This article was co-authored by Gonzalo Martinez and by wikiHow staff writer, Jennifer Mueller, JD. Gonzalo Martinez is the President of CleverTech, a tech repair business in San Jose, California founded in 2014. CleverTech LLC specializes in repairing Apple products. CleverTech pursues environmental responsibility by recycling aluminum, display assemblies, and the micro components on motherboards to reuse for future repairs. On average, they save 2 lbs - 3 lbs more electronic waste daily than the average computer repair store.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 104,522 times.

Bitcoin was the first of a growing number of cryptocurrencies – digital currencies that are created, held, and exchanged electronically. Bitcoin and other cryptocurrencies run on a decentralized network and were created as an alternative to national, or fiat currencies.[1] While the value of any cryptocurrency is extremely volatile, Bitcoin may be more stable than others. As of 2019, you can get Bitcoins in one of three ways. The most basic ways are either to receive them (as payment for goods and services or in trade for fiat currency or another cryptocurrency) or to buy them on a cryptocurrency exchange. You may also want to try your hands at mining Bitcoins, although this option may not actually be profitable.[2]

Steps

Receiving Bitcoins

-

1Set up a cryptocurrency wallet that you control. Before you can receive Bitcoins in any way, you need a digital wallet to keep them in. You can think of a Bitcoin wallet as similar to your physical wallet where you keep your cash, credit, and debit cards, although of course, you don't need a physical wallet to accept other forms of money. You can choose from mobile, software, or hardware wallets. Go to https://bitcoin.org/en/getting-started to choose the best wallet for your needs.[3]

- Although online wallets are available, these typically aren't the best option because they are extremely vulnerable to hackers and you don't actually control them.

- Mobile wallets are free apps that you download from your smartphone's app store. A software wallet, on the other hand, is a desktop application that you download from the website of the wallet's creator. These wallets are as secure as your computer or smartphone and the network you're on.

- Hardware wallets look a bit like a thumb drive and can be purchased online or at computer stores for around $100. While they do require a bit of investment compared to the free mobile and software wallets, they keep your Bitcoin more secure because they are not connected to the internet. Use a hardware wallet if you plan on getting a lot of Bitcoin and want to hold it long-term.

Tip: Make sure you have a strong firewall enabled and that your anti-virus software is up to date before you download the software for a Bitcoin wallet. Remember that wallet is only as secure as the system you keep it on.

-

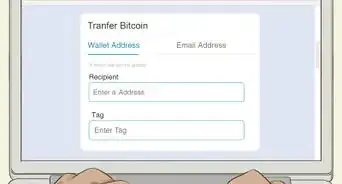

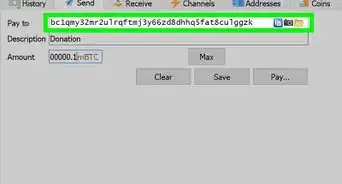

2Copy your wallet's Bitcoin address. Once you set up your wallet account, it will provide you with a Bitcoin address. You can think of this address as similar to a bank account. If you want to receive Bitcoin, you'll have to supply the sender of that Bitcoin with your Bitcoin address.[4]

- You don't need to keep your Bitcoin address a secret. Anyone can send you Bitcoin using the address, but they can't take any Bitcoin from your wallet (or even see how much you have). You need your private keys to manage the Bitcoin you own.

Advertisement -

3Connect with someone who wants to sell their Bitcoin. If you already know someone who is interested in giving (or selling) you some Bitcoin, all you have to do is give them your wallet's Bitcoin address. If you don't yet know anyone but are interested in an in-person exchange, there are peer-to-peer (P2P) websites that can help you find a seller.[5]

- For example, LocalBitcoins is a site that helps match buyers and sellers of Bitcoins who live near each other and want to complete an in-person exchange.

- You shouldn't ever need to meet someone physically in person to conduct a Bitcoin exchange. These transactions can be completed entirely online.

Tip: There are community groups of Bitcoin enthusiasts who meet regularly to discuss cryptocurrency. Transactions often take place during these community meetings, but it's safe to say these individuals don't consider each other complete strangers.

-

4Buy Bitcoin through a Bitcoin ATM. Bitcoin ATMs enable you to buy small amounts of Bitcoin without going through a third-party exchange or finding another individual who has Bitcoins they're willing to sell to you. However, using a Bitcoin ATM largely depends on whether you live in an area where these ATMs are available.[6]

- Visit https://coinatmradar.com/ to locate Bitcoin ATMs near you.

-

5Accept Bitcoin as payment for goods or services. If you own a small business, you can sign up with a merchant services program to accept Bitcoin as payment. These programs are particularly popular with online businesses and most shopping cart services allow you to enable Bitcoin as a payment option.[7]

- Even if you own a brick-and-mortar business, you can also accept Bitcoin if you use a tablet or mobile phone to allow customers to pay with their mobile phones.

- Since Bitcoin transactions are irreversible, if you accept Bitcoin for payment you can avoid chargebacks as a result of a customer complaint or dispute.[8]

Using a Cryptocurrency Exchange

-

1Compare different exchanges to find the right one for you. If you have experience with online stock trading platforms, cryptocurrency exchanges aren't much different. There are hundreds of cryptocurrency exchanges online. As you research these exchanges, you'll find that they have varying degrees of security, charge different fees, and may have vastly different trading interfaces.[9]

- Ideally, you want the most secure exchange possible that also charges the lowest fees. You also want to look at the exchange's server locations. Transactions will be quicker if the server is closer to you.

- Not all exchanges operate in all countries. If you live in a remote area, you may not have many exchanges to choose from.

-

2Set up an account at your chosen exchange. Once you've found an exchange you want to use, navigate to the home page and look for a button or link to register an account. Initially, you'll be asked for information about yourself, including your name, address, and email address. After that, you'll have to verify your identity.[10]

- The identity verification process varies among cryptocurrency exchanges. It may involve scanning your government-issued photo ID, taking a selfie holding a particular code, or scanning a bill or correspondence from a government agency to prove your address.

Tip: Transactions through a cryptocurrency exchange are not anonymous. Many exchanges go to great lengths to verify your identity before they allow you to trade with them. If you want to purchase Bitcoin anonymously, use a P2P website to connect with another individual.

-

3Link a bank account, credit or debit card to purchase Bitcoin. Once your account is set up, you need to fund it. Most exchanges allow you to connect a bank account and transfer funds in fiat currency electronically. Some exchanges also allow you to use a debit or credit card, although they usually place more limits on these transactions, such as only allowing you to buy a maximum amount of Bitcoin a day.[11]

- As with a stock trading platform, the cryptocurrency exchange can't tell how much money you have available in your bank account or on your card. Before you can buy Bitcoin on the exchange, you'll have to transfer fiat currency to your exchange account.

-

4Place an order for the amount of Bitcoin you want. Once you've funded an account, ordering Bitcoin on an exchange is similar to ordering stock on a trading platform. You can request a specific amount of Bitcoin at whatever the market rate is, or you can specify that you want as much Bitcoin as you can buy for a set amount of fiat currency.[12]

- As with trading platforms, you typically also have the option of specifying the maximum rate you'll pay for your Bitcoin. Given the volatility of Bitcoin prices, this is typically a good idea.

- Once you've placed your order, the exchange will withdraw your fiat currency from your exchange account and purchase your Bitcoin. Because Bitcoin transfer rates are relatively slow compared to other, smaller cryptocurrencies, it may be a few hours before the Bitcoin shows up in your exchange account.

-

5Transfer your Bitcoin from your exchange account to your wallet. Cryptocurrency exchanges are vulnerable to hackers. To keep your Bitcoin secure, transfer it to a cryptocurrency wallet that you control as soon as possible after it's confirmed in your exchange account.[13]

- To send your Bitcoin to your wallet, click the link on your exchange account to withdraw your Bitcoin. Then enter the Bitcoin address your wallet produced. The exchange will send your Bitcoin to your wallet. It may take a few hours for the Bitcoin to show as confirmed in your wallet.

- Some exchanges offer software wallets of their own that may make the withdrawal process a little quicker.

Mining Bitcoin

-

1Calculate mining profitability with an online mining calculator. If you're thinking about mining Bitcoin with your own hardware, you need to understand exactly how much of an investment you're going to make and how long it will likely be before you turn a profit. Online mining calculators can help you determine if it's really worth it for you to invest in your own rig.[14]

- Bitcoin is mined by networks of computers that solve difficult numeric problems to verify Bitcoin blocks of transactions. A block of transactions is made up of a reward subsidy and transaction fees. As of 2020 the block reward subsidy is 12.5 bitcoin, but the amount halves every four years with the amount scheduled to halve to 6.25 bitcoin around the 12th of May 2020. To be competitive as a miner, you will either need an ASIC (Application-Specific Integrated Circuit) unit connected to a computer or several GPUs (Graphics Processing Units) which would be better suited to mining alternative crypto currencies which could be traded for bitcoins.

- Go to https://www.cryptocompare.com/mining/calculator/ to get an idea of how much you would have to spend in hardware and electricity costs before you turned a profit mining Bitcoin. Keep in mind that for most individual miners, the reality is that they will spend thousands before they mine enough Bitcoin to put them over the top.

Tip: The lower your electricity cost is, the less risk of losing money you have. Use renewable energy if possible. Keep in mind that as the price goes up, it will be more difficult to mine bitcoins as there will be increased competition.

-

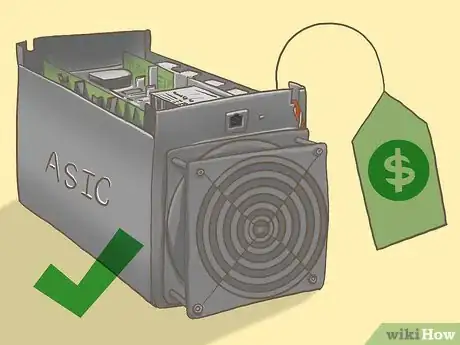

2Buy your mining hardware. If you're set on trying to mine Bitcoin despite the cost, you'll need an ASIC miner and a power supply to run it, as well as several GPUs. ASIC miners vary in price depending on their power and efficiency, but you can expect to spend between $1500 and $2000.[15]

- Once you buy your hardware, you need to be able to set it up. If you don't know your way around circuit boards and computer hardware, this might not be the best hobby for you.

-

3Join a mining pool. A mining pool, such as BitMinter, CK Pool, or Slush Pool, allows you to pool your mining resources with other miners to increase your power and efficiency. Without a mining pool, you would likely mine for years before you managed to get any Bitcoin at all.[16]

- When you register with a mining pool, you'll receive configuration settings you can use to add your mining rig to the pool as a worker. Your mining rig will start working as soon as you save these settings in your rig.

-

4Run your mining rig constantly to maximize profit. You can control electricity costs by only running your mining rig a few hours a day. However, you're not likely to mine very much Bitcoin this way. Even in a pool, you're only going to get Bitcoin that your rig actually played a part in mining.[17]

- Because mining rigs generate a lot of heat, keeping it in a basement or garage, where it may be naturally cooler, can be a good option.

Tip: If and when you do mine Bitcoin, transfer it from your mining pool account to a Bitcoin wallet that you control as soon as possible.

-

5Pick a cloud mining contract package if you don't want to build your own rig. Not everybody has thousands of dollars to invest in a mining rig, or the tech savvy to keep it up and running –that's where cloud mining comes in. Cloud mining companies own massive server farms of mining rigs and offer contracts that essentially allow you to lease the power of their miner farms for a limited period of time.[18]

- There are a lot of cloud-mining scams out there. Go to https://www.cryptocompare.com/mining/#/ to research the company's reputation before you buy a contract.

- Smaller contracts (typically around $100) may never mine enough Bitcoin to turn a profit. Even larger contracts (several thousand dollars) may take years to mine enough Bitcoin for you to break even.

Warnings

- All cryptocurrencies are highly volatile, and Bitcoin is no exception (although it may be more stable than newer cryptocurrencies). Invest in Bitcoin at your own risk, and never buy more Bitcoin than you can afford to lose.⧼thumbs_response⧽

References

- ↑ Gonzalo Martinez. Computer & Phone Repair Specialist. Expert Interview. 1 June 2021.

- ↑ https://www.coindesk.com/information/what-is-bitcoin

- ↑ https://bitcoin.org/en/getting-started

- ↑ https://coincentral.com/how-send-receive-bitcoin-address/

- ↑ https://www.weusecoins.com/en/getting-started/

- ↑ https://coinsutra.com/how-to-use-bitcoin-atm/

- ↑ https://bitcoin.org/en/getting-started

- ↑ https://bitcoin.org/en/faq#what-are-the-advantages-of-bitcoin

- ↑ https://www.coindesk.com/information/how-can-i-buy-bitcoins

- ↑ https://www.coindesk.com/information/how-can-i-buy-bitcoins

- ↑ https://www.coindesk.com/information/how-can-i-buy-bitcoins

- ↑ https://www.coindesk.com/information/how-can-i-buy-bitcoins

- ↑ https://www.coindesk.com/information/how-can-i-buy-bitcoins

- ↑ https://www.investopedia.com/tech/how-does-bitcoin-mining-work/

- ↑ https://www.bitcoinmining.com/getting-started/

- ↑ https://www.bitcoinmining.com/getting-started/

- ↑ https://www.bitcoinmining.com/getting-started/

- ↑ https://www.bitcoinmining.com/getting-started/

About This Article

To get Bitcoins, start by setting up a Bitcoin wallet either online or with software. Then, make sure your wallet is secure by choosing strong passwords and backing up your data. Once you’ve set up your wallet, find an exchange online or at a Bitcoin ATM to purchase this currency. After that, you can spend your Bitcoins online at sites that accept them, but be cautious since Bitcoins are a highly volatile currency and their value fluctuates often. If you want to learn more about Bitcoin scams, read on!