This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 75,129 times.

A quitclaim deed is a document that legally transfers interest in real estate from one party to another. The party that is transferring rights is called the “grantor” and the recipient is the “grantee.” Quitclaim deeds are used in a variety of situations: cases of divorce or real estate transfer between family members, transferring rights to a timeshare property or trust, or moving real estate interests to a company or corporation. Quitclaim deeds should not be used between strangers. To file a quitclaim deed in Nevada, you will need to contact the Recorder of Deeds in the county in which the property is located and ask about the county's specific requirements for quitclaim deeds.

Steps

Drafting the Quitclaim Deed

-

1Find sample forms. You can find many quitclaim deeds on the Internet. If you want to use one, then print it off and fill out the requested information. You can also hire an attorney to draft your quitclaim deed.

- Remember that any form you find on the Internet still must comply with your county's formatting requirements. You should stop into your county Recorder of Deeds office and ask about requirements. If you don't follow them, you may be charged more when you file or the deed might be rejected.

-

2Format your document. If you want to type up your own quitclaim deed, then open a blank word processing document. Set the font to something readable—Times New Roman 12 point works for many people.

- Your county may have specific requirements for the page layout. For example, in Carson County, the quitclaim deed must be on 8.5” by 11” paper and have a one-inch margin on both sides and on the bottom. There must be a 3” by 3” box in the upper right hand corner.

Advertisement -

3Include required information. At the very top of the document you need to insert required information. Remember to include the following so that the quitclaim deed will be legal:

-

4Provide the address where taxes should be mailed. The county recorder also won't record a quitclaim deed unless you tell them where the statement of taxes should be sent.[3]

- You can type in bold “Mail tax statements to” and then insert the name and address. Don't forget to include this information.

-

5Title the document. Put the title “Quitclaim Deed” in bold and center it between the right- and left-hand margins. You can make the title in a larger font, such as 14 point, so that it stands out.

-

6Identify the parties. With the deed, the owners (the grantors) convey the property to the grantee for money. The amount of money is called “consideration.” You should have an opening paragraph that identifies the parties and states that consideration was given.

- For example, you could write, “For a valuable consideration, receipt of which is hereby acknowledged, Melissa T. Banks and Arthur C. Banks hereby remise, release, and forever quitclaim to Andrew X. Smith, of 1111 South Winship Avenue, City, Nevada, the property in [insert county] Nevada, described as….”

- You should be sure to include the address of the grantee.

-

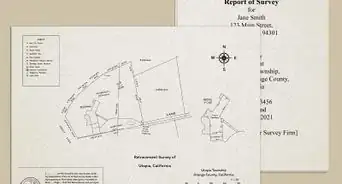

7Describe the property. You should have pulled the legal description of property, which you could find on the current deed. You then need to insert the legal description onto the quitclaim deed.

- The legal description is usually stated in metes and bounds. For example, it might read: “Commence at the SE Corner of the East 1/2 of West 1/2 of Section 12, Township 2 East and run E 0 degrees….”[4]

-

8Identify who prepared the legal description of property. You might have to provide the name and address of the surveyor who prepared the legal description if no prior document has been recorded with that legal description.[5]

- For example, if you bought half of someone's property, then that particular portion has not been recorded before. You would need to provide the surveyor's name and address in this situation.

- However, if you buy someone's entire parcel—and that parcel has been recorded before—then you don't need to provide the surveyor's address. Instead, you can cite the document number from where you got the description.

-

9Insert the date. You need to date the quitclaim deed, so include the word “Dated” and then a blank line so that you can write in the date.

-

10Include an affirmation. In some counties, you will need to submit an affirmation for the quitclaim deed to be filed. You should check your county's requirements by asking the county recorder.

- For example, in Esmeralda County, you should include the following: “I, the undersigned, hereby affirm that this document submitted for recording does not contain the social security number of any person or persons.”

-

11Add a notary block. You must sign your deed in front of a notary public. Accordingly, you should type in an appropriate notary block at the bottom of your document. Also leave a space for the official notarial seal.

- The Nevada Secretary of State's office has sample notarial language, available here: https://www.nvsos.gov/sos/home/showdocument?id=1836

-

12Have the grantor sign in front of a notary public. You need to include signature lines for all of the grantors to sign the deed, which they must do in front of a notary public. You can find notaries at the courthouse, the county recorder's office, and at most large banks.

- You should take sufficient personal identification to show the notary, such as a valid state ID or a passport.

Filing the Quitclaim Deed

-

1Visit the Recorder of Deeds and ask to file. Take the completed deed to the Recorder of Deeds. Ask if you need to complete any other paperwork. For example, you probably will have to complete a Declaration of Value form.

- You should be able to complete all required paperwork at the Recorder of Deeds office.

- You should also take a self-addressed stamp envelope so that the recorder can return the document. This will speed up the return.

-

2Pay the filing fee. You must pay a fee to file a deed with the county recorder. The fee should be $14.00 to record the first page of a quitclaim deed and $1.00 for each additional page.

- However, you should call ahead of time to check about the amount and acceptable methods of payment.

-

3Pay your transfer tax. You may also have to pay a transfer tax. Both the grantor and grantee are responsible for paying the tax, so talk ahead of time about how you will divide the amount. The tax must be paid before the deed will be recorded.

- Fortunately, there are exemptions to the transfer tax. For example, transfers to most family members are exempted.[6]

-

4Receive the deed. If you are the buyer/grantee, then you should receive your copy of the deed within a couple of weeks after it has been processed. Store it in a safe place.

References

- ↑ https://www.leg.state.nv.us/nrs/nrs-111.html

- ↑ https://www.ezlandlordforms.com/documents/nevada-quitclaim-deed-109991/

- ↑ https://www.leg.state.nv.us/nrs/nrs-111.html

- ↑ https://www.deedclaim.com/legal-description/

- ↑ https://www.leg.state.nv.us/nrs/nrs-111.html

- ↑ https://bongiovilaw.com/2015/11/clark-county-real-property-transfer-tax/