wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 9 people, some anonymous, worked to edit and improve it over time.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 76,582 times.

Learn more...

If you don’t qualify for a conventional credit card but would like the convenience and security that come with such a card, consider purchasing a prepaid credit card. Visa and MasterCard both offer prepaid credit cards. Each comes with its own fees and terms. Fund the prepaid credit card with a deposit at the time of purchase. The amount you deposit becomes the balance on the card. You can write a check to purchase a prepaid credit card. Here's how:

Steps

Finding a Prepaid Credit Card to Purchase

-

1Decide which prepaid credit card you want to buy. You can purchase prepaid credit cards online. If you want to pay with a check, however, you will have to go to a brick-and-mortar store to make the purchase. Many drug stores, such as CVS and Walgreen, sell prepaid credit cards. Discount stores such as Target and Walmart also sell them. You can find them in most major supermarket chains and gas stations, too.[1]

-

2Research Visa prepaid credit cards. Visa offers many different prepaid credit cards. They are easy to use and reloadable. If you buy with cash, you don’t even need a bank account. No credit check is necessary. [2]

- Go to the Visa Product Locator website. Enter your location, and it will tell you where you can purchase Visa prepaid credit cards in your area.[3]

- Although Visa does not require you to have a bank account to purchase one of their prepaid cards, if you want to write a check to the retailer, you will need to have a checking account.

Advertisement -

3Research MasterCard prepaid credit cards. You can use MasterCard prepaid cards anywhere you use a MasterCard credit card. This includes online shopping, bill payments and everyday purchases. You can purchase them online or at participating retailers.[4]

- Visit the MasterCard Prepaid Cards site to find where you can purchase one in your area.[5]

-

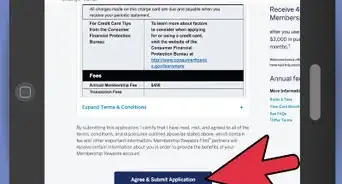

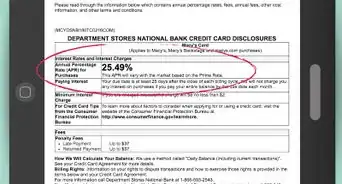

4Understand the fees associated with prepaid credit cards. Some cards charge activation fees, initial load fees or monthly fees. Sometimes you will also pay fees for certain kinds of transactions, such as ATM withdrawals or bill-pay services. Read the packaging on the card to learn about the fees that come with it. Compare several different cards and choose the card with the lowest fees. [6]

- Sometimes activation and initial load fees are added to the purchase price. For example, suppose you are purchasing a $100 prepaid card with a $6 activation fee. You will need to write a check for $106 to pay for the card.

- Sometimes the activation and initial load fees will be deducted from your available balance. For example, if you are purchasing a $100 prepaid card with a $6 activation fee, you will write a check for $100, but your available balance will start at $94.

- Transaction fees, if applicable, will be automatically deducted from your balance as you use your card.

-

5Load your prepaid credit card. The credit card is not worth anything until you fund it and the cashier validates it. When you take your card to the register, the cashier will ask you how much money you want to put on the card. Sometimes the cards have predetermined amounts printed on them, such as $25, $50, $100 or $200. Other cards allow you to choose any amount you wish. [7]

- Look for a display rack in the store that holds the cards. You can choose from a variety of different designs.

- Choose the card you wish to purchase, take it to the register and pay the cashier.

- Tell the cashier how much you want to load on the card.

- Write a check for the total amount you are loading on the card plus any activation fees.

Writing the Check

-

1Find a retailer that accepts checks. Most major supermarkets, discount stores and gas stations that sell prepaid credit cards accept checks. However, some retailers are phasing out checks as newer, more convenient technology replaces them. [8] If you are not sure, ask a cashier or someone at the customer-service desk whether or not the store accepts checks as a form of payment.

- Many retailers require you to show identification before they'll accept a check. Be prepared to provide your driver’s license or other picture ID.

-

2Fill out the check properly. Since other, more convenient payment methods are so widely available, some people are not sure how to write a check. In order for the check to be valid, it must be filled out correctly. [9]

- Write the date in the upper-right-hand corner. Enter the complete month, day and year. You can write out the date (e.g., October 8, 2017) or use numbers (10/8/17).

- Enter the name of the recipient on the line next to “Pay to the order of.” Write the name of the retailer on this line. For example, if you are purchasing the prepaid credit card at Walgreen’s, you would write “Walgreen’s” on this line. If you are not sure what name to write on this line, ask the cashier.

- Write the exact amount of the check on the right-hand side of the check next to the dollar sign. For example, if you are paying $106.71, write this exact amount. Do not round up or down.

- Write the check amount in words on the line under the recipient’s name. Write the dollar amount in words and the change as a fraction. For example, if your check is for $106.71, write “one-hundred six and 71/100 dollars.” If "dollars" is already printed on that line, you don't need to write it.

- If you're dealing with another currency, the procedure remains the same.

- Fill out the memo space in the bottom-left-hand corner. This is optional. It's a note explaining the purpose of the check.

- Sign the check in the bottom-right-hand corner. Use your full legal name. It should be the same name you used to open the checking account. Sign only the front of the check. Don’t sign the back. (That's for endorsing the check later.)

- Enter the information in your check register. Record the date, recipient and amount of the check, along with any memos, in your check register. Deduct the amount of the check from your available balance in the register.

-

3Verify funds in your checking account. Before writing a check, verify that you have enough money in your checking account to cover the check. Many banks have online services where you can check activity in your account, including your balance, on your computer or mobile device. You can also call your bank’s customer-service line to verify your account.

- Be prepared to provide your account number, or enter a user name and password. You may also have to answer a previously arranged security question to gain access to information about your account.

- If you don’t have enough funds to cover a check you've written, you will have to pay an overdraft fee. Your check might be returned instead. This means that instead of an overdraft fee you will have to pay a returned-check fee to the retailer.

-

4Monitor your checking account to make sure the check clears. Once you have written the check, monitor activity in your account. You can use your computer or mobile device to access your account information online. Verify that the check has cleared.

Reloading the Prepaid Credit Card

-

1Reload your card. Once you have used up all or most of the money you loaded onto your card, you may be able to load more money onto the card so you can keep using it. This is called reloading the card.

- Some cards may not be reloadable. If this is the case, once you have used up the funds, you can just throw the card away. Prepaid gift cards, for example, may not be reloadable.

-

2Read the fine print. The packaging that comes with your card explains all of the terms and options, including how to reload the card. If you do not have this packaging, look at the back of the card. You should find a customer-service number or website that may give you information about how to reload the card.

-

3Reload the card online. If you purchased the card with a check, consider linking your checking account to the card. You will likely be able to reload your card online with a linked checking account.[10]

- A linked checking account can also serve as overdraft protection for your prepaid credit card. If you accidentally go over your pre-loaded balance, it may keep a transaction from being declined if you have funds in your checking account to cover the transaction.

-

4Reload the card at the register. Some prepaid cards allow you to go to a retailer and reload the card at the register. Pay the cashier the amount you want to put on the card. If the retailer accepts checks, you can write a check to pay for reloading the card. The cashier will swipe your card to activate this amount on your card. [11]

Community Q&A

-

QuestionCan I buy a card with a check online?

Community AnswerNo, you cannot use a check online. You would have to mail the check to the credit card company directly after finding out how to pay by mail.

Community AnswerNo, you cannot use a check online. You would have to mail the check to the credit card company directly after finding out how to pay by mail. -

QuestionHow do I pay online with a check?

Community AnswerThe website should give you the option to pay by check, then just use the account and routing number at the bottom of the check (usually in the left hand corner) in the appropriate area of the page.

Community AnswerThe website should give you the option to pay by check, then just use the account and routing number at the bottom of the check (usually in the left hand corner) in the appropriate area of the page. -

QuestionIs it possible to buy an e-gift card online with a check?

Community AnswerNo. To purchase things online, you really need a debit or credit card.

Community AnswerNo. To purchase things online, you really need a debit or credit card.

References

- ↑ http://creditcards.lovetoknow.com/What_Stores_Sell_Prepaid_Credit_Cards

- ↑ https://usa.visa.com/pay-with-visa/cards/card-finder/prepaid-finder-page.html

- ↑ https://usa.visa.com/pay-with-visa/cards/services-locator.html

- ↑ https://www.mastercard.us/en-us/consumers/find-card-products/prepaid-cards.html

- ↑ https://www.mastercard.us/en-us/consumers/find-card-products/prepaid-cards/card.html

- ↑ http://creditcards.lovetoknow.com/What_Stores_Sell_Prepaid_Credit_Cards

- ↑ http://creditcards.lovetoknow.com/What_Stores_Sell_Prepaid_Credit_Cards

- ↑ http://money.usnews.com/money/blogs/my-money/2015/06/11/why-no-one-knows-how-to-write-a-check-anymore

- ↑ http://money.usnews.com/money/blogs/my-money/2015/06/11/why-no-one-knows-how-to-write-a-check-anymore