wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 20 people, some anonymous, worked to edit and improve it over time.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 60,716 times.

Learn more...

A life of poverty is a difficult and psychologically draining experience.[1] Many people never rise above poverty because there are many barriers to achieving a life of financial security, especially during tough economic times. While we can't end poverty overnight, there are some strategies we can use to fight it. In this article, we'll show you how to deal with a life of poverty and offer some ideas that might help you reduce poverty.

Steps

Saving Money

-

1Create a budget. One of the best ways to make sure you are getting everything you can out of the money you have is to create budget. By keeping track of how much money you are bringing in and what you are spending it on, you can eliminate the uncertainty that comes with not knowing if you can afford something, and also identify areas where you can cut costs.

- Keep records of every dollar you earn and spend.

- Classify your expenditures as fixed essentials (things you need and will always cost about the same amount, like your phone bill), variable essentials (things you need but which vary in cost from month to month, such as gas or food), and non-essentials (things you want but don't necessarily need).

- There are many ways to keep track of your budget. While numerous computer programs and smartphone apps exist that can make this process simple, an ordinary Excel spreadsheet will also work fine, as will an old-fashioned ledger book or ordinary lined paper.

-

2Cut routine expenses. Once you've created a budget, it's easier to identify areas where you might be able to cut back on spending. Identify non-essential expenditures in your budget, and think about ways to make them cheaper or if you might be able to eliminate some of them altogether. Here are a few suggestions:

- You can spend less on utilities if you use less energy. Make sure to turn off all appliances when not in use, and unplug them when they won't be used for an extended period of time. Every degree you reduce your thermostat will also save you between one and three percent on your heating bill.

- The average person spends about $600 dollars a year on phone service. Especially if you are paying more than that, you may want to look into finding a less expensive plan.[2]

- If you subscribe to cable television, consider going without for a while. Many of the shows you're watching are probably available for free online.

- Drive less, if you can. If you live somewhere with a decent public transportation system, you'll probably find that it's cheaper than gas and parking. You can also save thousands of dollars a year by carpooling.[3]

Advertisement -

3Reduce your medical costs. With the cost of medical treatment increasing all the time, anything you can do to reduce your bills in this area without sacrificing your health is a good idea.

- Switch to generics. Most generic medications do exactly the same thing as the name brand versions, but at a fraction of the cost.

- Visit in-store pharmacy clinics. For minor ailments, this can be a cheaper alternative to a regular doctor, especially if you don't have insurance.[4]

- Get a free checkup at your local dental school. Many dental schools will give you a free checkup and cleaning as a way to train their students.[5]

-

4Reduce your housing costs. You can spend less on housing by moving to a smaller house or apartment, renting out any spare rooms you have (if you own your house), or getting a roommate. Be sure to get work and personal references and check each of those, before allowing anyone to live in your house or apartment. Also, put all terms and conditions in writing, and have both parties sign and date the papers. If you rent, make sure you ask your landlord first, before advertising for a roommate.

-

5Review your utility bills. If you must pay for utilities (heat, electric, water), you might qualify for government assistance programs for gas/ heat and electric. Programs like Percentage of Income [PIP] are not loans; you do not need to repay (unless your income changes drastically). As well, PIP will apply more to your utility bills at the end of the year IF you have paid your portion every month and on-time every month. You might also qualify for a one-time emergency help to avoid an imminent shut-off during winter (call your local utility office for phone numbers). Community Action or some churches offer assistance, but be careful not to abuse the programs because you could be blacklisted and receive no further help.[6]

- Depending on where you live, you may also be able to save a lot of money by moving to a different neighborhood. You may even want to consider moving to a different part of the country (i.e. one where the cost of living is lower and/or job opportunities are more plentiful) if this is an option.

-

6Cook at home. Although 99 cent hamburgers from fast food restaurants seem like a bargain, you can prepare meals at home that are often equally economical, healthier for you, and create leftovers for your lunch the next day.

- Plan meals in advance so you can use what you already have in your kitchen and take advantage of sales at the grocery store. This makes cooking at home even cheaper.

-

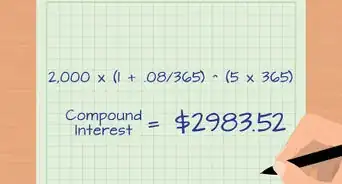

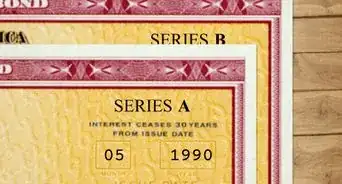

7Avoid debt. It can be hard to live within your means when you don't earn much, but buying things using credit or rent-to-own plans makes them cost more in the long run and is a significant factor in keeping many people poor.[7]

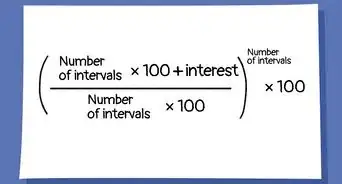

- Avoid getting a "pay day" loan. These small loans come at a high cost. Often, the amount you will have to pay back will be nearly three times the amount of the loan. These loans should be used only as a last resort.[8]

Getting Assistance

-

1Go to the food bank. In most communities, there is at least one non-profit organization that distributes donated food to those in need. If you are having trouble affording a trip to the grocery store, this can be a great way to get some basic items to stock your pantry.

- Food banks are typically run by independent charitable organizations and churches in your local community, so you should be able to track one down on-line. If you're having trouble finding out where the food bank is in your community this website describes many food banks around the nation, though it is not an exhaustive list.

- Similar services exist to help you meet your clothing needs. These clothing banks are are run by churches and other private charities, sometimes at the same site as your local food bank. If your food bank doesn't have a clothing bank and you need some clothes, the volunteers at the food bank may be able to tell you where these services are available.

-

2Apply for food stamps. The United States Department of Agriculture (USDA) offers assistance to individuals and families who's income does not exceed 130 percent of the poverty line. This program, called the Supplemental Nutrition Assistance Program (SNAP) can make trips to the grocery store much less painful and makes cooking your own meals an even cheaper option.[9]

- In most states, you can apply for SNAP online. Links to each state's application page are available here.

-

3Apply for welfare. If you have children, you may be eligible for a federal program called Temporary Assistance to Needy Families (TANF), more commonly known as welfare. This is a cash assistance program that can help you make ends meet for a while.[10]

- Funds for TANF are provided to states in block grants from The Administration for Children and Families (ACF), a division of the Department of Health & Human Services. It is up to each individual state to distribute these funds. You can find information about your state's requirements and application processes by visiting the ACF's website and selecting your state.

- TANF benefits are available for a maximum of five years, and recipients typically must demonstrate that they are making an effort to become self-sufficient. [11]

-

4Apply for Section 8. Assistance with housing costs is also available for families who earn less than 50 percent of the median income in their area. The U.S. Department of Housing and Urban Development (HUD) will pay some portion of your rent directly to your landlord if you qualify.[12]

- Like TANF, Section 8 housing is administered at the state level. To find your local Public Housing Authority and apply for a HUD voucher, visit the HUD website and select your state.

-

5Get child care assistance. If you have a family, the cost of childcare can be a major burden, but may be unavoidable if you go to work or school. The Child Care and Development Fund provides assistance for working parents of children under the age of 13.[13]

- Like many of the programs discussed above, this assistance is provided at the state level. To find out who to contact for information about assistance in your state, visit the Department of Health and Human Services Office of Childcare website.

-

6Apply for free/reduced lunch. If you have school aged children, they may be eligible for subsidized meals at school through the USDA's National School Lunch Program(NSLP). For information about eligibility requirements and how to apply, visit their website.

- The NSLP website also provides other valuable information about how create low-cost healthy meals and snacks for your children.

Getting Educated

-

1Take care of the basics. Individuals lacking a high school diploma have the highest rates of unemployment and are paid the least. If you don't have your diploma, an important step to escape from poverty will be getting your GED by passing the Test of General Education Development. This is the equivalent of a high school diploma.

- In some states, free classes are offered to help you prepare for the GED. The test itself also may or may not be free, depending on the state in which you live. You can find information about how to get a GED in your state here.

-

2Participate in a job training program. The United States Department of Labor's Employment and Training Administration provides funding for a range of different programs designed to make you a more qualified job applicant. To find out more about their programs, and to find links that will direct you toward opportunities in your area, visit their website.

- Participating in one of these programs may partially fulfill the requirements for TANF benefits.

-

3Go to college. Any kind of college degree, even a two-year Associate's degree from a community college, can make a big difference in your prospects for employment and the wages you might earn once you do get a job. If it is at all feasible for you to do so, working toward a college degree can be very helpful in rising above a life of poverty.

- You may think you could never afford a college education, but the Department of Education may be able to offer you a student loan or grant that could put college within your reach. While funding has decreased some in recent years, federal aid can make a less-expensive options like community college a real possibility for many people. To see what options they might make available to you, visit their website and file a Free Application For Student Aid (FAFSA).

Becoming Employed

-

1Look for job opportunities. There are many ways to find a job. Regularly checking postings on sites like Craigslist and in your local newspaper is a good place to start. It's also a good idea to look for help wanted signs as you go about your daily business.

- Many people get jobs through their social networks, so it's a good idea to make sure your friends and family know you are looking for opportunities.[14]

- There are numerous websites that exist to connect employers with potential employees that are worth exploring.

-

2Apply for jobs. Apply for any job for which you are qualified, and as many jobs as possible.

- Carefully read the description and application requirements for any job you apply for. Then, make sure that your application is complete and responds to every major requirement in the job description.

- For example, your resume and cover letter should feature key words and ideas found in the job description. Neither the letter or resume should be generic, but instead should make it clear why you are a good fit for the job and the job is a good fit for you.[15]

- Make sure your application materials are easy to read and free of spelling and grammatical errors. If possible, have someone else check your work.

- As you start applying for jobs, make sure there is nothing to embarrass you on social network profiles such as your Facebook page. Any pictures of you drinking, dressed provocatively, or otherwise suggesting you are unprofessional should be removed, or your privacy settings should make these images unavailable to potential employers. Checking applicants' social networking profiles has become a very common practice among employers.[16]

-

3Interview effectively. If you are called for an interview, showing up on time, looking professional, and speaking articulately are all important for your job prospects.

- At the start of the interview, shake hands with the interviewer.

- Smile and try to relax, no matter how nervous you may be.

- Listen carefully to the questions you are asked, and answer them in a direct way and with a positive attitude. Try to emphasize why you would be a good candidate for the job using concrete examples.

-

4Move up. Once you get a job, or if you already have one, keep your eyes peeled for better opportunities. If your job doesn't pay enough to raise you out of poverty, stick with it, but keep looking. It's easier to get a job once you already have one.[17]

Community Q&A

-

QuestionWhat is the definition of poverty?

DonaganTop AnswererA dictionary definition would refer to the lack of material assets (principally money) that would meet a minimum standard of living, particularly regarding the ability to feed oneself and one's family enough calories to maintain proper health.

DonaganTop AnswererA dictionary definition would refer to the lack of material assets (principally money) that would meet a minimum standard of living, particularly regarding the ability to feed oneself and one's family enough calories to maintain proper health.

Warnings

- If you are not a US citizen, many of the government programs discussed above will not be available to you.⧼thumbs_response⧽

References

- ↑ http://www.theguardian.com/science/2013/aug/29/poverty-mental-capacity-complex-tasks

- ↑ http://www.bls.gov/cex/cellphones2007.htm

- ↑ http://www.realsimple.com/work-life/money/lower-monthly-bills

- ↑ http://www.realsimple.com/work-life/money/lower-monthly-bills

- ↑ http://www.realsimple.com/work-life/money/lower-monthly-bills

- ↑ http://www.forbes.com/sites/trulia/2014/08/15/cutting-housing-costs-when-financial-hardship-strikes/

- ↑ http://www.businessweek.com/stories/2007-05-20/the-poverty-business

- ↑ http://www.huffingtonpost.com/2012/07/18/payday-lending-pew-study_n_1684292.html

- ↑ https://www.fns.usda.gov/snap/recipient/eligibility

- ↑ http://www.welfareinfo.org/apply/

- ↑ http://www.cbpp.org/cms/?fa=view&id=936

- ↑ http://portal.hud.gov/hudportal/HUD?src=/topics/housing_choice_voucher_program_section_8

- ↑ http://www.benefits.gov/benefits/benefit-details/615

- ↑ http://finance.yahoo.com/blogs/daily-ticker/no--you-can-t-just--bootstrap--yourself-out-of-poverty-172104522.html

- ↑ http://money.usnews.com/money/blogs/outside-voices-careers/2012/07/11/the-9-best-tips-for-submitting-an-online-job-application

- ↑ http://www.forbes.com/sites/kashmirhill/2012/03/06/what-employers-are-thinking-when-they-look-at-your-facebook-page/

- ↑ http://www.cbsnews.com/news/unemployed-then-dont-bother-applying/