This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 148,224 times.

The American Express Platinum Card offers a higher level of benefits than American Express Green and Gold Cards. The benefits include a point reward system, four free companion airline tickets per year, airport club access and round-the-clock Platinum Card Concierge service to assist with travel and gift purchases. The Platinum Card is popular with frequent travelers and with travelers to luxury destinations. While the company originally offered the charge card to existing American Express customers with a 2-year account history, new customers can now complete a Platinum Card application online.

Steps

Part 1: Meeting The Eligibility Requirements

-

1Confirm you meet the age requirements. You must be over 21 years of age to obtain the American Express Platinum Card. Additional cardholders must be over the age of 18.

-

2Obtain your credit report and credit score. Because American Express Platinum is a premium card, it will require a higher than usual credit score to obtain acceptance

- A credit score of 720 or over -- which is considered good -- will greatly boost your odds of acceptance. The average score for those approved for the American Express Platinum card, according to Creditkarma.com, is approximately 716, with the lowest score being 643. Only 26% of those approved had a credit score of below 700[1]

Advertisement -

3Bring any current credit accounts into good standing. If your credit score is below 700, try improving your credit score to maximize odds of approval.

- Pay down outstanding balances to less than 30 percent of the available credit. Your balance divided by your credit limit is known as the "credit utilization ratio", and keeping at 30% or less can greatly enhance your credit score.[2]

- Always pay bills on time to boost your credit rating and to increase the chances of approval for your charge card application. Timely payment history makes up 35% of your credit score so make sure you have no late or skipped payments [3]

- Dispute any errors on your credit report that may lower your credit score.

- Increase your credit limit. Although this sounds strange, boosting your credit limit can lower your credit utilization ratio. Make sure however you do not use the additional space, otherwise you can easily reduce your odds of getting approved for the Platinum card significantly.

-

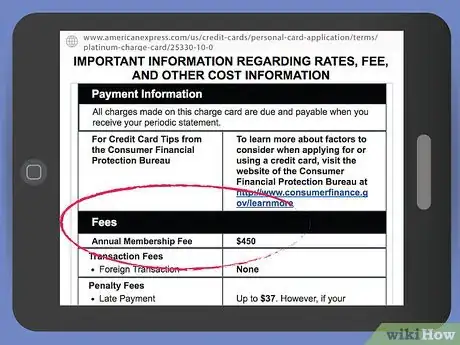

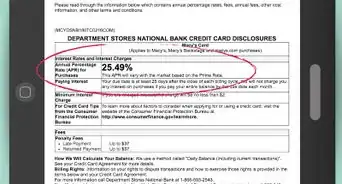

4Ensure you can afford the Platinum Card's annual fee. Since the Platinum card offers extensive rewards, it charges a US$450 annual fee to users.[4]

- Since the Platinum card is a charge card, ensure that you can always pay your monthly balances in full. Keep in mind that there is a difference between a charge card and a credit card. Unlike a traditional credit card, charge cards do not have a credit limit, and the entire balance must be paid at the end of the current month. In the case of American Express Platinum, failure to pay results in a late fee of $38 or 2.99% on the past due amount, whichever is greater. [5]

-

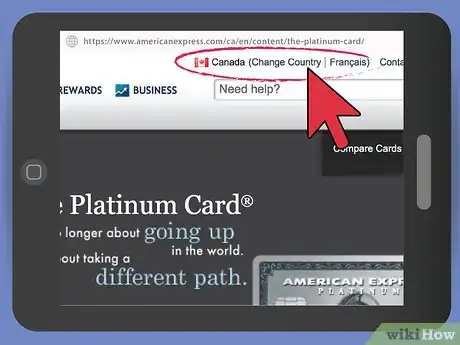

5Check the American Express website for the particular country you are in to verify any additional eligibility requirements. Different countries have different eligibility requirements, and checking them beforehand can save time.

- While the U.S. American Express Platinum website does not specify any eligibility requirements, if you are a Canadian citizen applying for the Canadian Platinum Card, you are required to have a minimum CAD$40,000 income, have not filed for bankruptcy for the past 7 years, and always made your monthly payments on time. Similarly, the U.K. American express card, specifies a minimum income of 65,000 euros.[6]

Part 2: Applying For The Platinum Card

-

1Choose an application method. It is possible to apply for the card online, or by phone, although online is quicker.

- To apply by phone, contact the Apply By Phone Team at 877-621-2639. They are open 24 hours a day. Once on the phone simply answer the questions, and be sure to have your social security number ready.

- To apply online, follow the remaining steps.

-

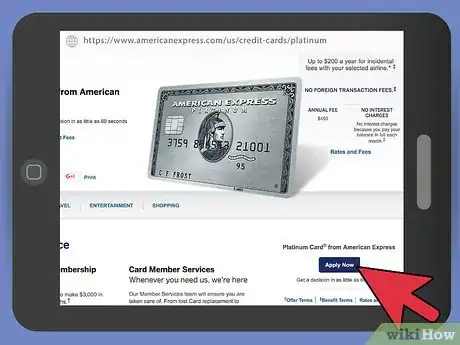

2Open the American Express website to begin your application. Choose the option for the Platinum Card and click "Apply now."[7]

- If you have an existing American Express account, sign in. If you are a new customer, choose the option to create a new account.

- You must complete the American Express Platinum Card application in a single online session. Navigating away from the application or closing your browser will cause the application to time out for security reasons.

-

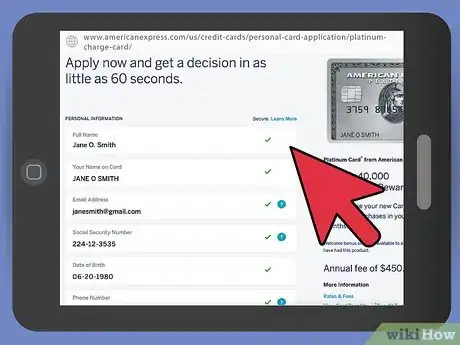

3Fill in the required information. Make sure to follow instructions carefully and not leave any required spaces blank.

- Enter your name as you want it to appear on the charge card.

- Enter your name, your email and home addresses, your social security number and your date of birth in the designated spaces in the personal data section. Provide any additional information requested on the Platinum Card application.

- Fill in the employment section with your company's name, city, state and business phone number.

- Proceed to the financial information section. Enter your total annual household income and choose the income source from the drop-down menu. Check the boxes to indicate whether you have a checking account and money market/savings account.

- Indicate whether you would like to obtain additional American Express Platinum Cards on your account and fill out the information requested for additional cardholders.

-

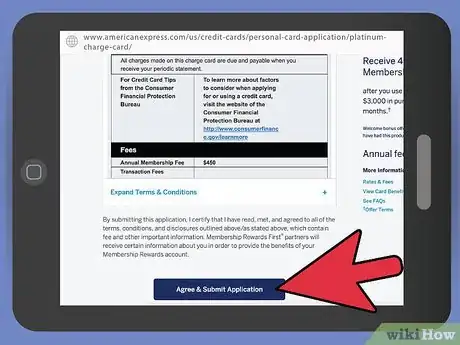

4Verify your information and submit the application. American Express may notify you of a decision within 60 seconds. You should receive notification by mail within 10 days.

Warnings

- American Express Platinum is a charge card, not a credit card. You must pay your balance each month.⧼thumbs_response⧽

References

- ↑ http://milecards.com/6158/credit-scores-needed-for-the-best-mile-credit-cards-fresh-data/

- ↑ http://www.forbes.com/sites/moneybuilder/2014/05/02/11-ways-to-raise-your-credit-score-fast/

- ↑ http://www.forbes.com/sites/moneybuilder/2014/05/02/11-ways-to-raise-your-credit-score-fast/

- ↑ https://www.americanexpress.com/us/credit-cards/personal-card-application/terms/platinum-charge-card/25330-10-0/?print#terms-details

- ↑ https://www.americanexpress.com/us/credit-cards/personal-card-application/terms/platinum-charge-card/25330-10-0/?print#terms-details

- ↑ https://www.americanexpress.com/ca/en/content/the-platinum-card/

- ↑ https://www.americanexpress.com/us/credit-cards/platinum

About This Article

Before getting an American Express Platinum Card, make sure you meet the eligibility requirements, including being over 21 years of age and having a credit score of 720 or higher. Additionally, make sure you can afford the annual fee of $450. When you’re ready to apply for the card, apply by phone by calling 877-621-2639 or online by going to the American Express website. If you choose to apply online, click the option for "Platinum Card," followed by "Apply Now" and fill in the required information. To learn how long it takes to be approved for your Platinum card, keep reading!