This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 13,814 times.

Learn more...

Millions of people don't have bank accounts for various reasons. Not having a bank account is a complication if you want to open a credit card because you don't have an easy payment method and banks can't tell if you'll be able to make your monthly payments. If you’re one of those people, you still have options for opening a credit card and paying your bills. Your best option is a secured credit card. These require a cash deposit as collateral in case you don’t pay your bill. Find a list of secured credit card providers near you. Visit a branch location to fill out the application and pay the security deposit. When it comes time to pay your bill, pay in person at a branch or mail a money order to the payment location.

Steps

Finding a Credit Provider

-

1Find a bank that offers secured credit cards. A secured credit card is a card that requires a collateral security deposit. They are usually for people trying to rebuild bad credit, but can also work for a person without a bank account. Search online for banks near you that offer secured credit cards. Most large banks offer this service. Make a list of possibilities so you can contact them later on.[1]

- Usually, the security deposit is equal to the spending limit on the card. If you have a $500 limit, then you’ll have to deposit $500. If you don’t pay your bill one month, the bank will take your deposit to pay it. Your credit line depletes as the deposit is used. You'll then have to provide another cash deposit to raise your credit level again.

- You could also look for banks that aren’t in your immediate area, but finding one close by makes paying your bill without a bank account much easier. You can just visit a branch in person and pay in cash.

- Capital One, Discover, and Citibank in particular offer a variety of secured cards with different fees and conditions. Smaller local banks may not have these offerings, but check local branches if you want to shop around more.

-

2Ask a bank representative if they will issue a card without an account. Usually, a bank uses your checking account to fund the security deposit, but this isn’t a possibility here. Take your list of secured credit card providers and contact each one. Ask the representative if you can still open the card without a bank account. Narrow down your search list by eliminating banks that won’t offer you a card without an account.[2]

- Make sure you explain that you don’t have a bank account at all, not just with another bank. The representative may automatically assume that you mean you don’t have an account with this particular bank.

- Most credit unions require you to have an account for a credit card, so these are not an option in most cases.

Advertisement -

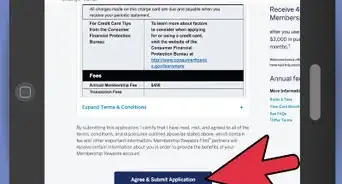

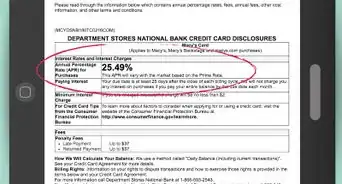

3Compare the fees and conditions on each card to pick the best one. Like normal credit cards, different secured cards all come with different conditions and fees for use. After narrowing down which banks will offer you a card without an account, then look at what each particular card offers. Some may offer perks like cashback on purchases or rewards points. On the other hand, they may have annual maintenance fees or stiff penalties for missing a payment. Pay particular attention to fees. These can eat away at your income over time. Weigh all of these strengths and weaknesses to pick the best card for you.[3]

- For example, Citibank's secured card requires a minimum $200 deposit, while Capital One's minimum deposit is $49. The Capital One card would give you a much lower credit limit, but it would be easier to make a $49 deposit than a $200 deposit. Use features like these to determine which card is best for you.

- Although the interest rate may not matter initially, since you made a cash deposit, some cards increase your credit limit after a few months of on-time payments without requiring another cash deposit. If this happens, you'll be subject to an interest rate if you don't pay the bill in full.

- If you’re at all confused on what each card offers, call the bank and directly ask. Customer service representatives are there to answer any questions you may have.

- If you’re working on building your credit back, make sure to pick a card that reports to the major credit bureaus.

Applying for the Card

-

1Fill out the credit card application at a branch location. Usually, you can only apply for a card online if you have an account at the providing bank, so be ready to visit a branch to submit the application. Go to the branch location and tell one of the tellers that you’d like to apply for a credit card. They will then set you up with one of the bank’s credit specialists and have you fill out the application.[4]

- Typical information on a credit card application is your address, Social Security number, job, and annual income.

- Fill out all the information accurately and don’t lie. Lying on a credit application could be considered fraud.

-

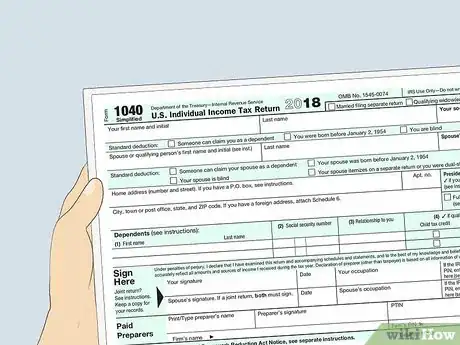

2Be prepared to show proof of income. Credit providers usually don’t verify your income for credit applications, but since you don’t have a bank account, they may want more information. Be prepared to bring pay stubs or tax returns indicating your income. This could make the bank more likely to accept your application without a bank account.[5]

- Banks use your income information to determine your credit spending limit. Banks could face penalties for granting credit limits far beyond what a person could realistically pay back.

-

3Pay the security deposit in cash if your application is approved. Banks usually take a few days to approve your credit card application. Once you’re approved, visit the branch with cash or a money order in the amount of the required deposit. Submit this payment to open your card.[6]

- If you pay your bill every month, then the security deposit is refundable when you close the credit card.

- If you get rejected, ask the bank for an explanation. You can use this information to improve your application to a different bank.

-

4Pay your balance at the end of every month to keep your deposit. The deposit is only collateral in case you don’t pay your bill, so keep up on your monthly statements to avoid losing the deposit. Pay your bills as soon as you get the monthly statement to avoid late fees or losing your deposit.[7]

- Remember that without a bank account, you can’t make instant transfers to pay your bill. Always pay at least a few days before the due date to make sure the payment processes in time.

- Paying on time is also extremely important for keeping your credit score up. If you’re working on rebuilding your credit, pay close attention to payment due dates.

- Once your credit score reaches a certain level, your bank may allow you to upgrade to an unsecured, normal credit card. Take advantage of this to have a higher credit limit and get your deposit back.

Paying Your Bill

-

1Visit a bank branch and pay in cash if the location is local. If your credit card comes from a local bank, then you can pay the bill in person. Visit the branch a few days before the payment due date with the amount due in cash. Give the cash to a teller along with the statement you received so they submit the payment correctly.[8]

- The bank may also accept money orders. Ask a teller if this is possible.

-

2Mail a money order if the payment location isn't local. If the bank branch isn’t local, then mail your payment every month. Go to a post office with cash and buy a money order for the amount you owe to the credit card company. Then address an envelope to the payment location and send it a few days before the due date.[9]

- Remember that you can only buy money orders with cash or a debit card.

- The payment will take a few days to get to the location. Mail the payment a few days to one week ahead of time to make sure it reaches the destination by the due date.

-

3Take advantage of 7-Eleven’s bill pay app for a convenient payment method. 7-Eleven franchises use a bill pay app that allows users to pay most bills at a store location. Download the app and connect it to your card so the bill shows up in your account. When you want to pay the bill, select it from your account and press "Pay Bill." Then visit the nearest 7-Eleven location and give the cash to an employee. This is another simple way to pay your bills without a bank account.[10]

- Check if your card provider takes part in this program before trying to pay your bill.

- The app lets you pick a 7-Eleven as your main location for paying bills. Set this location to make paying your bills easier.

References

- ↑ https://www.nerdwallet.com/article/credit-cards/secured-credit-cards-vs-unsecured-difference

- ↑ https://creditcards.usnews.com/articles/can-i-get-a-credit-card-without-a-bank-account

- ↑ https://www.nerdwallet.com/blog/evaluate-credit-card-offers/

- ↑ https://creditcards.usnews.com/articles/can-i-get-a-credit-card-without-a-bank-account

- ↑ https://www.creditcardinsider.com/blog/annual-income-for-credit-card-applications-everything-you-need-to-know/

- ↑ https://www.investopedia.com/terms/s/securedcard.asp

- ↑ https://www.investopedia.com/terms/s/securedcard.asp

- ↑ https://creditcards.usnews.com/articles/can-i-get-a-credit-card-without-a-bank-account

- ↑ https://creditcards.usnews.com/articles/can-i-get-a-credit-card-without-a-bank-account