new questions can arise or old questions can remain unanswered. These can require further research or different methodological approaches to be satisfactorily answered. If the results of your initial market research are promising, you may be able to receive permission for further projects after presenting your findings.

- In our landscaping company example, for instance, our research has led us to the conclusion that offering a flower-planting service in our current market is not necessarily a wise idea. However, several questions remain which may be good topics for further research. A few additional research questions are listed below, along with ideas on how to solve them:

- Is the flower planting service itself unappealing to customers, or is there a problem with the specific flowers we're using? We might research this by using alternate flower arrangements in our product tests.

- Is there a certain section of the market that is more receptive to our flower planting service than others? We might research this by cross-checking our previous research results with demographic data from the correspondents (age, income, marital status, gender, etc.)

- Are people more enthusiastic about the flower planting service if we package it with the basic service and increase the price slightly, rather than offering it as a separate option? We might research this by conducting two separate product tests (one with the service included, one with it as a separate option).

- In our landscaping company example, for instance, our research has led us to the conclusion that offering a flower-planting service in our current market is not necessarily a wise idea. However, several questions remain which may be good topics for further research. A few additional research questions are listed below, along with ideas on how to solve them:

Expert Q&A

-

QuestionHow wide of a net do you conduct market research?

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Digital Marketing Specialist The first thing you want to figure out is the scale of the research you want to conduct. If you're competing globally, you definitely want to do a deep dive on the economic conditions where you're operating and take a look at the industry's positioning. If you're local, you can dedicate a good amount of your time looking at your individual competitors in the area.

The first thing you want to figure out is the scale of the research you want to conduct. If you're competing globally, you definitely want to do a deep dive on the economic conditions where you're operating and take a look at the industry's positioning. If you're local, you can dedicate a good amount of your time looking at your individual competitors in the area. -

QuestionHow do I analyze the profit margins in the context of the competition?

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Digital Marketing Specialist Your goal should generally be to perform roughly 10% better than your direct competitors. However, it definitely depends on what the competitive landscape looks like. A pizza restaurant in New York City is going to have a much harder time competing than a high-end interior designer with only one other competitor.

Your goal should generally be to perform roughly 10% better than your direct competitors. However, it definitely depends on what the competitive landscape looks like. A pizza restaurant in New York City is going to have a much harder time competing than a high-end interior designer with only one other competitor. -

QuestionHow often should I be conducting market research?

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Anna ColibriAnna Colibri is a Digital Marketing Specialist and the CEO of Colibri Digital Marketing in the San Francisco Bay Area. Anna specializes in branding, digital strategy, product and service development, team management, and leadership development with a focus on women and minority business owners and professionals. Anna holds a Bachelor's degree in Sociology from The University of California, Davis, and a Master's degree in Social Welfare from The University of California, Berkeley. Colibri Digital Marketing is San Francisco’s first B Corp certified digital marketing agency. They won the 2019 Better Business Bureau Torch Awards for Ethical Business, the 2009 Local Excellence Award, and one of the Best Digital Marketing Agencies in San Francisco in 2017.

Digital Marketing Specialist It really depends on the space you're in, but you always want to have a sense for what's going on in the market at all times. If that means you do a deep dive every few weeks, do that. If it's just once or twice a year, that's fine too.

It really depends on the space you're in, but you always want to have a sense for what's going on in the market at all times. If that means you do a deep dive every few weeks, do that. If it's just once or twice a year, that's fine too.

References

- ↑ Anna Colibri. Digital Marketing Specialist. Expert Interview. 29 June 2021.

- ↑ http://www.bls.gov/ces/

- ↑ Anna Colibri. Digital Marketing Specialist. Expert Interview. 29 June 2021.

- ↑ http://www.columbus.org/solutions/market-research/

- ↑ https://knowledge.wharton.upenn.edu/special-report/2013-wharton-private-equity-review-navigating-the-new-normal/

- ↑ http://www.prnewswire.com/news-releases/the-advent-of-digital-retailing-and-the-impact-on-global-car-dealership-structures-239047331.html

- ↑ Anna Colibri. Digital Marketing Specialist. Expert Interview. 29 June 2021.

- ↑ Anna Colibri. Digital Marketing Specialist. Expert Interview. 29 June 2021.

About This Article

If you want to conduct the online portion of market research, collect data from government websites, trade associations and publications, academic institutions, third-parties, and market research services. Then, use the data you gather to determine the supply and demand in your market to see if your business would succeed. If you think it would, send out surveys to get a better idea of what people want. For tips on interpreting and applying your data, read on!

-Step-17.webp)