This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

This article has been viewed 91,926 times.

Macy's is a U.S. department store chain featuring mid-to-high-range products. Macy's stores carry a variety of goods including apparel, bedding, shoes, small electronics, jewelry, cosmetics, a gift registry and home décor items. Macy's Corp., in affiliation with Department Stores National Bank (DSNB), also offers an in-store credit card which provides member-only discounts and incentives. You can apply for a Macy's charge card on line, in-store or over the telephone.

Steps

Applying for the Card Online

-

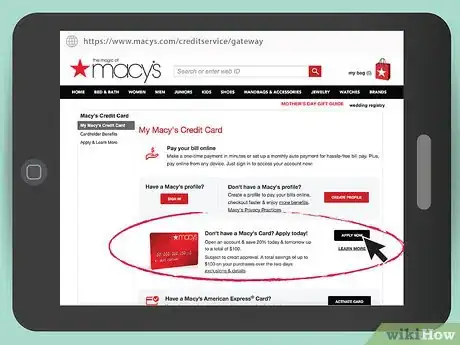

1Go to the Macy's website. The easiest way to apply for a Macy's credit card is to simply fill out the form online. You can do so from your own home. Go to Macy's company website. On the top of the screen, there should be a search bar. Type in "Macy's Credit card." You should be provided with a list of buttons, one of which says "Apply Now." Click on this button.

-

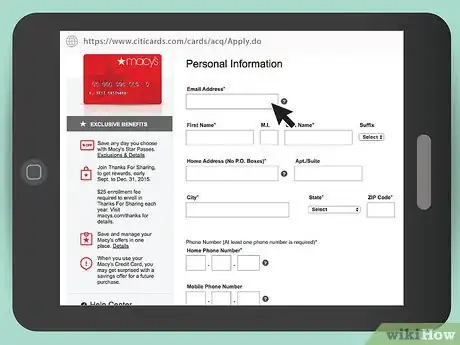

2Enter your personal information. From here, you will reach a screen that asks for a variety of personal information. First, you'll be asked for basic contact information. Macy's will want your full name, e-mail address, address, city, state, zip code, and phone number.

- You will also be asked to provide some very basic financial information. This is to ascertain whether you would be a good candidate for a Macy's credit card. You'll need to enter your annual income, as well as your residential status (i.e., do you rent or own?). You will then need to enter your monthly rent or mortgage.

- You will need to enter somewhat sensitive information during the application process, so make sure you're accessing the internet from a secure WiFi or ethernet connection. It's advised you do not use public WiFi for this part of the application. You will have to enter your date of birth, social security number, and driver's license number.

- You will need to scan a photo ID, such as a passport or driver's license, and include this in the application. If you do not have a scanner at home, you can use one at a local print shop and e-mail the scanned image to yourself. However, do not fill out the Macy's credit card application from a computer at a print shop.

Advertisement -

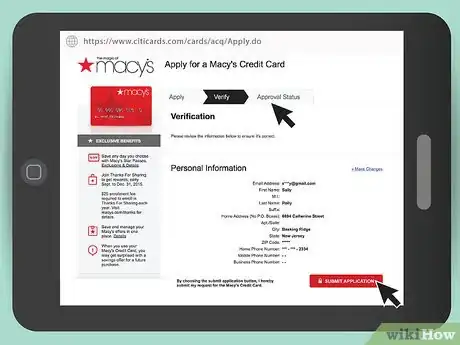

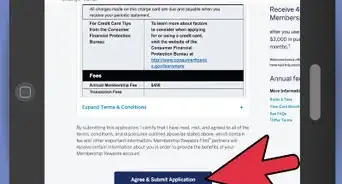

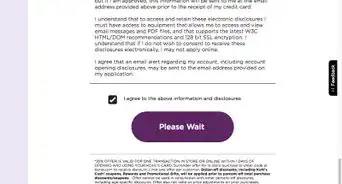

3Verify your information and apply. After you enter this information, you will click a box that says you agree to the terms and conditions. You will then be taken to a screen that overviews the information you just entered. You will be asked to verify that this information is correct. Then, you can apply for the card.

- Make sure you read the information closely to verify it is correct. You do not want to be rejected from getting a credit card do to a small error, like entering your social security card number incorrectly.

- It may be a good idea to wait for half an hour or so and then review your information. You may be more likely to catch your own errors if some time has passed.

Applying for the Card in the Store

-

1Ask at the counter. At some Macy's locations, you may be able to apply for a card in the store. You may feel more comfortable with a paper application for a variety of reasons. To find out if you can apply for a basic Macy's credit card in the store, ask at the store. You can ask a cashier at the counter or you can also ask at the customer service desk.

-

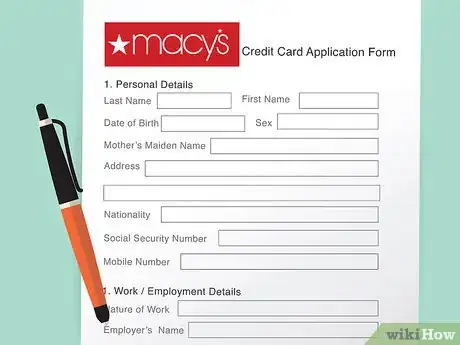

2Fill out the paper application. If you are able to apply for a card in the store, you'll have to fill out a paper application. You will be required to include basic personal information, such as your name and address, as well as sensitive information like your social security number. Depending on store requirements, you may need to give a copy of your driver's license.

- As you may not have all the materials or know all the required information offhand, you will probably have to complete the application at home and submit it to the store the following day.

-

3Apply for a Macy's American Express card in the store. The Macy's American Express card is a version of the Macy's card that you can apply for if you already have an existing Macy's credit card. The main advantage is that the American Express card is that it can be used at any store that accepts American Express, not just at Macy's stores. It also offers rewards ranging from 1%-3% of purchases depending on how much money you spend at Macy's. If you are a frequent Macy's shopper, the American Express card may be worth it. You must apply for a Macy's American Express card in the store as there is no online application process.

- As stated, you must already have an existing Macy's credit card to apply for an American express card. You can only apply for an American Express card in the store.

- You can ask for an application at the counter. You can take the application home and fill it out there. It will ask for much of the same basic contact and financial information as the previous application. It may also want the number of your current Macy's credit card.

- You may have to provide a copy of your photo ID when applying for a Macy's American Express. Stop by a local print shop and get a copy made if this is the case.

- When you finish your application, you can turn it in at the store.

-

4Call in the event you have questions about your application. If you have any questions while filling out an application, you can call the Macy's corporation. You can call the number listed on their website or contact a local Macy's in your area. A worker should be able to provide you with further information on the application process.

Obtaining Your Card

-

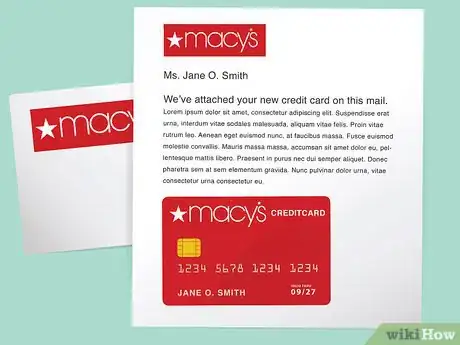

1Wait 7 to 10 days. On average, it takes 7 to 10 days for an application to be processed. You will usually get a letter or e-mail letting you know that your application was accepted. Your card should arrive shortly thereafter.

- Macy's store cards are somewhat harder to obtain that most store credit cards. On average, Macy's store card holders have fairly high credit scores. If your credit score is in a lower range, there's a chance your application may be rejected. You can check your credit score online through a variety of free websites.

- If you're applying for an American Express card, you may be rejected if you were frequently late on payments for your regular Macy's credit card.

- Unfortunately, in the event you're rejected, there's not much you can do but wait and try to build up your credit. In a year or so, it may be worth it to apply again.

-

2Get your card in the mail. If you are accepted for a Macy's credit card, you should receive your card in the mail shortly after being notified your application was accepted. Make sure you store your card in a safe place to avoid losing it. As soon as the letter comes, remove the card and put it in your wallet for safe-keeping.

-

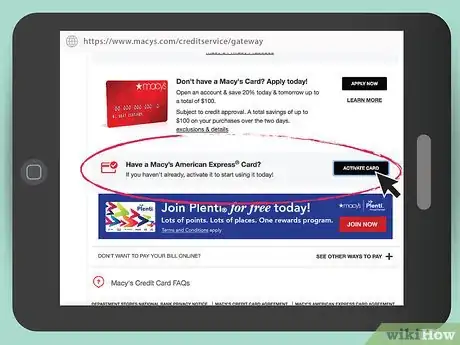

3Activate your card. You will have to activate your Macy's credit card once you receive it. You can activate your card by going online and clicking the "Activate My Card" button on Macy's website. You will then submit information, like your name and birth date, as well as your card number. After this, your card should be activated.[1]

- In the event you cannot navigate the website, you can call Macy's customer service department to activate your card at 1-888-257-6757. Business hours are Mondays to Saturdays, 9AM to 10PM EST and Sundays 11PM to 8PM EST.[2]

Being Responsible

-

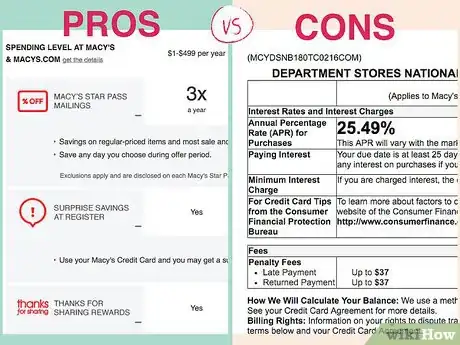

1Learn the pros and cons of a store credit card. There are various pros and cons to using a Macy's store credit card. Spend some time familiarizing yourself with the benefits and drawbacks before committing to applying for the card.

- The pros are most store credit cards offer discounts and promotions for card holders.[3] With the American express, Macy's offers 1.5% cash back on purchases if you spend between $500 and $999 a year. If you spend over $1,000 a year at Macy's, you get 3% cash back on purchases. If you're a frequent Macy's shopper, the card may be worth the cost. A store card can also help you build your credit history.

- Store cards tend to have very high interest rates. You also may end up being tempted to spend money you would otherwise save to meet spending quotas for store rewards. If you're not a frequent Macy's customer, and question your ability to pay off the card regularly, you may be better off passing on a Macy's credit card.[4]

-

2Pay off your balance regularly. You should pay off your Macy's store card balance in full each month. This way, you can prevent accruing interest. The quickest way to pay off your card is online. You can access your account through Macy's website and then click "Make a Payment." You will then be taken to a screen where you can enter a debit, credit card, or bank account number. If you tend to forget deadlines, you can set up an AutoPay system in which a certain amount of money is transferred from your bank account to your Macy's card each month. To avoid interest, set up AutoPay to pay the balance in full each month.[5]

-

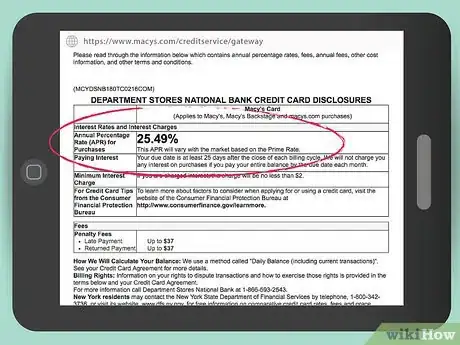

3Keep an eye on interest rates. As stated, interest rates on store cards are notoriously high. For a Macy's card, your interest rate is 25% each month. Therefore, do not charge more money on your Macy's card than you can reasonably pay each month. It will add up fast and being in credit card debt can negatively affect your credit.

Expert Q&A

-

QuestionHow should you destroy a credit card that you're no longer using?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive Call your credit card company and let them know that you no longer have this card or tell them you want to put a freeze on the credit card. Also, cut it in half and throw it in the garbage.

Call your credit card company and let them know that you no longer have this card or tell them you want to put a freeze on the credit card. Also, cut it in half and throw it in the garbage. -

QuestionHow do I apply for a Macy's credit card if I don't have ID?

DonaganTop AnswererYou can't apply for any credit card without ID. Any card company will want to know for sure who you are and what your financial history is, and you need to provide proof of your identity. If you don't have an ID, get one.

DonaganTop AnswererYou can't apply for any credit card without ID. Any card company will want to know for sure who you are and what your financial history is, and you need to provide proof of your identity. If you don't have an ID, get one. -

QuestionWhy must I give my social security number to apply for a credit card?

DonaganTop AnswererTo verify your identity.

DonaganTop AnswererTo verify your identity.

References

- ↑ https://www.customerservice-macys.com/app/answers/detail/a_id/758?cm_sp=macys_customer_service-_-Macy%27s%20Credit%20Card-_-How+can+I+activate+my+new+card

- ↑ https://www.customerservice-macys.com/app/answers/detail/a_id/758?cm_sp=macys_customer_service-_-Macy%27s%20Credit%20Card-_-How+can+I+activate+my+new+card

- ↑ http://www.bankrate.com/finance/credit-cards/store-credit-card-good-deal-1.aspx

- ↑ http://www.bankrate.com/finance/credit-cards/store-credit-card-good-deal-1.aspx

- ↑ https://customerservice-macys.com/articles/how-do-i-manage-billing-or-payments-for-my-macys-credit-card-online

- ↑ https://www.customerservice-macys.com/app/answers/detail/a_id/568

- ↑ https://www.customerservice-macys.com/app/answers/detail/a_id/568