X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 12 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 309,153 times.

Learn more...

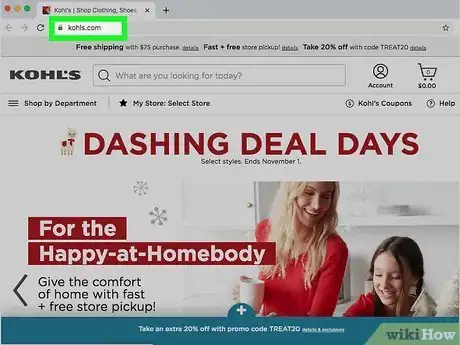

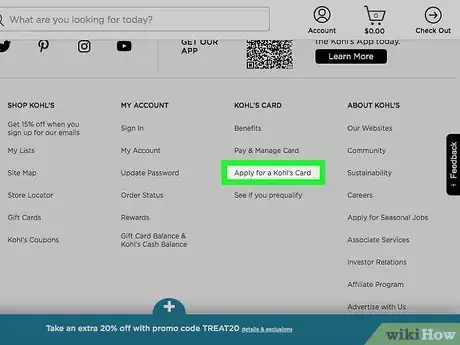

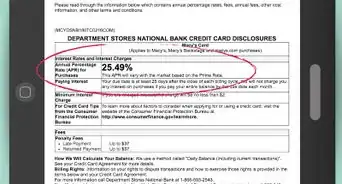

To be approved for a Kohl's credit card (issued through Capital One), you need a credit score of 640 or higher. The approval process is quick, and in some cases can take less than one minute after applying! This article provides a simple walkthrough to guide you through the application process.

Steps

Expert Q&A

-

QuestionHow should you destroy a credit card that you're no longer using?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive Call your credit card company and let them know that you no longer have this card or tell them you want to put a freeze on the credit card. Also, cut it in half and throw it in the garbage.

Call your credit card company and let them know that you no longer have this card or tell them you want to put a freeze on the credit card. Also, cut it in half and throw it in the garbage. -

QuestionCan I re-open a Kohls card after a bankruptcy?

Community AnswerIf your Kohl's card was part of your bankruptcy filing and therefore left unpaid, it's highly unlikely they will allow you to open another card.

Community AnswerIf your Kohl's card was part of your bankruptcy filing and therefore left unpaid, it's highly unlikely they will allow you to open another card. -

QuestionHow do you increase your credit card limit?

DonaganTop AnswererIf an increase isn't given automatically after a year of on-time payments, just call and ask the company for one. They will decide based on your income and credit history.

DonaganTop AnswererIf an increase isn't given automatically after a year of on-time payments, just call and ask the company for one. They will decide based on your income and credit history.

Advertisement

About This Article

Advertisement